Summary:

- Tesla’s Q3 results dispelled bearish concerns, showing strong EPS and expanding margins, proving robust demand and effective cost management.

- The company’s autonomous vehicle capabilities and upcoming affordable models are set to significantly expand Tesla’s market, driving future growth.

- Musk’s projection of 20-30% vehicle growth in 2025 underpins a bullish outlook, with potential valuation reaching over $1 trillion.

- Despite risks of Musk’s optimistic timelines, Tesla’s strategic plans for 2025, including cheaper models, suggest substantial upside, making shares still a strong buy.

wellesenterprises

Co-Authored By Noah Cox and Brock Heilig.

Investment Thesis

As of the close here on Thursday, Tesla (NASDAQ:TSLA) shares are up almost 22% yesterday as a result of the strong Q3 results by the now dominant EV maker. Wall Street analysts have been increasingly worried about deflating demand and shrinking margins in the EV space. Tesla proved them wrong and showed how their gross margins expanded significantly in Q3. I cannot emphasize enough how much this dispelled many bear theses. Bears argued the company was trying to basically give away their vehicles through incentive offers and selective financing. I think this quarter dispelled much of that narrative.

Now heading into 2025, the company is really firing on all cylinders, no pun intended. The company has a strong autonomous offering through full self-driving (FSD), and a more affordable vehicle entering the market (I talked about this in the spring). Both of these are going to expand the automotive TAM of Tesla, which I think is a big deal.

I have personally been following Tesla for over 6 years now. I genuinely saw this as the most bullish quarter in years proving the EV giant still has a lot of potential. With this, I continue to believe shares are a strong buy.

Why I’m Doing Follow-Up Coverage

Post Q3, Tesla appears to be hitting its stride. When I last covered the company (earlier this month) some analysts were using the delivery number miss as a bearish signal. Then (and now) I think it was always clear that the shift in EV mix from Tesla was the main reason for the delivery miss, and therefore demand (plus customer willingness to pay) was still strong underneath.

Now, the company is proving how strong demand is with strong earnings showing that automotive margins are holding up. The purpose of this follow-up article is to show how the Tesla thesis (really between now and 50% upside from now) has been significantly de-risked. I think there is room for upside.

Q3 Review

While the EV giant did miss on revenue, EPS came in stronger than expected (and to the street that was worried about margins that’s all that mattered).

Tesla’s EPS came in at $0.72/share on revenue of $25.18 billion. EPS beat by $0.12/share, while revenue missed $314.74 million according to estimates compiled by Seeking Alpha. Revenue growth was still healthy at 7.85% YoY.

In an Earnings Call on Wednesday, Tesla CEO Elon Musk described the business as strong. Musk noted that Tesla just produced its 7 millionth vehicle, and he expects to see 20-30% vehicle growth in 2025 compared to 2024.

Tesla at the same time has achieved record deliveries. In fact, I think if you look at EV companies worldwide to the best of my knowledge, no EV company is even profitable…

To the best of my knowledge, there was no EV division of any company, of any existing auto company that is profitable. So it is notable that Tesla is profitable despite a very challenging automotive environment. And this quarter actually is a record Q3 for us. So we produced our 7-millionth vehicle actually just yesterday [October 22].

I think probably people are wondering what should they assume for vehicle sales growth next year. And at the risk of – to take a bit of risk here, I do want to give some rough estimate, which is I think it’s 20% to 30% vehicle growth next year -Musk Q3 Call.

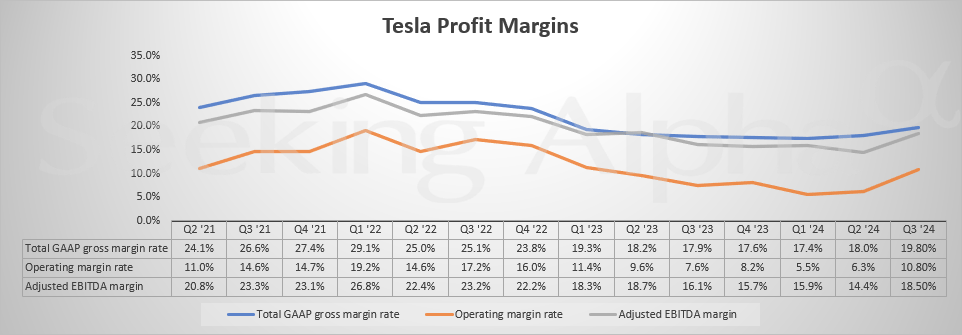

From a margin standpoint, profit margins for Tesla are up in all categories in Q3 compared to Q2.

The Total GAAP Gross Margin Rate is up exactly 10% from Q2 to Q3, the Operating Margin Rate has increased more than 71%, and the Adjusted EBITDA Margin is up more than 28%. All of these show how the company is managing to produce more vehicles at a higher margin. This is an incredible example of strong unit economics.

It marks the first time in exactly two years that all three categories have increased quarter-over-quarter.

Tesla Margins (Seeking Alpha)

Why 2025 Looks Amazing

For anyone who watched the Tesla robotaxi event earlier this month, there were definitely a lot of technical displays of innovation at the event that made you excited about the future of Tesla.

But that’s not why I am excited about 2025.

For me, the biggest factor for how 2025 is looking is really because Musk said so (driven by core EV demand growth). As he noted during the Earnings Call, Musk projects 20-30% growth in 2025.

While at Tesla’s current run rate of over 1.8 million vehicles annually, volume growth of 20-30% sounds insane, I actually think this is not only reasonable but also feasible.

In the Earnings Call, Musk notes that it’s so “blindingly obvious” that the future of on-ground transportation is in autonomous vehicles.

Everything’s going to be electric autonomous, Musk said:

I think this is like it should be frankly blindingly obvious at this point that that is the future. So a lot of automotive companies or most automotive companies have not internalized this, which is surprising, because we’ve been shouting this from the rooftops for such a long time, and it will accrue to their detriment in the future. But all of our vehicles in the future will be autonomous.

It’s easy for the CEO of the electric vehicle company to say this, but Musk backed it up with numbers. Tesla is making 35,000 autonomous-enabled vehicles per week, he notes:

All the vehicles that we’ve really made, all the 7 million vehicles, vast majority are capable of autonomy. And, we’re currently making on the order of 35,000 autonomous vehicles a week.

From here, the 25% (midpoint) leg up in volume growth seems reasonable. Their vehicles are seeing an expanded use case (thanks to autonomous driving). By the numbers, the company sold 1.81 million vehicles in 2023, which was up 38% from 2022.

Now, Tesla is growing automotive volumes this year (as of Q3) by 6% compared to Q3 2023. This is slower growth than 25%, but my point here is that the company can produce strong volume growth even when they are working with a 7 figure volume output annually at current levels.

To me, the businesses’ margins tell me that there is plenty of EV demand for them. Now it’s about increasing supply.

Valuation

Tesla’s forward Non-GAAP P/E ratio is currently at 92.75, which is a 439.52% premium to the sector median number of 17.19. This obviously feels high from a sector median standpoint, but what, I think, is key here (compared to the sector median) is that Tesla is still offering a far superior business for investors to invest in.

From my last article, my rough math said the automotive division of the company was worth roughly about $455 billion. However, after the calculated 5% bump (based on volume growth of 6% YoY), I arrived at a new automotive division valuation of roughly $477.75 billion. When added to the base valuation of the company, which I pegged at the time at roughly $425 billion, I got a blended valuation of just over $902.75 billion, which represented roughly 13% upside in shares at the time. Since then, Tesla shares have picked up roughly 1/2 of this upside.

Post Q3, however, I think the potential upside has increased. As Musk said in the Earnings Call, the company is expected to grow automotive volume by 20-30% in 2025.

If we use 25% as an average for this sales growth, I think this means we need to pencil in a higher automotive division valuation.

If Tesla does, in fact, grow automotive revenue by 25% in 2025, I think this increases the present value of the automotive division to just under $600 billion ($597.188 billion).

Now adding in the estimated base valuation of the remainder of the company, which I peg at $425 billion (this includes Tesla Energy and Tesla Optimus robots), and we come to an overall company valuation of just over $1.022 trillion. Keep in mind that even though Tesla Energy had a strong quarter as well, I am keeping this division valuation the same to be conservative.

Taking the new projected valuation of the company ($1.022 trillion) and dividing it by the current market cap of $682.53 billion, we can assume that the projected upside for Tesla is roughly 49.8% from here, assuming minimal dilution in shares.

While this might seem like a rich valuation, I think we need to think about the opportunity set ahead of Tesla. This quarter (in my opinion) was one of the best in years, not due to revenue performance itself (though this was record revenue). Rather, it was the really straightforward outlook in 2025 that gets us to even more growth that made this quarter so bullish.

Risks

Tesla has a strong plan ahead of it for excellent growth. The biggest risk to this plan (and this research for that matter) is that Musk is sometimes overly optimistic on his timelines for product launches. Specifically, Musk is notorious for not adhering to specific timetables, and when he does discuss timetables, he often fails to meet those deadlines. For shareholders (myself included) this can be frustrating. We’re obviously buying into a growth stock. The key here (in the name) is that there has to be growth. Both growth in revenue, but also in product offerings.

However, in this specific case, I actually think Musk is set up for success.

As Musk mentioned in the Earnings Call, Tesla is planning to release a more affordable automated vehicle in 2025. A new, more mass-market vehicle (at a cheaper price) has been the trend for Tesla products for the last 20+ years of the company’s existence. This is not new.

“Regarding the vehicle business, we are still on track to deliver more affordable models starting in the first half of 2025,” Musk said during the Earnings Call.

Musk notes that these cheaper models will cost less than $30,000 after incentives.

Although Musk misses deadlines, I think he almost always delivers on his big-picture promise with enough time. Because of this, I feel fairly confident that Musk and Tesla will release more affordable models of the Tesla in their 2025 timeline. Will they come in the “first half of 2025” like Musk mentioned in the Earnings Call? We’ll have to wait and see. But, at the end of the day, I think these new products will come. And when they do, they will help power shares higher.

Bottom Line

Q3 earnings have reminded Wall Street (and the overall market) of the promise that Tesla offers as an investment, as many of Musk’s long-term projects are now much closer to coming to fruition. Based on the new FSD features, the cheaper vehicle, and the robotaxi, I feel good that shares are set to accelerate from here. I think the potential upside in the company is nearly 50%, and the overall valuation of Tesla is projected to grow to $1 trillion.

The company is (ironically) firing on all cylinders and is now able to benefit from a position of strength going into 2025.

With this, I continue to believe shares are a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.