Summary:

- Selling put options on high-quality stocks is our favorite way to generate yield. By doing so, you can achieve flexibility, higher returns, and reduced volatility vs. traditional approaches.

- This article will explore 2 option trade ideas on Rocket Lab and Snap Inc. that stand to benefit investors.

- Both ideas include substantial potential returns, low deltas, and considerable breakeven thresholds, ensuring a cushion against stock price drops.

- While put selling does limit ‘max profit’ potential, we think these are both solid ways to allocate capital in a modern portfolio.

PM Images

Selling put options on high-quality stocks is our favorite way of generating yield in the market

Some people like buying real estate, others prefer BDCs, and some invest in MLPs.

That said, in our mind, none of these strategies come close to the unique advantages that you get when you sell put options – namely the strong yields, the reduced volatility, and the increased probability of success on each individual trade.

That is, when you buy a stock, there’s a 50-50 chance you make money over any given time frame on a statistical basis, but by selling an option, you can tilt those initial probabilities in your favor.

While the world of option trading can seem complex, grasping the basics isn’t too difficult.

In short, when you sell a put option, you agree to buy a stock at a predetermined price if shares fall below that price – between now and the expiry date of the option.

In return for committing to the arrangement, you get paid a cash premium, which acts as your potential ‘profit’ on the trade.

Thus, when you sell a put, one of two things happens – either you keep the cash and walk away, or you keep the cash and get assigned shares in the underlying stock, typically if the shares have dipped. Most of the time, we would argue that this is a win-win setup for sharp investors.

Today, we’re taking a look at 2 ‘short put’ trade ideas that feature strong yields, reduced volatility profiles, and attractive breakeven thresholds.

While these trades do have capped ‘max profit’ figures, we think both of them represent a solid capital allocation over the next few years.

Sound good? Let’s dive in.

Trade #1 – Rocket Lab (NASDAQ:RKLB)

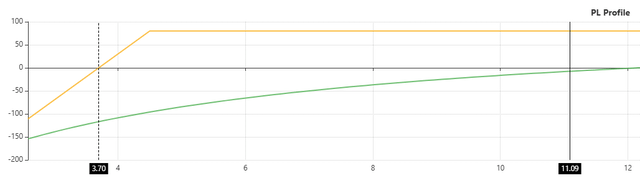

Idea – Sell the $4.5 strike, December ’26 put options for $0.80 a share, or $80 a contract.

R/R – This premium represents a 21.62% yield over the next 786 days, which annualizes to ~10.04%. Here are the calculations for illustration purposes:

- Yield: $80 / $370 (capital required to maintain the position) = 21.6%

- Annual Multiple = 365.25 (1 year in days) / 786 (DTE) = 0.45.

- Annualized Yield = 0.45 * 21.6% = 10%

The trade also has a -66% breakeven, meaning shares would have to drop by 2/3rds for an investor to lose money by expiry.

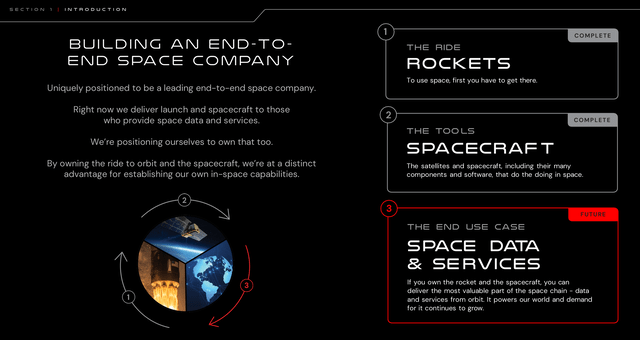

Notes – You can read our most recent standalone coverage of Rocket Lab by clicking here, but suffice it to say that we think the company is on the right track when it comes to commercializing space, hence the recent run-up in the share price.

Recent rocket tests have gone well, and the company is on schedule to launch Neutron sometime in the next twelve months. This is on top of Electron’s significant, existing record bookings.

When combined with the company’s strong spacecraft division and significant cash runway, it seems incredibly unlikely that shares in RKLB would head lower to the $4.50 region anytime soon, barring a significant issue with Neutron.

This trade comes with a comfortable $3.70 per-share breakeven, so even if RKLB’s stock heads lower over the next two years, you still have a considerable cushion of error for your capital:

RKLB’s stock is somewhat volatile, but we expect that the volatility of this ‘short put’ option position would be materially reduced, illustrated by the option’s ‘8’ delta reading. For reference, this means that for every $1 the stock moves in price, the option should theoretically move $0.08.

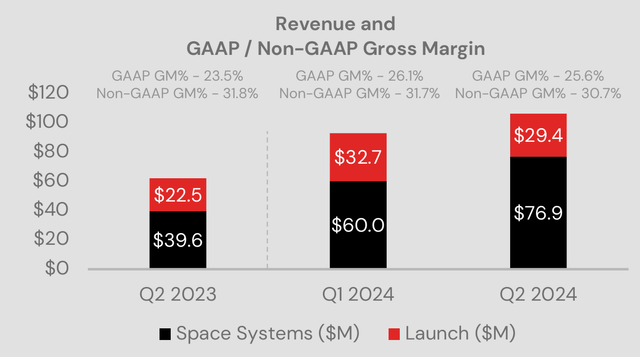

On the financial side, RKLB has done a great job growing revenues and gross margins while simultaneously building out a platform for significantly higher profitability in the future:

The company’s existing businesses are humming along, but the launch and spacecraft capability that RKLB has built will also one day service the company’s ambition to monetize the more lucrative space data & services opportunity:

As the company transitions towards being a vertically integrated space company, we see the current valuation, at only 4x 2027’s estimated sales, as a reasonable price to pay.

If assigned, put sellers would get the stock at roughly 7x FWD sales, or 2x ’27 sales, which provides an even greater margin of safety.

All in all, we think this RKLB trade is a great way to conservatively deploy capital in a great company.

Trade #2 – Snap Inc. (NYSE:SNAP)

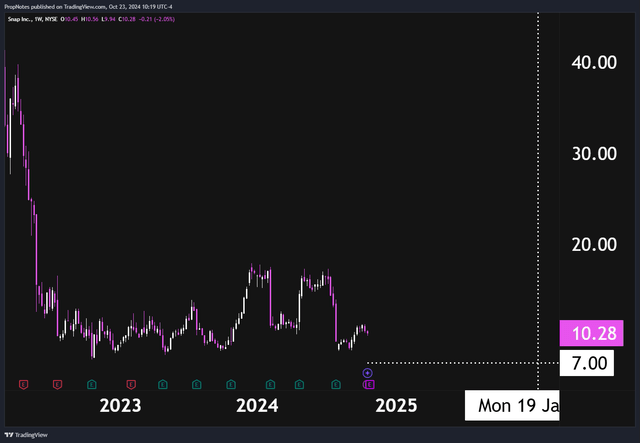

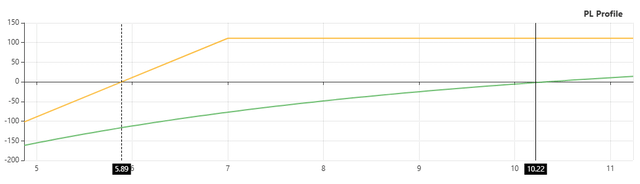

Idea – Sell the $7 strike, January ’26 put options for $1.08 a share, or $108 a contract.

R/R – This premium represents an 18.24% yield over the next 450 days, which annualizes to ~14.79%. You can reference the math for the first trade above if you want to double-check these figures.

The trade also has a -42% breakeven, meaning shares would have to drop by almost half for an investor to lose money by expiry.

Notes – You can read our most recent standalone coverage of SNAP by clicking here, but long story short, we’ve recently changed our opinion of the social media company.

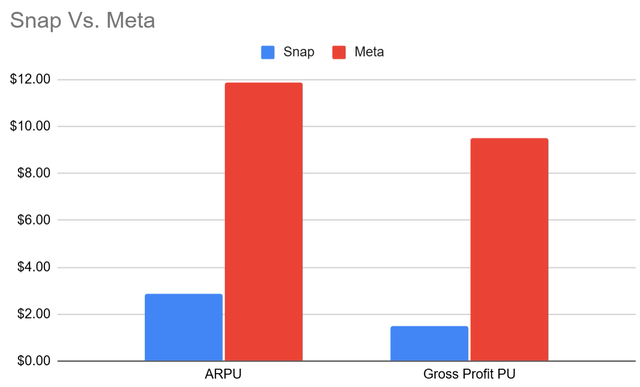

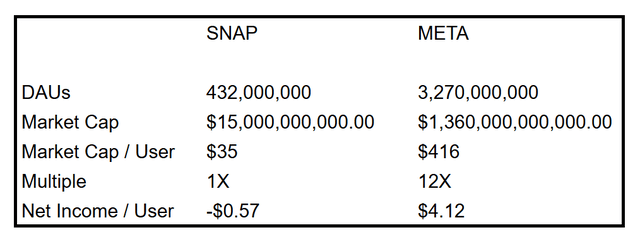

In the past, the stock has been largely discarded by investors as management has failed to close the gap, monetization wise, with other firms like Meta (META).

ARPU has been substandard up to this point, which has led to a rough breakeven financial situation and a great deal of underlying volatility in the stock:

However, as time goes on, SNAP has continued to grow DAUs, and the company has done a good job introducing new, high-ROI ad formats for advertisers. Simultaneously, as the user base continues to increase in buying power as they age into their 20s and 30s, we see room for SNAP’s margins, revenue, and returns to shareholders to improve.

At the very least, we think the stock will be trading above at least half of where it is now at the start of 2026.

This trade comes with a very comfortable $5.89 per-share breakeven, which, like above, means that option sellers can get this one directionally ‘wrong’ and still make money, given the company’s huge cushion:

On the valuation side, SNAP is trading at roughly 7.8x FWD sales, which is a bit pricey, but if Evan Spiegel and management can get to $100 million per quarter in net income, then we see SNAP’s valuation as highly attractive.

This shouldn’t be too hard to do, and we’ve seen recent progress on this front.

Finally, if you were to be assigned shares, you’d be looking at getting SNAP at almost half of the current valuation, which would be around 3.9x FWD sales. For a leading social media company with hundreds of millions in DAU, in our mind, this would be a very, very attractive entry price.

Taken together, we see this SNAP trade as a low-volatility way to profit from SNAP’s stable and growing user base.

Risks

There are some risks to be aware of when you’re selling put options.

We laid out the generalized risk profile of ‘short put’ trading above, but it is important to note that if a stock goes to zero, a put option seller could still be forced to buy shares at the strike price, which would represent a significant impairment of capital.

Functionally, this risk is no different than simply being an ‘owner’ of a stock that goes to zero, but it’s something to be aware of before entering into a trade. This also does make the R/R ratio a bit different than a bond, which is higher up the capital ladder. For us, when we compare short put trading to bonds, it’s simply in reference to the relatively lower volatility returns profile that once enjoyed with fixed income.

That said, it’s good to be aware of the full risk picture before taking a trade.

Summary

So, there you have it – 2 ‘bond-like’, low volatility option trade ideas in high-quality companies.

Each of these trades should serve to boost portfolio income, reduce volatility (given the very low deltas), and get you started thinking about how you can use options to generate income going forward in your investing journey.

Thanks for reading and stay safe out there!

Cheers~

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SNAP, RKLB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.