Summary:

- For Alphabet’s Q3 earnings results, Street consensus is expecting $1.84 in EPS on $86.3 billion in revenue and $26.44 billion in operating income, for expected y-o-y growth of 19%, 13% and 24% respectively.

- Unlike the EPS estimate revisions, which have remained stable since the April ’24 quarter, Google’s revenue estimate revisions have seen downward revisions of late, particularly the 2026 column, even though 2025 estimates remain fairly stable.

- Trading at $165 per share, Google is valued at 22x ’24 EPS for estimated EPS growth of 20% and 14% in 2024 and 2025. The stock is quite cheap on a PEG basis, even at today’s levels.

JHVEPhoto

Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) reports after the closing bell on Tuesday night, October 29th, 2024, and Street consensus is expecting $1.84 in EPS on $86.3 billion in revenue and $26.44 billion in operating income, for expected y-o-y growth of 19%, 13% and 24% respectively.

In Q2 ’24, revenue, operating income, and EPS grew 14%, 26% and 31% respectively, while GOOGL’s operating margin expanded from 29% to 32% in the summer quarter. Advertising, which was 76% of Google revenue in Q2 ’24, grew 11% in Q2 ’24, consistent with the last 4 quarters, while Google Cloud, just 11% of Google total revenue, grew 29% in Q2 ’24.

Google Cloud is Google’s fastest-growing segment, but it’s still considered third to Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure, and Google Cloud is just 4% of Google’s operating income as of Q2 ’24.

Full-year ’24 and ’25 revenue growth expectations remained unchanged after the second quarter and through this Q3 ’24 so far, with the sell-side expecting 20% and 14% EPS growth for full-year ’24 and ’25, while revenue growth expectations remain at 13% and 11% for ’24 and ’25 respectively.

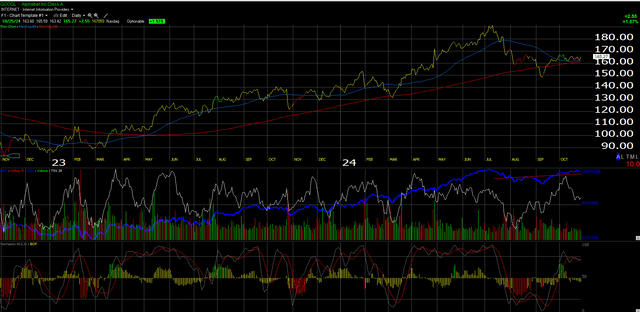

Since peaking in early July ’24 at $190-191 per share, GOOGL (the only share class clients own) has fallen to a low of $150’ish on DOJ (antitrust) litigation issues, but since that drop has rebounded back above its 50- and 200-day moving averages to close on Friday, 10’25/24 at $165 per share.

A number of technicians seem to like Google’s chart here:

As a fundamental analyst who has never taken a technical analyst course, I’ve always liked when the 50- and 200-day moving averages compress on a stock, and the stock remains above the key moving averages.

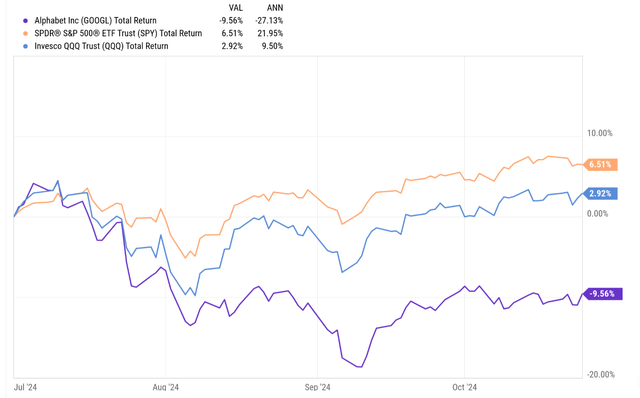

Like a lot of growth stocks the last three months, GOOGL has underperformed as a myriad of worries loom over growth stocks and the stock market in general, which has tempered expectations coming into Q3 ’24 earnings results.

Here’s a quick performance chart showing GOOGL’s performance versus the SPY and QQQ since July 1, ’24:

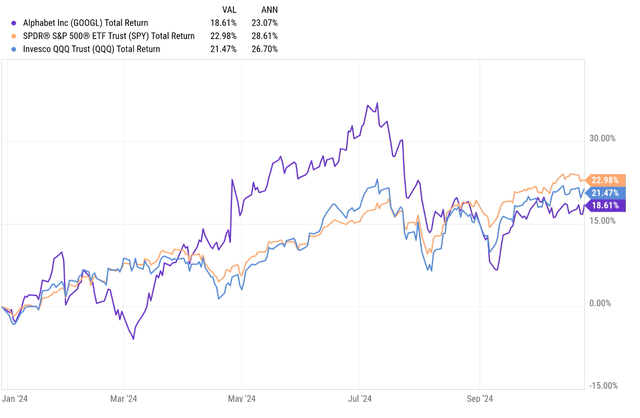

From January 1, ’24, here’s the trio’s YTD performance:

Google is trailing the SPY and the QQQs substantially since 7/1/24, or the start of the third quarter ’24, which has also pulled its YTD performance lower.

EPS and revenue estimate revisions

EPS revisions:

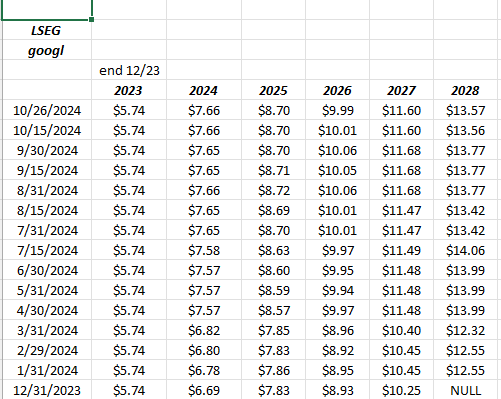

GOOGL’s EPS estimate revisions were revised sharply higher after the April ’24 earnings report (for calendar year ’24) and then not so much after the July ’24 report, possibly due to the company’s operating margin (see valuation below).

Revenue revisions:

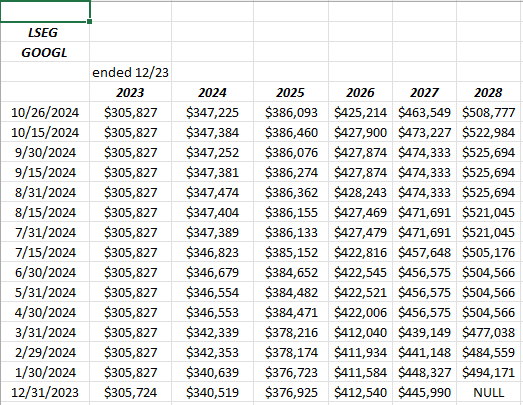

Unlike the EPS estimate revisions, which have remained stable since the April ’24 quarter, Google’s revenue estimate revisions have seen downward revisions of late, particularly the 2026 column, even though next calendar year – 2025 – estimates remain fairly stable.

Is this analyst “angst” thanks to the wet blanket thrown over mega-cap tech stocks, or is there some tangible reasons for the revisions?

Inquiring minds want to know.

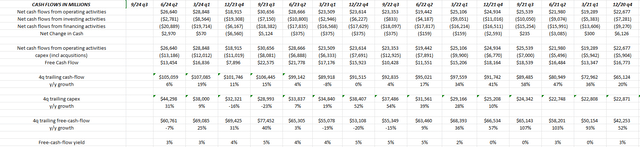

Examining Google’s cash flow statement

Here’s the issue: Google’s trailing-twelve month (TTM) capex grew 31% y-o-y in the July ’24 quarter, and as the above spreadsheet shows (that’s a cut-and-paste of an internal Google valuation spreadsheet), TTM free cash flow has basically stagnated the last 10-12 quarters, although the search giant remains a significant free cash flow generator.

Free cash flow is a significant input to discounted cash flow valuation (DCF) models, so if the significant capex requirements for AI strains free cash flow projections (or actually lowers forward expected free-cash-flow projections), then DCF models will subsequently lower Google’s forward valuation as a result.

Here’s an article written in May ’24 on this blog about mega-cap tech stock valuations and AI’s capex strain. (It’s wonky stuff: capex runs through the cash flow statement, and not the income statement or PL, and thus isn’t expensed, so earnings growth can look great but the stock goes nowhere on the capex drag.)

Valuation

Trading at $165 per share, Google is valued at 22x ’24 EPS for estimated EPS growth of 20% and 14% in 2024 and 2025. Looking at the “average of 2024-2027”, Google is expected to average 16% EPS growth over the next 3.5 years, while the “average P/E” on the forward estimates is 18x. (Revenue growth – given current forward estimates – is expected to “average” 11% over the next 3.5 years).

The stock is quite cheap on a PEG (P/E-to-expected growth) basis, even at today’s levels.

Other valuation metrics don’t look nearly as attractive (which is usually the case for growth stocks), as price to TTM sales is 6.25x and price-to-TTM cash flow and free cash flow (ex cash) are 19x and 32x respectively.

Ruth Porat, Google’s CEO, and the Board are buying back a lot of Google stock with their free cash flow, averaging $15-16 billion in share repurchases per quarter the last 9 quarters, which has represented 3-5% of Google’s market on a TTM basis over the last 9-10 quarters.

I’ve always felt Morningstar’s “moat analysis” was good research, since they will give subscribers their 3-5 year projections for a company’s revenue growth, operating income growth, gross and operating margins, etc.

This blog’s earnings-based model values Google closer to $190-200, while Morningstar assigns a valuation of $182 on the stock, but the assumptions, particularly the peak operating margin assumption for Google, is in the low-30% range (which is where it hit in Q2 ’24 at 32%).

Morningstar was looking for a 31-32% operating margin by 2029, and Google has beaten that already by 5 years. Is this now “peak margin” for Google or is more margin expansion to come?

Summary / conclusion

While the stock is cheap on a P/E-to-expected growth basis, ultimately, Google’s quarter is going to be about advertising and search, and over the longer term I do worry that AI is another step above search and worry that AI disrupts Google and the search engine.

While lunching with an analyst from a large bank that was on the bank’s “growth team”, I mentioned to the analyst that I struggle with AI’s “implications” and what it might mean for the corporate world in general, and so I asked the analyst straight up, “If I’m describing AI to a client and what it might look like in 5 years, how would you summarize that for me?” – and the response was “smarter search”.

You’d have to think that, ultimately, that’s a direct threat to Google.

Google Cloud is growing revenue smartly but it’s still a smaller part of Google’s operating income at 4% (see the top part of this blog post and the review of Q2 ’24 earnings).

Expectations are more subdued too coming into Google’s earnings and mega-cap stocks in general, and as we saw with Netflix (NFLX) and Tesla’s (TSLA) earnings, that’s never a bad thing. Google is still a Top 10 client holding.

None of this is advice or a recommendation, but this blog post is only my opinion. Past performance is no guarantee of future results. Investing can, and does, involve the loss of principal even for short periods of time. This blog may or may not be updated on individual topics, and if updated, may not be done in a time fashion. Readers should gauge their own comfort with portfolio volatility and adjust accordingly.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.