Summary:

- Taiwan Semiconductor boasts strong financials with $23.5 billion in 3Q 2024 revenue and high margins, but future margin improvements are uncertain.

- TSM’s market cap is around $860 billion, with a modest FCF yield and significant capex requirements.

- Growing competition from Intel and Samsung, along with slowing innovation, could pressure TSM’s future returns and market position.

- Despite its critical role in global manufacturing, TSM appears overvalued, with concentrated customers and potential growth limitations.

Monty Rakusen

Taiwan Semiconductor’s (NYSE:TSM) is the largest contract chip manufacturing firm in the world. The company has a market capitalization of roughly $860 billion, and the company has seen continued demand for its assets. The company enables the largest firms in the world including Apple (AAPL) and Nvidia (NVDA) to build their market leading products.

Despite that, as we’ll see throughout this article, a slowing pace of innovation and growing competition will hurt future returns.

Taiwan Semiconductor Income

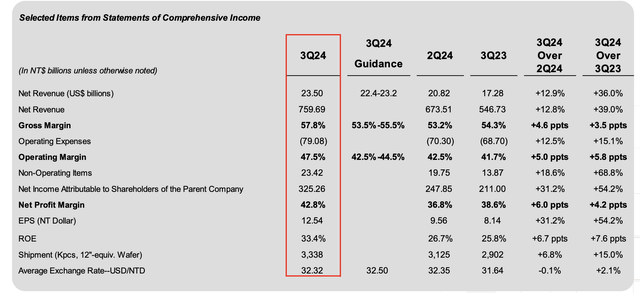

Taiwan Semiconductor reported US$23.5 billion in net revenue for the 3Q 2024, showing the company’s financial strength.

The company managed to have an almost 60% gross margin and an almost 48% operating margin. That translated to a bottom line net profit market of more than 40%, as the company saw strong YoY improvements in margins due to demands. While that’s respectable for the company, we don’t expect margin improvements to be a new permanent feature for the company.

The company managed to ship 3.4 million equivalent wafers with EPS giving the company a P/E of more than 30.

Taiwan Semiconductor Segment Breakdown

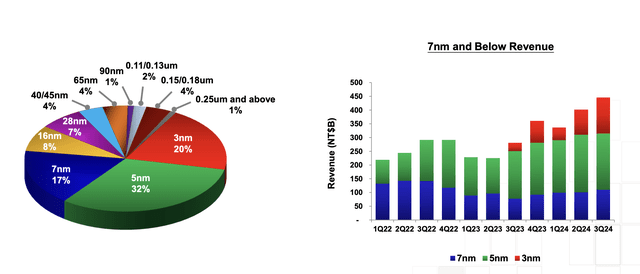

The company continues to earn massive revenue from its key segments, with 3nm already making 20% of revenue and 5nm more than 30%.

The company has also seen remarkable stability in 7nm revenue, which declined going into 2023 but has remained relatively flat. The company’s growth has come primarily from substantial growth in 3nm revenue. The company is the leading manufacturer here and has customers that care about being on the leading edge such as Apple.

We do expect the company to remain a leading player. However, there’s two aspects worth noting here. TSMC saw a slow ramp up with 3nm after initial problems with the node. Customers like Apple were willing to put up with that, however, rumor was the company got a sweetheart deal in return. The company’s existing large customers mean 2nm capex will surge.

TSMC 2nm is expected to launch in 2025 after 3nm launched in 2023. Expectations of potential slowdowns in future nodes, with scalings becoming more difficult. That could enable competitors to catch up as the company’s capex requirements remain in the $10s of billions.

Capex that’s invested in volume growth rather than new node technologies could enable companies that don’t need the same volume requirements, such as Intel, to catch up as they can allocate more capex towards new nodes.

Taiwan Semiconductor Cash Flow

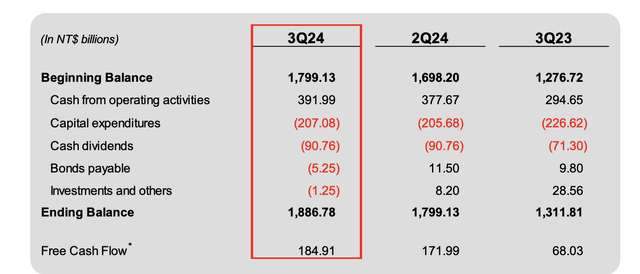

TSM’s cash flow shows difficulty in justifying its present valuation of almost $900 billion.

For the quarter, the company had approximately $US 6 billion in FCF. YoY the company’s ending cash balance has increased by ~$US 16 billion. That’s an almost 2% FCF yield for a company that’s worth almost $900 billion. The company pays a modest dividend of just over 1% affecting those returns, but still total returns are low.

That’s because the company’s business continues to require enormous capex, with each node’s fabs more expensive than the last.

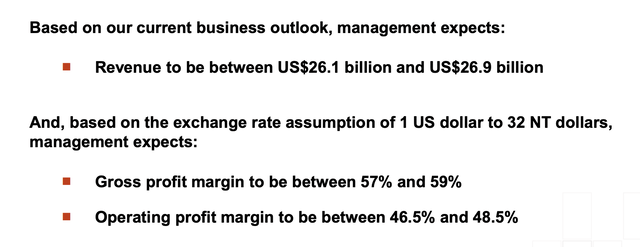

The company expects strong margins going into the end of the year with revenue at roughly $26.5 billion. That’s a strong improvement from 3Q 24, not surprising going into holiday season with new iPhones. That’s traditionally the company’s strongest quarter of the year, so that’s not particularly surprising to see.

As we can see, the company’s cash flow is strong, but the company needs substantial growth and cash flow to justify its market cap.

Taiwan Semiconductor Competition

The semiconductor market has decreased dramatically by number of competitors and many have bowed out given the massive expenditures.

Intel Investor Presentation

That has made TSM so powerful of a company that it has provided Taiwan with a so-called “silicon shield”. It has also convinced the U.S. government to spend more than $50 billion on the Chips and Science Act to promote domestic manufacturing of such an important industry.

There are effectively two competitors left, Samsung and Intel. Samsung has been struggling with incredibly low GAA yields on its 2nm process, and there’s questions about whether it can move forward. The issue with nodes at this stage are so expensive, $10s of billions, that fixing an issue versus deciding to end investment is questionable.

Samsung does have more synergies from its strong memory business though. Intel, however, is becoming competitive again and starting an outside foundry business. The company is past the hurdle in its investing and argues the defect density for its 18A node is healthy. Of course, we have to keep waiting until it ships to customers, and the company has struggled in the past.

However, Intel is perhaps the most competitive it’s been since its original 10 nm node before its fiascos of recent years. First customers are expected to tape out in 1H 2025, which we’ll keep a close eye on. Increasing competition can pressure margins. At the same time, as TSM has large concentrated customers, that could also pressure the business.

Apple supposedly provides ~25% of TSM revenue, a substantial risk should Apple choose to move to another manufacturer the same way it moved away from Intel. The U.S. government has advocated for Apple to use Intel’s foundries, seeing the concentration in Taiwan as a risk, and the company is notorious for the pressure it puts on suppliers margins.

A competitive offering from Intel, which would increase the risk of the company switching, could by itself put pressure on TSM if the company has to offer a more appealing deal.

Valuation

It’s tough to value TSM, even with its low FCF yield, given the relatively lofty valuation on traditional metrics of its peers (i.e. Intel is currently generating effectively no positive FCF). Instead we will make two arguments as to TSM’s valuation.

The first is that any investment should be benchmarked versus an S&P 500 ETF, which has close to double-digit long-term returns. TSM shouldn’t solely be valued versus Intel, it should be valued versus putting your money in a simple market ETF which has dramatically lower cash flow risk.

Given TSM’s current FCF yield, which is well below 10%, along with the expanding capex and competition which will impact earnings (next year capex will expand substantially) we don’t see the company as having the ability to outperform the S&P 500.

The second is versus its peers. Doing a traditional valuation here is tough, however, it’s clear the company is already the leader in its field. Given that, the potential fallout of a costly mistake, like Intel made with 10 nm, could be disastrous. New nodes are increasingly expensive.

As a part of this, the company is also located in Taiwan, which has massive geopolitical risks. The U.S., the global economic leader, also understandably wants the most important technology in the world to be homegrown, as discussed above. That, combined with the potential success of Intel’s 5N4Y strategy and TSM’s concentrated customer risk that could switch, shows that Intel as a peer has the potential to beat TSM.

These two parts show that TSM, as a standalone investment today, is a poor choice in our opinion.

Thesis Risk

The largest risk to our thesis is that TSM has built up a very strong market position for itself in arguably the most important industry in the world. Nvidia’s CEO Jensen Huang has said TSM could comfortably raise its prices. Should Samsung and Intel be unable to compete, the company could reach a de-facto monopoly enabling strong long-term profits and shareholder returns.

Conclusion

TSM is such a valuable company, with a market capitalization approaching $1 trillion, that it has a provided its country Taiwan with a silicon shield to threats from its neighbor to the west. The company has managed to grow its earnings substantially, supported by 3nm and AI demand, however, we see the company’s profits as balancing out as more customers roll over to 3nm from 5nm and AI demand growth slows.

At the same time, that lofty valuation, combines with concentrated customers and growing competition. The company’s competition is expected to potentially grow massively through Intel. Samsung is struggling with yields, and the results remain to be seen, however whether the company can have a strong 2nm offering remains to be seen. Still, we view TSM as an overvalued investment at this time that the market is too excited about.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.