Summary:

- Carnival’s strong earnings have set high expectations for Royal, with demand for cruises increasing among younger demographics, suggesting industry growth potential.

- I am particularly interested in Royal’s debt reduction efforts and their impact on financial stability, given the industry’s high debt levels.

- Despite high capital costs, Royal’s superior ROIC and profit margins make it the best player in the cruise market, though the industry remains unattractive long-term in my opinion.

Ceri Breeze

The Royal Caribbean Investment Thesis

I first wrote about Royal Caribbean Cruises Ltd. (NYSE:RCL) about a year and a half ago because I thought the idea of a rebound to pre-pandemic levels was worth exploring. Since then, Royal has surpassed my expectations with a total return of 112%, far outpacing the S&P 500 (SPY). At the time, I thought the upside would be closer to 30% to 40%, which turned out to be too low. But when you expect a conservative upside, and it is exceeded, that is usually a good thing. The danger comes when you underestimate the downside, and it turns out to be stronger than you thought.

I still believe that Royal is the company with the highest quality in the industry, both qualitatively and quantitatively, as they are particularly strong in the luxury segment. After all, luxury often means having higher margins than players who are willing to compete on price. Therefore, I think that Royal’s offer of better activities on board, better cabins and also the reward system gives Royal an edge over the competition.

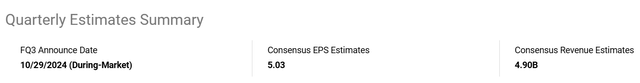

Therefore, I believe that Royal will outperform its peers and continue to be the highest quality company, and, as a result, will post a double beat in earnings next week.

How Could Carnival’s Earnings Affect Royal Caribbean’s Earnings Next Week?

Carnival Corporation & plc (CCL) double beat and increased guidance has created some euphoria, making expectations for Royal’s earnings relatively high. Royal shareholders expect similarly strong results. The risk, however, is that good results are delivered but sold off because expectations were even higher.

Of particular note, Carnival’s FY24 Adjusted EBITDA is projected to be 40% higher than in 2023 due to overwhelming demand for cruises and additional cost savings. This demand is being driven by the fact that younger people are now more interested in cruising, rather than just baby boomers. This means that in addition to the post-pandemic recovery, there is now a larger customer base than there was then, which leads me to believe that the industry peak is still some way off. In addition, J.P. Morgan’s Industry Outlook, linked above, found that cruises are sometimes cheaper than land-based vacations, which is definitely a positive sign for the industry in times of economic uncertainty.

With that in mind, I really think that anything less than a double beat of the same size as Carnival’s would fall short of market expectations. Especially considering that the EPS guidance was beaten by 35% in Q1 and 16% in Q2, I think the surprise should be positive this quarter as well. The industry is currently in a positive trend which, according to the market outlook mentioned above, is likely to continue for a few more years.

But as always when it comes to making predictions about the future, caution is called for here, too, because the expert bias leads people to overestimate the opinions of so-called experts and to forget that predictions about the future are always very difficult and often not really accurate.

What Will Be Of Interest To Me In Royal’s Earnings Report?

I will be particularly interested in the debt situation and the extent to which debt has been reduced. I would even have liked to see the dividends suspended for a little longer in order to further reduce the debt, but that is my personal preference, as I do not like a large debt burden, as it always increases the risk. I usually like asset-light companies that have a lot less debt.

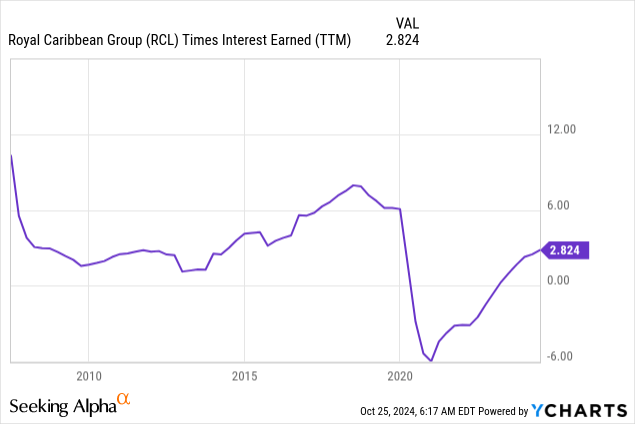

In particular, I am concerned about the interest coverage of only 2.8x, since the average for the S&P 500 excluding banks is about 10x and the companies in my portfolio have even higher interest coverage on average. But of course, this is also an industry phenomenon because this industry tends to be asset-heavy because of all the costs.

But I think any improvement and any commentary on the debt and how they want to deal with it in the future will be helpful, even for those who think the debt burden is okay. Everybody has different standards here. My maximum debt is usually 4 times net income, and at Royal, it is currently 8.4 times ($21 billion / $2.5 billion). This is not to say that a high debt load is always a bad sign, but I sleep better knowing that the balance sheet can withstand difficult times. Unfortunately, cruise lines simply had to take on so much debt to survive the pandemic. And with the senior notes, which will likely be used to repay some debt, they are doing something in that area as well.

Peer Comparison with CCL and NCLH

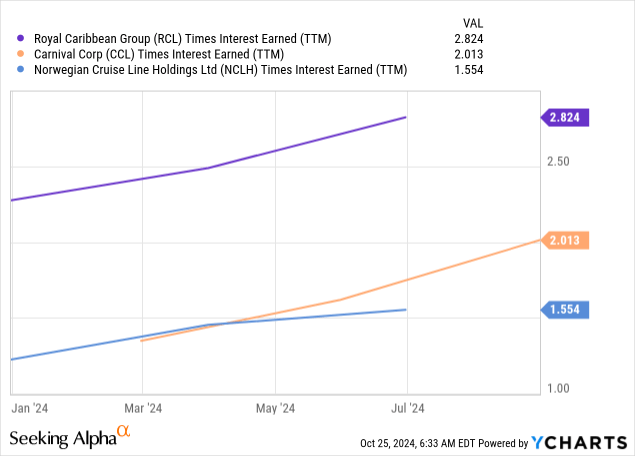

A comparison with peers Carnival and Norwegian Cruise Line Holdings Ltd (LCLH) again shows that low-interest coverage is an industry problem and that Royal nevertheless has the best interest coverage of the peer group. In addition, we see that Carnival continued to improve its coverage in its most recent quarterly results, suggesting that Royal could break 3x this quarter if it continues to improve, which is to be expected.

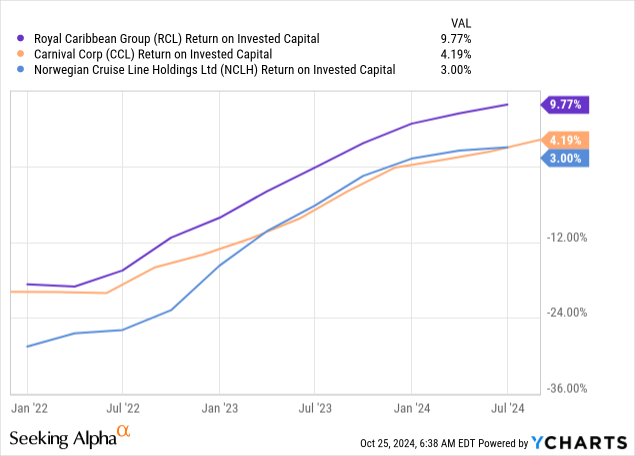

In addition, Royal is significantly better positioned than its peers in terms of capital allocation, as they appear to be better able to utilize capital. Although the ROIC-WACC spread is relatively narrow due to the high cost of capital, but Royal is still the clear leader in the industry.

With a WACC of 6.77%, Royal only has a spread of 9.77% – 6.77% = 3%, but they are still creating value for shareholders, and for their competitors, their spread may even be negative due to their lower ROIC figures. Since return on invested capital is very important to me, and the company with the highest ROIC tends to have the best competitive advantages, I consider Royal to be the best player in the cruise market. I also believe that Royal will continue to improve their ROIC and thus their ROIC-WACC spread, which should benefit shareholders.

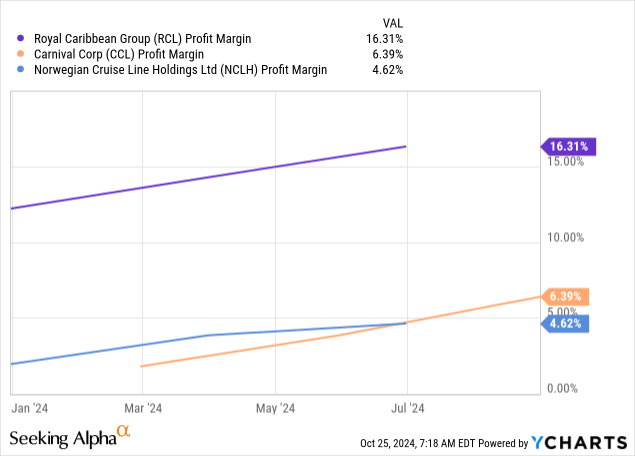

Profit margins also clearly show that Royal’s luxury focus gives it a huge margin advantage. The difference from Royal’s ~16% to Carnival’s ~6% and Norwegian’s ~4% is huge. The competition clearly cannot compete on ROIC or margins, which shows that Royal is, in my opinion, the clear leader in this industry when it comes to quality.

Conclusion

Royal and their strategy of focusing heavily on luxury has paid off in my opinion, as they have built a brand name and their revenues are protected by high barriers to entry, such as long-term contracts with ports. However, I continue to find the industry unattractive in the long term, as the cost of capital is enormous and ROIC is low compared to other industries. And since I am always long-term oriented, this is more of a sector that looks attractive for short-term plays, and here the easy money will probably be over after the rebound.

But Royal, which has a 10-year total return CAGR of about 13.5%, seems to be generating above-average returns despite this, at first glance, uninteresting industry. So maybe I am wrong in my assessment that this industry is not attractive in the long term. But after the rebound play, this industry is not what I normally like: boring industries that are asset-light and generate 20%+ ROIC.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.