Summary:

- Tesla, Inc. experiences considerable operational issues.

- Price cuts will increase demand, but margins will come under pressure.

- Tesla has fallen so much that valuation isn’t the key issue it used to be any longer, although Tesla is still far from cheap.

insta_photos

Article Thesis

Tesla, Inc. (NASDAQ:TSLA) has seen its share price drop quite a lot over the last year. Demand problems are mounting, and the company’s recent price cut initiative will pose a headwind for Tesla’s margins. There are thus good reasons to not be overly bullish when it comes to Tesla’s operational near-term outlook.

On the other hand, Tesla has become pretty inexpensive relative to how the company was valued in the past. I used to be a major critic of Tesla’s valuation, and while TSLA still trades at a premium compared to other automobile companies, the current valuation is way more reasonable than it used to be.

Operational Headwinds For Tesla

Much has been said about headwinds for Tesla such as Elon Musk’s controversial behavior and how that alienates some consumers, thus I won’t put the focus on that in this article. Instead, I’ll look at some other items that are problematic for Tesla’s near-term business outlook.

The Waning Virtuous Cycle

A dropping share price could be an issue for Tesla. Some investors that got into Tesla early on have seen their investment grow massively over the years. These gains were, by some, used to acquire a vehicle from Tesla — which, in turn, was good for Tesla’s sales and profits, thereby impacting the share price performance positively. One could call this a virtuous cycle. But with Tesla dropping lower and lower, fewer and fewer investors will be happy with their investment performance, and fewer and fewer investors will be able to lock in massive gains that can be used for the acquisition of a high-priced electric vehicle.

In short, a declining share price could thus negatively impact Tesla’s sales in the future, as an important buyer group — Tesla investors with massive gains — is fading away. All else equal, this should diminish Tesla’s sales potential. Between January 2020 and January 2022, Tesla added around $1.1 trillion in market capitalization — investors benefitted massively from this wealth-creating effect. It is, I believe, reasonable to assume that a substantial amount of wealth that was created this way flowed back towards Tesla via the purchase of new Tesla vehicles by investors. Since January 2022, however, Tesla’s market cap declined by around $800 billion, which was a huge amount of wealth destruction. That will most likely not impact Tesla’s sales potential positively going forward — the contrary could be true.

Declining Value Of Vehicles

Tesla’s margins have, relative to other automobile companies, been excellent over the last two years. Only a few other automobile companies such as Ferrari (RACE) and Porsche (OTCPK:POAHY) were able to generate similarly attractive margins. This is partially due to the premium segment that Tesla addresses, but Tesla also benefitted from the fact that fiscal and monetary stimulus made its customers flush with cash, which is why buyers were willing to pay higher and higher prices for one of Tesla’s vehicles, which bolstered Tesla’s margins.

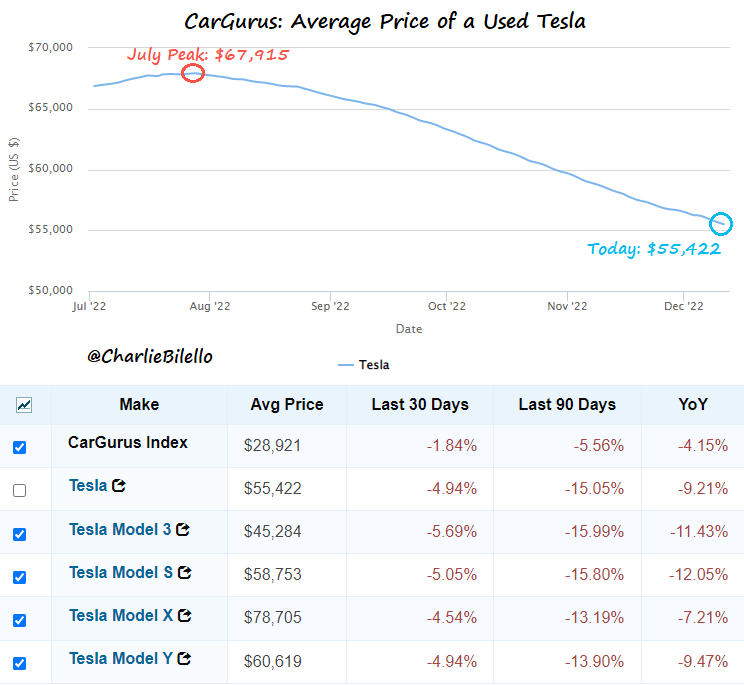

Current data points suggest that this will not be the case going forward. The following chart shows the average pricing of used Tesla vehicles in the U.S.:

Charlie Bilello on Twitter

Used vehicle prices from all manufacturers have been pulling back across the board, but not to the same degree compared to what we are seeing here when it comes to Tesla’s models. From a peak in July, prices have pulled back by a massive 18%. Note that this data does not yet include the impact from the price cuts that were announced in the U.S. in the very recent past, which will likely result in even more downward pressure on vehicle prices. The downward movement in used vehicle prices tells us that the supply-demand picture for used vehicles must have shifted massively. Either, more Tesla owners are willing to sell their vehicles (e.g., due to being unhappy with Musk), or fewer people must be willing to buy a Tesla (e.g., due to inflation pinching their pockets), or it might be a combination of both factors — fewer willing buyers and more willing sellers. The steep price drop also means that Elon Musk’s statement about Tesla vehicles being appreciating assets seems even more questionable now, as prices have fallen across the board.

Price Cuts Spell Trouble

Tesla started cutting the price per vehicle a couple of weeks ago in China and has now also cut prices for vehicles in other markets, such as the U.S. There is a lot of controversy about how to interpret these price cuts, but I believe they don’t paint a positive picture. A company that sees its backlog grow due to demand outpacing supply will increase prices over time in order to boost profits, all else equal. That’s what Tesla had been doing in 2021 and 2022, which is why profits rose considerably in that time frame.

Right now, Tesla is doing the contrary — cutting prices. All else equal, this will result in two things: First, lower prices will result in higher demand for Tesla’s vehicles. This should result in growing sales volumes, but depending on the size of this impact, it may not result in growing revenues. If, for example, a 15% price cut results in a 10% boost to sales volumes, overall revenue growth would still be negative. Since the total electric vehicle market will likely grow meaningfully this year, I believe that a revenue decline for Tesla is unlikely, but investors should nevertheless not overestimate the demand-stimulating impact of price decreases. A $60,000 EV (electric vehicle) is too expensive for many consumers in a high-inflation environment even following a 10%, 15%, or 20% price cut, thus demand will not suddenly explode upwards.

Looking at some data points from China, where Tesla first lowered its prices drastically, there seems to be additional demand — one report suggests that Tesla sold 76% more vehicles in the week ending January 15, relative to one year earlier. Of course, other factors could be at play, such as the impact of economic reopening. It is also far from guaranteed that this impact will last, but at least for a short period of time, the price cuts seem to have juiced up demand. On the other hand, it is worth noting that some Tesla customers that bought vehicles at the old, higher price, were very unhappy with Tesla’s price cuts and have stormed Tesla’s stores in protest. It thus looks like some new customers were attracted by the price cuts, while Tesla angered some of its previous customers. Angering existing customers poses a risk, as it might make these customers less likely to buy another Tesla in the future.

The even more important impact of Tesla’s price cuts is what happens to its margins, however. Over the last year, Tesla’s gross margin was 27%, according to YCharts’ data. We don’t know yet what the average price cut impact will be, as this depends on items such as sales mix (unknown), what percentage of buyers will pay for high-margin items such as the self-driving package (unknown), and so on. We can make estimates, however. Reuters reports that the price cuts ranged from 6% to 20%, thus the middle of that, 13%, could be a reasonable base case assumption. If Tesla cuts its vehicle prices by 13% while its costs remain unchanged, that results in a massive hit to its gross margins, which would drop from 27% to 14% in this scenario. Tesla would thus have to sell around 90% more vehicles in order to generate the same total gross profit.

Of course, there are some other factors at play on top of that. First, higher sales numbers will have a positive impact on margins, as it allows Tesla to distribute its fixed production costs over more vehicles. On top of that, some other input costs will likely be lower this year as well, as many commodity prices have pulled back from the highs seen during the pandemic. Overall, I thus do not believe that the gross margin impact will be as large as the price cuts suggest at first sight.

But even if the actual hit to Tesla’s gross margin is just half as high as what the price cuts suggest (7% instead of 13%), Tesla’s gross margin drops from 27% to 20%, all else equal. This means that Tesla will have to generate around 35% higher revenues for gross profits to remain unchanged versus the previous year. Due to market growth and the ramp-up of its two newest Gigafactories, revenue growth in the 30s seems achievable. But it looks highly likely that 2023 will not be a strong year for Tesla when it comes to profit growth. Today, Wall Street analysts are predicting that Tesla will grow its earnings per share by just 12% this year — which is far from overwhelming for a high-growth EV company.

Valuation: A Less Impactful Headwind Going Forward

All in all, there are thus good reasons to be cautious when it comes to Tesla’s business outlook in the near term. A weak demand picture, falling used vehicle prices, and weak expected profit growth don’t paint a rosy picture. The good news is that Tesla’s shares have fallen so much that this might already be priced in today.

I have been a critic of Tesla’s very high valuation for some time, e.g., in this bearish article from October 2021 where I stated: “The biggest issue for Tesla, at current prices, [is] its ultra-high valuation.” Shares have fallen by 58% since then, thus the overvaluation thesis has played out pretty well so far. Today, Tesla’s valuation does not seem like an equally large issue any longer. While Tesla is still far from cheap and continues to trade at a major premium versus how other automobile companies are valued, the valuation seems at least somewhat reasonable today. Based on expected profits for 2023, Tesla trades at 28x net profits, for an earnings yield of close to 4%.

Legacy players are considerably cheaper, but I believe Tesla deserves a premium valuation, due to stronger growth, higher margins (at least up to the recent price cuts), and due to a clearer path forward due to their EV focus, whereas some legacy players don’t really seem to know what their future product mix should look like.

Takeaway

I do not deem Tesla, Inc. attractive at current prices, as I am generally not a fan of owning automobile companies going into an economic downturn, and since Tesla is still far from cheap. But the share price slump over the last year has been so pronounced (to the detriment of shareholders) that Tesla’s valuation isn’t as concerning as it used to be. Depending on Tesla’s execution going forward, one can make a reasonable case that Tesla is not very overvalued any longer. While the near-term business outlook has worsened, the Tesla, Inc. valuation picture thus has improved considerably, which can be seen as a good thing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!