Summary:

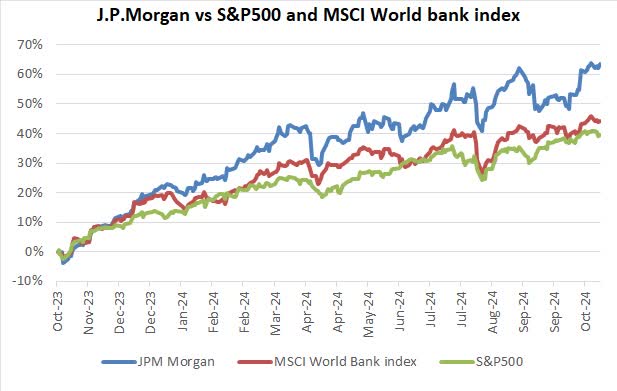

- JPMorgan, the largest U.S. bank, outperformed the S&P 500 and global bank index with a 63% return last year.

- Despite solid Q3 results and upward revised 2024 guidance, potential revenue and net income declines in 2025 suggest limited equity gains.

- The high current valuation, with P/E at 13.4x and P/BV at 1.8x, indicates investors are already optimistic, warranting a cautious stance.

- Analysts’ consensus target price is USD 232.07, with modest upside potential; CEO Jamie Dimon advises caution on stock repurchases at high valuations.

JayLazarin

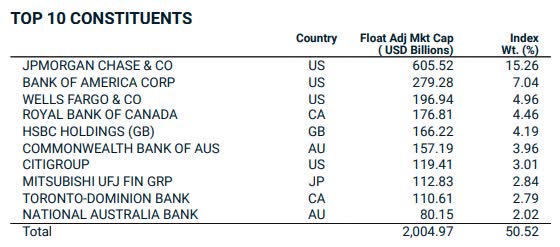

JPMorgan (NYSE:JPM) is the largest U.S. bank by market capitalization (USD 640 billion) and balance sheet assets (USD 4.2 trillion). JPMorgan also holds the highest weight within the MSCI World Bank Index (15.26%), demonstrating its global leadership.

JPM weight (MSCI index)

Over the last year, the bank recorded a total return of 63%, significantly outperforming both the S&P 500 (39.6%) and the global bank index (44.3%).

Radaecowatch

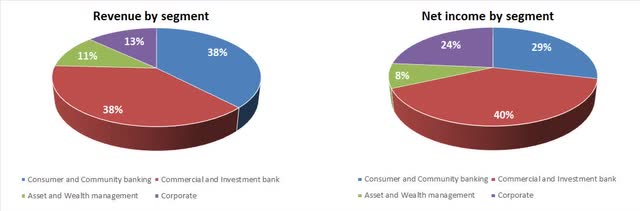

JPMorgan’s activities are divided into three main segments, plus a corporate segment, which includes activities that cannot be allocated to the three primary business lines:

- Consumer and Community Banking: it encompasses traditional banking services aimed at consumers and small businesses. It represents 37.8% of the bank’s revenues and 28.6% of net profit.

- Commercial and Investment Banking: It offers solutions for large corporations, governments, and institutions in areas such as consultancy for extraordinary operations and financing. It contributes 38% of revenues and 39.7% of net profit.

- Asset and Wealth Management: Includes wealth management and private banking activities, accounting for 11.1% of revenues and 8.1% of net profit.

- Corporate: Accounts for 13.1% of revenues and 23.6% of net profit.

Q3 Results Again Beat Consensus estimates

For the ninth consecutive quarter, in Q3 ’24 JPMorgan reported EPS above consensus expectations, driven by better-than-expected results in net interest, fee income (particularly trading and investment banking fees), expenses and share repurchases. JPMorgan reported EPS of USD 4.37, versus consensus of USD 4.01. It added USD 1 billion to its loan loss reserves (after adding USD 0.8 billion in Q2 2024). Revenue increased 5% year-over-year and decreased 1% from the previous quarter to USD 43.3 billion. Tangible book value increased 3.9% sequentially to USD 96.42.

The bank reported a return on assets (ROA) of 1.23%, a return on equity (ROE) of 16% and a return on tangible capital (ROTCE) of 19%. The CET1 ratio remained stable at 15.3%. JPMorgan repurchased common shares for USD 6.4 billion (including USD 6.0 billion net), more than expected, compared to USD 5.3 billion in the second quarter of 2024.

2024 guidance revised upward

Following its better-than-expected Q3 results, the bank raised its net interest income guidance for FY24 to approximately USD 92.5 billion (total value) and approximately USD 91.5 billion (ex-markets), both up from the previous estimate of USD 91 billion. It also lowered its expense guidance to around USD 91.5 billion (from USD 92 billion). Looking ahead to 2025, JPMorgan expects net interest income (ex-markets) to be slightly lower than the current consensus estimates of USD 87 billion, while inflation, capital expenditures, and volume-related activities could push expenses toward USD 95 billion in 2025.

Investment case

Despite solid Q3 results, we believe a potential decline in both revenue and net income in 2025, due to the Fed’s expansionary monetary policy, could limit further equity gains. The Fed Funds futures indicate a likely decline in the Fed Funds rate from the current 4.75-5% to 3.25-3.5% by the 2025-end, which may lead to a further steepening of the yield curve.

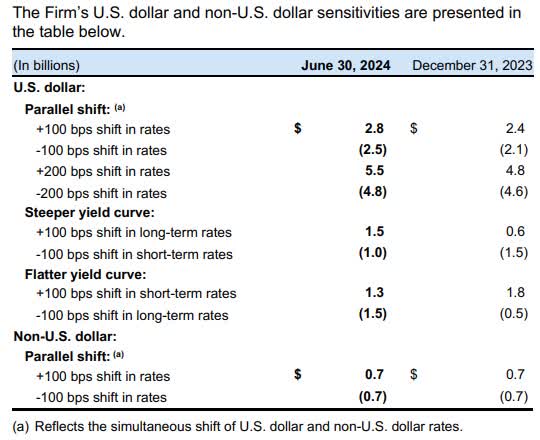

In its Q2 2024 financial statements, the bank updated its projections of the impact of interest rate and yield curve changes on earnings. The table above shows that it sees a negative effect from declining interest rates, and the only sustained increase in long-term yields could offset the impact of a steepening curve.

Company Q2 report

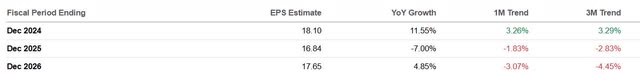

Consensus estimates see revenue and net income to decline by 2.6% and 7% respectively in 2025. However, we believe that the EPS estimates downward revision process for 2025 and 2026 that began in recent weeks could continue if economic growth were to surprise negatively.

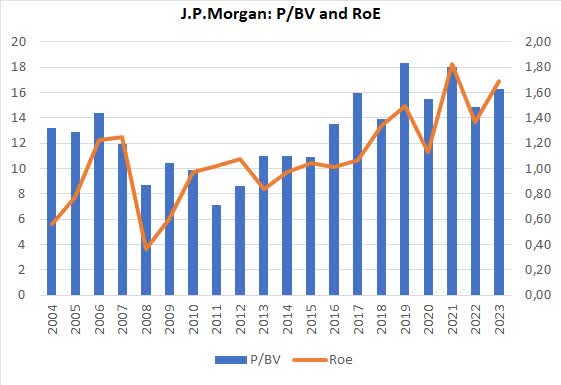

This could have a negative impact on the stock prices, as current valuation is already higher than the last few years average according to a multiple analysis. The P/E ratio is now at 13.4x against a 10-year average of 12.2x, while the P/BV is 1.8x against an average of 1.5x. It is a sign that investors are already discounting an optimistic scenario for the bank.

While the current high valuation aligns with the bank’s strong recent results, as shown in the graph that links ROE to P/BV, we think that the expected decrease in profitability may lead to a contraction in valuation ratio, suggesting a cautious approach to JPMorgan’s stock. For this reason, we adopt a neutral stance on the stock.

Company’s data, Radaecowatch

JPMorgan’s CEO Jamie Dimon also advised caution on the stock during the Q3 2024 earnings call, noting that “buying stock back at more than two times tangible book value is not necessarily the best thing to do because we think we’ll have better opportunities to redeploy it or to buy back at cheaper prices at one point. Markets do not stay high forever.”

The view from the Street

JPMorgan is followed by 21 analysts: 13 analysts have a BUY recommendation on the stock, 7 have a hold rating and 1 a sell rating. The consensus target price is USD 232.07, with an upside potential of 3.8%. Although the upside potential may be considered modest, in our opinion, it is positive that the target price has been consistently revised upwards in recent months.

Conclusion

The Q3 ’24 results reported by JPMorgan were once again solid and above expectations. However, after the 1-year strong stock performance and given the Fed’s recent monetary policy stance, we believe that the scope for further significant appreciation is modest. A multiple analysis suggests that valuations are high considering the anticipated decline in profitability in 2025 and 2026. Consequently, a cautious stance on the stock is recommended, as suggested by CEO Jamie Dimon during the recent earnings conference call with the equity analysts.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.