Summary:

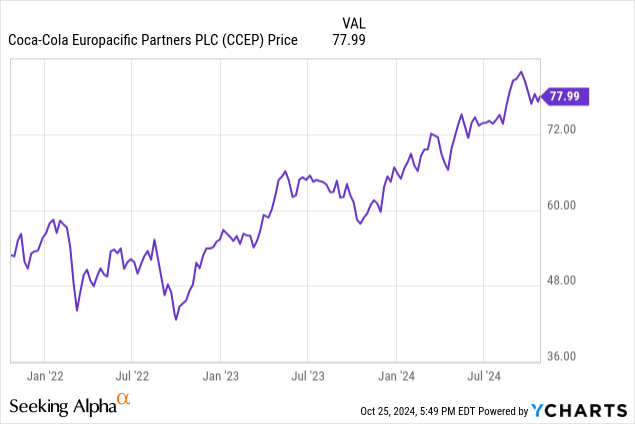

- Coca-Cola Europacific Partners has seen a 70% stock increase and 80% total return over two years, outperforming the S&P 500.

- The company expanded its footprint by acquiring Coca-Cola Amatil in 2021, adding Australia and New Zealand to its high GDP per capita regions.

- Despite increased costs, CCEP’s free cash flow remains strong, with a projected full-year EPS of $4.08 per share.

- At almost $80 per share, CCEP trades at 19 times net profit; writing out-of-the-money put options is a preferred strategy to initiate a position.

- The recent acquisition of The Philippines division will fuel further growth.

Marvin Samuel Tolentino Pineda/iStock Editorial via Getty Images

Introduction

The very last time I covered Coca-Cola Europacific Partners (NASDAQ:CCEP) here on Seeking Alpha was in October 2022 when the stock was trading at just $46.36 per share. At the current share price, the stock is up approximately 70% in those two years while the total return exceeds 80%, clearly outperforming the S&P 500 index. As it has been a while since I held my finger on the pulse, the two year “anniversary” since the previous article was published provides a good opportunity to have another look.

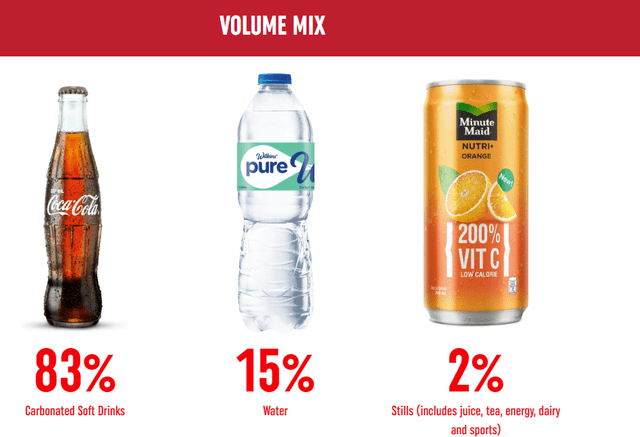

As mentioned in my previous articles, this company has the monopoly to produce, market and distribute Coca-Cola (NYSE:KO) products for several regions with a high GDP per capita (Western Europe, two of the three Scandinavian countries – except for Denmark – and Australia and New Zealand). While CCEP was originally solely focusing on European countries, the acquisition of Coca-Cola Amatil in 2021 has expanded its footprint which added the latter two countries and resulted in the name change to “Europacific.”

This article is meant as an update to previous coverage of CCEP, which you can find here. As the company reports its financial results in Euro, I will use the Euro as base currency throughout this article. The company also has a listing in Amsterdam where it is trading with CCEP as ticker symbol as well. The average daily volume in Amsterdam – which obviously means the stock is trading in Euro there – is just over 13,500 shares per day. So in this case the US listing is definitely the most liquid one and preferred trading venue.

The Q3 trading update should confirm 2024 will be a good year

While the company will only publish its Q3 trading update in November, the strong start of the year already provides a decent look under the hood as by the time the H1 results were published, management obviously already had a good idea of order volumes throughout the summer.

Although my original investment thesis was focusing on the company’s ability to generate a positive free cash flow, it always makes sense to first have a look at the income statement to see if there are any elements with a spillover effect into the cash flow statement.

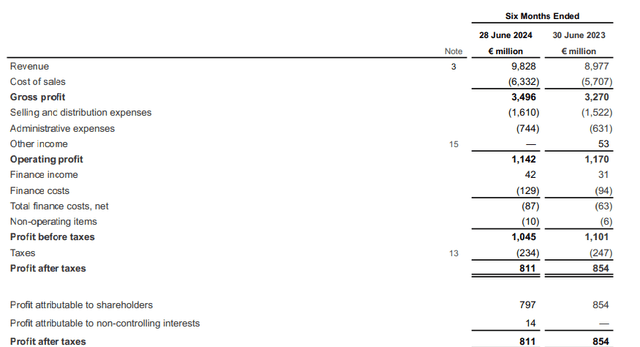

In the first half of this year, CCEP saw its revenue increase by almost 10% to 9.84B EUR while the COGS increased at a slightly faster pace resulting in a gross profit expansion to 3.5B EUR, which represents an increase of “just” 6.9%. As the other operating expenses also increased, the company’s operating profit decreased by just under 3% on a reported basis, but as you can see below, the comparable basis is a bit skewed due to the non-recurring 53M EUR “other income” generated by CCEP in the first half of last year. Excluding that non-recurring item, CCEP would only have generated 1.117B EUR in operating profit in H1 2023 and the H1 2024 operating income would have shown a 2% increase. Still not great given the revenue expansion, but certainly more than OK.

CCEP Investor Relations

The net finance expenses also increased (which isn’t really a surprise considering we’re exiting an era where the interest rates on the financial markets were absurdly low), resulting in a pre-tax profit of 1.045B EUR, a decrease of 56M EUR compared to the first half of last year. The net attributable income was 797M EUR for an EPS of 1.73 EUR per share. This represents approximately $1.90 per share.

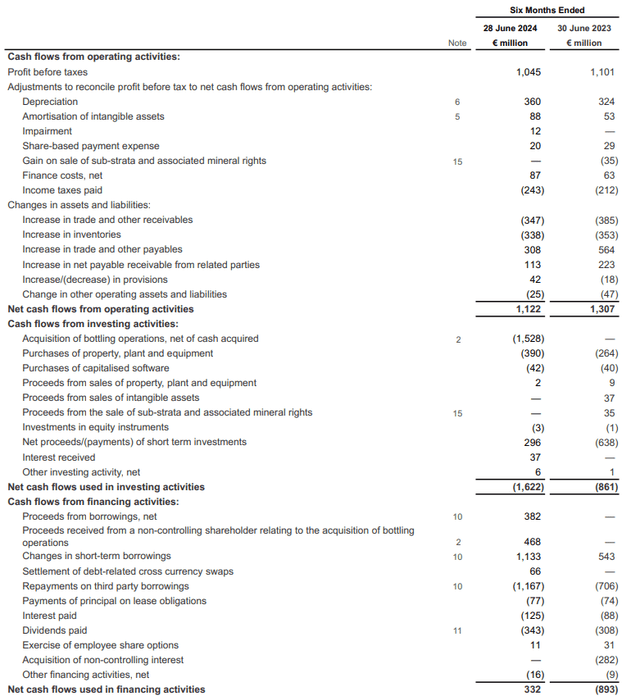

The total reported operating cash flow was 1.12B EUR, but this included an investment in the working capital position to the tune of 247M EUR. We should however also deduct the 125M EUR in interest payments and the 77M EUR in lease payments. The company also received 37M EUR in interest income. This means the total adjusted operating cash flow was approximately 1.2B EUR.

CCEP Investor Relations

The capex was 432M EUR excluding M&A, resulting in an underlying free cash flow of 770M EUR. As you can see above, CCEP also forked over a net cash payment of 1.53B EUR to acquire the right to bottle Coca-Cola products in The Philippines. The acquisition results in adding an additional 19 manufacturing plants as well as adding 1 million customers to its order book. The acquisition will see CCEP partner up with Aboitiz Equity Ventures in a 60/40 joint venture which means CCEP is consolidating its ownership in the Philippines division with an allocation to non-controlling interests, which explains why the H1 income statement shows a 14M EUR net profit allocation to non-controlling interests.

CCEP Investor Relations

The completion of the acquisition of the bottling plants in The Philippines means CCEP was in a good position to reconfirm its guidance for this year. It still expects an operating profit increase of around 7% compared to FY 2023. This implies an operating profit growth to 2.5B EUR and assuming a net finance expense of around 160M EUR this year, the full-year pre-tax income should come in around 2.34B EUR.

CCEP is guiding for an effective tax rate of around 25%, which would result in a net profit of 1.76B EUR, of which I estimate 1.72B EUR will be attributable to the shareholders of Coca-Cola Europacific Partners. Based on the current share count of approximately 460M shares outstanding, this implies a full-year EPS of 3.74 EUR per share, or approximately $4.08 per share.

Investment thesis

At the current share price of almost $80, Coca-Cola Europacific Partners is trading at almost 20 times its net profit for this year, which is pretty high. Of course the management deserves the credit for building out a real Coca-Cola bottling empire and it continues to expand its geographical exposure while the demand for its product offerings won’t decrease. Looking at the consensus estimates for FY 2026, the anticipated EPS is 4.83 EUR which works out to approximately $5.25 per share. Would I be willing to pay 15 times earnings for a robust profit machine like CCEP? Yes, I think so. CCEP isn’t a “strong buy” but I think it could justify a “buy” rating.

I currently have no position but in cases like this. When there’s no real urgency in buying the stock, I would be looking at writing some out of the money put options. On the US exchange, a P70 for May could be written for around $2.25 per contract, which would reduce the effective purchase price to $67.75 representing just 13 times the subsequent year’s consensus EPS.

I haven’t made a decision yet, but I think writing put options would be my preferred way to initiate a long position.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may write out of the money put options on CCEP in the near future.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!