Summary:

- TSM recently reported strong Q3 earnings, largely driven by AI and high-performance computing demand.

- TSM’s earnings growth foreshadows a strong Q3 from AMD, given AMD’s position in these segments.

- In particular, when considered in combination with AMD’s historical cyclicality, I think AMD is very likely entering a new expansion phase.

E_Y_E

AMD stock and TSM earnings report

My last work on Advanced Micro Devices (NASDAQ:AMD) focused on its recent ZT system acquisition, as reflected in the article’s title – AMD: ZT Systems Acquisition Improves AI Positioning. I argued that this acquisition will bolster its AI capabilities substantially and argued for a Buy rating based on the following considerations:

It will help it to strengthen its AI product lineup (especially in the data center AI accelerator space) and better compete with Nvidia. Market consensus has not fully captured the potential impact here.

Since that work, there are several developments surrounding the stock that are worth updating. In the remainder of this article, I will focus on the top two developments on my list: The recent earnings report released by Taiwan Semiconductor (TSM) and also AMD’s own upcoming Q3 earnings (which is scheduled to be on 10/29/2024 after market close).

The TSM’s ER shows us the persisting demand for AI-related chips and serves as a foreshadowing of AMD’s strong earnings in the past quarter. For readers unfamiliar with the ER yet, TSM’s Q3 net revenue grew 36% year-over-year and EPS (i.e., per American Depositary Receipt) reached $1.94 in Q3, translating into a YOY growth of more than 50% compared to $1.29 in the same period of 2023. In particular, according to Seeking Alpha’s report:

High Performance Computing represented 51% of net revenue, up from 42% in the year-ago period… both top and bottom-line numbers surpassed analysts’ expectations. “Our business in the third quarter was supported by strong smartphone and AI-related demand for our industry-leading 3nm and 5nm technologies,” said TSM’s Senior VP and CFO Wendell Huang.

Given the role of high-performance computing (HPC) in AMD’s business model, especially the products featuring advanced 3nm and 5nm manufacturing processes, I consider the above growth reported by TSM to be a bullish signal for AMD’s upcoming Q3 ER and also a leading signal that the chip sector is entering an expansion phase in its business cycle, as detailed next.

AMD stock: Q3 preview

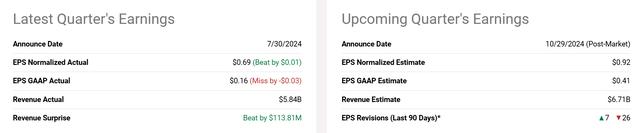

AMD’s earnings results reported in Q2 were a mixed bag. On the positive side, the company beat revenue estimates by ~$113 million, coming in at $5.84 billion. Its normalized EPS came in at $0.69, narrowly beating the estimate of $0.68 by only 1 cent. However, GAAP EPS fell short, reaching $0.16 compared to the expected $0.19.

Looking ahead to the upcoming quarter, analyst estimates are also quite mixed. The estimated normalized EPS is $0.92, the GAAP EPS is projected at $0.41, and the revenue estimate is projected at $6.71 billion. Thus, the good news is that the market is expecting a sizable earnings growth compared to the past quarter. However, note that out of the 33 EPS revisions in the past 90 days, 26 of them were downward revisions and only seven were upward revisions.

Next, I will explain why I view such revisions as being too negative. Thus, I see a large possibility for AMD to deliver a positive surprise in Q3 and trigger a large stock price advancement.

Seeking Alpha

AMD stock: status of the chip cycle

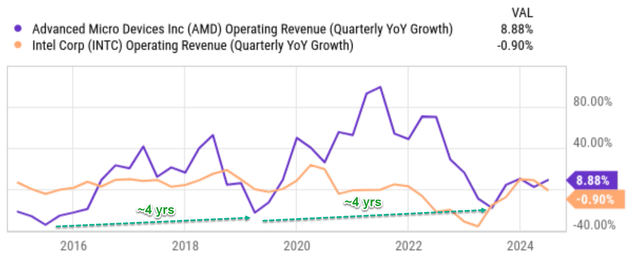

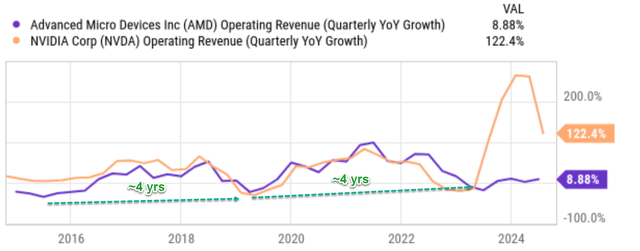

As aforementioned, a key reason behind my optimism is that I consider TSM’s recent ER as a leading signal that the chip sector is entering an expansion phase in its current business cycle, as illustrated in the next chart below. This chart relies on the YOY growth of quarterly operating revenue as an indicator for business cycles. The method is detailed in my earlier analysis of the business cycle of Intel (INTC) and I will only quote the gist here briefly:

The chart shows quarterly revenues change YoY, for INTC and AMD over the past 10 years. You see a quasi-sine wave behavior for both of them. AMD demonstrates the cycles more dramatically and INTC less. You can clearly see AMD’s previous chip contraction cycle reached its worst in 2019 and bottomed again around 2023, resulting in a trough-to-trough duration of about four years. The cycle before that reached its worst in late 2015 and bottomed again in 2019, again resulting in a trough-to-trough duration of about four years.

Seeking Alpha

The comparison of AMD’s and Nvidia’s (NVDA) cycles shows the same pattern, as you can see from the chart below. Actually, the patterns between AMD and NVDA are in closer overlap until the recent 1~2 years, when NVDA’s AI chips began to dominate its addressable market.

As of the latest quarter, the YOY growth of AMD’s quarterly operating revenue is only 8.8%, among the lowest end of its historical spectrum. Such a slow growth, combined with the fact that TSM has recently reported rapid sales growth, indicates to me that the previous contraction cycle is ending and the next expansion cycle is beginning.

Next, I will discuss the underlying business developments that can support such an expansion.

Seeking Alpha

AMD stock: Other risks and final thoughts

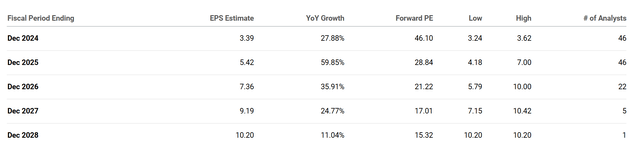

Looking past Q3, the consensus EPS estimates for AMD stock are projected to grow strongly over the next few years. Analysts expect EPS to reach $3.39 in FY 2024, a significant 27.88% increase from the previous year. This growth momentum is expected to continue, with EPS annual growth estimated in the range of about 11% to almost 60% in the next five fiscal years.

I do see good catalysts to support such rapid growth. The booming AI business is a top catalyst. I expect this catalyst to generate $4.5 billion in revenue during FY 2024. As a reflection of the potency of this catalyst and AMD’s position to capitalize on it, AMD’s MI300 series, a new line of graphics processing units optimized for AI and data center workloads achieved more than $1 billion in quarterly revenue for the first time during the June quarter. I expect it to continue its momentum in the years to come. The recent acquisition of ZT Systems (for about $4.9 billion) is another catalyst that can enhance AMD’s AI capabilities and accelerate the development of integrated data center solutions (the focus of my last article).

Seeking Alpha

In terms of downside risks, the primary risks common to AMD and its peers are competition intensification and geopolitical tensions, in my view. Competition intensification (against INTC and NVDA) is a frequent topic on the Seeking Alpha platform so I won’t further add on here. Geopolitical events, especially those between China and the U.S. involving advanced chips, can severely disrupt supply chains and marketing channels. The ongoing investigation by the U.S. Commerce Department involving TSM and Sophgo serves as a live example of such risks.

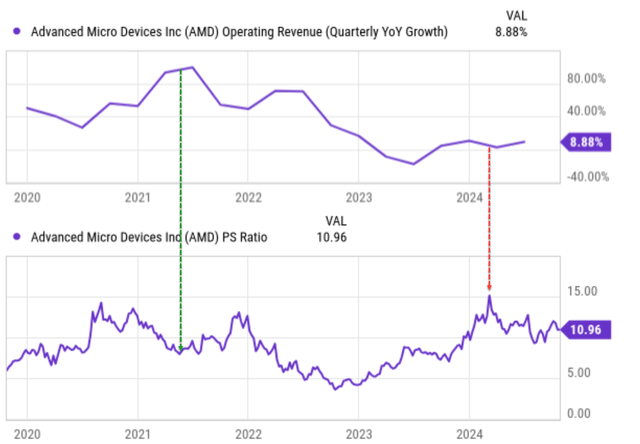

For risks more specific to the approach used in this article, AMD is currently trading at a premium valuation and there can be considerable valuation risks. If you recall from the earlier chart above, the forward P/E ratio for AMD is over 46x, a very elevated valuation both in absolute terms and relative terms. However, investors with experience in cyclical stocks must know that valuation multiples (especially bottom-line oriented multiples such as P/E or P/cash ratios) can be a very misleading indicator of the status of business cycles. As you can see from the chart below, a temporary low valuation multiple could correspond to the peak of the business cycle as indicated in the green arrow, and vice versa (as indicated by the red arrow). Thus, deciphering the relationship between valuation multiples and the phase of the business can be very ambiguous, and timing the cycle is simply impractical in our view. As such, the analysis performed here is only meant to be a directional guide, which is sufficient to deliver robust returns already in our experience.

To conclude, my goal is to explain why TSM’s recent ER serves as a leading indicator for the AMD business cycle. TSM’s larger earnings growth in the past quarter, combined with AMD’s (and other chipmakers’) historical cyclicality, suggests to me that AMD is very likely ending the contracting phase and entering a new expansion phase. This cyclical force is joined by other fundamental catalysts (such as its MI300 chips and acquisition of ZT Systems) creating a high probability for AMD to deliver a strong Q3 and trigger a large stock price surge during/after the Q3 ER.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.