Summary:

- Tesla, Inc.’s Q3 2024 report and Robotaxi event provided enough insights and details to allow proper valuation of the segment.

- Most business segments are revised up in my intrinsic valuation, both in terms of growth and profitability.

- The energy segment shows exponential growth both in terms of sales and gross margins. This should be a core driver moving forward.

- Tesla trades at fair intrinsic value without valuing the robotics segment. This provides optionality where investors get robotics for free, whatever it may output in the future.

Kevin Winter/Getty Images Entertainment

My approach to Tesla, Inc. (NASDAQ:TSLA) has been laid out in two previous articles on Seeking Alpha (article 1, article 2). It revolves around paying for the tangible core business segments and receiving the potential segments for free. When I value the business, I only value the segments that exist today or that have a clear roadmap and that contribute to the core drivers of the business. Segments like Robotaxi and robotics were previously excluded due to the lack of information regarding output and timelines.

However, as of the Q3 2024 report, we now have a lot more tangible details regarding Robotaxi and I can now incorporate that segment into my valuation. With some new details regarding the business, Tesla is now undervalued and a buy again, despite the recent surge in the stock price.

I will break down each segment of my sum-of-the-parts valuation model and walk you through the input changes from my previous two articles, which were more detailed per segment. I recommend reading either one, or both, of my previous articles for more details regarding each segment, as I think articles will start to become very bloated if I reiterate each detail over and over. Instead, the focus is on identifying hints that help us project future drivers for the business as well as looking for a positive outlook for the shorter term.

Automotive

With the recent Robotaxi event, we gained some details about the production and price point of Cybercab. In addition, during the Q3 earnings call, CEO Elon Musk mentioned the following:

I do feel confident of Cybercab reaching volume production in ’26. So just starting production, reaching volume production in ’26. And that’s — that should be substantial. And we’re aiming for at least 2 million units a year of Cybercab. That’ll be in more than one factory, but I think it’s at least 2 million units a year, maybe 4 million ultimately.

The details are a bit up for interpretation, but my takeaway is that Elon Musk projects roughly 2 million vehicles per year as of 2026, scaling up to 4 million vehicles. If we take the price point into consideration, which was said to be ~$30,000, that results in a net addition of ~$60 billion per year in automotive revenue by 2026 from Cybercab alone. There are some problems with the statement, though, as Tesla does not have the capacity for that output as of the time of writing.

Emir Mulahalilovic, Tesla SEC Filings

With their current capacity, they would have to sack current models to reach that, which would impact revenues negatively as the automotive segment is doing ~$75 billion on a trailing 12-month basis currently. What is more likely is that capacity will increase, and we will likely see new factories being built out to support the projected output. We will keep this in mind as we will have to project higher capital expenditures in the reinvestment portion of our valuation model later.

The sensible approach, in my opinion, is to account for a slight increase in market share as of 2026 and onwards, to accommodate the launch of Cybercabs, and also increase the operating margins of these vehicles. In my opinion, it is likely that the Cybercab platform will be easier and cheaper to manufacture than current lineups, driving higher margins.

The assumptions are also supported by this comment from the Q3 earnings call, also made by CEO Elon Musk:

I do want to give some rough estimate, which is I think it’s 20% to 30% vehicle growth next year […]

I think with our lower-cost vehicles with the advent of autonomy something like a 20% to 30% growth next year is my best guess.

Here are my updated projections for the automotive segment, reflecting a slight increase in market share as well as a margin improvement.

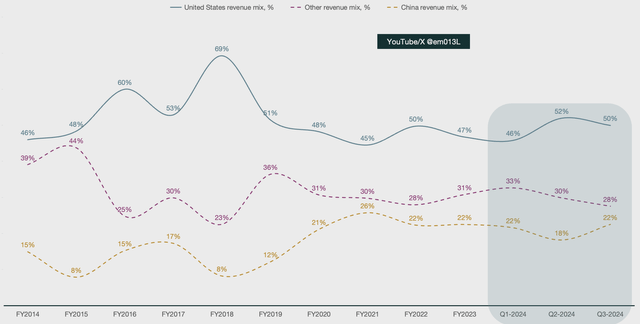

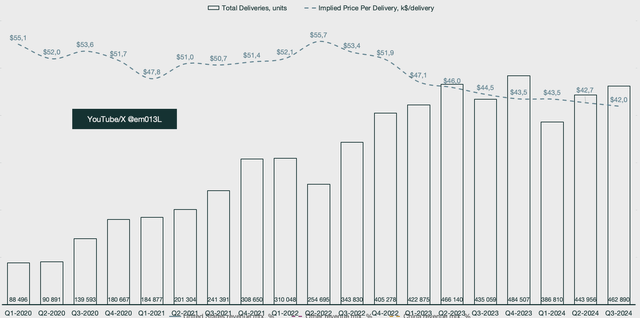

In the shorter term, investors were given plenty of positive catalysts, which likely contributed to the market rewarding Tesla with a +22% share price increase on the day following the Q3 earnings. First, deliveries were up year-over-year (YoY) for the first time in 2024, and it came with a 137 basis points gross margin improvement YoY, which at 19.6% is the best recorded gross profit margin since Q1 of 2023 (20.5%). This comes as the Chinese market picks up and accelerates again, breaking a potential downtrend that had investors worried.

Emir Mulahalilovic, Tesla SEC Filings

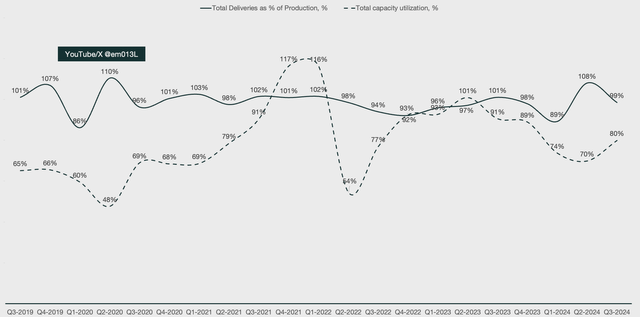

Another positive note is that capacity utilization increased by 10% quarter-over-quarter (QoQ), breaking another negative downtrend while still delivering ~100% of production output. This means that every car being produced is also sold, not taking inventory into consideration. The reason we sometimes see periods with more than 100% deliveries as a percentage of production is when inventory is clearing out in addition to new production.

Emir Mulahalilovic, Tesla SEC Filings

Energy

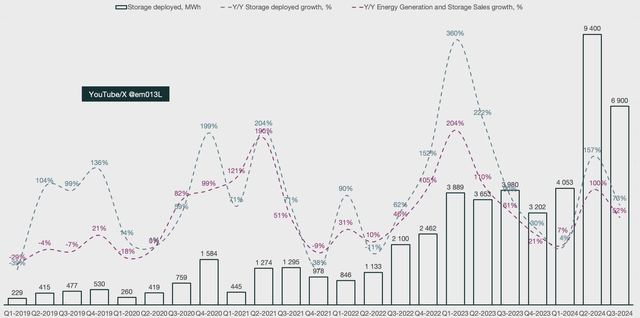

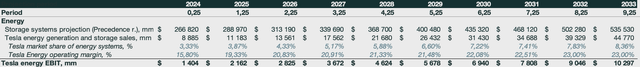

Compared to my first article, the energy segment has been cut down to only account for the energy generation and storage part of Tesla since we no longer get information regarding the solar business since Q4 of 2023. We are currently witnessing a massive expansion of this segment by Tesla, both in storage deployment and recorded sales. Q3 of 2024 proves that the prior quarter of 157% YoY growth in deployment was not a mere anomaly but a new exponential growth curve forming. While Q3 was not quite as impressive, Tesla still grew the quarter 73% YoY against a much more difficult comparison period compared to Q2.

Emir Mulahalilovic, Tesla SEC Filings

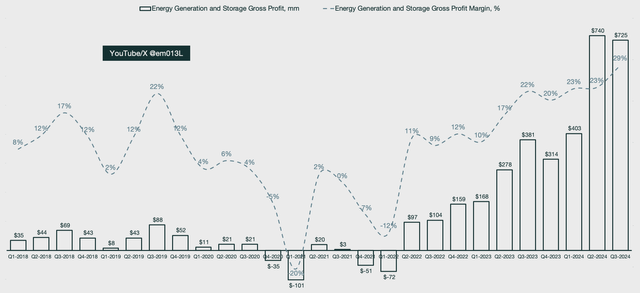

While Q3 recorded ~$600 million less revenue compared to Q2, the difference in gross profit was only $15 million. Tesla is becoming increasingly profitable in this segment, which has led me to increase my profitability projections for the segment as well as drive slightly stronger revenues into the future as it is proving to be a core segment.

Emir Mulahalilovic, Tesla SEC Filings

I have left the ending period’s operating margin the same and only ramped up how quickly they get there, as I still can’t tell a story in my valuation where Tesla exceeds 23% operating margins for the segment. As for an increase in revenues, I only adjusted 2024 and 2025 to reflect the accelerated pace, but ultimately, the periods onwards are left in accordance with my previous projections. I already accounted for energy being a large driver, and I only really got hints of an accelerated route to reach the end goal, but not enough to change the goalpost. Elon notes the following during the earnings call, supporting the current outlook:

So, let’s see. And we also have the energy storage business is growing like wildfire, with strong demand for both Megapack and Powerwall.

Emir Mulahalilovic, Tesla SEC Filings

Services excluding Robotaxi and Robotics

I have divided the services segment into multiple parts, historically excluding robotaxi and robotics as these are separate segments in my valuation sum-of-the-parts model. Instead, services mainly consist of automotive servicing as well as full self-driving (FSD). Tesla gives us very little information to work with for this segment; therefore, I have to make many assumptions. For the automotive servicing segment, I have based the margin profile to be in line with industry standards more or less. There is an increase towards the latter periods to account for Tesla’s efficiency and growth in miscellaneous line items attributed to servicing, such as spare parts manufacturing. The revenue reflects a percentage of automotive sales, partly in line with historical averages, but also accounting for an increase in efficiencies. There are no changes to this segment compared to previous articles.

However, the FSD segment has received some assumption changes to reflect the recent Robotaxi event. This is mainly represented in an increase in the adoption rate, ramping up a bit faster after the launch of the Cybercab in 2026. Unfortunately, Tesla does not disclose adoption rates for FSD, and there are various reports citing anything from a 5% adoption rate to something like 20% at the time of writing. I have a more modest approach, believing the FSD adoption rate is in the single digits right now, and after more widespread regulatory approval of the technology, I believe it will reach up to ~40% by 2033. If we are to believe CEO Elon Musk, it should be significantly higher, as the future is said to be fully autonomous by the CEO. However, I believe my current projections reflect the reality provided by the information we have available today.

The way I calculate FSD revenue is to assume a 5-year life length per vehicle. I then get an estimated vehicle sales figure by dividing the current average sales price by the projected future revenue. The reason I don’t try to adjust the median cost per vehicle in my model is because there are too many variables affecting future median sales prices for the Tesla fleet. For one, we have no idea what the fleet is composed of 10 years out, what they’ll be selling for, what the inflation rates will look like, and so forth. I take the simple approach of adjusting the model to use the latest available median cost per vehicle, which is calculated by dividing automotive revenues by automotive deliveries not subject to operating leases.

Emir Mulahalilovic, Tesla SEC Filings

The reason this calculation is important is that it impacts the FSD revenue because I calculate FSD revenue by multiplying the assumed FSD annual cost (subscription) by the trailing twelve months of vehicles on FSD, calculated by using the adoption rate. This method may inflate the vehicles sold per period, but by having a conservative approach to the adoption rate, it normalizes the figure.

Robotaxi

In my two previous articles, I excluded the Robotaxi segment from the base model because it was not much more than speculation as a result of a few hints by Tesla. Now the segment is a lot more tangible, with specific timelines and figures given to support it. As such, I have decided not to include it as part of optionality any longer, but instead incorporate it into my main model. However, it is still modeled to leave a lot of margin of safety. This means that I am actively valuing the segment, and I am paying for it. Before, whatever Robotaxi results would have been, they would have been given to me “for free” as long as I purchased shares below intrinsic value.

This segment does not include actual sales of Cybercabs; instead, it focuses on the service, meaning the software and application. The way I approach Robotaxi revenue is to look at the ride-hailing market projections and assume a market share of this. Operating margins are significantly higher than companies like Uber Technologies, Inc. (UBER) since the operations will exclude plenty of expenses that UBER has to incur. For one, the main expense associated with Robotaxis will be FSD as well as the actual vehicle production costs, none of which are included in this segment.

I don’t think the solution will have wide regulatory approval any time in this decade, and as such, the market share I assign Tesla is relatively low. The ride-hailing market is not particularly crowded; there are only a few main businesses operating within it. However, once regulatory approval is more widely spread, Tesla will have a quick scaling mechanism, as not only Cybercabs will be eligible for the service but also all Teslas. Elon Musk mentions that there won’t really be a need for parking spaces anymore, as a Robotaxi fleet can operate around the clock.

Tesla owners can connect their vehicles to the network and make money whenever they don’t make use of their vehicles themselves. It’s an interesting concept and one that may be a highly lucrative business in and of itself, but it is still too early to put too much faith into overly bullish projections for the segment. It starts off in 2026 with a ~0.21% market share and tops off at ~14% in 2033. These figures will likely have to be constantly monitored and updated as we grow closer to the launch of the Cybercab.

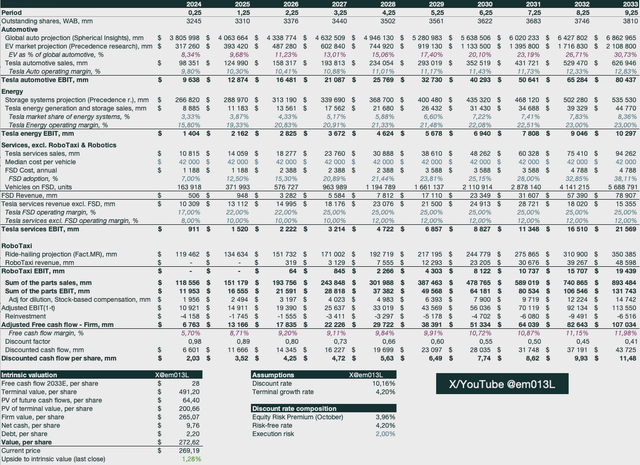

Valuation

Now that we have our projections, we can incorporate all the segments in our sum-of-the-parts valuation model and create our intrinsic valuation. There are a few key assumptions made:

- The discount rate is composed of the implied equity risk premium for the month of October (as calculated by Professor Aswath Damodaran), the risk-free rate, and a rather hefty execution risk of 2% assigned by me for Tesla. The execution risk reflects high uncertainty in future performance relative to more predictable businesses.

- The terminal growth rate is anchored to the risk-free rate. Some like to set a static figure here like 2 or 3%, but economists can’t forecast the next quarter’s economic growth, let alone more than 10 periods out. Instead of using a historical average, I use a rate that reflects the implied economic growth set by the market at the time of the valuation, with the risk-free rate as a proxy for that.

- Stock-based compensation, or SBC, is accounted for by diluting the outstanding share per period and calculating free cash flow to the firm on a per-share basis. As stock-based compensation is not a cash expense, it should not affect free cash flow. However, it is important to capture the dilutive effect of this type of compensation, and the best approach, in my opinion, is to dilute the outstanding shares per period.

Emir Mulahalilovic, Tesla SEC Filings

These inputs give me a fair intrinsic value per share of ~$273, roughly in line with the closing price as of Friday, the 25th of October. This is after Tesla’s massive increase in share price after the Q3 earnings report. Tesla at around fair intrinsic value is a buy for me, especially considering that we have the optionality of not paying for the robotics or supercharger network segment. Whatever these two segments may contribute to the future, we receive it for free by not valuing them in our sum-of-the-parts model.

Risks

Whenever you value a business where most of the value is terminal, meaning outside the projection periods, you really have to be cautious in your projections. It is easy to get swept up in the hype from the CEO, claiming there is merit to the ARK Innovation ETF (ARKK) projections of reaching $20-30 trillion of market cap in the years to come. Here is a quote from the Q2 earnings call:

That’s why my rough estimate long-term is in accordance with the ARK [ph] Invest analysis of market cap on the order of $5 trillion for — maybe more for autonomous transport, and it’s several times that number for general purpose humanoid robots.

I try to be sensible in my approach and root the assumptions in a more cautious approach backed by what is tangible. It is important to have an understanding of the future outlook of the business and track it closely. Some I choose to be careful regarding Tesla, as investors can really be swept away in the tides of excitement. Tesla is an exciting company, but be careful what you pay for.

Summary

The period between Q2 and Q3 earnings in 2024 provided investors with a lot of new insight and input into the business. Tesla has given comments for each business driver, which can be extrapolated into future periods, even though a cautious approach is advisable. Most segments in my sum-of-the-parts have seen revisions to the upside in terms of growth and profitability, and with the addition of Robotaxi as a segment, it is now fairly valued.

Any time I can get a wonderful business like Tesla at fair value that usually trades overvalued, it’s an opportunity. Most of the value is terminal, and as such, I tend to be cautious with my projections. With a proper margin of safety and plenty of optionality in terms of the robotics segment, I have upgraded Tesla to a buy from a hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.