Summary:

- Bank of America reported better-than-expected Q3 earnings, with strong trading results and net interest income.

- Despite solid performance, shares trade above the 3-year average price-to-book ratio, presenting an unattractive risk profile. The bank also faces future earnings growth challenges due to declining federal fund rates.

- Concerns persist about Berkshire Hathaway selling shares and potential impacts of federal fund rate cuts on net interest margin and earnings.

- Given the current valuation and economic outlook, I advise against accumulating Bank of America shares at this time.

ProArtWork

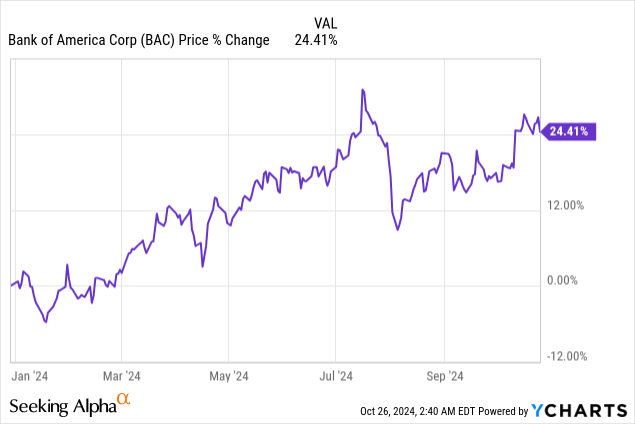

Bank of America (NYSE:BAC) (NEOE:BOFA:CA) submitted a better than expected earnings sheet for its third fiscal quarter last week that showed sequential net interest income growth, a moderate top line gain and high balance sheet quality. The bank managed to report strong results in trading, which aided Bank of America’s top line growth. With federal fund rates having started to slide, however, I believe the longer-term outlook in terms of earnings growth is leaning negative. Shares of Bank of America continue to trade above the longer term, 3-year average price-to-book ratio and don’t have an especially attractive risk profile, in my opinion. With the bank’s net interest income and yields set to decline, I believe the big money with regard to Bank of America has already been made.

Previous rating

In my last work on the bank — The Risk Matrix Just Deteriorated — I expressed my concerns about Berkshire Hathaway dumping millions of shares of Bank of America on the market and reducing its decade-old stake in the Wall Street bank. Further, a changing federal fund rate trajectory poses significant earnings risks for Bank of America. While the bank reported better than expected Q3 earnings, I believe Bank of America is going to have a much harder time growing its earnings and book value in the future.

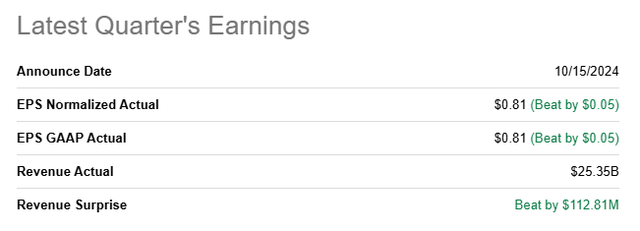

Bank of America beats top and bottom line estimates

As did other big banks, Bank of America surpassed consensus estimates for the third-quarter last week, reporting adjusted EPS of $0.81 which beat the average prediction by $0.05 per-share. The top line, boosted by trading results, came in at $25.35B, beating the consensus estimate by $113M.

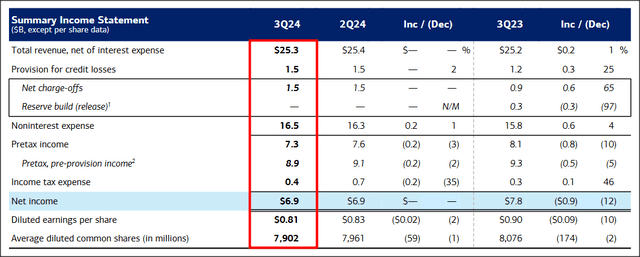

Bank of America generated a total $25.3B in revenue in the third-quarter, showing 1% year-over year growth, with solid loan and net interest income performance sustaining the bank’s high earnings. Net charge-offs remained steady at $1.5B quarter-over-quarter and the bank reported $6.9B in earnings, which was flat quarter-over-quarter.

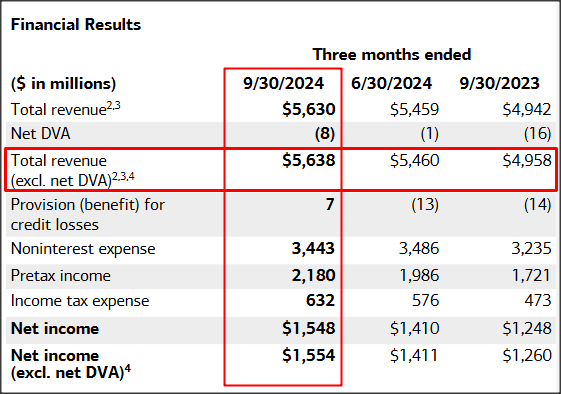

Sales and trading, which is part of Bank of America’s Global Markets business, had an especially good quarter in Q3: sales and trading generated 12% year-over-year top line growth and revenues of $4.9B. Total segment revenues calculated to $5.6B, showing 16% year-over-year growth. However, sales and trading are very volatile and results should not be expected to continue to grow at such high rates going forward. While it was especially sales and trading that led Bank of America to report top line out-performance in the third-quarter, other parts of the bank’s Q3 earnings release also looked good, especially the bank’s net interest income.

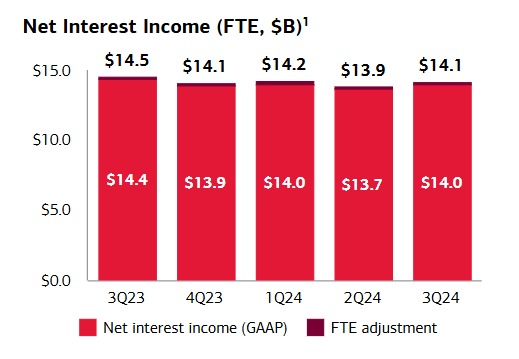

Bank of America

Net interest income is a widely watched figure in the banking segment, as it indicates the health of a bank’s core lending operations. Net interest income for a major bank captures the difference between its interest rate-related income (its loans) and its interest expenses (its liabilities), thereby giving insights into the most fundamental part of a bank’s operations: the profitability of its lending activity.

In the third-quarter, Bank of America generated $14.1B in net interest income, showing a 3% decline year-over-year, but an increase of 1% quarter-over-quarter due to higher cost for its deposit base. Overall, Bank of America’s net interest income has remained fairly steady in the last year, but investors should expect a continual slide here as the Federal Reserve is set to continue to lower federal fund rates, the rates at which banks borrow money overnight. The bank’s net interest yield declined for the third time in four quarters and was reported at 2.40%, showing a drop-off of 0.24 PP compared to Q3’23.

Bank of America

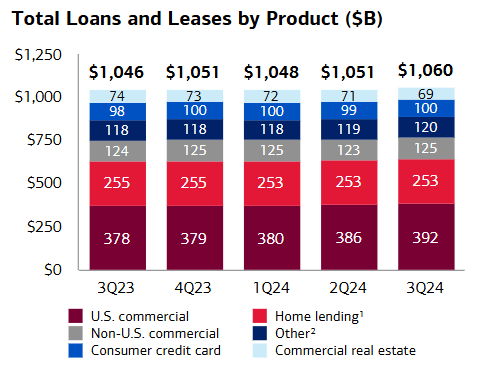

In terms of loans and leases outstanding, another key figure to determine how robustly the lending business is performing, Bank of America did reasonably well: in Q3’24, the lender had total loans of $1.06T on its balance sheet, showing an increase of 1% quarter-over-quarter. This growth was driven chiefly by loans in the U.S. commercial category.

Bank of America

Bank of America’s valuation

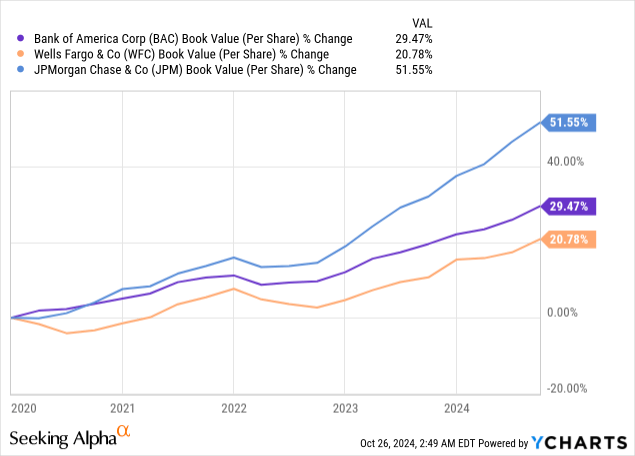

Bank of America has seen solid book value growth in the last five years, but has not grown its book value the fastest in its industry group. This accomplishment goes to JPMorgan & Chase (JPM) which increased its book value per-share by 52% since FY 2020, in part because the Wall Street bank acquired new banks during last year’s regional banking crisis. Bank of America grew its book value by almost 30% the last five years, beating Wells Fargo’s (WFC) 21% book value increase. Wells Fargo, in my opinion, is the most comparable Wall Street bank for Bank of America in terms of commercial focus.

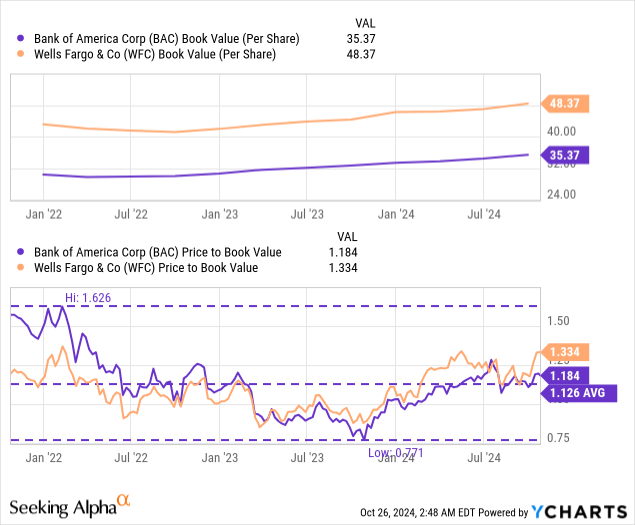

Bank of America is currently trading at a price-to-book ratio of 1.18X, which is about 5% above the bank’s 3-year average price-to-book ratio of 1.13X. The 10-year average price-to-book ratio is 1.04X, meaning the bank’s current valuation is quite significantly above the long-term average. Wells Fargo, the most comparable banking rival, is trading at a price-to-book ratio of 1.33X due to strong execution in its core loan and deposit business. I have a negative, sell rating on Wells Fargo as I expect to see falling net interest yields here as well. My current fair value estimate for Bank of America is $35.37 — which equals the bank’s updated book value per-share as of the end of the September quarter. In a lower-rate world, I expect Bank of America to revalue to its book value and lose a good chunk of its premium valuation.

Risks with Bank of America

The biggest risk for Bank of America, as I see it, relates to a contraction in the bank’s net interest income and yield in a lower-rate world. The bank’s net interest income is a key income pillar for Bank of America, and contractions related to federal fund rate cuts could have a detrimental impact on Bank of America’s earnings potential and capital returns in coming quarters. What would change my mind about Bank of America is if the bank’s balance sheet quality improved or if the bank managed to grow its net interest income after all.

Final thoughts

Bank of America submitted a decent earnings scorecard for the third fiscal quarter, which beat estimates on both the top and the bottom line. The bank’s net interest income grew Q/Q, but the net interest yield fell to 2.40%. I continue to have serious reservations investing in Bank of America at a time when federal fund rate cuts have started, as they will lead to shrinking net interest income and yields going forward. As I indicated in my last work on Bank of America, I am also very cautious in the context of Warren Buffett’s Berkshire Hathaway offloading billions of dollars’ worth of shares. With shares also trading above the longer term P/B average, I believe we may have already seen the top, and I continue to evaluate Bank of America as a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.