Summary:

- Disney CEO Iger’s fixes and tweaks are winning over some fans, signaling a possible creep up for DIS shares. But, over time, it won’t happen outside the narrow range it now trades at.

- Positive reports highlight major progress by Iger, transforming Disney into a strong buy story for true believers. But facts ahead still roil.

- Iger’s moves tweak and shift, but in the end are small potatoes next to what really needs to be done.

- Massive issues remain, but recent efforts by Iger and team show no real moves to transform business model for more viable stock performance.

tobyfraley

Above: Mr. T. rex couldn’t survive because it was too big, clumsy, and slow to adapt-just like the challenges facing showbiz today.

Premise: Investor confidence grows as Disney (NYSE:DIS) CEO Bob Iger’s fixes and tweaks are bringing cheers from fanboys who see a strong upside coming, directly related to reversing some moves made during the short-lived covid/Chapek era. Iger’s kudos emanate from much wishful thinking.

These fans, however, may be overly optimistic-a perspective we’ll explore further.

The dinosaurs rattling the DIS cage in no specific order:

- A manageable, but still oppressive debt load of $47.8b as of June this year.

- A film lineup heavily reliant on recycled legacy IP.

- The Parks and Experiences segment carries a significant revenue burden amid increasing theme park competition.

- An unclear succession plan-leaving Iger’s eventual exit uncertain. 2026 attests to the board’s misguided view that Iger may, in fact, be replaceable. What should have taken at most a year, is now dragging into 6 and probably more. Vital change is needed. But DIS appears to be convinced that there is plenty of time for Iger victory laps.

- The board is anemic and needs fresh blood that only a new CEO can accomplish. Otherwise, a clean sweep is in order.

- An ESPN segment that is utterly incoherent to the core business of DIS.

Positive sentiment around DIS is growing, fueled by perceived progress from Iger that has changed the game to a strong buy story. In all fairness, it’s not our intention to disparage what has been done since the swoon of the shares from its high in March 2021 over $201.

Conversely, we list here what Iger and company have done in the light of massive issues left to deal with that could indeed propel the shares to regain anything near its previous high. Moves to cut movie budgets, consolidate staff with major layoffs, heavily support growth of DISNEY+ results, and above all focus productivity in films to sequels and reboots of DIS legacy IP.

All these pivots are sensible, but come from the Captain Obvious Playbook. And they contribute to improved, but rather modest, in bottom-line results. What we can also see is that this slow and steady focus on the planned $60b in Capex for Parks also meets the common-sense test.

What is realistically wrong here, what fans think they see, is the vision of a probably more focused use of existing IP rather than loading the creative guns searching for new IP lands to conquer. The results envisioned, slow and steady EPS gains without forays into the unknown gambles that may be required. Looking for the possible range of $5.50 to $6.00 EPS forward years.

What is real, sans the rose colored glasses, is The Jurassic Park analogy I have imagined for the industry recognizing the party is over. Currently, we have yet to see moves at DIS that attack big problems.

If we may, we move our lens further into the animal kingdom to present a mind experiment for tossing away the rose colored glasses of DIS fandom at the moment, for a look at where the industry now sits.

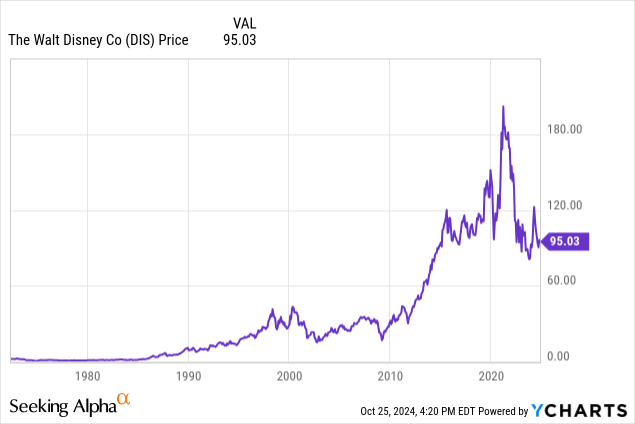

Above: On its way to a settling place in an $88 to $120 comfort trading zone, but hard to make a case for more yet.

The business has entered a ‘Jurassic World,’ where massive, outdated entities are struggling to survive, who eat smaller animals or one another as the streaming service TV business has turned into a souk with vendors yelling price deals at consumers as they wander past the tents. Profits are yet to be found. The mammoth creatures are too big, too clumsy and are following the road to extinction as their ancestors have in the animal kingdom. They will evolve into smaller, more efficient creatures, nimbler and smarter to rationalize a scale and mix that makes money. DIS shares some of these Jurassic World struggles on its way to becoming a scaled down company making money for shareholders at a regular pace.

So with oversized creatures, limited tree branches or eatable competitors, and a coming ice age already past the gates, investors can’t be bullish unless major structural changes are made to turn the dinosaurs into viable survivable animals.

As this process goes on, the DIS stock seems to stay comfortably nested in a trading range between the $80s and $120s. Nowhere in sight, sad to say, is the March 2021 high. There are still too many factors keeping it eating tasty leaves on Jurassic Park. A CEO successor remains to be found. A 2026 target for the selection of a new boss will only extend the Iger legacy.

The movie pipeline

All 10 projected DIS film releases through May 2027 are sequels of stalwart IP. There is no sign yet that DIS is willing to roll the dice even on gems from the ancient past like Snow White, a $300m DEI stumble. Clearly made to prove, among other things, DIS’s lapdog fealty to woke diktats which continue to haunt the precincts of the creative teams. It may be snuck out in 2025, starved into the marketing dead zone of DIS flops and deservedly forgotten.

The subject has been debated to death. Our industry friends have been telling us for years that the streamers have always had a special reluctance to let viewing numbers loose on woke content because viewership was so low. So it’s all about doing God’s work, not making money for shareholders?

Investors who do see this as a reason audience segments may boycott DEI heavy films should be polled. Once and for all, ask audiences if they find DEI heavy content a reason to pass. DIS may well have done that many times over. Investors are entitled to know the results. It’s just another part of the landscape of Jurassic Park/Hollywood. Doing God’s work financed by the pockets of shareholders is unaffordable, pretentious nonsense as a policy of a once great corporation.

The simple proof, perhaps oversimple for some: DIS shares have lost 60% of their value since the March 2021 high, shedding $200b of shareholder value. Clearly, the descent of the industry into a post covid swoon is a key factor outside DIS control. But what is still fair to ask is this: What has been the response of Iger and his management since the 2020 dark age? Mostly what appears as the kind of general housekeeping that could well have been done during the 2005 to 2020 Iger regime. That era was about buying IP that reflected the creative wells at DIS diminished or gone dry. Why not? Earnings were robust, revenues swelling, Wall Street singing its praises. There was an edge of arrogance that sometimes invades corporate success.

So in the end DIS’s remedies were too little too late in IMHO.

In point of fact, it is time for Dinosaur Disney (and many of its competitors) to trim down in order to really grow free of trying to build on existing segments:

I’m not trying to play wannabe investment banker–it’s way above my pay scale. The industry’s 600-pound gorillas are demanding Disney’s attention. Without them, DIS’s core business of children’s entertainment will remain the global leader, making tons of money.

Spin off these segments makes some sense to me. Traded separately, a truer value could emerge without the baggage of other segments underperforming.

Parks & Experiences: Revenue now $32.6b, contributing 30% of corporate total and 70% of income. A napkin valuation with a banker friend brings an estimated $55b.

ESPN: Spin off as a pure sports play. Overall subs and viewership sliding for years, rights costs skyrocketing, bet on sports betting years away from paying off but alone has enough audience to make sense as a pure play on sports. Estimated value: $24b

Add some linear TV parts and DIS might well end up banking $100b in cash, or less if they wish to retain minority positions.

By this strategy, DIS could immediately pay down at least 60% of its current LTD, saving well over a billion in interest at its 4.5% averaged rate. That would still leave a bundle for IP development.

Conclusion

Recognition that a jungle landscape of over hungry creatures too big to provide a strong buy story for the shares in a rapidly going extinct business model is still missing in many of the remedial medicines applied by DIS management. Treading water is a strategy for sure. But steering a company with fresh ideas and bold moves to disassemble a broken business model too big to endure the crises ahead seems a lot better for investors with eyes on a bigger prize in the potential of a far away leader in children’s entertainment. And that is the key to open eyes. DIS at its best, at its core, is a children’s/family entertainment giant. No company comes close to its share in the segment.

Small facts that reveal big truths:

Why did it take so long for ESPN to dive head first into sports setting since the 2018 court decision? They faced what they saw besides competition, the conflict of DIS customers and holders who had problems with the family entertainment heritage getting spoiled by the sin business of betting. So they settled for a fig leaf deal with refugee Barstool that is simply a branding $1.5b media buy over 10 years. ESPNBet continues to struggle out of the cradle.

Miscues like the Star Wars hotel debacle likewise expresses the development of a product scaled far too high for its fans. Plus, as few remember, the first Star Wars movie debuted in 1977. I stood in line with my little kids for hours to get a look at the very first showing. Those kids are now young men with little interest in the genre. This could–repeat could–apply across the board to the legacy IP DIS hopes will produce hits.

Some will, but overall, my own view of sequels is like the days when typewriters held sway. Secretaries rolled in a blank sheet to type the letter, then at bosses’ request, made 6 carbon copies rolled in behind the original typed document. A sheet of carbon paper was slipped between each while sheet. And when finished, if you examined the carbons, each successive copy grew little and lighter until the last copy was hardly readable.

No matter how much inventive plot twists given to sequels, it is clear that, with periodic exceptions, sequels have a hard time ever matching the originals in their grosses. Some do well, others are mega flops. So to assign a presumably solid performance EBITDA contribution from a slate of sequels to me is problematical.

Streaming progress for Disney+ is fine in subscription building, in offering content that still attracts families. But the real test comes as the glut of products hurled at consumers, priced to lure trial. But retention remains a risk longer term.

My sense is that DIS price action could really accelerate with moves that attract new investors. As earnings rise, operating margins improve, and debt shrinks, the stock becomes much more appealing-like a tempting meal compared to nibbling on leaves in Jurassic Park as the threat of extinction grows.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.