Summary:

- Alibaba’s shares are falling after the market questions the effectiveness of China’s stimulus package.

- The overexposure of Alibaba and its stock to developments that are outside of the company’s control is a major red flag.

- In the current environment, Alibaba is a SELL for us.

Andrea Verdelli/Getty Images News

In the middle of 2023, we said that the market is underestimating the benefits of Alibaba’s (NYSE:BABA) spin-off that was announced earlier that year. A few months later, the macro environment for Chinese stocks worsened and the company canceled an IPO of its cloud division, which should’ve unlocked significant value after becoming a separate public entity. This made Alibaba’s shares underperform for over a year and our thesis didn’t play out.

The company’s shares rallied only recently as a result of the announcement of the stimulus package by the Chinese government that’s aimed at growing the Chinese economy. Most of the Chinese stocks along with Alibaba rallied in late September and early October thanks to that announcement. However, the rally is already losing its momentum and we believe that at the current price, it’s smart to sell Alibaba’s stock since it doesn’t have any other major growth catalysts that could help its stock continue to increase in value.

Why The Rally Is Coming To An End

As we write his article, Alibaba’s shares are already tumbling after reaching a 52-week high price at the beginning of October as the rally is losing its momentum. This is happening not only to Alibaba but to other Chinese stocks as well since there’s skepticism about the announced stimulus package. The IMF recently has even lowered China’s GDP growth rate as systemic issues remain.

Alibaba’s business has been directly impacted by the weaker growth of China’s economy. Alibaba’s latest earnings report for Q1 showed that its core eCommerce business, which is reported under the Total Taobao and Tmall Group segment, has experienced a 1% Y/Y decline in revenues to $15.6 billion. Its adjusted EBITDA was also down 1% Y/Y to $6.7 billion. We might see a further underperformance of the eCommerce business since consumer confidence in China is currently close to its historically low levels and the consumer price growth in September was weaker than expected.

The cloud business, which we hoped would become a separate entity a year ago, is also underperforming against its international competitors. Its revenue in Q2 was up only 6% Y/Y to $3.65 billion. Its international competitors like Microsoft (MSFT), Google (GOOG)(GOOGL), and Amazon (AMZN), are growing at a much better double-digit rate even though their initial base for comparison is much higher in comparison to Alibaba. Even some Chinese businesses are turning to Western cloud providers, which can run the code on more advanced AI chips.

One of the main reasons why Alibaba’s overall sales were up last quarter was thanks to the better growth of the international business, which is reported under the Total Alibaba International Digital Commerce Group segment in the earnings report. The international sales were up 32% Y/Y last quarter to $4.03 billion, which helped the company improve its overall top-line performance. But since the escalation of the Sino-American trade war is likely a matter of time, there’s no guarantee that the international business will be able to continue to grow at such a big rate in the future.

We believe that Alibaba’s reliance primarily on external developments and the exposure of its stock to developments that are outside of the business’s control is a major red flag. Unlike its Western eCommerce competitors that continue to scale their businesses aggressively, Alibaba is expected to grow its sales and earnings only at a single-digit rate. This makes it hard to call it a growth stock with significant upside potential, especially considering its recent performance and exposure to external developments. Not only did its stock increase in value aggressively in the last month mostly due to China’s actions, but it also has been depreciating in the last couple of weeks as the market questions the announced actions, while Alibaba has no internal catalysts to keep the momentum going.

Better Future Still Possible?

There’s still a possibility that China’s stimulus package will be beneficial to China’s economy and Alibaba in particular over the long term. The proposed reduced mortgage rates could revive the activity in the housing market, while the proposed stock buybacks could stabilize market prices for Chinese equities.

The growth of retail sales in China in September by 3.2% against the expectations of 2.5% could also lead to the improvement of consumer sentiment and boost Alibaba’s sales in Q2. The earnings report is expected to come out next month as the potential improvement of the eCommerce business and a sales beat could reignite the investors’ confidence.

Finally, the overall improvement of the macro environment and the forecasted global growth rate of 3.2% in 2024 and 2025 could help Alibaba’s international business to perform well despite the geopolitical risks.

The Real Value of Alibaba

Considering all the upsides and downsides of Alibaba, we wanted to find out what is the real value of the company. Below are valuation tables with our calculations.

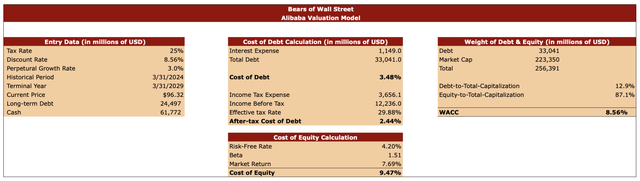

Our model covers the period of the next five years. In the model, we use a tax rate of 25%. In 2021, some of Alibaba’s businesses lost the preferential tax treatment and the management warned of a period of higher taxes ahead. The current standard corporate rate in China is 25%, and we could see Beijing doing a tax reform in the future. Considering this, we believe that applying a 25% tax rate when forecasting Alibaba’s performance makes sense.

We created this model when Alibaba was trading at $96.32 per share and used the cash and long-term debt data from the latest earnings report. The perpetual growth rate in our valuation model is 3%, which is the rate that’s typically used when valuing a major public company.

The discount rate in our valuation model is 8.56%. We found it by calculating Alibaba’s after-tax cost of debt and cost of equity. For calculating the after-tax cost of debt, we used Alibaba’s TTM data. For calculating the cost of equity, we used a risk-free rate of 4.2%, a beta of 1.51, and a market return rate of 7.69%.

Alibaba’s Valuation Model (Bears of Wall Street)

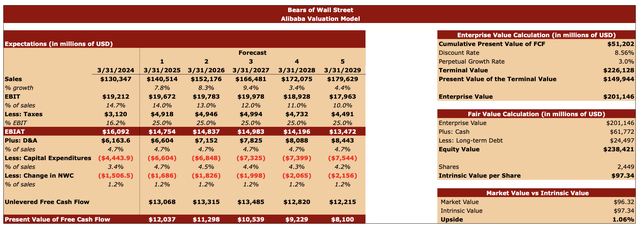

In the forecast table below, we assume a sales growth rate of 7.8% in the current fiscal year. The sales growth rate assumptions are mostly similar to the current consensus. The CapEx for the following years is increased in our model. In Q1, Alibaba’s CapEx was $1.66 billion and the management said that it’s expecting a similar level of investments in CapEx in the next few quarters. Other assumptions are similar to Alibaba’s historical performance.

After figuring out the cumulative present value of FCF based on the numbers from the forecast table, we applied the discount rate and the terminal growth rate to get the terminal value, the present value of the terminal value, and the enterprise value, which is $201.15 billion in our case. We then added the current cash reserves to the enterprise value and subtracted long-term debt to find out the equity value, which in our case is $238.42 billion. We then divided the equity value by the number of outstanding shares and found out that Alibaba’s intrinsic value is $97.34 per share, which indicates a 1% upside.

Alibaba’s Valuation Model (Bears of Wall Street)

Why We Still Believe That Alibaba Is A SELL

While our model shows that Alibaba’s stock represents a minimal upside, we believe that the company is a SELL right now. The only reason why its shares were able to rally is because there was a macro catalyst that boosted the share prices of all major Chinese companies that are trading on American exchanges. Without it, Alibaba would’ve probably traded around $70 – $80 per share today like it was more than a month ago. This is because Alibaba in our opinion has no direct major catalysts that could improve the performance of its stock.

In the current environment, it seems that being fundamentally undervalued is not enough to drive the stock price higher. Alibaba has been undervalued solely on fundamentals for a long time, but that didn’t help its shares to increase in value until very recently for reasons beyond the company’s control. We also see that the rally is already losing its momentum, the shares are now relatively far away from their 52-week highs that were achieved at the beginning of October, and the price action suggests that a further pullback might be on the way.

As for the bigger picture, until the Sino-American relations improve, we’re unlikely to see a revived interest in Chinese stocks from Western investors. That is why we believe that Alibaba is not investable right now despite trading close to its intrinsic value and give its stock a rating of SELL.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.