Summary:

- Starbucks is set to release its annual earnings on October 30, making it a crucial time to reassess the company’s valuations.

- I thought in August that Brian Niccol’s appointment as Chair/CEO had resulted in a valuation based on obtuse and sanguine expectations.

- Mr. Niccol’s statement to employees on September 10th and his surprise statement Tuesday indicate to me that Niccol has no clear strategy to advance a recovery of the brand.

- Niccol could surprise me and the market if he’s willing to take audacious steps to recover the brand.

- “Return to Starbucks” is a marketing meme, not a strategy. The kind of value Niccol needs to build won’t be driven by lower prices and a simplified menu. He needs audacity.

nattrass/E+ via Getty Images

NEW YORK (October 24) – Starbucks (NASDAQ:SBUX) is set to release its annual earnings October 30th. After Tuesday’s surprise release after the close, it’s clear it’s time for investors to bring the coffee chain valuations down to reality. That is, unless Brian Niccol can demonstrate he has the audacity, conviction, and fortitude to fundamentally alter the coffee chain’s business model. Around this time in August, I had expressed some skepticism that the hope the markets gave Brian Niccol, the former CEO of Chipotle (CMG), would be able to turn around Starbucks. But I was willing to give Niccol a chance.

Of late, however, my opinion has changed. It’s been seven weeks, and I am now more firm in my belief that the market’s confidence in Niccol has been considerably overstated.

The Niccol Run-Up

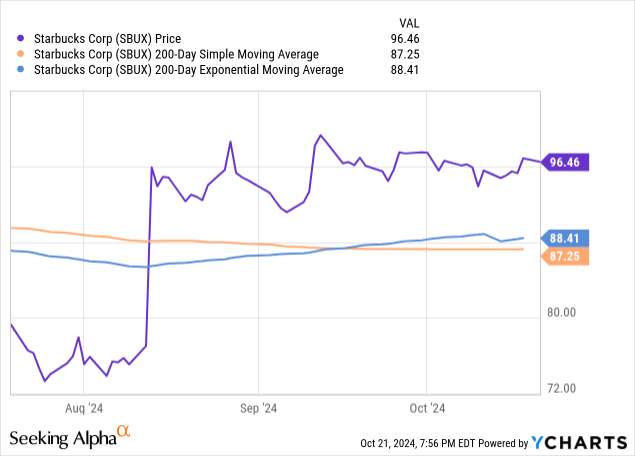

As you can see, the Starbucks announcement that Niccol would become the SBUX CEO, announced in mid-August, drove the stock up some 9% above its current 200 day moving average (which takes account of the five weeks of the spiked price.)

SBUX stock closed August 12 at around $77; two days after the announcement Niccol would join as CEO, the stock spiked to about $97, a spike of over 25%.Niccol only took over as CEO September 9th, but in the six weeks since, there has been a dearth of information from Niccol or corporate headquarters, other than a statement issued September 10th from Niccol listing four nebulous “key areas”, or goals where Niccols says he intends to focus:

- Empowering our baristas to take care of our customers:

- Get the morning right, every morning:

- Reestablishing Starbucks as the community coffeehouse:

- Telling our story

Even the paragraphs following the stated goal seem nebulous.

For example, to describe “Telling our story”, Nichol said “We won’t let others define who we are”. That sounds like something one would hear at a political rally at the start of a campaign for the House of Representatives than a welcome message from a new CEO. Who else is going to define who Starbucks is? Why does anyone else care who you are? (In my student days, a friend with whom I used to debate everything from politics to football, used to call such vacuous ramblings of our mutual friends “winding”; meaning that the speaker was saying something simply to say “something”, but not something actually important or pertinent. I think Niccol was “winding”. )

Niccol’s statement offered from September 10th offers nothing that even resembles a strategy in my opinion. Starbucks’ surprise statement Tuesday, and Niccol’s video statement are equally nebulous. In my view, “Back to Starbucks” doesn’t seem so much a strategy as a marketing slogan. And simplifying the menu and lowering prices aren’t really grand strategy.

Niccol promises more details next week, when earnings are released, but it seems to me the slight hike in the dividend, announced Tuesday, is an effort to buy time for a CEO who’s flailing about to come up with a strategy. Releasing the video was a mistake, in my view; Starbucks simply should have withdrawn guidance and left the statement to stand on its own. What he said in the video didn’t offer a concise set of objectives or the means to achieve them. For me, it did not inspire confidence. (And I liked Niccol when he took over Chipotle (CMG).)

Getting “Back to Starbucks” and to restore Starbucks as the “neighborhood coffee house” is going to require a considerable capital and operational spend, particularly in big cities.

Most Starbucks here in New York, for example, are, today, built in a smaller footprint than their larger counterparts of a decade and more ago. Few have bathrooms because Starbucks’ 2018 decision to open restrooms to all, whether or not users were customers, resulted in vandalism, drug use, and people experiencing homelessness using them as shelter. Only a few now seem to have restrooms, even for paying customers. I do not see an opportunity for a “return to Starbucks” of the 1990’s and 2000’s”, where one would linger with a laptop and have small meetings, at least in major cities. Instead, locally-owned, independent, coffee shops fulfill that kind of coffee house, and generally at a lower price.

The “Superstar CEO” Narrative is Sanguine

I wrote in August that Niccol had replaced an executive team at Chipotle (CMG) that was, in my view, well beyond their executive competencies and expressed my doubts that he could replicate any of the big changes he made at CMG. I recommend reading that article now if you have not already.

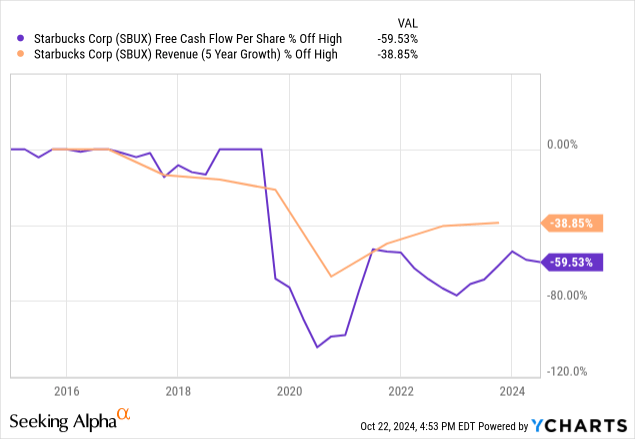

Revenues and Cash Flows Have Fallen

Starbucks revenue and free cash flow are well off pre-pandemic trends. Yesterday’s surprise announcement stated that there had been a 10% decline in North American same store comparable transactions, offset by a 4% increase in the average ticket.

The Macro Environment in the USA is Challenging

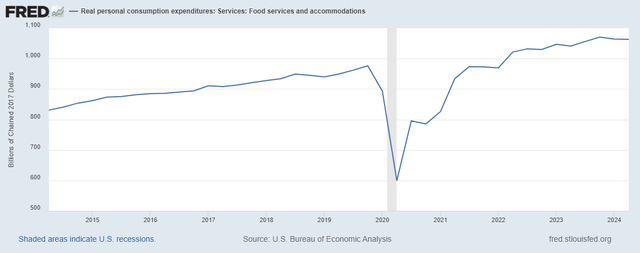

Real personal consumption expenditures: Services: Food services and accommodations (Federal Reserve)

The above chart of Real Personal Consumption on Food Services and Accommodations shows flat and even declining real spending on such services since 2023. With Starbucks plain coffee in the $6 or $7 range in my market, it should come as no surprise that it is among the first things that consumers have cut back.

Starbucks Valuation is Overstated

Oakoff Investments made the case last month that Starbucks valuation is overstated. I agree. Moreover, I don’t think that Brian Niccol has a strategy to recover the valuation. I think he’s floundering for lack of a strategy and his public statements, so far, make that clear to those of us paying attention.

A Better Valuation

I think Starbucks target price is likely in the $80 to $85 range unless Niccol takes some audacious steps to turn the brand around. “Back to Starbucks” or other work around the edges of performance simply won’t do and certainly will not do within the time investors expect. In my August article, I suggested some steps Niccol might use to improve Stabucks daily operational performance. But those aren’t the kind of audacious changes that result in turnaround.

Be Audacious. Change the Game

Starbucks had pegged its hope for growth on China, and it has not gone well. Growth in mature businesses almost always requires a fundamental shake-up of the underlying business model.

General George Patton, the legendary World War II Army commander, was fond of quoting Frederick the Great’s phrase, “il nous faut de l’audace, et encore de l’audace, et toujours de l’audace!” (“We need audacity, more audacity, and always, audacity!”)

“Starbucks, as a commenter on another Starbucks article wrote, “is a mature brand.” It also has a low barrier to entry (as Luckin’ Coffee in China and countless independent coffee shops have shown.) Growth in such circumstances can only come from either boosting the top line, with innovation, or increasing margins, to boost the bottom line.Raising prices and reducing menu complexity will not revive the brand and will only generate marginal growth in the top or bottom line. It won’t create the values that Starbucks is now trading at.But Niccol could wake up the market and give investors confidence with an audacious change to the business model.Here are three things Niccol could do to build value:

China is a Money Pit. Get Rid of It.

Starbucks has reportedly spent 25% of its capital spend on China, with horrible results. According to yesterday’s presser “China comparable store sales declined 14%, driven by an 8% decline in average ticket compounded by a 6% decline in comparable transactions.”

Starbucks has lost half its China market share since 2017, when Chinese mirror entity Luckin’ Coffee started, according to the Financial Times. FT columnist Pan Yuk recommends refranchising the China operations to a master franchisee or spinning the operations off into a separate, public, corporation. I agree. Luckin’ Coffee, a lower-priced Chinese competitor of equivalent quality beats SBUX in that market.

Refranchise Struggling North American Retail Stores

The principal asset of Starbucks is its brand. That’s why people pay a premium price for it. So why does the company need to own retail outlets? Niccol should go “asset light” and refranchise them with licensing and supply contracts. This was a tactic that former McDonald’s CEO Steve Easterbrook used to develop an “asset light” model and return enormous amounts of capital to MCD investors. Niccol could take a lesson. Easterbrook’s strategy built margins, reduced debt, and created great value. (I was quite circumspect of Easterbrook’s methodology at the time because I thought it was merely financial engineering, not building the business. But I now see the value proposition behind what he did because MCD was a mature business without much to offer in the way of operational growth by innovation, an attribute I value greatly.)As with Starbucks in China, refranchising makes sense, especially given Starbucks control of its quality growers, roasters, and brewing technology. Franchising out the brand to people with personal, direct, ties to the community, and a personal stake in making the location a success, makes far greater sense if Niccol is serious about realizing a return to “the neighborhood coffeehouse” vision he has pushed. After all, owner-operators have a greater personal stake in the location’s success than hourly baristas – and even store managers – who get “paid the same whether they march or fight”. They’re personally invested in the business, not just drawing a paycheck.

License the Clover Vertica Machine to Offices and Workplaces

A Starbucks Vertica (Starbucks)

Starbucks owns rights to the Vertica machine, an incredibly simple, award-winning coffee maker design that holds a variety of beans, grinds them, then brews them and dispenses them as single cups of coffee with a single push button and dial. Office workers could dispense their own coffee and SBUX could have the exclusive right to deliver the beans, filters, and other materials to make coffee in corporate offices. In some localities, the “in-office” location might allow a stand alone retailer to close, but for Starbucks to realize bigger margins.

With so many employers struggling to get workers to return to the office, this in-office perk would be a great motivator. The license fees for the use of the machine would be a steady, predictable, source of revenue and the fact that employers would offer Starbucks coffee free as a perk would increase consumption. Starbucks can realize significant value, but not if its CEO fails to be audacious. My view that Starbucks will underperform, and investors should be short, assumes Niccol will not be so audacious. (See the bold portion of the NOTE, below.)

_________________________________

NOTE: Our commentaries most often tend to be event-driven. They are mostly written from a public policy, economic, or political/geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be under-performing and include strategies that we would recommend were the companies our clients. Others discuss new management strategies we believe will fail. This approach lends special value to contrarian investors to uncover potential opportunities in companies that are otherwise in a downturn. (Opinions here with respect to whether to buy, sell, or hold such companies, however, assume the company will not change its current practices).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The views expressed, including the outcome of future events, are the opinions of the firm and its management only as of October 24, 2024, and will not be revised for events after this document was submitted to Seeking Alpha editors for publication. Statements herein do not represent, and should not be considered to be, investment advice. You should not use this article for that purpose. This article includes forward-looking statements as to future events that may or may not develop as the writer opines. Before making any investment decision you should consult your own investment, business, legal, tax, and financial advisers. We associate with principals of Technometrica on survey work in some elements of our business.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.