McDonald’s: E. Coli Is Not A Nothingburger, But There Is More To This Correction

Summary:

- McDonald’s remains a long-term Hold despite recent E. coli concerns, with its stock down 8% in a week but still up 20% from early summer levels.

- Historical parallels with Chipotle suggest potential short-term challenges, but McDonald’s geographically diversified market presence mitigates similarly extreme downturns.

- Yet, current high valuation metrics justify a correction regardless of the E. coli outbreak.

- McDonald’s franchise model and valuable real estate holdings provide strong financial resilience, though short-term caution is advised until the full extent of the bacteria outbreak is more tangible.

tofumax

McDonald’s (NYSE:MCD) has been an anchor investment in my portfolio for about 5 years, currently holding over 5% weighting and having delivered an average annualized total return of more than 10%. Nevertheless, this company is not a mindless Buy at any time, given that growth is harder to come by. Recent noise around the E. coli outbreak has once again drawn attention to the “Check” in a “Buy & Hold & Check” strategy.

First, talk of McDonald’s shares having “crashed” amid these headlines is largely exaggerated. Although the shares trading almost 8% lower than a week earlier is notable, one must view it in the context of the last three months’ performance, which has been around 30%, with about a 20% gain still holding at $293, compared to under $250 in early summer. Back then, I took the opportunity to expand my position, and I would likely do so again if shares fell back to or below $250. This scenario is not unrealistic and is not solely attributable to the E. coli situation, which is why McDonald’s, while a personal anchor investment, is not a Buy for me now and only deserves a Hold rating for the long term, with a short- to medium-term negative inclination.

Please also understand that stock analyses and discussions are never intended to downplay or minimize the potentially serious health consequences of incidents like the recent E. coli outbreak, and that compassion for those affected, especially those who have lost their lives, is always a given. I am likely speaking for all analysts when I say that we all expect and sincerely wish for companies to prioritize the safety and health of consumers, not only in our own financial interests.

History Does Not Repeat Itself, But It Might Rhyme

Let us take a look at what happened to Chipotle Mexican Grill (CMG) when an E. coli outbreak was traced back to their food in 2015. On the surface – specifically in the stock price – the impact was sobering. In the immediate aftermath, over roughly three months from early October 2015 to early 2016, the stock plunged by 46%. A final low was only reached two years later, in early 2018. Overall, it took more than three years for Chipotle’s stock price to return to its pre – E. coli level – with emphasis on returned. Because ultimately, as we know today, this incident was not the end for Chipotle. The stock now trades at four times its pre – E. coli level.

Drawing parallels here, the medium-term pessimist may see further challenges ahead for McDonald’s shareholders, while the long-term optimist sees little reason for concern and perhaps even spots buying opportunities coming towards us. Both perspectives appear justified.

Chipotle stock price (dividendstocks.cash)

To a large extent, the degree of potential downside depends not only on actual fundamental developments within the company but also on the valuation level. In Chipotle’s case, an adjusted P/E ratio of 50 at that time of the E. coli outbreak represented a clearly above-average valuation over a five-year historical comparison period, with the average having stood at 39. That represented an almost 30% premium versus five-year-averages.

Chipotle adj. P/E multiples before and surrounding E. coli outbreak in 2015 (dividendstocks.cash)

Or, looking at the example of the price/cash flow multiple, we see that Chipotle had a P/C multiple of 34 before the E. coli outbreak, whereas McDonald’s stands at 22 today. However, this should perhaps not lead to a false sense of security, as McDonald’s multiples may also be elevated compared to its own historical averages. As we will later see, this is indeed the case, though not nearly to the extent seen with Chipotle, then or now.

Chipotle & McDonald’s P/C multiples in 2015 and today (dividendstocks.cash)

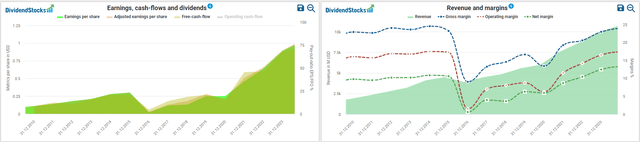

Looking at Chipotle’s fundamentals following the E. coli incident is once again sobering, with revenues having slipped by double digits, margins having eroded, and years needed to return to prior earnings levels. This is depicted below. However, with McDonald’s being less reliant on a single regional market, I consider the risk of similar significant losses due to the incident to be rather low, even though headlines are spreading worldwide. Communication about regional suppliers allegedly having been identified poses less of a risk for a worldwide loss of trust.

Chipotle fundamentals (dividendstocks.cash)

To sum up this section, historical parallels suggest that further drawdowns would not be surprising, although the extent should be significantly less extreme for McDonald’s. It is worth taking a closer look at McDonald’s valuation in the next step.

Ambitious Valuation Adds Pressure

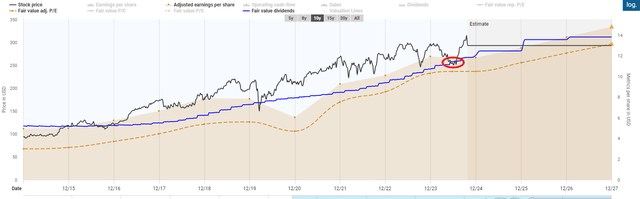

As stated in the introduction, together with the team from a monthly stock market column, we identified McDonald’s as a Buy in June at around $250, which led me to make a purchase as well. This Buy rating was based on considerations that took into account the high global exposure, with country risk premia factored in as value-diminishing, and, following the classic CAPM model, a company-specific beta. Additionally, McDonald’s growth expectations were included.

Today, as then, I conclude that McDonald’s should be trading at an EPS multiple of around 20, or potentially even below, aligning with its 20-year average. In recent years, however, McDonald’s has consistently enjoyed a premium on this valuation. The orange dashed line indicates the fair value based on a 20x EPS multiple which I set manually, while the blue line shows the unadjusted 10-year market valuation average based on the typical 2.5% dividend yield within that timeframe. The stock price trades significantly above both levels, E. coli or not. McDonald’s valuation metrics alone indicate an overextended price that would justify a correction regardless of the current bacteria outbreak.

McDonald’s stock price and fair value lines as described in the text. Personal Buy territory highlighted in red. (dividendstocks.cash)

Do We Need To Quantify E. coli Risk Separately?

I argue that no, we do not. Just because it has now actually occurred does not change the fact that it was a company, and industry-specific, risk that already existed beforehand and will continue to exist looking forward. It is precisely risks of this nature that are factored into the discount rate or the multiple as its inverse. The same risk also affects every other representative of the industry equally, and E. coli thus does not dethrone McDonald’s as my best-in-class representative for the long term.

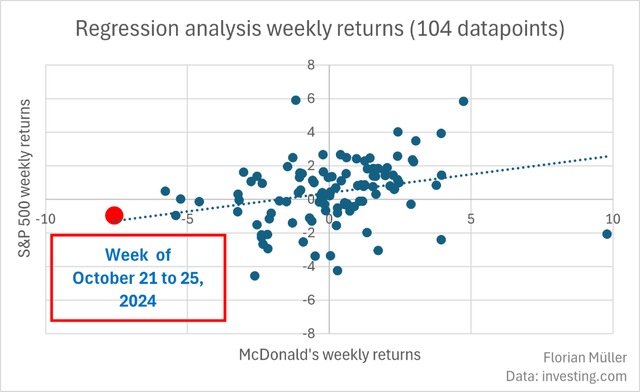

If this risk was already factored into the company-specific part of the risk assessment, i.e., the beta factor, did the event then actually have any more immediate statistical impact on it? In the short term: no, not yet. Certainly, this past week was an extreme, with McDonald’s stock down almost 8% compared to a 1% decline in the S&P 500. This is illustrated in red below, along with additional weekly data points from the past two years in blue. During this period, McDonald’s has maintained a beta factor of around 0.4, almost unchanged from the same rolling timeframe just one week earlier. Thus, any effect on McDonald’s valuation is not yet statistically measurable and will need to be monitored in the coming weeks.

Author | Data: investing.com

McDonald’s Remains Best In Class

At least for the long term. In the short term, however, keep in mind that a high valuation combined with current E. coli developments could be potentially toxic. In this chapter, I want to briefly summarize aspects that I consider worth mentioning, but that were not the focus of this article.

- Investigations surrounding the E. coli outbreak are ongoing, and the suspected cause – slivered onions – along with the Quarter Pounder burger itself, has been temporarily removed from the menu. Supplier Taylor Farms is recalling products. It may take several weeks before the full extent of the outbreak becomes evident.

- Business Model: Only about 5% of McDonald’s restaurants are fully operated by the corporation, while the remaining 95% are run by franchisees under various models. More than half of these franchisees also pay rent to McDonald’s, as the company owns a large portion of its properties. Therefore, historical revenue development alone has not been a fully meaningful indicator for McDonald’s, as the shift to a lower-risk, less capital-intensive, and more profitable franchise model means that not all restaurant revenue flows directly through the corporation anymore. However, this shift has significantly increased operating margins from 30% to over 45% over the years due to the lower operating costs associated with franchise and rental income.

- Balance Sheet: McDonald’s high stock buybacks have led to a substantial treasury stock position, resulting in negative equity on the balance sheet. However, the company’s real estate holdings, often in prime locations, are generally considered far more valuable than their book value, indicating substantial hidden reserves. This also offsets the apparent debt load.

- Upcoming Event: The next quarterly earnings report is expected before the opening bell on Tuesday, October 29, 2024.

__________

If you found my analysis useful, feel free to check out similar articles of mine, such as:

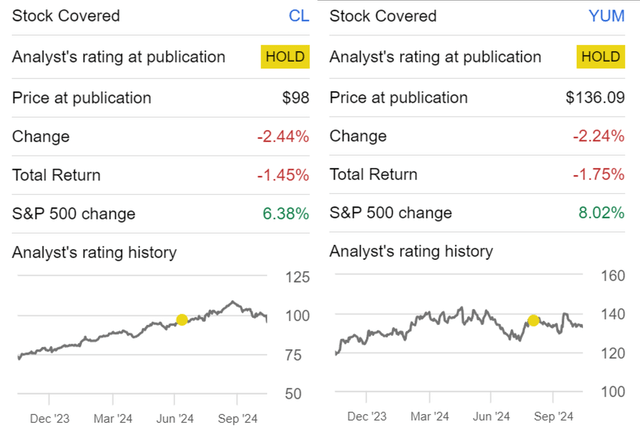

- My June analysis of Colgate Palmolive, also one of my “favorite” stocks for the long term but, at the time of publication, not at fair levels to expand the position. The conclusion proved correct to date, with approximately 8-9% underperformance since then.

- Or my August analysis of fast-food conglomerate Yum Brands, where I gave a negatively inclined Hold rating for the short term, which proved accurate with around 10% underperformance.

Review CL and YUM coverage (Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.