Summary:

- Adobe has been able to rapidly embed Gen AI features into its products, which are getting a lot of traction.

- It has also been able to generate more sales but these are progressing gradually, as it reshapes its product portfolio in a market that has been disrupted.

- Adobe’s inability to hike pricing hints that the competition is strong while it has lost the first-mover advantage in image creation.

- Due to high investor expectations built into the stock price, it could suffer from further volatility.

- Also, as AI-driven image generation takes center stage, Microsoft, with its investment in OpenAI is now a competitor, in addition to being a partner.

mvp64/E+ via Getty Images

I last covered Adobe (NASDAQ:ADBE) in September 2022, two months before the launch of OpenAI’s ChatGPT. I had a hold position mainly based on its $20 billion bid to acquire Figma. Eventually, the deal did not materialize, and the stock has gained 71% since then, in large part due to investor enthusiasm around GenAI.

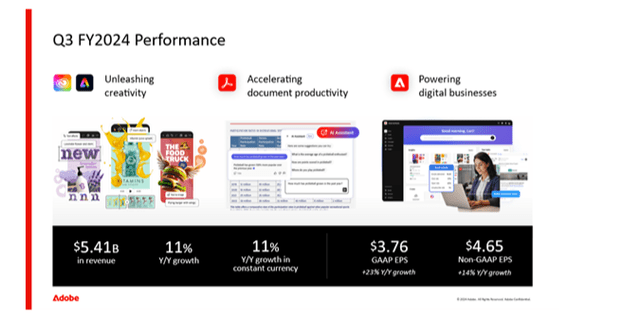

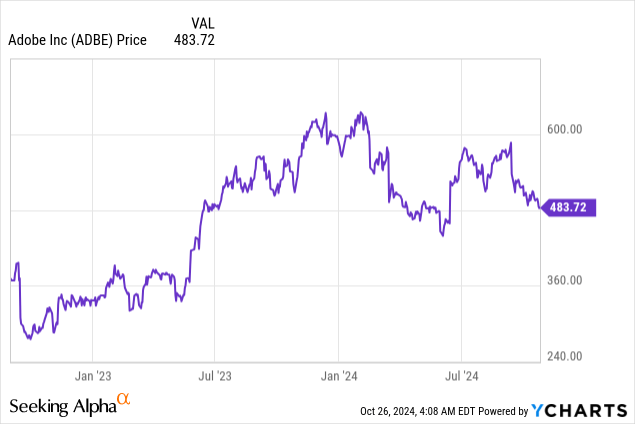

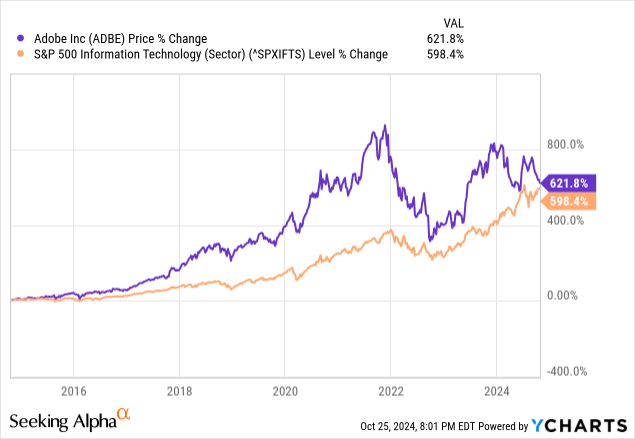

Thus, high expectations could explain why the stock dropped by around 10% on September 12 despite strong performance for its third-quarter fiscal 2024 (Q3) results, with the slide subsequently continuing as shown below.

The problem was the disappointing fourth-quarter (Q4) guidance, with the stock now trading over one hundred dollars below its mid-September high of $586, which may seem tempting. However, this thesis aims to show that despite promptly embedding GenAI into its product line and seeing traction for these, sales will likely continue progressing gradually, not rapidly as the market is pricing in as Adobe reshapes its portfolio.

This explains my hold position and I start by analyzing the outlook to understand how its products have penetrated the market and assess its ability to attract premium prices.

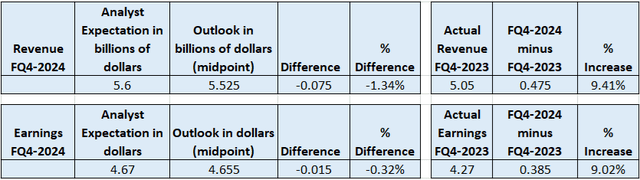

Guidance Points to an Attractive Product but not Pricing Power

First, looking into the revenue guidance, it was $5.50 billion to $5.55 billion whose midpoint of $5.525 billion was below analysts’ expectations of $5.6 billion by 1.3%. The mid-point of the EPS guidance of $4.63 to $4.68 fell short of what analysts expected by 0.3% as calculated in the table below. Moreover, based on the outlook provided, the revenue in Q4 should grow over the same period in 2023 by over 9%, but this would mark more than 1% deceleration, both on a YoY and sequential basis.

Table built using data from (www.seekingalpha.com)

Putting things into context, the company guiding both higher sales and EPS shows it continues to leverage AI to advance growth and profitability. However, the larger sales outlook miss suggests that Adobe is not being able to attract paying customers to the degree the market expects.

In this respect, the traction for its Firefly offering, a suite of GenAI-based creative APIs targeted at enterprises that have already been used to generate over 13 billion images as of September 2024, means the product is market fit. However, looking deeper, users are not paying for it separately as it is available as part of Creative Cloud, and other paid subscriptions. It can also be used freely as part of users’ free Creative Cloud accounts. Also for enterprises, Firefly is offered as part of Adobe Experience Cloud, thereby helping drive more customer adoption of its products in general.

Thus, given the way its products are bundled, the lower-than-expected sales suggest an inability to raise prices, possibly because of a higher degree of competition, an idea supported by the EPS outlook miss which hints the company is not enjoying natural (or organic) demand for its products or services but rather having to drive these through relatively higher marketing expenses, hinting it may not have pricing power.

As a result, and especially for a company that has beaten expectations in recent quarters, the missed sales guidance negatively impacted investor confidence and led to a sharp correction. This raises questions about growth prospects, and, to obtain an answer, I look at the competition.

Faces Both Incumbents and Disruptors Including OpenAI

First, competitor Autodesk (ADSK) competes mainly in 3D design and engineering software have also rapidly embedded GenAI into its products like Project Bernini but this is only for design and manufacturing industries. On the other hand, Canva with Magic Studio is more of a direct competitor to Adobe products, especially given the user-friendliness of its design tools, and their appeal to non-designers. Others competing with Adobe’s Creative Cloud applications are Corel with CorelDRAW offering graphic design and photo editing software, and Figma’s cloud-based design tool that emphasizes collaboration across workspaces.

Still, despite facing these competitors, Adobe was able to drive adoption for its Firefly services, namely by positioning it as a product for quickly generating new content, and for making quick changes at speed. Analyzing the product strategy, Firefly is complementary (integrated) to Adobe’s Photoshop application used for editing images and already known to creators throughout the world.

Discussing further, the challenge when determining the optimal pricing strategy for such integrated offerings is finding a balance between how customers use core products like Photoshop and adopt GenAI-based product lines, which may prove intricate in a market that has been disrupted where it does not have the first mover advantage.

In this connection, the first mover and disruptor was OpenAI’s DALL-E, an AI-driven image generation tool that offers a different interface and a more intuitive approach, namely through prompts, or word-based requests. Also, more than 1.5 million people use DALL-E daily to create more than 2 million photorealistic and detailed images which are indistinguishable from real ones, but Adobe also faces competition from other startups like Midjourney, and Stable Diffusion. Tellingly, a comparison of AI-generated images from Midjourney, DALL-E, Stable Diffusion, and Adobe Firefly showed the latter followed the directive provided in the prompt most accurately (faithfully) but still the image generated was not perfect.

To this end, with each new product release, AI generators are growing in sophistication and this is another factor that makes it difficult to attach a premium price to a product. Thus, in a market where users are still experimenting with innovation, by hiking prices, Adobe faces risks of customers either switching to lower-cost disruptors or opting for open-source alternatives.

GenAI is Incremental to Adobe’s Sales, as it does Not Possess First Mover Advantage

Thus, not possessing the first mover advantage of OpenAI and Firefly being proposed mostly as an integrated product, the impact of GenAI on Adobe’s revenue has been incremental, not exponential. As such, it cannot charge a premium solely because it has embedded GenAI into its products in response to user demand, but this will depend on its ability to continuously innovate and differentiate itself.

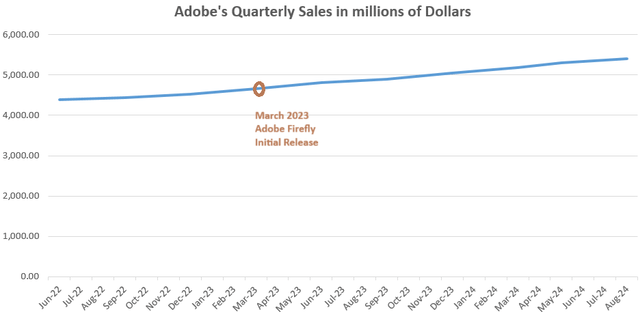

Its ability to charge higher will also depend on the productivity benefits to be derived by its customers. In this respect, while some reports credit GenAI with allowing designers to be more productive on creative tasks others are more cautious as to the prospects. Consequently, unless there is an acquisition, the company is likely to continue increasing revenues gradually, or by an average of 10.6% since the initial release of Adobe Firefly in March 2023 as shown below.

The chart was built using data from (www.seekingalpha.com)

Now, compare this with OpenAI’s exponential growth with monthly revenues expected to reach $300 million in August, up 1,700% since the beginning of 2023. One may argue this is not a like-to-like comparison, and Adobe’s core business like documents and PDFs, goes beyond just generating and editing images, but, for a company whose flagship product is Creative Cloud, or the business of creation, it seems no longer to boast the innovator role and not even managing to grow at one-hundredth OpenAI’s despite having leveraged GenAI for more than one and a half years. For investors, Firefly and other AI innovations form part of its Digital Media segment which accounted for 74% of overall sales in Q3 and grew by 11% YoY.

Too Much Optimism Baked in the Share Price

On the other hand, the GenAI disruptor is expected to suffer approximately $5 billion loss this year, compared with an operating income of $1.99 billion for Adobe in Q3.

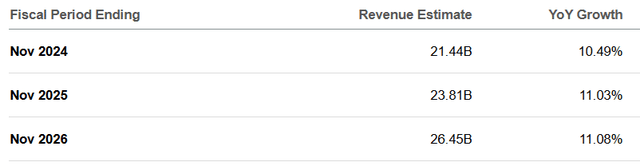

Therefore, if you are an investor looking to make money from AI-driven image generation, a market projected to grow by 17.5% CAGR from 2024 to 2032, Adobe could be a profitable way to do so. However, given its trailing price-to-sales of 10.4x which exceeds the IT sector median by a whopping 246%, the market seems to be overly optimistic about its growth prospects which according to me is not justified because GenAI has only an incremental impact on sales. Worst, Adobe grew by only 10.2% in fiscal 2023, and sales growth is estimated to be 10.5% for this year and around 11% for fiscal 2025, or far below what is expected from this innovation.

Analysts’ Consensus Revenue Estimates (seekingalpha.com)

Thus, if it does not improve growth rapidly, it will be again punished hard, which is why it is not advisable to invest at the current juncture. To this end, the blue chart below shows the degree to which Adobe has been volatile relative to the S&P 500 Information Technology sector. Now, given it is not growing according to Wall Street’s expectations currently, its outperformance of about 23% (621.8-598.4) does not make sense. Thus, I believe it could potentially fall to the $372.5 (483.72 x 0.77) level based on its current share price of $483.72.

Justifying Caution as Microsoft is Now a Competitor

To further justify my cautious position, as AI-driven image creation and editing tools have taken center stage, questions may arise about whether Adobe can continue utilizing Microsoft’s (MSFT) Azure cloud’s massive reach to expand its user base. In this connection, my last thesis detailed its strategic partnership with the software giant both for cloud and AI.

In this case, the problem is Microsoft now competes with Firefly for certain use cases after integrating DALL-E in products like Microsoft Designer. On top, the software giant has invested $13 billion in OpenAI which is not yet profitable. Therefore, while Adobe and Microsoft will likely continue their partnership, the dynamics may change as the focus turns to return on investment.

In conclusion, this thesis has shown that Adobe has integrated GenAI into its offering but growth is progressing gradually, while a valuation of over 10 times trailing twelve months sales hints at expectations of substantial growth which is not currently possible as Adobe is actively reshaping its offerings in an AI-driven image generator market disrupted by new entrants whose tools enable people without design skills to produce high-quality output. As a result, these have emerged as alternatives to Adobe which no longer has a first-mover advantage.

Still, investors will note that I am not bearish as Adobe’s products retain their appeal in enterprises where the needs go beyond GenAI and it is continuously innovating, namely by offering new products like GenStudio for performance marketing and other solutions which make it easier to manage high volumes of content generated daily. These could boost sales, while the EPS outlook miss could indicate the company may be planning to spend more marketing dollars to drive faster product adoption, breaking away from its strategy to focus both on growth and profitability at the same time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.