Summary:

- VZ remains a compelling Buy due to its increasingly richer dividend yields, thanks to the market’s overreaction to the top-line FQ3’24 miss.

- The telecom’s core wireless services segment continues to perform well, with stable gross margins and increasing ARPA, as myPlan grows in popularity.

- VZ’s reiterated forward guidance and raised consensus estimates imply continued top and bottom-line expansion, with it supporting the safe dividend investment thesis.

- Even so, readers may want to brace for a potential FY2024 top-line miss, attributed to the YTD performance at +1.7% YoY.

- In addition, we expect a normalized borrowing rate only by the end of 2026, along with it, VZ’s temporarily elevated interest expenses and consequently, prolonged bottom-line recovery.

z1b

VZ Is Inherently Undervalued – Offering Opportunistic Investors With The Richer Dividend Yields

We previously covered Verizon Communications Inc. (NYSE:VZ) in July 2024, discussing why we had maintained our Buy rating after the painful correction – with it presenting a great opportunity for dividend-oriented investors to dollar cost average, attributed to the expanded dividend yields.

This was on top of the reiterated FY2024 guidance and upgraded consensus forward estimates, with it signaling the safety of its investment thesis.

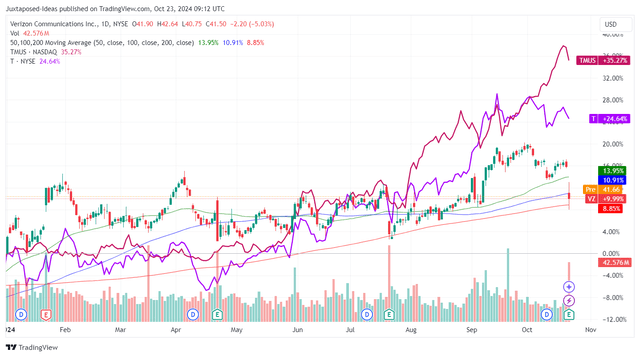

VZ YTD Stock Price

Since then, VZ has had a robust outperformance attributed to the market rotation from high-growth stocks to value/ dividend-yielding stocks in July/ August 2024, one which has rapidly moderated upon the market’s over-reaction to the FQ3’24 mixed performance.

For reference, the telecom has reported consolidated revenues of $33.3B (+1.5% QoQ/ inline YoY) and adj EBITDA of $12.5B (+1.6% QoQ/ +2.4% YoY) – with the miss attributed to the consensus revenues estimates of $33.42B.

We believe that the correction has been overdone indeed, since the miss was attributed to the lumpiness in VZ’s wireless equipment revenues at $5.34B (+7% QoQ/ -8% YoY) – with it well-balanced by the growing core services revenues at $27.98B (+0.6% QoQ/ +1.6% YoY).

Most importantly, the Consumer Services revenue remains the top-line driver at $19.26B (+0.3% QoQ/ +2.1% YoY), thanks to the growing wireless retail postpaid consumer count at 94M (+0.04M QoQ/ +1.3M YoY) as the telecom’s flexible mobile plan, myPlan, grows in popularity.

myPlan’s success has also contributed to the wireless retail postpaid segment’s higher Average Revenue Per Account [ARPA] at $139.06 (+0.4% QoQ/ +4.1% YoY) – with it signaling VZ’s ability to increasingly monetize its highly sticky consumer base.

The same has been similarly observed in the robust YoY Consumer Wireless retail postpaid upgrade rate at +3.2% in the latest quarter, building upon the +2.9% observed in FQ2’24 and +3.6% in FQ3’23, despite the elevated churn rate at 1.07% (+0.07 points QoQ/ +0.03 YoY).

With VZ’s core telecom services business still doing well, we believe that the sell-off has been overly done indeed, especially given the consistently growing Fios internet and broadband adoption.

At the same time, readers must note that the services segment remains the telecom’s bottom-line driver with a relatively stable gross margin of 74.3% (-0.6 points QoQ/ +0.1 YoY), compared to the wireless equipment segment at a loss gross margin of -13.1% (-1.7 points QoQ/ +1.8 YoY).

For now, VZ has continued to reiterate their FY2024 guidance of adj EBITDA growth by +2% YoY – with us believing that the management “remains on track to meet financial guidance,” based on the YTD numbers of +3.1% YoY.

This is despite the potential total wireless service revenues guidance miss at +2.75% YoY and YTD performance of +1.7% YoY, one that we believe to be immaterial for now.

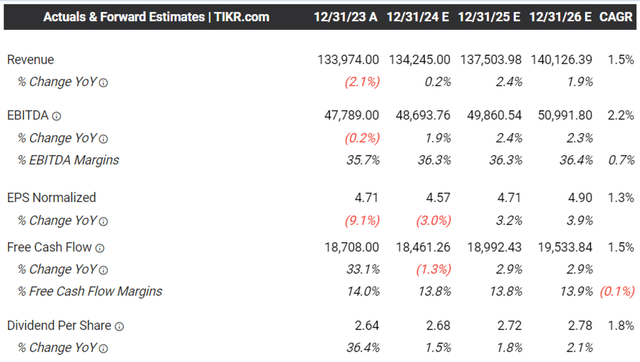

The Consensus Forward Estimates

If anything, the consensus forward estimates remain promising, with VZ expected to generate decent top/ bottom-line growth at a CAGR of +1.5%/ +2.2% through FY2026.

This is compared to the original estimates of +1.4%/ +1.7%, while building upon the historical growth at +0.9%/ +0.9% between FY2016 and FY2023, respectively.

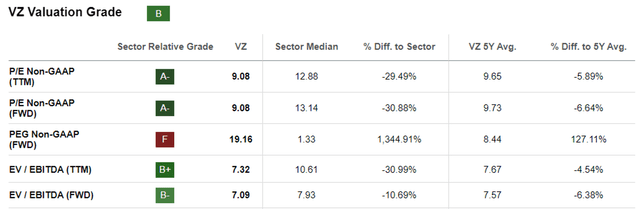

VZ Valuations

And the improved top/ bottom line growth is why we believe that VZ remains compelling at FWD EV/ EBITDA valuations of 7.09x, compared to its 5Y mean of 7.57x, 10Y mean of 7.18x, and the sector median of 7.93x.

Even when comparing to its telecom peers, including AT&T Inc. (T) at FWD EV/ EBITDA valuations of 7.08x and T-Mobile US, Inc. (TMUS) at 11.51x, it is undeniable that there is an excellent margin of safety for those looking to add VZ here.

This is especially true since VZ continues to report robust YTD Free Cash Flow of $14.5B (-0.6% YoY) compared to the YTD dividend obligations of $8.38B (+2% YoY) – implying the safety of its dividend investment thesis.

This is on top of the stable debt to adj EBITDA ratio of 2.5x (inline QoQ/ down from 2.6x reported a year ago), thanks to its growing YTD profitability, as the consensus also expects a consistent expansion in its adj EBITDA and Free Cash Flow generation over the next few years.

So, Is VZ Stock A Buy, Sell, or Hold?

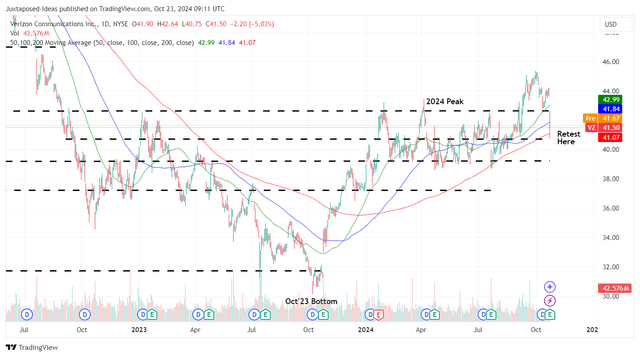

VZ 2Y Stock Price

For now, VZ appears to be well-supported at the $41s as the bulls defend the dip, with it currently trading near its 100-day moving average.

As a dividend stock, it goes without saying that its dividend investment thesis remains rich at forward yields of 6.53%, compared to the 5Y mean of 3.96% and the sector median of 3.57%, significantly aided by the recent pullback by -5%.

This is especially true since the Fed has already commenced the rate pivot with an outsized moderation by 50 basis points in the recent September 2024 FOMC meeting, with the market pricing in another 25 basis point cut in the upcoming November 2024 FOMC meeting.

This development has already triggered the moderation in the US Treasury Yields to between 4.02% and 4.63% by the time of writing, compared to the peak of 4.95% and 5.51% observed in October 2023, respectively.

As a result of the richer dividend investment thesis, we are maintaining our Buy rating for the VZ stock here.

Risk Warning

As a capex-heavy and debt-laden telecom stock, readers should not look towards VZ to generate high capital appreciation prospects, since it is geared towards investors seeking regular quarterly incomes.

As a result, investors should look at its Free Cash Flow generation and dividend yields as the two key metrics to its investment thesis, which currently remain more than decent.

At the same time, while VZ may have guided lower capex on a YoY basis as we leave peak 5G-related spending in 2022, it is apparent that the higher YTD interest expenses by +27.6% YoY remain a bottom-line/ Free Cash Flow headwind.

While we are entering a deflationary and rate normalization environment, we expect the process to be prolonged, implying that the telecom is likely to report higher interest expenses for longer, attributed to the higher weighted average interest rates of 5.1% by FQ2’24 (+0.1 points QoQ/ +0.3 YoY/ +0.3 from FY2019 levels of 4.8%), with FQ3’24 detailed filings yet released.

As a result, readers may want to temper their intermediate-term expectations, since we expect a normalized borrowing rate only by the end of 2026, along with it, VZ’s improved bottom-line performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.