Summary:

- AT&T reported better-than-expected Q3 earnings, with strong broadband momentum, resulting in a 5% share price increase after the earnings report.

- The telecom added 226k broadband subscribers in Q3, marking the 19th consecutive quarter of over 200k net adds, and saw a 5% Y/Y ARPU gain.

- AT&T generated $5.1B in free cash flow, with a 255% dividend coverage ratio, and confirmed its $17-18B free cash flow forecast for the year.

- Despite high debt, AT&T’s deleveraging efforts and robust broadband subscriber growth suggest continued upside potential and excellent value for dividend investors.

ryasick

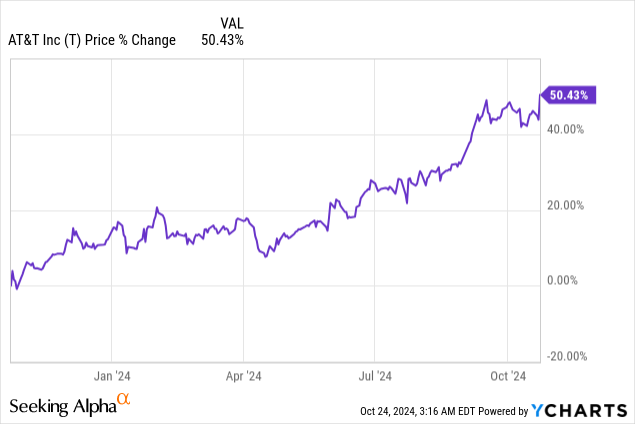

After Verizon Communications (VZ) submitted its earnings sheet for the third fiscal quarter on Tuesday, AT&T (NYSE:T) reported results on Wednesday. The telecom had better than expected earnings but missed on the top line. Shares of AT&T increased 5% after the Q3 earnings report, attesting to the fact that investors appreciated the company’s solid subscriber momentum in the broadband business. Additionally, AT&T benefited from strong free cash flow, which implies a Q3’24 dividend coverage ratio of 255%. I believe AT&T continues to have valuation upside and the dividend should prove to be very safe for investors going forward.

Previous rating

Last week, I indicated that AT&T was likely headed for a good Q3 earnings release as the telecom benefited from a strong deleveraging trend as well as robust subscriber acquisition momentum in the core broadband business: AT&T: The Moment Of Truth. AT&T also achieved considerable free cash flow in the third fiscal quarter and added more than 200K subscribers to its broadband segment. I see a favorable risk profile for long-term dividend investors and AT&T’s 10% earnings yield makes shares a strong buy, in my opinion.

Q3’24 results beat

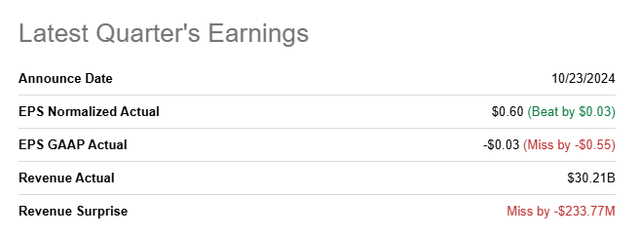

AT&T reported better than expected earnings for the third-quarter: it had $0.60 per-share in adjusted earnings, beating the average prediction by $0.03 per-share. On the top line, however, the telecom’s results fell short of expectations and the company missed the consensus by $234M.

Strong momentum in broadband

AT&T had 226k net adds in the broadband business in the third-quarter, which marked the nineteenth consecutive quarter in which the telecommunications company added at least 200k new subscribers to its broadband operations. I estimated a range of 230-250K new subscriber adds in the third-quarter, so AT&T slightly missed my estimate. Importantly, AT&T saw a healthy 17% Y/Y increase in fiber broadband revenues, driven by growth in its subscriber base and higher average revenue per user/ARPU.

Average revenue per user in broadband grew 5% year-over-year (including both fiber and non-fiber operations) to $68.25 per-user. Both the subscriber momentum as well as continual ARPU growth are two reasons within the broadband segment that are going really well for AT&T.

|

Broadband KPIs |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

Y/Y Growth |

|

Revenue |

||||||

|

Fiber |

$1,613 |

$1,678 |

$1,736 |

$1,796 |

$1,882 |

16.68% |

|

Non-Fiber |

$1,054 |

$1,022 |

$986 |

$945 |

$956 |

-9.30% |

|

Total Revenue |

$2,667 |

$2,700 |

$2,722 |

$2,741 |

$2,838 |

6.41% |

|

Net adds |

||||||

|

Fiber (in thousands) |

296 |

273 |

252 |

239 |

226 |

-23.65% |

|

Non-Fiber (in thousands) |

-281 |

-254 |

-197 |

-187 |

-198 |

-29.54% |

|

ARPU |

||||||

|

Fiber |

$68.21 |

$68.50 |

$68.61 |

$69.00 |

$70.36 |

3.15% |

|

Non-Fiber |

$60.43 |

$61.38 |

$61.81 |

$61.38 |

$64.43 |

6.62% |

|

Total Broadband ARPU |

$64.91 |

$65.62 |

$65.98 |

$66.17 |

$68.25 |

5.15% |

(Source: Author)

Free cash flow and debt repayments

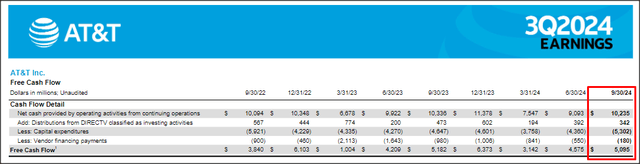

AT&T generated $5.1B in free cash flow while paying ~$2.0 billion in dividends during the last quarter. The dividend coverage ratio in Q3’24 therefore calculates to 255%. For context, Verizon’s dividend coverage ratio in the third fiscal quarter was 214% meaning AT&T does overall offer investors a higher safety margin to investors. AT&T also confirmed its free cash flow forecast (which I expected) and continues to guide for $17-18B in free cash flow in FY 2024.

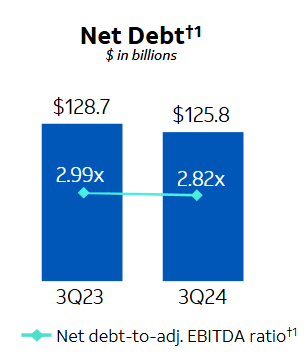

AT&T also repaid more debt in the third-quarter, which, I believe, is a catalyst — as explained in my pre-earnings review Moment Of Truth — for higher free cash flow and higher capital returns in the future. In the third-quarter, AT&T reduced its net debt by $1.1B, which compares to a Q/Q net debt reduction of $1.9B in Q2’24. Year-over-year, the net debt reduction was $2.9B, so AT&T is making some solid progress here in terms of deleveraging.

AT&T

AT&T has a 10% earnings yield

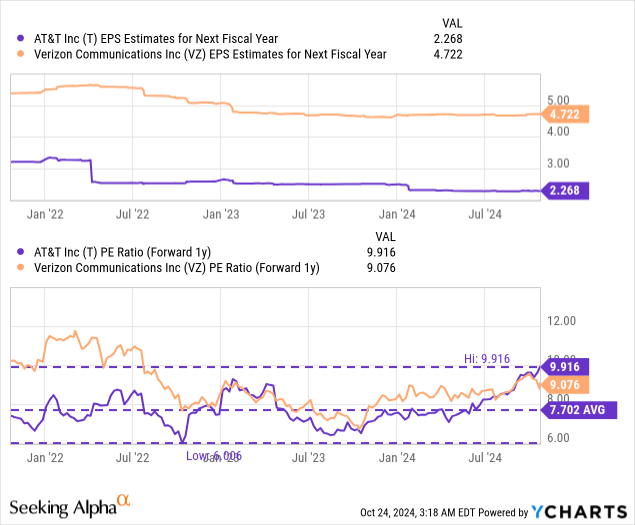

AT&T is currently trading at a forward P/E ratio of 9.9X, which implies a material earnings yield of 10%. Verizon, on the other hand, is trading at a 9.1X P/E ratio on a forward (FY 2025) basis, which implies a slightly higher earnings yield of 11%. Verizon dropped after Q3 earnings, but I believe the drop is a new engagement opportunity for dividend investors, as I explained here.

In my last work on AT&T, published just before earnings, I indicated that I saw a fair value P/E ratio of 11-12X, given the telecom’s potential to lower its debt burden in the long term. This translated to a fair value of $25-27 which implies, at a current price of $22.49, up to 20% upside revaluation potential. Since AT&T has mostly met my expectations for Q3 — confirmed FCF outlook for FY 2024, ARPU growth, subscriber additions ~230k, Q3 net debt reduction of at least $1.0B — I believe the bullish case for AT&T is very much intact.

Risks with AT&T

AT&T still owns a ton of debt, which is a major issue for me as a shareholder. The telecom, however, is moving in the right direction and is lowering its financial obligations, which could lift a weight off of AT&T and result in lower interest expenses and higher free cash flow going forward. In consequence, a continual deleveraging trend could pave the way for higher capital returns, and potentially a higher dividend as well. What would change my mind about AT&T is if the telecom were to see slowing subscriber acquisition momentum in its core broadband business, or if the telecom stopped reducing its net financial debt.

Final thoughts

AT&T delivered a strong earnings report card for its third fiscal quarter and the telecom convinced on a number of fronts including subscriber acquisition momentum in the broadband business, free cash flow and net debt reductions. The latter especially, debt repayments, is a crucial lever that the telecommunications company can pull in order to reduce its interest expenses and therefore grow its free cash flow. I believe AT&T continues to represent excellent value for dividend investors, and the free cash flow performance in the third quarter highlighted a dividend coverage ratio of 255%. With shares trading at an earnings yield of 10% and below fair value, AT&T remains a no-brainer buy for me after Q3 results.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.