Summary:

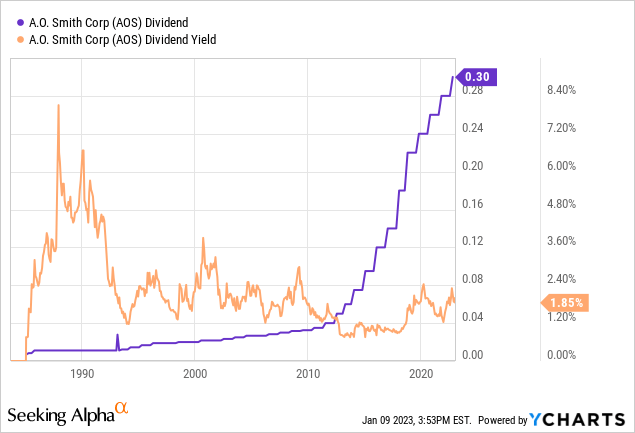

- A. O. Smith is one of the few companies that can call itself a dividend aristocrat thanks to 30 consecutive annual dividend hikes.

- The company yields 2.0% and maintains double-digit annual dividend growth, backed by high and rising free cash flow and a very healthy balance sheet.

- Due to macroeconomic challenges, the stock is struggling. I believe this comes with opportunities and urge investors to keep an eye on the AOS ticker.

CatLane

Introduction

When people think of dividend aristocrats, they more often than not think of old, mature companies with decent yields and low growth rates. That is a reasonable assumption, as mature companies, more often than not, come with higher dividend yields and slower growth. However, there are some exceptions. The Milwaukee, Wisconsin, based A. O. Smith Corporation (NYSE:AOS) has raised its dividend for 30 consecutive years. However, instead of slowing down, the company maintains a double-digit long-term dividend growth rate, rapid free cash flow growth, a healthy balance sheet, and a business model that will more than likely provide outperforming capital gains the moment the housing market rebounds.

In this article, we’ll discuss all of that as I’ll make an investment case for 2.0%-yielding AOS shares.

So, bear with me!

What’s AOS?

A. O. Smith is one of the oldest companies I have ever discussed on Seeking Alpha. The company’s history goes back to 1874 when it was founded by Charles Jeremiah Smith as C.J. Smith and Sons. Back then, the company was a baby carriage and bicycle parts manufacturer.

In the 1960s, it opened a commercial water heater and boiler plant in Stratford, Ontario. By 1969, the company had produced its 10-millionth residential water heater. This business is now the core of the company.

On a side note, I just skipped almost 100 years of the company’s history. If you’re interested in the details, the company’s Wikipedia page is truly fascinating as it shows how some companies transform and adapt to new technologies and innovation.

Fast forward, we’re now dealing with a company that employs close to 14,000 people with international operations. The company has one operating segment, which is water heaters, boilers, tanks, and water treatment. AOS sells these in its two regions: North America (71% of 2021 sales) and the rest of the world.

A. O. Smith Corporation

The rest of the world segment mainly covers China, Europe, and India. These segments primarily manufacture and market in their respective regions of the world.

In China, the company has been operating for more than 25 years. The Chinese water heater market is predominantly comprised of electric wall-hung, gas tankless, combi-boiler, heat pump, and solar water heaters. The company believes it is one of the leading suppliers of water heaters and reverse osmosis water treatment products to the residential market in China in dollar terms.

In the United States, the company offers a wide range of water heaters, boilers, and water treatment products. In 2016, AOS bought Aquasana, which added water treatment exposure to the OAS portfolio. Since then, the company has bought several other companies to expand its operations in this key industry focused on water quality.

A Fast-Growing Dividend Aristocrat

A dividend aristocrat is a company that has hiked its dividend for at least 25 consecutive years. A. O. Smith is in that category with more than 30 uninterrupted dividend hikes.

There are several reasons why dividend aristocrats are so special and valuable for long-term wealth generation.

According to S&P Global (SPGI):

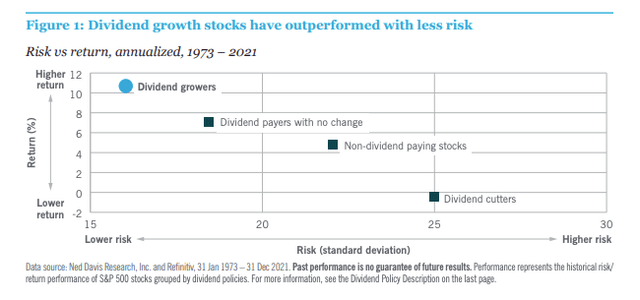

- “Dividends play an important role in generating equity total return. Since 1926, dividends have contributed approximately 32% of total return for the S&P 500, while capital appreciations have contributed 68%. Therefore, sustainable dividend income and capital appreciation potential are important factors for total return expectations.

- Across all of the time horizons measured, the S&P 500 Dividend Aristocrats exhibited higher returns with lower volatility compared with the S&P 500, resulting in higher Sharpe ratios.”

This assessment makes sense, as I have often made the case that the ability to pay a dividend is a stamp of approval. Surviving in a competitive business environment is tough. Letting investors benefit through regular cash payments in the form of dividends isn’t easy.

Nuveen

Dividend growth companies exhibit a special ability to thrive. The market rewards that with long-term outperformance and subdued volatility as investors prefer to sell lower-quality stocks during bear markets.

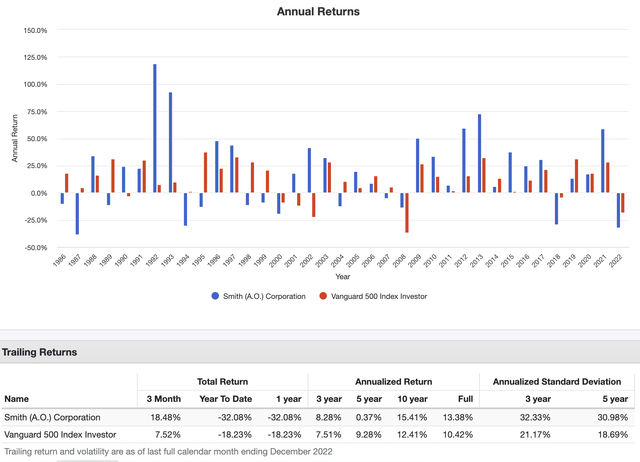

With that said, AOS is an outperformer. Going back to 1986, the stock has returned 13.4%. This beats the S&P 500 by roughly 300 basis points per year. While AOS outperforms the market quite consistently, it is not a low-volatility stock. That is solely based on its cyclical business model, which depends on housing demand and related financial indicators. Hence, the stock is underperforming the market on a 3/5-year basis as the data below shows. This underperformance started in early 2022 when the market peaked. Since then, the stock has lost roughly a third of its market cap. But more on that later.

Portfolio Visualizer

With that in mind, AOS shares currently pay a dividend of $0.30 per share per quarter. That’s $1.20 per year, which translates to a dividend yield of 2.0%.

While 2.0% isn’t a high yield, it’s higher than the “average” dividend aristocrat and dividend growth stock yields.

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL): 1.9% yield

- Vanguard Dividend Appreciation Index Fund (VIG): 1.8% yield

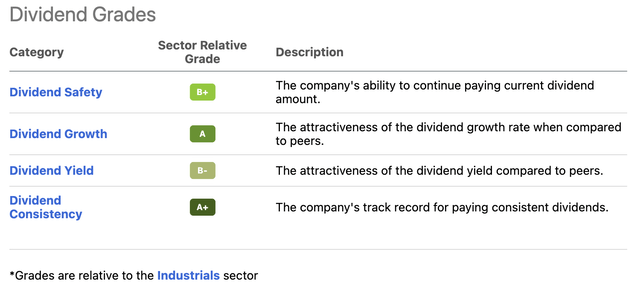

Moreover, the company’s Seeking Alpha dividend scorecard shows a lot of green. The company scores very high on dividend consistency (it’s a dividend aristocrat) and dividend growth and somewhat high on safety and yield.

Seeking Alpha

The “A” dividend growth score can be explained by a 10-year average annual compounding dividend growth rate of 20.3%. The industrial sector median is 7.9%. On a five-year basis, these numbers drop to 15.3% and 7.5%, respectively.

With that said, the company’s dividend growth isn’t just high, it’s also very sustainable.

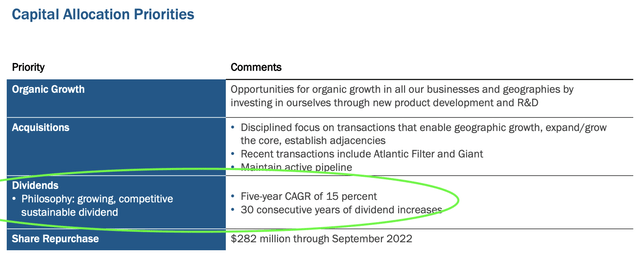

As the overview below shows, the company’s capital priorities are:

- Organic growth through investments in its business segments and capabilities.

- Acquisitions to add new capabilities.

- Dividends are expected to grow gradually after the company has taken care of organic and acquired growth.

- Excess cash can be used on share repurchases.

A. O. Smith Corporation (Author Annotation)

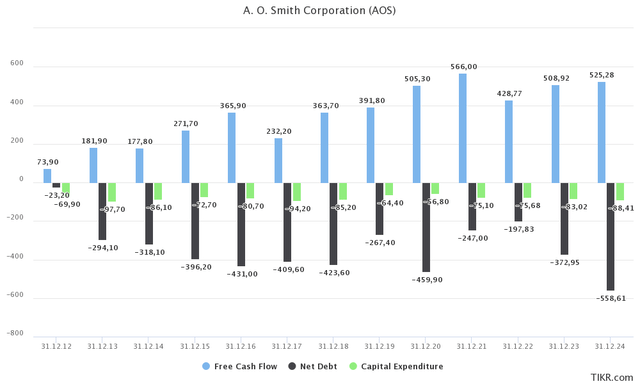

While it is impossible to incorporate future acquisitions into financial expectations, we can display capital expenditures (organic growth) and the company’s debt position. What you’re looking at below is the company’s free cash flow, CapEx, and net debt. Free cash flow is cash a company can spend on dividends, buybacks, and debt reduction after it has taken care of investment needs (CapEx requirements). As the company’s CapEx requirements have remained very stable throughout the past few cycles, the company can turn higher operating growth into high free cash flow.

TIKR.com

Between 2012 and 2024E, the annual compounding revenue growth rate is 5.8%. Normalized net income is growing by 11.0% CAGR. Free cash flow is growing by 17.7% CAGR. This means that the company is increasingly efficient when it comes to turning higher growth into even higher cash generation. That is great news for all parties involved.

It also supports the company’s aim to maintain strong, double-digit dividend growth.

Moreover, the company has negative net debt, which means AOS has more cash than gross debt on its balance sheet. As analysts are not incorporating buybacks into their models, net debt is expected to fall into deeper negative territory in the years ahead.

That said, if we assume that the company can do $509 million in FCF in 2023, it would imply a 5.4% FCF yield using its $9.5 billion market cap. This not only covers its 2.0% dividend yield but also leaves a lot of room for buybacks. According to the company:

The strength of our balance sheet allows us to maintain our strong track record of delivering returns to shareholders. This has been done through both our dividend that we have increased for 30 consecutive years as well as share repurchases that have totaled $650 million since the beginning of 2021.

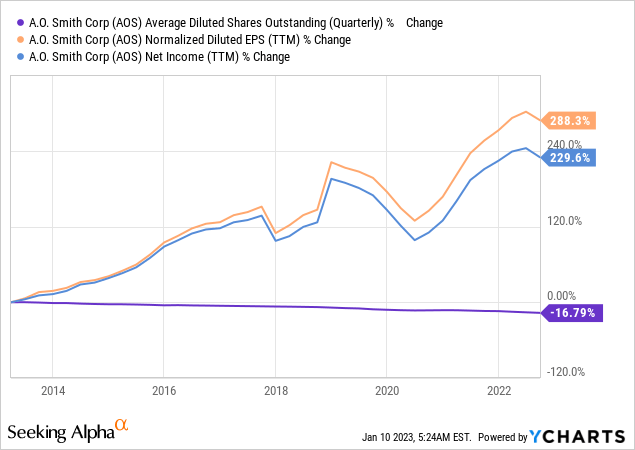

Over the past ten years, the company has repurchased 17% of its shares outstanding. This helped to turn 230% net income growth into 288% earnings per share growth.

With that said, let’s dive into the valuation.

Valuation

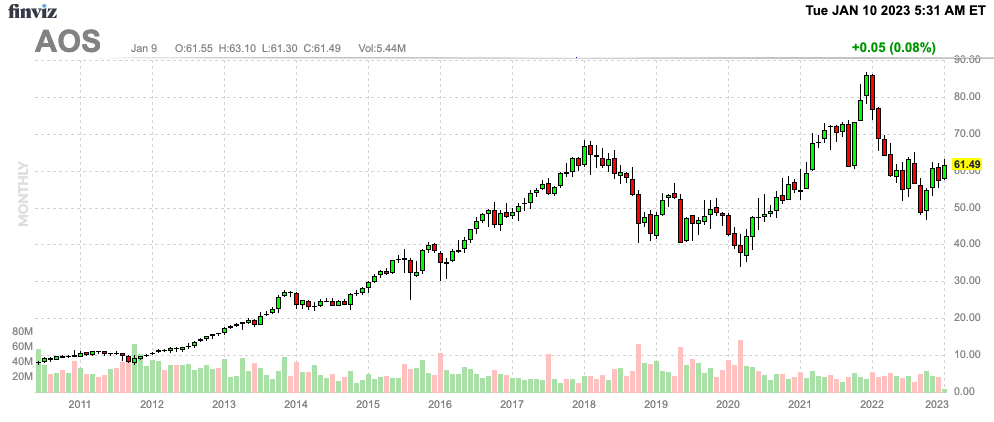

AOS shares are up 7% this year, but down 26.5% over the past 12 months.

FINVIZ

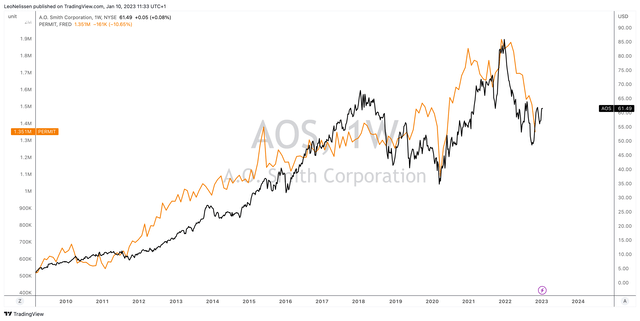

Weakness started in early 2022 when investors started to price in a much weaker housing market. The chart below compares the AOS stock price to building permits.

TradingView (AOS, Building Permits)

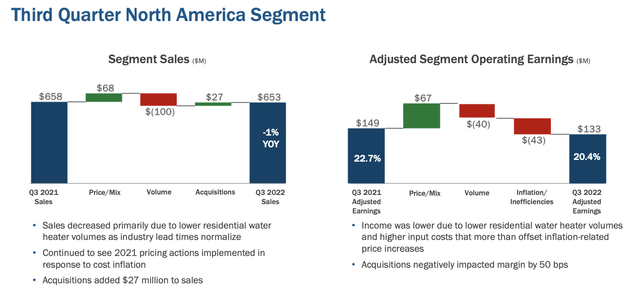

As the free cash flow chart in this article showed, the final results for 2022 are expected to show a weaker year. In its North America segment in 3Q22 (the most recent quarter), the company generated 1% lower sales as volumes caused a $100 million headwind. Adjusted operating earnings were down as inflation caused additional headwinds, pressuring margins.

A. O. Smith Corporation

In the rest of the world, sales were down 13% as a result of lower Chinese volumes, which more than offset 16% growth in India. Operating earnings fell from $27 million to $22 million due to the aforementioned weakness in Chinese orders.

The Chinese reopening is great news for the company as it might boost volumes in the quarters ahead.

On a full-year basis, the company expects at least 5% revenue growth.

We project revenue growth for 2022 of 5% to 7%, which is lower than our outlook in July as a result of softer-than-expected demand in residential water heating. Our sales assumptions include, after approximately 8% growth in each of the last two years, which is well above the historical average growth rate, we estimate U.S. residential water heater industry unit volumes will be down approximately 12% to 13% on last year as customers rightsize their inventories and industry demand normalizes.

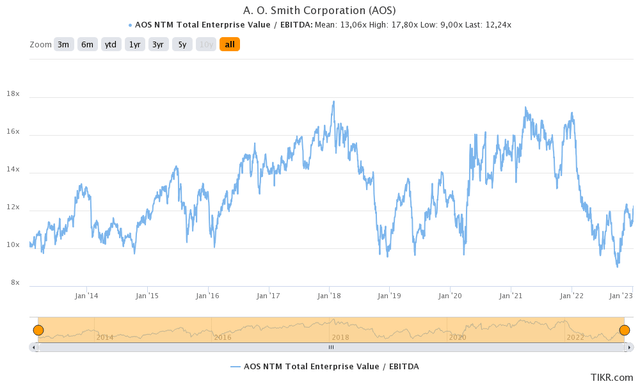

This year, the company is expected to generate $740 million in EBITDA, which implies 2.7% EBITDA growth after 1.5% expected growth in 2022. The company is trading at 12.3x 2023E EBITDA based on its $9.1 billion enterprise value (market cap plus net cash).

This valuation is very fair and well below the longer-term median close to 13x NTM EBITDA.

TIKR.com

Given the economic circumstances, I believe that AOS is a great buy close to $50. At that point, I would buy in intervals, meaning adding gradually over time. If the housing market continues to weaken, investors will likely be able to average down. If the stock market suddenly takes off, investors have a foot in the door.

Takeaway

A. O. Smith is a tremendous long-term compounder. The company is operating in a mature business, but capable of high growth thanks to its portfolio of advanced heaters, boilers, and water treatment products. Thanks to this, the company can protect its status as a dividend aristocrat with double-digit annual dividend hikes. These are backed by high and fast-rising free cash flow, a healthy balance sheet, and management’s willingness to let shareholders benefit.

The only problem is that AOS suffered from supply chain issues and Chinese lockdowns. Now, the company is also being pressured by weakening housing demand, which will likely be a topic of discussion in the next earnings call.

While I believe that AOS will remain rangebound due to macroeconomic challenges, I have little doubt that the stock will outperform the market on a long-term basis and break out as soon as demand bottoms. I expect that to happen in the second half of this year.

(Dis)agree? Let me know in the comments!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.