Summary:

- Applied Materials (AMAT) is a key player in the semiconductor industry, benefiting from the growth driven by generative AI.

- AMAT’s business model covers a wide variety of products, designed and built in collaboration with customer needs.

- The semiconductor industry’s growth, coupled with AMAT’s compounding relationship with customers, supports a low double-digit growth outlook.

- Valuation suggests AMAT shares are fairly valued around $186, supported by a strong balance sheet and shareholder-friendly capital allocation.

zbruch

Applied Materials (NASDAQ:AMAT) is another player in the semiconductor industry riding growth provided by the emergence of generative AI.

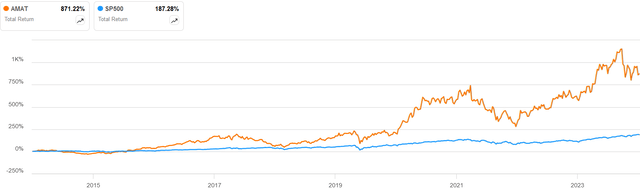

AMAT vs. S&P 500 10Y Returns (Seeking Alpha)

Even before AI became a driver of growth, AMAT significantly outperformed the broader market over the past decade. I wanted to determine if a similarly attractive opportunity lay ahead, based on that growth story and the price we pay for it. I concluded that there is a promising future, and today’s price fairly values it, making AMAT a high-quality Hold.

Business Model

AMAT produces a variety of manufacturing equipment and services to chip makers, namely the foundries. These products allow customers to make leading-edge chips, at scale.

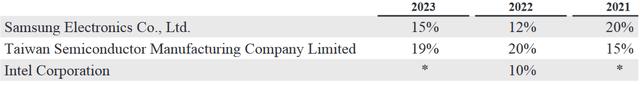

Top Three Customers (2023 Form 10K)

Unsurprisingly, their top three customers typically account for 40% to 50% of sales and are dominant businesses unto themselves.

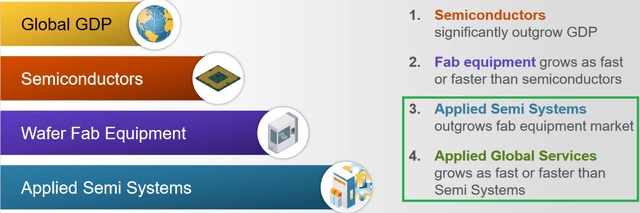

AMAT breaks their business into three segments:

- Semiconductor Systems: Devices to manufacture semiconductors (72.6% of YTD revenue)

- Applied Global Services: Foundry support and related services (23.3% of YTD revenue)

- Display and Adjacent Markets: Devices to manufacture display screens (4.1% of YTD revenue)

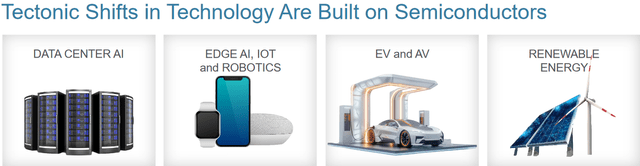

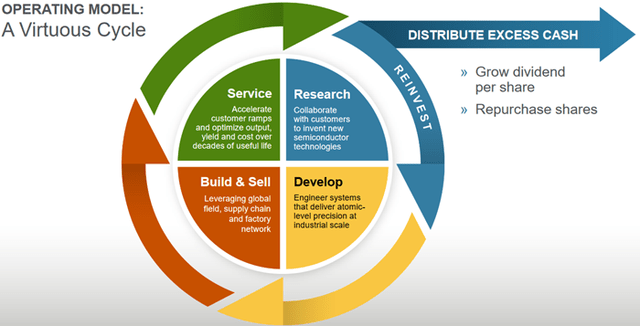

Q3 2024 Company Presentation

These segments give them good coverage of this sector and have allowed them to ride the growth of tech.

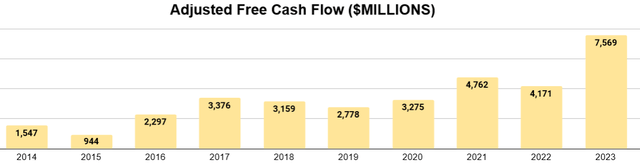

Author’s display of 10K data

This is evidenced by the growth of their free cash flow (above, adjusted for M&A) over time.

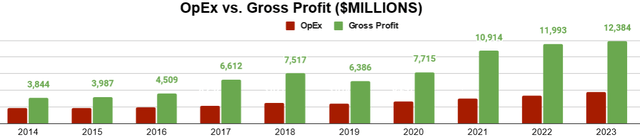

Author’s display of 10K data

An important factor has been the operating leverage that comes from these segments’ product coverage. Operating expenses were up about 2x between 2014 and 2023, while gross profits soared 3.2x for the same period.

Q3 2024 Company Presentation

A major reason for this is that AMAT has been able to plan its R&D expenses with customers, as opposed to speculating about customer trends. This, in turn, allows it build synergies and efficiencies into its future operating model. To quote CFO Brice Hill from a recent conference with Citi:

The strategy for Applied is to put our R&D in collaboration with our key customers. So we’re working together, which, to me, raises the confidence in the success of those R&D dollars.

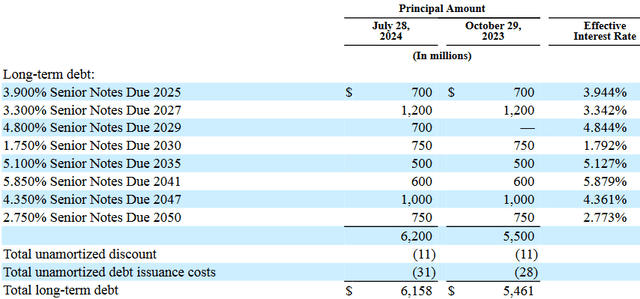

Q3 2024 Form 10Q

With the strong financial position allowed by this growth and high-certainty R&D, AMAT sits on only about $6.1B in debt, with attractively low interest and long maturities.

Overall, Applied Materials is a well-oiled machine.

Future Outlook

It’s very difficult for such a financially sound company to face disaster, especially in the midst of a rising tide. The real risks are that growth expectations may be less than believed and that long-term investors may therefore overpay for ownership in this business. I will therefore review the factors that will affect growth going forward.

Industry Growth Plus Company Growth

The semiconductor industry has been favorable to investors for one reason: it’s grown at higher rate than American GDP, and management cites this for its own growth.

Q3 2024 Form 10Q

With the broader tailwind of this industry, the company itself also enjoys higher rates of growth than the market across their two main segments. Hill also elaborated this in the Citi conference:

But that low double-digit outlook, where does that come from if semis are only growing at 7.5%. The first thing is, every time we ship a tool, it grows the installed base of tools that we can service. So think of that, we have 50-some-odd thousand tools in our installed base every day and every year, we’re adding to that installed base. Companies around the world are being incentivized to go in different places with their fabs. And they’re more interested in a lot of cases in using our services because it’s difficult to get the labor, and it’s difficult, certainly to get the trained labor. So our attach rate to the equipment that we’re selling is higher than it was in the past.

And the last thing is the equipment is ever more complex, requires more spares, requires more information and requires more service to operate at that top level, and that also grows. So when you add those three factors together, you get low double-digit growth rate for us.

In other words, today’s sale naturally embeds AMAT in the lifeblood of the customer and lays the base for new business. It is the manifestation of high-quality compounding in a company.

Keep in mind here, however, that we are talking about long-term averages. The semiconductor industry has been cyclical historically, the cyclical trends of AI-driven semiconductor use are currently unknown and being discovered as we go.

Capital Allocation

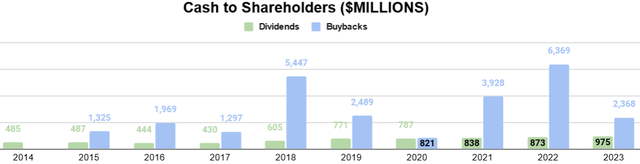

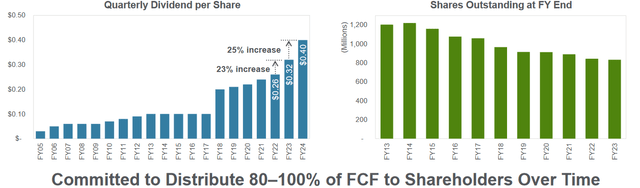

The next thing to consider in growth of free cash flow is their policy on capital allocation, namely between buybacks and dividends.

Author’s display of 10K data

Historically, AMAT has paid a regularly increasing dividend. Years with extra cash lead to more repurchased shares. As management believes M&A opportunities are few, they have guided for a continuation of this trend.

Q3 2024 Form 10Q

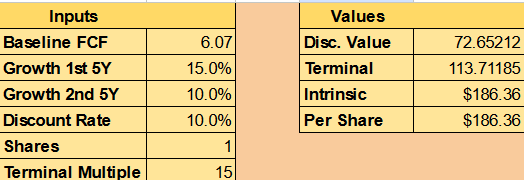

Valuation

To value shares of AMAT, I will use a Discounted Cash Flow model with the following assumptions:

- $6.07 as a baseline FCF per share

- 15% growth the first five years

- 10% growth the next five years

- Terminal multiple of 15

$6.07 is derived from the five-year average of the adjusted FCF I referenced earlier, which was about $4.6B. I rounded it up to $5B, however, as I think recent growth in the past year makes even that too low.

I believe double-digit growth is possible given the company’s own history, guidance, and compounding effect created by the buybacks. As we may see the AI cycle come full circle and begin to abate, I have projected for 5% less growth in the latter half of the decade.

As this company is very financially healthy and embedded with customers who will increasingly depend on them, I suspect the terminal multiple is likely to be in the range of 15 over time (with my baseline FCF, it would currently be a multiple of 30).

Author’s calculation

Priced for a 10% discount rate (typical return of the market), that gets us an intrinsic value of about $186, very close to today’s price. Consequently, I think the shares are fairly valued.

Conclusion

There are many players in the semiconductor space, and while most of them are benefiting from the AI boom, some have the operating excellence to do so better than others, and I think Applied Materials is one of those. With a strong balance sheet, precise R&D spending, and readiness to return profits to shareholders, AMAT has a lot of things going for it. At the current price, it comes to what I would consider a fair valuation, making it a fairly low-risk Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.