Summary:

- PLTR has been able to successfully monetize the ongoing generative AI chip and SaaS boom, as observed in the high double digits revenue growth.

- The same has been observed in its accelerating commercial and government segment growths, along with expanding multi-year RPOs.

- Despite the highly successful AIP platform, we believe that PLTR’s return profile at current inflated levels is likely to be underwhelming, attributed to the overly expensive valuations.

- If anything, SBC expenses and insider selling have grown drastically on a LTM basis, with it negating the high growth investment thesis and increasingly rich net income margins.

- Barring an acceleration in PLTR’s adj EPS growths in the triple digits, we believe that the eventual selling pressure is likely to be highly painful once buying momentum ends.

ismagilov/iStock via Getty Images

PLTR’s Investment Thesis Is Overly Expensive Here, Offering Interested Investors With An Uncertain Return Profile

We previously covered Palantir Technologies Inc. (NYSE:PLTR) in August 2024, discussing its outperformance compared to the wider market despite the drastic July/ August 2024 market rotation.

Part of the bullish support might have been attributed to the double beat FQ2’24 performance and raised FY2024 guidance, with it underscoring the successful penetration of generative AI monetization through the infrastructure layer to the SaaS layer.

Even so, we had downgraded the stock to a Hold then, since it was overly expensive with the baked in growth premium offering interested investors with a minimal upside potential.

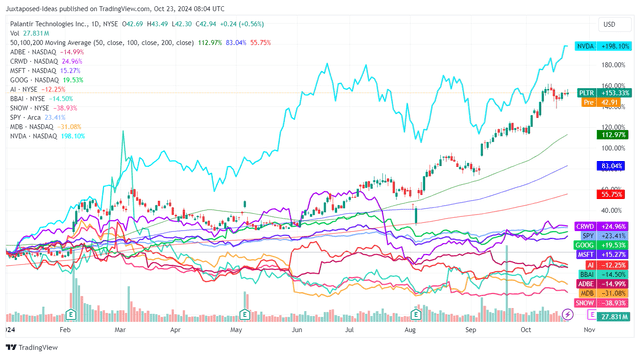

PLTR YTD Stock Price

Trading View

Since then, PLTR has charted another eye-watering +32.4% rally, well outperforming most of its generative AI SaaS peers and the wider market.

The bullish support observed in its uptrend is astonishing indeed, as the stock continues to run way from its 50/ 100/ 200 day averages and surpasses the historical peak of $39s in January 2021.

Part of the tailwinds may be attributed to the insatiable AI demand, as guided by the world’s leading foundry, Taiwan Semiconductor (TSM), with FQ4’24 quarter with revenues of $26.5B (+12.7% QoQ/ +35% YoY), gross margins of 58% (+0.2 points QoQ/ +5 YoY), and operating margin of 47.5% (inline QoQ/ +5.9 YoY).

The foundry’s robust sales guidance and increasingly rich profit margins all point to the durability of generative AI demand, as the hyperscaler segment grows to $11.98B by FQ3’24 (+10.7% QoQ/ +65.2% YoY).

Combined with the “strong structural AI-related demand,” raised FY2024 capex, and potentially higher FY2025 capex levels on a YoY basis, we can understand why market sentiments surrounding generative AI has rallied as it has, with it bringing many market leaders up for a stock price ride.

1. Overly Premium Stock Valuations Trigger A Minimal Margin Of Safety

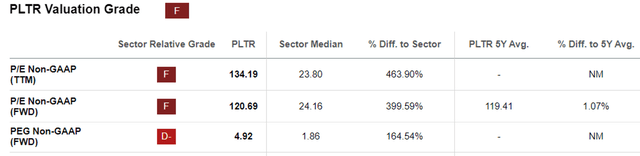

PLTR Valuations

Seeking Alpha

One of the beneficiary naturally has been PLTR, as observed in the YTD stock price outperformance, along with the nose-bleed FWD P/E non-GAAP valuations of 120.69x, up from the previous Hold article level of 90.29x and the sector median of 24.16x.

Part of the optimism may be warranted indeed, since the SaaS company has experienced a new growth opportunity through the Artificial Intelligence Platform [AIP] platform launched in April 2023, further aided by the new go-to-market strategy through boot camps.

These efforts have already triggered PLTR’s high double-digit revenue growth across the commercial and government segments, along with the expanding multi-year remaining performance obligations.

When compared to other generative AI SaaS peers, it is apparent that the Alex Karp led company has been able to successfully monetize generative AI while reaccelerating top/ bottom-line growths and grow its customer base, with it building upon its GAAP profitability.

For context, PLTR reported a top/ bottom-line expansion at a CAGR of +26.7%/ +10.3% between FY2020 and FY2023, compared to the promising consensus forward estimates at +21.5%/ +27.4% between FY2023 and FY2026, respectively, as the management raised their FY2024 revenue growth guidance twice to +22.8% YoY.

This is a direct contrast to PLTR’s big data analytic competitors, including c3.ai (AI), BigBear.ai (BBAI), and Snowflake (SNOW), attributed to their slower AI monetization/ decelerating revenue growth on a YoY basis, aside from MongoDB (MDB).

Even big legacy players such as Adobe (ADBE) has had trouble monetizing its natively integrated AI capabilities as observed in the softer FQ4’24 outlook at single digit YoY growths, with OpenAI unlikely to generate meaningful profitability through 2029 – with it underscoring why the market has been exuberant surrounding PLTR’s profitable/ high growth execution thus far.

On the other hand, with the consensus forward estimates remaining stable thus far, it is goes without saying that the PLTR stock is now trading at overly elevated FWD PEG non-GAAP ratio of 4.89x, compared to the previous Hold article levels of 3.67x and the sector median of 1.88x.

Even when comparing to other high growth generative AI/ SaaS peers, including Microsoft (MSFT) at FWD PEG non-GAAP ratio of 2.37x, Google (GOOG) at 1.28x, CrowdStrike (CRWD) at 2.58x, and NVDA at 1.32x, it goes without saying that PLTR is overvalued here.

This is especially given the SaaS company’s minimal profitability at an adj EPS of $0.09 in FQ2’24, with part of the headwinds attributed to the bloated share count of 2.41B (inline QoQ/ +6.1% YoY) – despite the increasingly rich adj net income of $221.4M (+12.4% QoQ/ +85.2% YoY) and net income margins of 32.6% (+1.6 points QoQ/ +10.2 YoY).

2. Ongoing Dilution Implies Decelerating Adj EPS Growth Trend & Shareholder Equity Erosion

If anything, PLTR’s Stock-Based Compensation [SBC] expenses have been gradually increasing again to $141.76M (+12.8% QoQ/ +24.1% YoY), partly contributing to the bloated share count.

At the same time, the company has “filed a prospectus related to the offer and sale of securities” in August 2024, with it potentially implying further insider selling and/ or dilutive capital raise for operational purposes, with the latter less likely attributed to the growing net cash on balance sheet at $3.99B (+4.4% QoQ/ +29.1% YoY).

For now, we have already observed a drastic increase in PLTR’s insider selling worth $1.09B over the LTM (+1,047.3% sequentially), with it comprising ~44.1% of its revenues over the same time period.

These numbers are somewhat reminiscent of the company’s extremely rich SBC expenses of $1.27B in FY2020, well exceeding the fiscal year’s revenues of $1.09B.

While the CEO has repeatedly promised to manage PLTR’s SBC expenses, the launch of AIP has already triggered a notable reversal in the company’s recent operations – with the higher expenses likely to be a new normal as growth accelerates.

With PLTR expected to report their upcoming FQ3’24 earnings call on November 4, 2024, interested readers may want to find out more about the rate of its adj net income growth against the rate of adj EPS growth indeed.

This is because H1’24 net income growth at +433.5% YoY and H1’24 adj EPS growth at +70% underscore the ongoing shareholder equity erosion, with it well negating the SaaS company’s high growth revenue investment thesis.

So, Is PLTR Stock A Buy, Sell, or Hold?

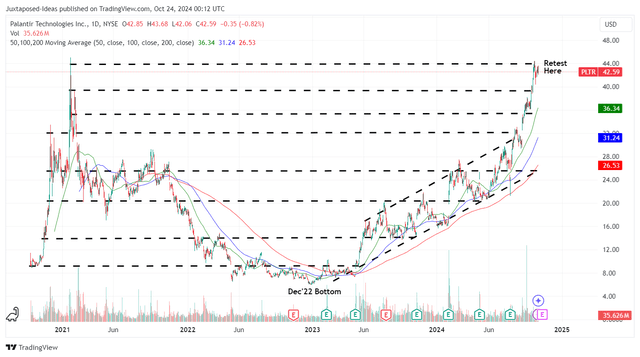

PLTR 4Y Stock Price

Trading View

For now, PLTR has had a near vertical rally by +78.2% after the worst of the August 2024 correction, with the stock now trading near to February 2021 heights.

For context, we had offered a long-term price target of $30.20 in our previous article, based on the consensus FY2026 adj EPS estimates of $0.53 and the 2022/ 2023 P/E mean of 57x (with those levels implying a more reasonable FWD PEG ratio of ~2.30x while nearer to its AI SaaS peers).

It is apparent by now, that PLTR is now trading at extremely inflated levels, with it remaining to be seen if the uptrend bullish support may be sustainable.

For now, we believe that a painful market wide correction is likely to occur in the near-term, as the stock market enters greedy territories thanks to the exuberant market sentiments after TSM’s robust FQ3’24 earnings results and the Fed’s outsized pivot by 50 basis point in the September 2024 FOMC meeting.

At the same time, while PLTR’s AIP has been highly successful in driving new growth in the US commercial market while being accretive to its bottom-lines, we believe that there is an uncertain stock price return profile at current nose-bleed valuation levels at FWD P/E non-GAAP valuations of 120.69x, barring a drastic acceleration in its adj EPS growth in the triple digits.

With the management merely guiding a FY2024 revenues of $2.74B at the midpoint (+22.8% YoY) and adj income from operations at $970M (+53.2% YoY), we believe that the optimistic sentiments surrounding the stock has gotten over board here, with selling pressure likely to be highly painful once buying momentum ends.

As a result of the potential volatility, we urge investors to take part of their gains off the table and coming back in after the correction is concluded, resulting in our Sell rating.

Do not chase this rally off the cliff.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.