Summary:

- Tesla’s stock surged 20% post-earnings due to improved margins and future model plans, despite missing revenue estimates.

- Elon Musk’s optimistic forecasts include new affordable models by 2025 and ramping up Cybercab production to 2 million units by 2026.

- While Tesla’s recent performance is promising, sustaining margins and meeting future targets are crucial for long-term investor confidence. Can Musk deliver?

Michael Swensen

Thesis Summary

Tesla, Inc.’s (NASDAQ:TSLA) stock exploded 20% higher following earnings despite missing revenue estimates.

Investors were pleased, however, with the robust increase in margins across the board and talks of new models in 2025.

With expectations and sentiment near historical lows, a squeeze like this wasn’t unlikely, although a 20% gain is more than I would have expected.

The question now remains if Tesla’s Q3 margins and trajectory can continue in the future.

In order to do this, Elon Musk has to actually deliver. Deliver new affordable models, as promised in the earnings call.

- Deliver FSD, as promised in the robotaxi event.

- Deliver steady growth and margin expansion in the face of increased competition.

Though I have been a long-term Tesla bull, I rated the stock a Hold in my last article following the robotaxi event, as I saw Musk deliver more promises without tangible results.

The latest earnings certainly do provide tangible results, but I’ll need to see more to fully restore my faith. Still, I remain optimistic, so I am upgrading back to a Buy following these earnings.

Q3 Earnings Overview

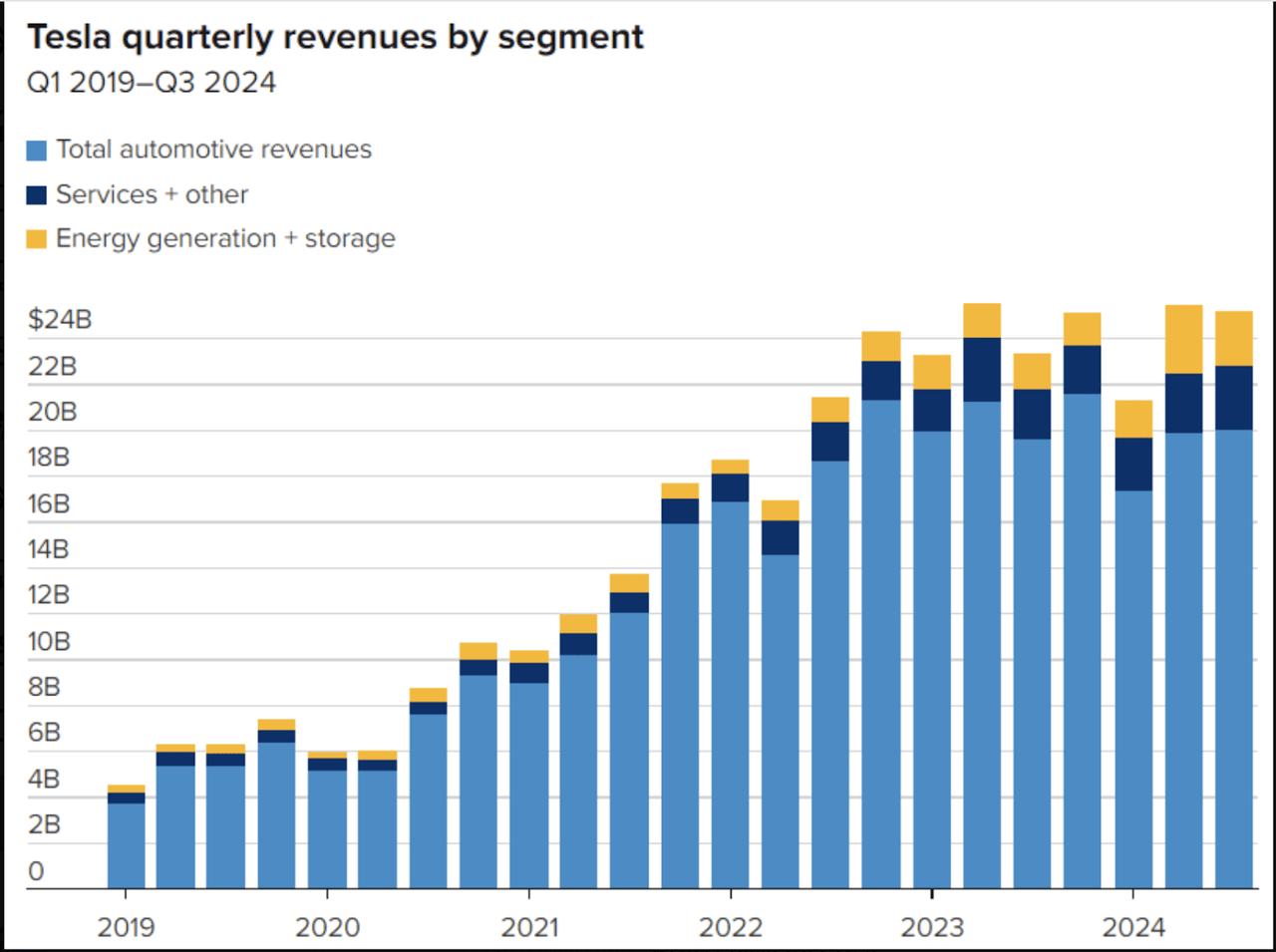

Tesla missed revenues by $314.74 million but beat EPS estimates by $0.12. Let’s begin by looking at some charts to see the company’s trajectory, and better understand why this quarter was actually so important.

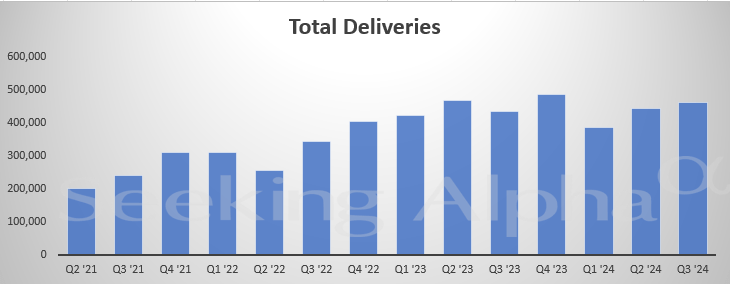

TSLA Deliveries (SA)

Despite missing revenues, deliveries were up QoQ. The growth has certainly slowed down, but it seems like the worst could be behind us, and at least the trend of higher deliveries continues.

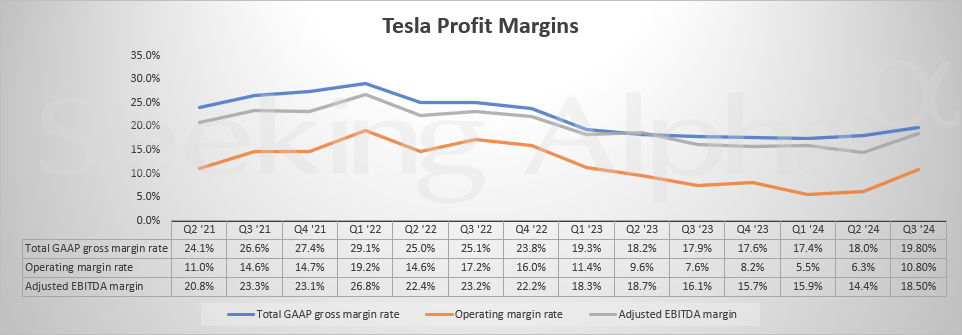

Tesla Margins (SA)

But of course, the big win this quarter was margins. The operating margin reached 10.8% up significantly from the last quarter and breaking the trend of lower margins. The profitability trajectory looks even better if we break it down by segment.

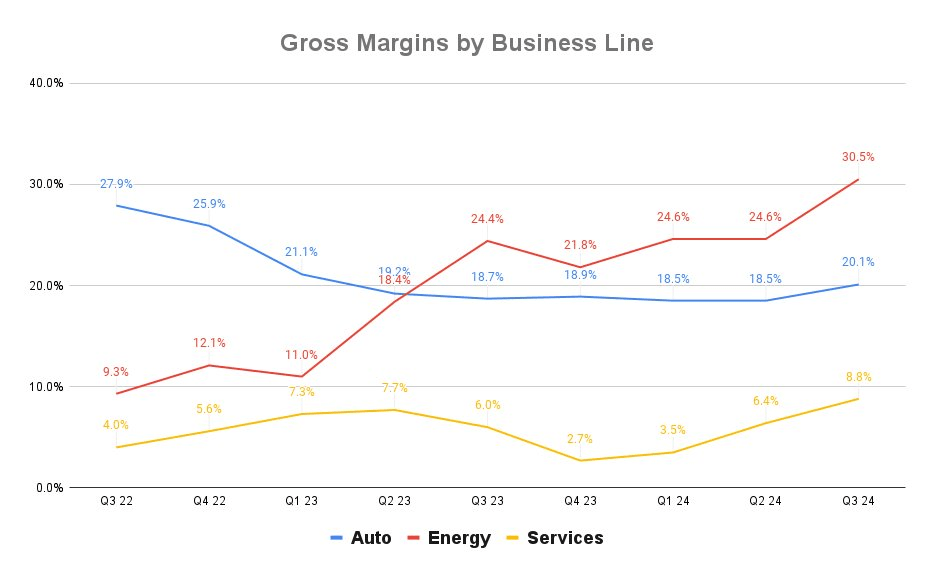

Gross Margin By Business (X)

The energy segment continues to fire on all cylinders and now has a gross margin of over 30%. The margin and growth for revenue from Services have also been really good. To top things off while Auto margins are still below their 2022 levels, they have shown an encouraging trajectory.

The latest quarter, in fact, confirms something I wrote about a few months ago after the Q2 earnings. The bottom is likely in, by which I mean the bottom in margins, revenue growth, and, of course, price.

Insights From The Earnings Call

We’ve pointed out two reasons why Tesla rallied:

-

Higher margins.

-

Encouraging trends in revenues.

However, there is one more catalyst here that completes the trifecta, and that is the encouraging news that Tesla will be developing new affordable models.

So, regarding the vehicle business, we are still on track to deliver more affordable models starting in the first half of 2025. This is I think probably people are wondering what should they assume for vehicle sales growth next year. And at the risk of – to take a bit of risk here, I do want to give some rough estimate, which is I think it’s 20% to 30% vehicle growth next year.

Source: Earnings Call.

Yes, it seems like we will see some more affordable models coming our way in 2025. In his usual fashion, Musk was not afraid to forecast an optimistic 20%-30% vehicle growth for next year.

Similarly, he remains very bullish on the ramp-up for the Cybercab:

And then Cybercab reaching volume production in ’26. I do feel confident of Cybercab reaching volume production in ’26. So just starting production, reaching volume production in ’26. And that’s — that should be substantial. And we’re aiming for at least 2 million units a year of Cybercab.

Source: Earnings Call.

This should take full effect by 2026 with the company aiming for at least 2 million units.

Lastly, and perhaps most importantly, let’s see what Musk had to say about the margins.

Automotive margins improved quarter over quarter as a result of a 50 features released discussed before. Increase in our overall production and delivery volume, albeit benefit from the marketing pricing, and more localized deliveries in region, which resulted in lower freight and duties.

Sustaining these margins in Q4, however, will be challenging given the current economic environment.”

Source: Earnings Call.

Tesla benefitted from 50 autonomous vehicles already released in 2024, as well as increased volume production and more local sales. While not mentioned here, Tesla likely also benefited from the lower lithium prices.

My 2 Cents

All in all, we can’t deny that the numbers did improve for Tesla this quarter. This, combined with the already terrible sentiment and some shorting, probably contributed to creating this 20% pop.

But will this be sustainable long-term? Let’s take it step by step.

Revenues

In terms of revenues, while Tesla is no longer a growth stock, we do have plenty of interesting growth avenues out there, and with new models coming I have some hope that auto sales will improve.

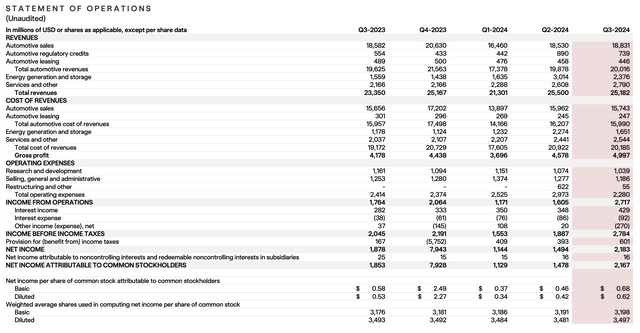

Statement of Operations (SA)

Meanwhile, Energy generation and storage grew 52% YoY, and Services increased 20% YoY. These are still small parts of Tesla’s total revenues, as we can see below, but they are slowly taking over.

Add to this some revenues from its AI initiatives and Tesla’s growth could even begin to increase in a few years.

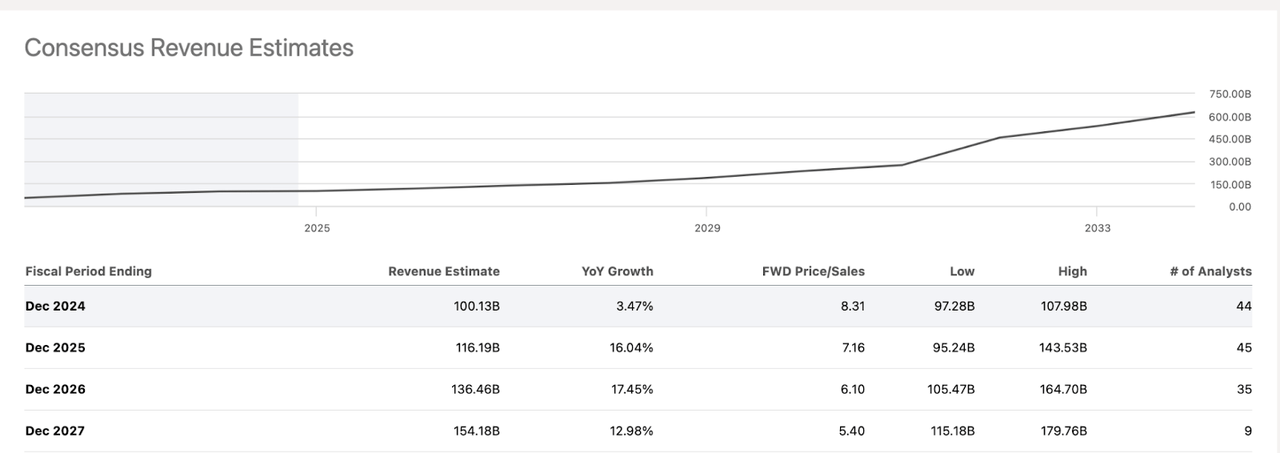

Is this what analysts expect?

Revenue estimates are quite conservative for the next few years, and it seems that at least a small number of analysts expect revenues to take off in 2030 as some of Musk’s vision comes to fruition.

The way I see it, if Tesla can pull forward some of these earnings, which would mean delivering close to the timelines Musk has set, then we would likely see some significant re-rating in the stock.

Margins

This one could be an issue. Despite the encouraging trend, even Musk admitted in the earnings call that maintaining these levels of profitability would be challenging in the next quarter.

Tesla has benefited from a lot of different factors that have helped it lift margins and investors were pleased.

However, investors should be aware that this is not Tesla’s main objective right now. The company has a lot of different projects going on, and this will require further investments.

In this regard, I do believe EPS growth could disappoint going forward.

FSD and Other Initiatives

Lastly, we have Tesla’s FSD and other AI initiatives. The FSD is perhaps the most pressing issue and one which will definitely shift investor sentiment.

Tesla plans to roll out robotaxis in California and Texas next year, though it’s already facing some regulatory hurdles.

However, I will point this out. Despite his reputation as an eccentric, somewhat anti-establishment genius, Musk has had a lot of success in businesses with a very strong regulatory influence; EVs and Aerospace.

I would not underestimate Musk’s ability to push through these immediate hurdles and play a big role in actually pushing forward the adoption of fully self-driving cars.

Final Thoughts

In conclusion, while Tesla has had a stellar quarter, it remains to be seen if Musk can deliver on his promises in 2025 and 2026. I remain quite bullish long-term, but in the short-term, investors will be quick to punish Tesla if margins fall or if deadlines aren’t met.

Ultimately, the question is; can Elon Musk deliver?

I like the direction the company is taking, and the recent earnings show a good balance between achieving future growth and maintaining and increasing revenues today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video