Summary:

- Boeing overspent on share repurchases at the cost of the rest of its business, wasting $10s of billions at higher prices.

- The company is still facing massive charges from its business, something which it needs to handle.

- The company’s new management seems to be aligned on what it needs to do with handling the strike as the first step.

ICHIRO

The Boeing Company (NYSE:BA) is a company we discussed recently as having strong potential if the company makes the right decisions. Now, the company has announced plans to raise up to $25 billion to shore up its balance sheet and an estimated $10 billion of that will be from share issuance.

As we’ll see throughout this article, the company is a quintessential example of the potential harms of share repurchases.

Share Repurchase

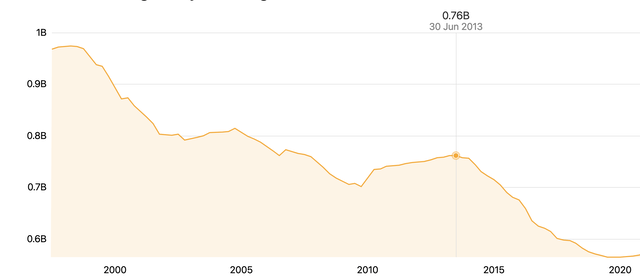

$10 billion of share repurchases at the current price of $150 / share would be the potential issuance of ~70 million shares.

For perspective, from 2013 to 2019, Boeing spent $43 billion on share buybacks, a substantial percent of that through debt. The company managed to repurchase 200 million shares during that time, meaning an average price of $215 / share, or almost 50% above the company’s current share price, an incredibly expensive buyback.

At the same time, this wasn’t just a buyback from the company’s profits, rather the company spent more than its profits over the same time. These buybacks came as the company dealt with both the MCAS scandal and what some would argue was chronic underinvestment in its business over the same time period.

Union Struggles and Spirit Aero

The company has continued to face a continued struggle around unions.

The company has had two deals, accepted by union membership, that have failed. The latest deal, with a 35% raise and a signing bonus of $7,000, was rejected. Additionally, struggling supplier Spirit AeroSystems Holdings, Inc. (SPR), which Boeing is slated to buy, has now put 700 workers on furlough over the impacts of the strike on its own business.

Boeing seems to be getting closer to a deal given the latest vote. However, it’s clearly not there. We do expect that given the 30% drop in “no” between the first and second offers, a third slightly improved offer will help seal the deal. In the meantime though, the company loses $1 billion/month.

An expensive contract could also have ramifications for other parts of the business if non-union workers raise their expectations for compensation. However, one positive out of the new deal, in our view, is that it includes an agreement for the company’s next plane to be in the Pacific Northwest.

Focusing on its union workforce and its traditional stronghold locations, in our view, will help the company much more in the long run.

Boeing 3Q Financial Results

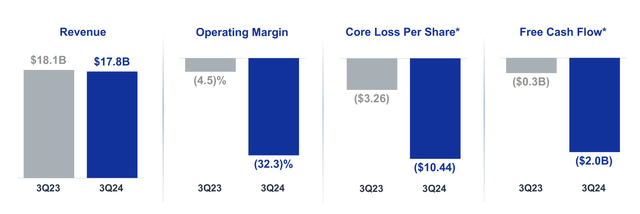

Boeing saw a modest decline in revenue year-over-year, but the true story was in the impact on margins.

The company saw a loss of more than $10 per share, with operating margins >30%. That decline was primarily driven by the impact of the strike. The company saw $2 billion in negative free cash flow as it continued to struggle financially. Boeing is planning a massive capital raise to weather this downturn, as we discussed above.

The biggest question here is if the worst has passed now.

Boeing Segment Performance

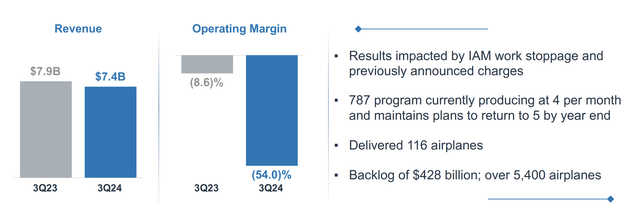

Boeing’s core commercial airline segment saw an almost 10% YoY revenue decline based on the IAM work stoppage.

This pushed the operating margin to more than -50% as the stoppage is costing the company roughly $1 billion / month. The company delivered 116 airliners (vs. 380 in 2019). The company is focused on its 787 program, at a non-union factory, recovering, however, overall the company’s business has seen substantial struggles.

The company’s key priority here is finding a contract that the IAM is OK with, closing the Spirit AeroSystems acquisition, and resuming efficient operations. Whether or not the company can do this remains to be seen.

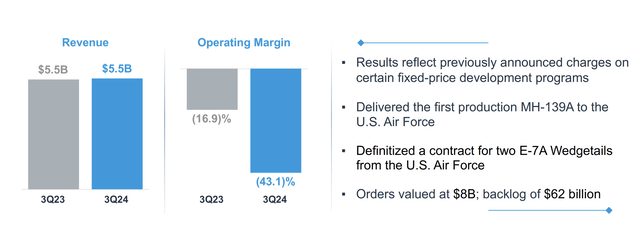

The company’s defense segment also saw a strong drop in operating margins from negative the year before. The company has continued to work through fixed-rate pricing obligations that have had a substantial impact on its financials. However, it has worked to improve that while capturing some new orders.

The company maintains a backlog of $62 billion. It needs to show an ability to improve FCF from its defense business over the long run.

Boeing Balance Sheet

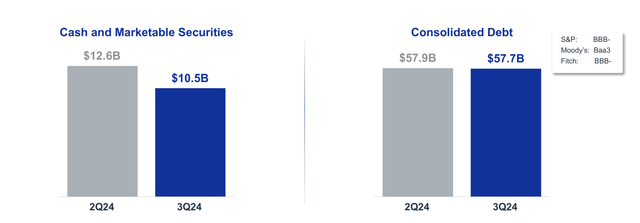

We discussed the company’s balance sheet struggles above and this provides a picture.

The company has a market cap of less than $100 billion now, with a consolidated debt of almost $60 billion. That puts the company at an enterprise value of almost $160 billion, not counting the impact of the company’s planned capital raise. The details of that remain to be seen, but it could have a big impact.

The company does have the cash and the brand to handle a market downturn for the next several quarters. However, at some point, it needs to return to profitability. That will be required for the company to continue driving shareholder returns.

Thesis Risk

There are two major risks to our thesis.

The first is that once your reputation is harmed, it can be tough to recover. Airplane demand is high right now, and so is demand for Boeing. However, airplanes are a notoriously cyclical industry. With Americans willing to pay more to avoid Boeing, it remains to be seen what the long-term damage to the company’s reputation is.

The second is that while Boeing falters, its competition grows. Airbus SE (OTCPK:EADSF) is now winning the annual production race with Boeing, and China has a domestic plane of its own now. While realistically no other country besides China is a risk as a fourth competitor in our view, a there-company market is very different from a two-company market. Slowdowns at Boeing could enable the competition to pass the company.

Conclusion

Boeing has an impressive portfolio of assets. The company’s brand is unparalleled, and the company operates in an effective duopoly with Airbus. However, the company’s prior decisions, especially in regard to focusing on shareholder returns before, show that it’s now in a tough position. The company needs to handle its union negotiations.

Going forward, we expect the company’s new management to stay true to its goals, improve operations, and focus on returning to profitability. That could enable substantial shareholder returns, making the company a valuable investment. Please let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.