Summary:

- Transocean’s recent stability in fundamentals contrasts with its volatile share price, justifying a ‘hold’ rating despite a 24.9% drop since July.

- Revenue increased by 18.1% year-over-year, driven by higher daily revenue, improved rig utilization, and newbuild floaters, despite some negative impacts.

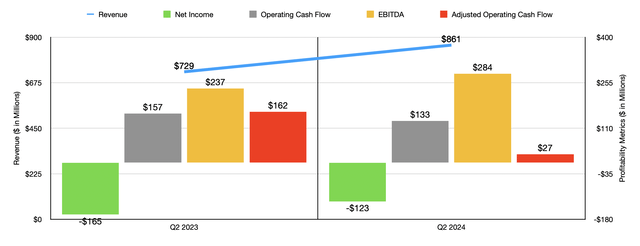

- The company’s net loss improved from $165 million to $123 million, with EBITDA rising from $237 million to $284 million, indicating better profitability metrics.

- Despite positive trends, concerns about declining backlog and high debt levels persist, making a ‘hold’ rating more appropriate until further financial results are released.

MarkusBeck

In the short run, individual stocks can be incredibly volatile. But as a value investor, I believe wholeheartedly that they ultimately find their fair value. Of course, the picture can always change, sometimes for the better and other times for the worse. But assuming things don’t get worse, you can still experience a great deal of fluctuation from a share price perspective. A good example of this can be seen by looking at Transocean (NYSE:RIG), a company that’s famous for owning and contracting out offshore drilling rigs. For several years, the company experienced troubles, driven by industry weakness that was caused by volatile oil prices. And while the oil and gas markets are going to continue to see volatility of their own, recent results have indicated that Transocean is finally showing some solid stability.

Even though fundamental stability has been building, the firm’s share price remains volatile. Back in July of this year, I reaffirmed the company as a ‘hold’ candidate, even going so far as to state that ‘things are looking up’. But since then, the stock is down 24.9% while the S&P 500 is up 4.3%. Whenever I rate a company a ‘hold’, I’m making the statement that shares are likely to perform more or less along the lines of the broader market. So clearly, I have been off a bit in this case. However, after looking at the most recent data provided by management, I do believe that the firm remains on the right track and that shareholders stand to benefit down the road.

This doesn’t mean that we won’t see some volatility in the near term. However, estimates provided by analysts for the third quarter of the 2024 fiscal year that management will be reporting on after the market closes on October 30th is definitely promising. They expect revenue, earnings per share, and net profits, all to improve year over year. When you factor that into how the stock is priced and you look at recent performance, I believe that maintaining a ‘hold’ rating is a sensible approach at this point in time.

The situation is improving

When I last wrote about Transocean earlier this year, investors had data covering through the first quarter of the 2024 fiscal year. Fortunately, we now have results covering through the first half of the year. During this window of time, things have been going quite well. And a decent part of the improvement can be attributed to how the business performed during the second quarter. During that time, revenue for the company totaled $861 million. That’s an increase of 18.1% over the $729 million reported one year earlier.

Based on the data that management provided, this increase in sales was driven by a few different factors. For starters, the company benefited to the tune of $65 million from higher average daily revenue. Another $40 million of the increase came from growing rig utilization rates. The company benefited to the tune of $35 million its newbuild ultra-deepwater floaters, the Deepwater Titan and the Deepwater Aquila. Plus, it also benefited in the amount of $20 million from one of its harsh environment floaters, in addition to another $20 million stemming from decreased amortization of contract intangible assets. The company did experience some weakness. Early termination fees hit sales negatively by $20 million. This is because that was the amount of the fees that were added to revenue in the second quarter of 2023 but were not repeated this year. Another $15 million came from the absence of revenue associated with the sale of one of its harsh environment floaters. And $15 million came from a change in reimbursement revenues.

The bottom line for the company has also been doing well. Even though the company generated a net loss of $123 million during the most recent quarter, that’s an improvement over the $165 million loss reported one year earlier. Unfortunately, there are a lot of one time items in here that impact results. For instance, year over year, the company reported a $90 million increase in losses on the impairment of assets. Interest expense plummeted, and the firm booked a $140 million gain on the retirement of debt in the second quarter of 2024. If we ignore the impairments, we would end up with and operating gain of $84 million in the most recent quarter. That compares to the $11 million gain reported the same time last year.

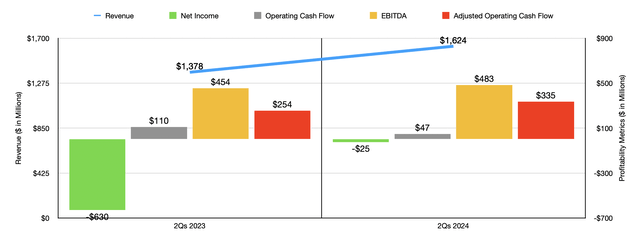

More appropriate profitability metrics should be cash flow figures. But even these have seen some volatility. Operating cash flow fell from $157 million last year to $133 million this year. If we adjust for changes in working capital, the difference is even greater, with the metric plunging from $162 million to $27 million. On the other hand, EBITDA for the company did improve, climbing from $237 million last year to $284 million this year. In the chart above, you can see financial performance for the first half of this year compared to the same time last year. This does show a great deal more stability, with adjusted operating cash flow and EBITDA both following revenue materially higher.

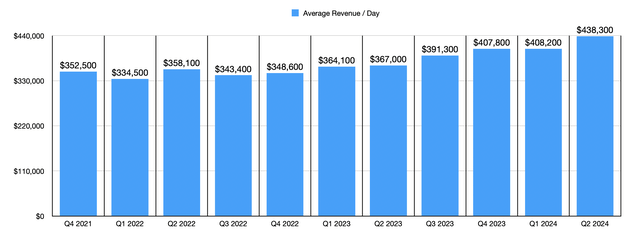

At this point in time, Transocean has some things going for it that investors should be happy about. In my prior article, I looked at the last several quarters worth of average revenue per day that the company was achieving. This was on a quarter-by-quarter basis beginning in the final quarter of 2021. In the chart above, you can see the most recent figures added to the mix. The $438,300 in average revenue per rig per day that the company generated in the most recent quarter is the highest that we have seen dating back through this window of time that we are looking at. And it is well above the $367,000 generated for the second quarter of 2023. This does seem to be an industry wide phenomenon. According to S&P Global, day rates in the spot market for both semisubmersibles and drill ships have reached recent highs, especially when it comes to the semisubmersible category.

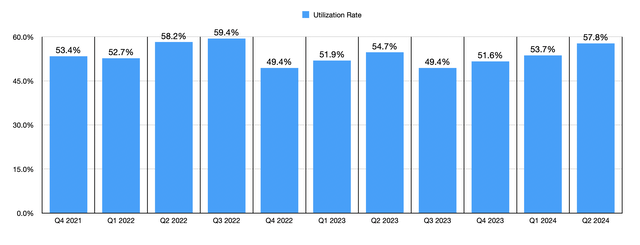

In addition to seeing average revenue per rig improve, Transocean has also seen an increase in its utilization rate. Although this is still lower than select windows of time in 2022, the 57.8% utilization rate that the company reported for the second quarter of this year was comfortably above the 54.7% that we saw the same time last year. It was also an improvement over the 53.7% the company experienced during the first quarter of 2021. This is not to say that everything is going great. The fact of the matter is that there are a couple of weak spots that investors should be paying attention to.

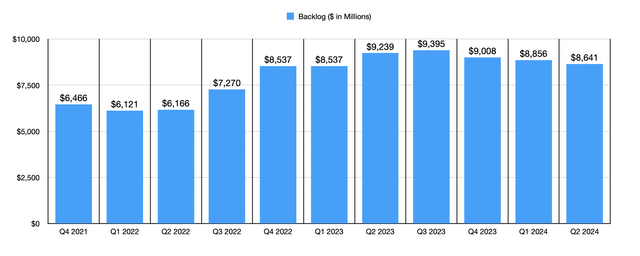

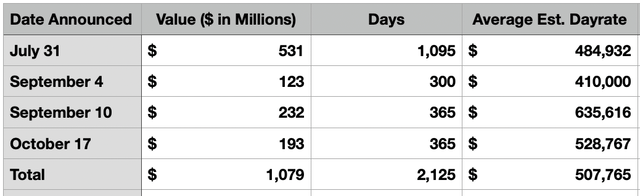

First and foremost, Transocean has experienced a startling and disturbing trend when it comes to backlog. After peaking at $9.40 billion in the third quarter of 2023, backlog has started to steadily decline. By the first quarter of this year, it had dropped to $8.86 billion. And by the end of the second quarter, it had declined further to $8.64 billion. This places it below the $9.24 billion the company reported the same time of 2023. Eventually, this will have an impact on revenue. But the good news is that we are starting to see some life on this front. Subsequent to the end of the second quarter, management struck four different deals for new contracts. Assuming none of the options are exercised by the companies that Transocean is catering to, the value of these contracts should be about $1.08 billion. And as you can tell in the table below, the average revenue per day for these contracts is quite high. But we won’t know until new data is provided during the company’s earnings release whether this will help to boost backlog or not. After all, every day the company generates revenue, backlog decreases if no new orders are coming in.

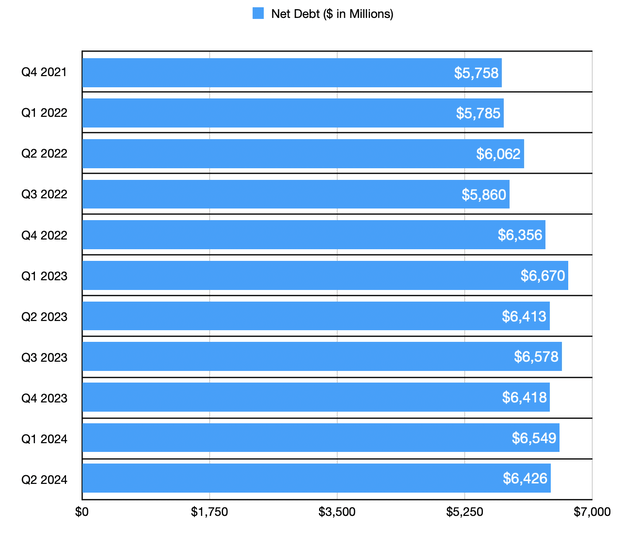

The other thing that we need to talk about that’s a weak spot is debt. Operators in this space are notorious for having meaningful amounts of debt. Using the most recent net debt figure provided by the company, I get a net leverage ratio for 2024 of 8.19. However, it is worth noting that overall net debt is down from what the company experienced during the first quarter of this year. At that time, the business had $6.55 billion worth of net debt. That number today is $6.43 billion.

There is some possibility that this picture is also improving compared to what the latest quarter showed. Subsequent to the end of the second quarter, management sold off its Deepwater Nautilus in a deal valued at $53 million. $3 million of that was already paid prior to the end of the second quarter. In addition to this, the company allocated $99 million to pay off its $91 million of senior guaranteed notes that come due in 2027. Although the business had to pay a premium for these, the effective interest rate is 11.50% per annum. This will save $10.5 million a year, which makes the $8 million premium paid for it well worth it.

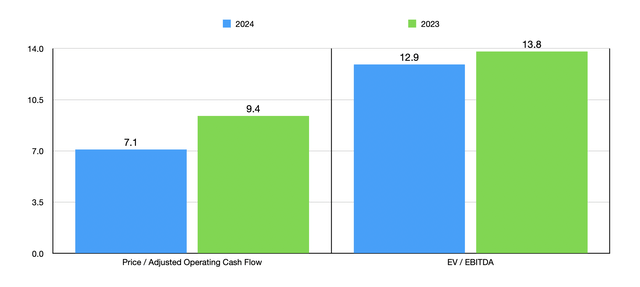

In terms of valuing the company, if we annualize the results we have seen so far for 2024, we would expect operating cash flow of $524 million and EBITDA of $785 million. In the chart above, you can see what this means for the valuation of the business. On a forward basis especially, shares don’t look bad. But I would also argue they don’t look great, especially on an EV to EBITDA basis. This is confirmed when we look at the table below, which compares Transocean to five similar businesses. On a price to operating cash flow basis, only two of the five firms ended up being cheaper than it is. However, our candidate is the most expensive of the group when using the EV to EBITDA approach.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Transocean | 7.1 | 12.9 |

| Seadrill Ltd (SDRL) | 7.7 | 3.1 |

| Patterson-UTI Energy (PTEN) | 2.5 | 3.3 |

| Noble Corporation (NE) | 7.2 | 5.8 |

| Helmerich & Payne (HP) | 4.7 | 4.2 |

| Valeris (VAL) | 20.4 | 10.6 |

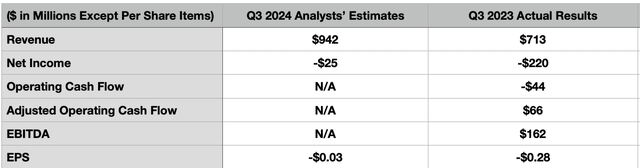

Because of the valuation and the weak spots that I mentioned already, I’m not ready to upgrade the stock just yet. However, the picture can always change. And it just so happens that the next opportunity for change to occur will be later this month when management announces financial results covering the third quarter of the 2024 fiscal year. In the table below, you can see what analysts are forecasting compared to what the company achieved the same time of 2023. Year over year, analysts expect revenue to climb from $713 million to $942 million. They also expect earnings per share to go from negative $0.28 to negative $0.03, which would take the firm’s net loss down from $220 million to roughly $25 million. The table also shows other profitability metrics as they were last year. I would venture to say that if revenue and profits are both rising, there’s a good chance these will also.

Takeaway

Based on the data provided, I do believe that Transocean remains a company that investors would be wise to continue to pay attention to. But I don’t necessarily believe that it’s a great candidate. The firm has some positive spots to it, but it also has some negative ones. Altogether, I would argue that this makes it a better ‘hold’ than it does anything else.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!