Summary:

- At present, Adobe’s AI growth drivers, margin stability, and reasonable price tag combine into a compelling package for investors.

- Competition is a risk consideration, especially following the Figma deal’s collapse.

- That said, Adobe’s strong fundamentals, distribution advantages, and strategic positioning justify an upgrade to a positive rating.

ivanastar/E+ via Getty Images

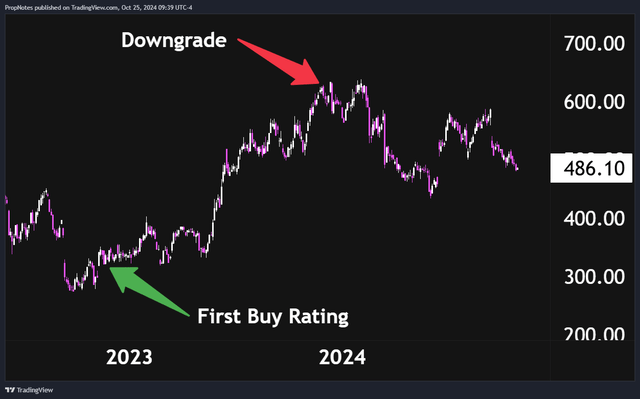

Over the last few years, we’ve written a number of articles on Adobe (NASDAQ:ADBE), discussing the company’s rise and fall as one of the market’s most important tech stocks.

Back in December 2022, we called the stock a ‘Strong Buy’, in an article titled: “Adobe: Buy The Dip In This Excellent Compounder“.

Over the twelve months following, the stock rallied a huge 70% before we wrote our second article, double downgrading the stock to a ‘Hold‘.

Titled “Adobe: It’s Time To Trim“, the piece mostly focused on how the stock looked very expensive on a historical basis, which, at the time, may not have been entirely justified by the fundamentals.

All of this is to say that we have a strong track record when it comes to timing Adobe, given that ADBE is down about 22% since our downgrade in the same time the market has rallied that same amount:

So – where is ADBE headed from here?

In short, we think the stock is priced well given the company’s margins and potential growth profile, and as a result, we’re re-upgrading the stock to a ‘Buy’.

Today, we’ll explore three key reasons why we like the stock and explain why we’re getting bullish on this top SaaS firm for the foreseeable future.

Sound good? Let’s dive in.

The AI Growth Driver

On the face of it, we never would have expected that ADBE would have been a huge beneficiary of AI. The firm makes tools for creators, which, in theory, is the exact kind of work that generative AI will be looking to eliminate in the future.

However, just as generative AI tools like ChatGPT don’t produce perfect pieces of text (and likely never will), content generation tools like Midjourney don’t product perfect images, video, or sound. To get things across the finish line and compile creative work, user input is required, which means that ADBE’s core offerings are actually more important than ever.

As a result, ADBE has pushed fully into the AI-enhanced creative sphere, building AI capabilities into key workflows to supplement build user productivity. This builds out the company’s competitive moat, giving users unparalleled efficiency and control over their work in the digital age.

You can see this emphasis in their product strategy and marketing:

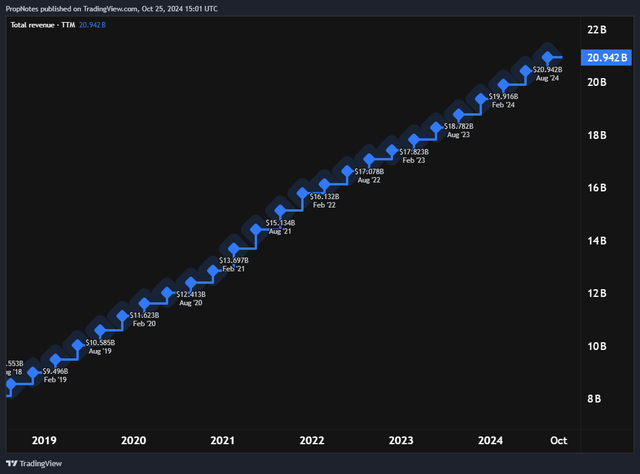

Looking ahead, management is planning on pushing these tools to further boost revenue growth, which has been robust up to this point:

On their most recent earnings call, ADBE management said the following:

Adobe’s customer-centric approach to AI is highly differentiated across data, models and interfaces. We train our Firefly models on data that allows us to offer customers a solution designed to be commercially safe. We have now released Firefly models for Imaging, Vector and Design and just previewed a new Firefly Video model.

Our greatest differentiation comes at the interface layer with our ability to rapidly integrate AI across our industry-leading product portfolio, making it easy for customers of all sizes to adopt and realize value from AI.

Firefly-powered features in Adobe Photoshop, Illustrator, Lightroom and Premiere Pro help creators expand upon their natural creativity and accelerate productivity. Adobe Express is a quick and easy create-anything application, unlocking creative expression for millions of users.

Acrobat AI Assistant helps extract greater value from PDF documents, and the Adobe Experience Platform AI Assistant empowers brands to automate workflows and generate new audiences and journeys.

AI is clearly central to ADBE’s product vision going forward, and we expect that the increased capability of ADBE’s core product suite will command a more inelastic price going forward for clients. Plus, the company’s focus around commercially safe AI content should prove to be a huge differentiator going forward, especially given the legal risks.

All in all, we think ADBE’s revenue growth, which stands at around 10% YoY, may get a welcome bump as the company adapts its pricing scheme to monetize more effectively, which is a huge plus for shareholders.

The Margin Stability

While we think the company’s top line will likely grow at a faster clip in coming quarters as a result of improved customer acquisition and monetization from product updates, the real key here is ADBE’s margin stability in the face of mounting R&D and scale.

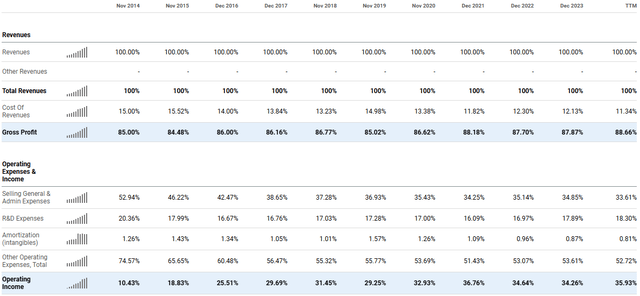

Luckily, ADBE has done an excellent job over the last decade of stabilizing, and even growing, margins in the face of scaling user requirements:

Gross margins have improved more than 300 bps in 10 years with the company’s incremental cost improvements, and the ADBE’s inherent operating leverage has shown through over that span as OM%’s have more than tripled, from 10.4% in 2014 to ~36% today.

As such, while we do see higher R&D costs coming down the pipe from the growth and cost of building Firefly, the multi-modal GenAI content model, we expect that management will strike a good balance when it comes to investing internally.

The company’s distribution advantages give ADBE time to ‘do it right’, avoiding legal pitfalls and accommodating commercial-scale product use cases.

Net net, we expect that ADBE will see continued margin stability going forward as the company grows revenues, which should mean higher, more substantial returns to shareholders on the bottom line:

In Q3, Adobe delivered year-over-year EPS growth of 23% on a GAAP basis and 14% on a non-GAAP basis. This was primarily driven by revenue growth and disciplined prioritization of our investments, which resulted in operating margin strength in Q3.

The company continues to deliver world-class margins while making significant investments in AI model training and inferencing capacity. Adobe’s effective tax rate in Q3 was 17.5% on a GAAP basis and 18.5% on a non-GAAP basis.

The Reasonable Price Tag

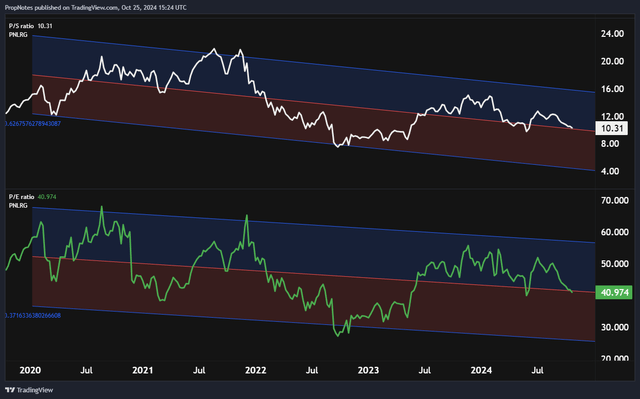

Finally, when it comes to the valuation, we think ADBE is back to being ‘well priced’ by the market, especially on a historical basis:

Looking back, the dip below the channel in late 2022 was where we first thought shares looked attractive. In late 2023, as shares began to trade towards the top end of the channel – for both P/E and P/S – we put out our ‘Hold’ rating, mainly citing the price tag.

Now, as we expect improved EPS strength on the back of meaningful top line expansion and stable margins, the price tag for shares appears highly reasonable.

Better potential results and a lower price tag, all at the same time? What’s not to like?

As you can see, ADBE is trading directly at the midpoint when it comes to the company’s historical valuation over the last 5 years or so, which isn’t a demanding entry point.

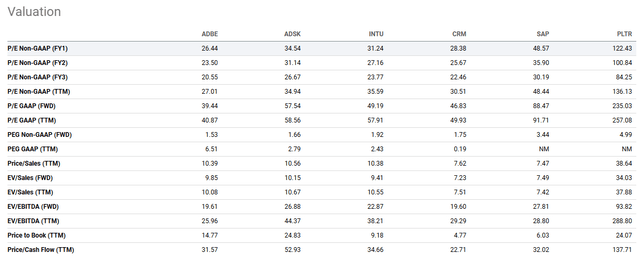

Plus, when you look at ADBE’s peers, the valuation begins to look downright affordable:

It’s’ true that ADBE’s growth profile is a bit more muted than these competitors, but the company is also far more profitable, on a net margin basis, than any of them.

Risks

There are some risks when it comes to investing in ADBE, primarily from competition with other companies targeting the same markets.

Figma (which ADBE failed to acquire), Canva, and new AI-enabled competitors have all begun fighting for share, which could negatively impact margins and growth.

Other than that, though, ADBE remains one of the more inelastic companies around when it comes to SaaS spend, due to the ‘mission critical’ nature of its’ products. In today’s day and age, companies need to focus on content and CX more than ever, which provides a high level of repeatability and consistency for investors.

Thus, the key risks we see here are from ADBE’s competitors, if they can successfully take share. It’s definitely something to keep an eye on.

Summary

Thus, when you add it up, we think ADBE is once-again a highly “buy”-able company. AI-powered growth, stable margins, and an attractive price tag combine to create a compelling package for investors.

Sure, there are some risks involved, especially around competition, but we’re happy with ADBE’s overall R/R at present.

Thus, our ‘Buy’ rating.

Stay safe out there!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.