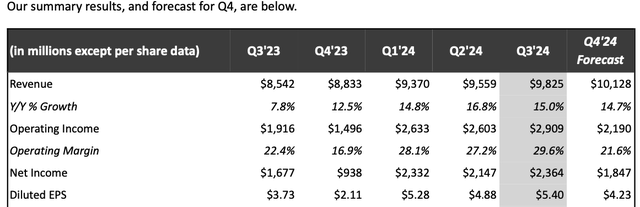

Summary:

- Netflix’s stock has surged 85% over the past year, driven by the company’s rising profitability.

- However, this year’s profits received a temporary boost from lower content spending during the Hollywood writers’ strike.

- Over the next 12 months, Netflix will likely face challenges in sustaining these profit margins and meeting earnings growth expectations.

Moshe Einhorn/iStock Editorial via Getty Images

Netflix (NASDAQ:NFLX) is experiencing a blockbuster financial year. While subscriber numbers grew by only about 14%, profit margins surged, leading to a roughly 60% increase in earnings. In response to these stronger earnings, the company’s stock has jumped by 85% in a year.

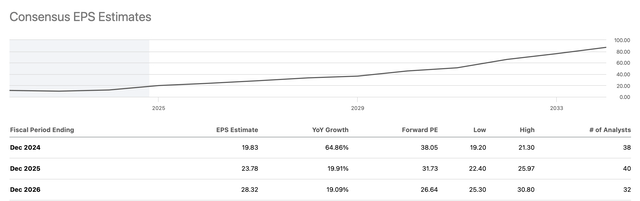

The Street analysts now expect the profit margins to continue appreciating as revenues grow, driving ~15%-20% annual earnings growth over the next few years. For this reason, Netflix is currently trading at a rather generous 38X forward earnings multiple.

We believe there are good reasons to be skeptical about these rosy expectations.

Reduced content expenses give Netflix a boost

Many analysts are overlooking the impact of last year’s Hollywood writers’ strike on industry-wide content spending. This strike continues to affect Netflix’s reported financials significantly, given that content remains the company’s largest cost item.

Netflix is dominating the streaming industry globally and is benefiting from a gradual decline of linear television. There is plenty of growth to be had with stock.

Markets rarely move in a straight line, often overreacting to both positive and negative news. While Netflix is on an upward path, its stock will continue to experience fluctuations, just as it has in the past. Buying the stock during a price spike driven by overreaction could negatively impact returns.

Investors considering adding Netflix to their portfolio now should be confident that the company can not only sustain its current higher profit margins but also continue to grow them going forward.

Most analysts anticipate that Netflix will continue to expand its profit margins and achieve earnings growth in the high teens.

EPS Growth Expectations (Seeking Alpha)

We are not as confident, however. The Hollywood writer’s strike is still haunting reported financials of Netflix and has contributed greatly towards the soaring profit margins this year.

Great business, but not at all prices…

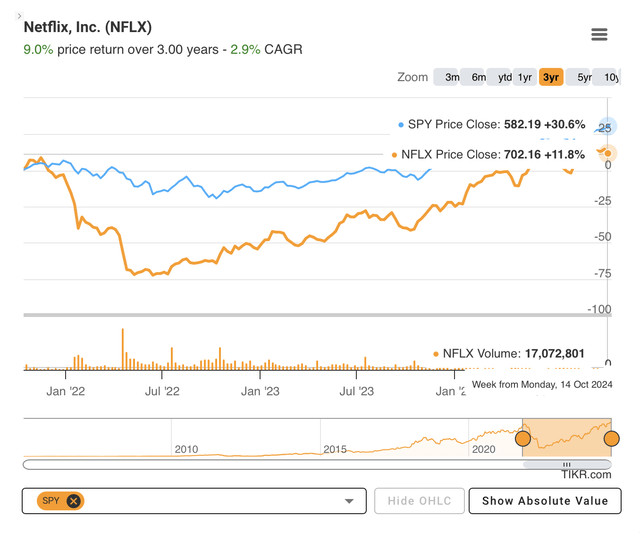

Netflix has established dominance in the highly competitive streaming industry, though the journey has been anything but smooth. Despite the recent surge, Netflix’s stock has risen only 12% over the past three years, lagging behind the S&P 500 (SPY).

Though Netflix is a strong business, its stock will inevitably experience fluctuations—that’s simply how markets operate. To achieve market-beating returns with Netflix, it’s crucial to avoid buying in at unsustainable earnings peaks.

Just as October of 2021 was not a great time to buy Netflix, now could also be the time to Hold and wait.

Netflix stock price and S&P 500 (TIKR Terminal)

Before getting caught up in the short-term volatility, let’s focus on Netflix’s long-term fundamental strengths, which make it a solid business. Then, we’ll delve into how we believe last year’s writers’ strike has temporarily boosted this year’s reported earnings.

Netflix outsmarts traditional media giants and takes the throne

Three years ago, the markets all of a sudden forgot how strong of a company Netflix was. It must have been a tough time for long-term holders and company insiders, but Netflix seems to have emerged from this even stronger.

As Disney (DIS) and Amazon (AMZN) started investing aggressively to expand their streaming services, Netflix decided to start cracking down on password-sharing. Their subscribed numbers stopped growing temporarily, and the share price tanked.

For years, Netflix relied heavily on a steady supply of content from major film and television studios, as these production giants likely viewed the streaming industry as too immature to warrant their own direct involvement.

We believe the major studios’ strategy was to let Netflix popularize streaming, then, once the industry matured, step in, cut off Netflix’s content supply, and take over.

Yet, Netflix has outmaneuvered the industry giants in plain sight. Since achieving positive cash flow, Netflix’s management has strategically invested heavily in original content production. This approach initially led to consistent reported earnings losses, but ultimately, it paid off in a major way.

The ongoing decline of traditional TV networks presents Netflix with significant growth opportunities

We had also been bullish on the traditional media giants. Their popular content franchises, extensive libraries of movies and TV shows, and robust cash flows from cable and network TV appeared more than sufficient to take command of the on-demand streaming landscape.

However, cord-cutting has accelerated with the continuous improvement of streaming platforms, resulting in sharp declines in both network TV viewership and advertising revenues.

The traditional U.S. content giants, long-time leaders in global video entertainment, now appear to be in structural decline. Entering the streaming industry too late, they lacked the necessary technical expertise as well as successful streaming originals to compete effectively.

Industry regulations that once kept the content giants in check have also contributed to their decline. While the largest TV and cable networks once held dominant positions, these outdated regulations remained stringent even as the networks weakened. Today, acquiring and merging these broadcasting groups is nearly impossible, leaving little hope for their revival.

The path is now clear for Netflix. In North America, the European Union, and Japan alone, there are 450 million households, with additional demand for American content in Southeast Asia and Korea. As traditional players retreat, Netflix has ample opportunity for subscriber growth across these markets.

Content is king, but distribution is as important

The strength of Netflix’s streaming platform is now widely recognized. It stands as the leading video-on-demand service that many feel is essential to stay in tune with popular culture. Most households now subscribe to three or four streaming services—Netflix being the mainstay, accompanied by others.

Netflix now possesses an unparalleled scale in direct content distribution, comparable to the dominance TV broadcast networks held 30 years ago. However, unlike traditional networks, Netflix both produces and broadcasts content globally.

We believe Netflix’s content production value remains largely unrecognized. While we’ve long admired the deep back catalogs of Disney, Paramount, and Warner Bros., we’ve overlooked the strength of Netflix’s own intellectual property. And Netflix is set to create even more blockbuster characters and franchises in our opinion.

With its unmatched distribution scale, Netflix can popularize new shows and effectively build valuable content IP from scratch. Back in the heyday of cable, John Malone of TCI employed a similar strategy by acquiring niche networks and including them in TCI’s cable packages, instantly expanding their audiences by millions. These networks skyrocketed in value, and Malone would sell them off at enormous profits. We think Netflix is now in a position to replicate this model in the streaming era, creating substantial IP value by capitalizing on its distribution reach.

Combining distribution and content production can do wonders for shareholders, and Netflix is only beginning to show the results. It’s exceptionally rare for one company to succeed at both, but Netflix did it.

The profit margins will likely decline next year

However, it won’t be smooth sailing from here. We believe Netflix’s share price has recently outpaced its underlying fundamentals. Meeting the current high earnings growth expectations will be challenging, and the stock is likely to underperform over the next 12 months. At the time of writing, Netflix is trading at $760.

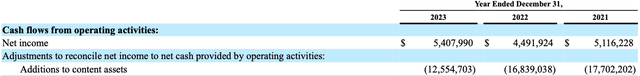

Netflix’s profit margins and reported earnings this year have been boosted by reduced content amortization expenses, a direct result of lower cash content spending during the Hollywood writers’ strike.

This year, Netflix is planning to spend $17 billion on content, broadly in line with spending in 2021 and 2022. It is significantly higher than the ~$13 billion spent last year.

Cash Content Spending (Netflix financials)

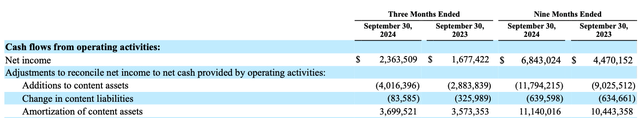

Content costs are only recognized as expenses on Netflix’s income statement once a show begins airing. Consequently, the cash content expenditure from last year is being expensed (or amortized) this year.

Netflix is planning to spend at a normalized level of ~ $4.25 billion per quarter on content, however, last quarter only ~$3.7 billion was expensed.

Content expense recognised (Netflix financials)

We believe Netflix’s underlying operating profit was ‘overstated’ by approximately $550 million in the last quarter, with operating income receiving a ~23% boost due to this accounting treatment.

Profit Margins boosted (Netflix financials)

As Netflix enters the next financial year and the higher content investment starts being expensed, the operating profit margin will come under pressure in our opinion.

The content cost will likely grow faster than the subscriber numbers, and therefore the profit margin of the business could go down.

It will be very challenging for Netflix to achieve the current earnings growth projections.

The risks

We believe only further price increases might enable Netflix to maintain its profit margins as content expenses continue to rise. However, we’re not confident that Netflix can keep raising prices in its major markets without risking customer loss. If they can, though, the share price could indeed climb higher over the next 12 months.

The summary

Netflix’s stock has appreciated this year, driven by stronger profitability, and the company is expected to continue rapid earnings growth. However, we believe this may be challenging in the next 12 months due to rising content expenses.

Having said this, we do like the long-term growth prospects of the business. We would not be willing to short the stock but would like to wait for a more favorable entry point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.