Summary:

- I’m downgrading Salesforce to a neutral rating after its sharp rally since May.

- The stock now trades at a ~26x P/E and ~6.5x forward revenue multiple, which no longer has as much room to rise.

- Fundamentally, Salesforce is also showing weaker performance, in particular with revenue growth decelerating ~3 points sequentially in Q2.

- Its integration and analytics segment, a major growth catalyst for Salesforce that has helped to offset deceleration in Sales Cloud, showed tremendously slowing growth.

- I recommend locking in gains here and moving to the sidelines ahead of the company’s expected Q3 earnings in late November. There will be a chance to buy back in at a cheaper price.

John M. Chase

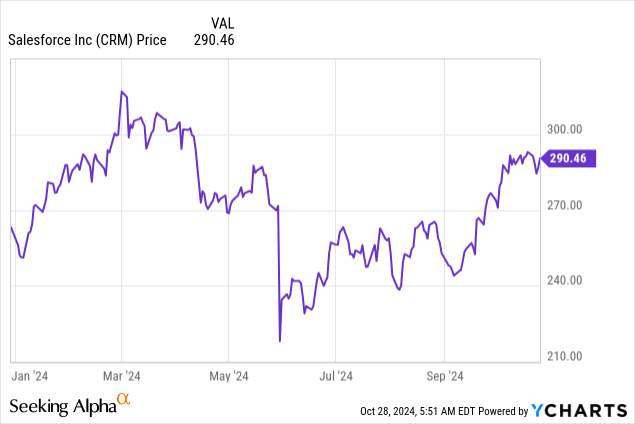

Salesforce, Inc. (NYSE:CRM) has long been a name that has been synonymous with Silicon Valley and enterprise software: after all, it was one of the first companies to pioneer the cloud-based delivery model and subscription business for software companies. And yet despite its blue-chip status in the tech industry, its stock has been incredibly volatile over the past few years, slicing in half from pandemic-era highs at its low point in 2022, and then, this year, rising ~15% to nearly reclaim its former peaks.

Amid sharp moves in the stock, however, the company has been quietly at work expanding its non-sales cloud products, maintaining low/mid-teens revenue growth, and championing a new ethos of efficiency to drive profits.

I last wrote a bullish opinion on Salesforce in June, when the stock was trading near ~$230 and just beginning its rally. I had argued at the time that the stock was trading at a very reasonable PEG ratio that undervalued its ~20% earnings growth. Now, as the stock has rallied ~25% since then, I am more cautious about Salesforce’s prospects going forward, especially as revenue deceleration kicks in for some of the company’s core expansion areas. I viewed Salesforce as more of a short-term play, and having already profited from my trade, I’m dropping my rating on Salesforce back down to a neutral opinion.

At current share prices just approaching $300, I see more of a neutral bull-and-bear case for Salesforce. On the bright side for this company:

- Deep enterprise software portfolio spanning many applications and use cases. Salesforce has among the largest product portfolios in the enterprise software sector, spanning CRM, service management, API integration and other backend software, messaging (Slack), AI (Einstein), and other tools that give Salesforce a tremendous opportunity to “land and expand” within its customer base.

- Best in breed and a category leader across many verticals. Many of Salesforce’s products, such as Sales Cloud, were the original movers in the space. Sales Cloud is still considered the top product in the CRM space. The company also has a history of acquiring other best-in-breed platforms, such as Slack.

- Tremendous earnings growth – Careful consideration of headcount and cost structure, unlike in the past, has also helped Salesforce to grow operating earnings and EPS well-exceeding revenue growth.

At the same time, however, I’m more concerned now about the following factors:

- Saturation – Salesforce, after all, is already top of the pack in many of its categories, including and especially CRM. This is a good thing, but it can also be a bad thing when it means there’s not much greenfield market territory left to cover.

- Revenue deceleration- Beyond the core areas like marketing and sales, Salesforce’s core expansion clouds are showing decelerating revenue growth, which could be compounded in a softer macro environment.

The next catalyst for Salesforce will be its Q3 earnings, expected sometime in late November. In my view, it’s time to lock in gains here and invest elsewhere before then.

Q2 download and Q3 look-ahead

Though Salesforce delivered an earnings beat in Q2, the company also showed a sharp deceleration in revenue and failed to raise its guidance for the year (in other words, it wasn’t one of the company’s usual “beat and raise” quarters).

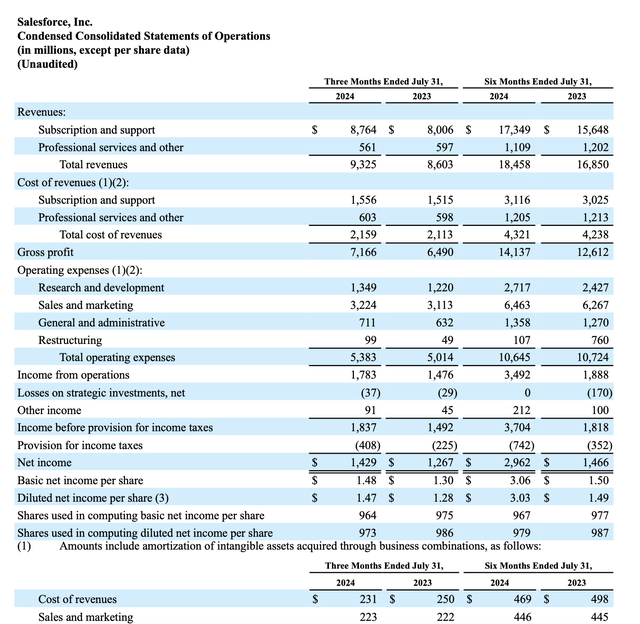

Take a look at the earnings summary below:

Salesforce Q2 results (Salesforce Q2 earnings deck)

Salesforce’s revenue grew just 8% y/y to $9.32 billion. Though this came in ahead of Wall Street’s expectations of $9.23 billion (+7% y/y), we note that revenue decelerated three points from 11% y/y growth in Q2.

The company chalks up some deceleration to a tough prior-year comp in professional services revenue, but we note that core subscription software revenue trends are also quite concerning. As shown in the chart below, the company’s subscription revenue growth slowed three points sequentially to just 10% y/y:

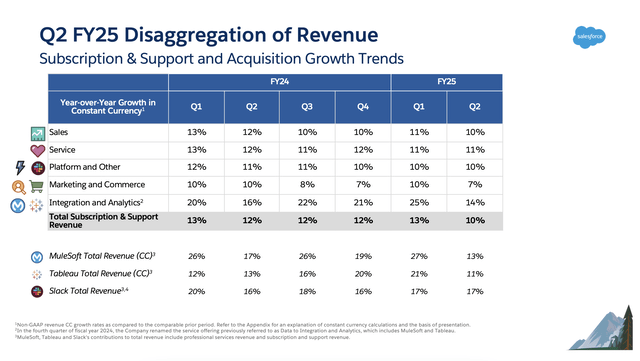

Salesforce revenue trends by cloud (Salesforce Q2 earnings deck)

With the exception of Service Cloud, every single product area showed slowing growth, but in particular, I’m concerned about the company’s “integration and analytics” segment, which to date has housed some of Salesforce’s most promising acquisitions like MuleSoft (software to drive API integrations) and Tableau (data visualization and business intelligence software). To me, this is an expression that Salesforce may be encountering macro pressures, as IT departments back away from more data-heavy and backend-oriented projects.

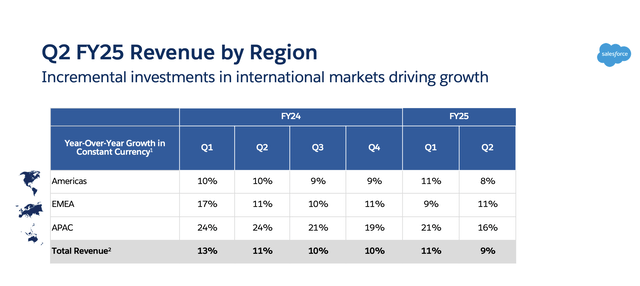

We note as well that by market, while Europe appears to be holding up strong with ~11% y/y growth, the company is seeing a marked deceleration in the Americas (three points of sequential deceleration) and APAC (five points). A worsening of the global macro environment may slow growth down even further in Q3.

Salesforce revenue trends by region (Salesforce Q2 earnings deck)

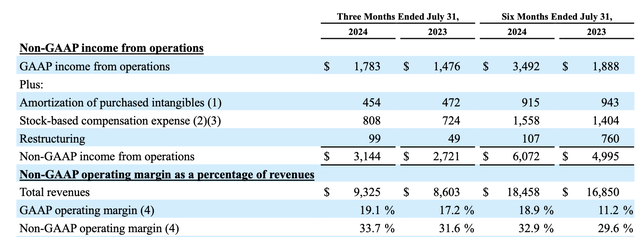

We do, however, remain impressed by Salesforce’s continued margin expansion, especially for a company that until recently was driven by an ethos of growth at all costs (especially through M&A). Pro forma operating margins rose 210bps y/y to 33.7%, which technically still puts Salesforce in the “Rule of 40” bucket.

Salesforce operating margins (Salesforce Q2 earnings deck)

Looking ahead to Q3, the key themes for investors to watch are:

- Does revenue continue to decelerate? To date, the data integration segment has been key to helping Salesforce continue to grow at a low/mid-teens pace, offsetting the deceleration in the sales and marketing clouds. Further deceleration in these growth segments will be a negative sign for Salesforce.

- Macro impacts- Multi-cloud adoption, or customers purchasing multiple products, has been an important growth lever for Salesforce. But as macro clouds darken, customers may be watching their budgets more carefully. Investors will need to watch closely for any incremental commentary that Salesforce provides on the macro’s impact on its sales momentum.

- Can Salesforce keep up its pace of profit expansion? Amid slowing growth, it’s important that we see Salesforce continuing to expand margins and remain a “Rule of 40” stock – a status it may be on the verge of losing. Q3 also contains the company’s very expensive annual conference, Dreamforce. We’ll need to watch if operating margins continue to trend upward from here.

Valuation and key takeaways

At current share prices near $290, Salesforce trades at a market cap of $277.68 billion. After we net off the $17.65 billion of cash, cash equivalents, and strategic investments on the company’s balance sheet against $8.43 billion of debt, the company’s resulting enterprise value is $268.46 billion.

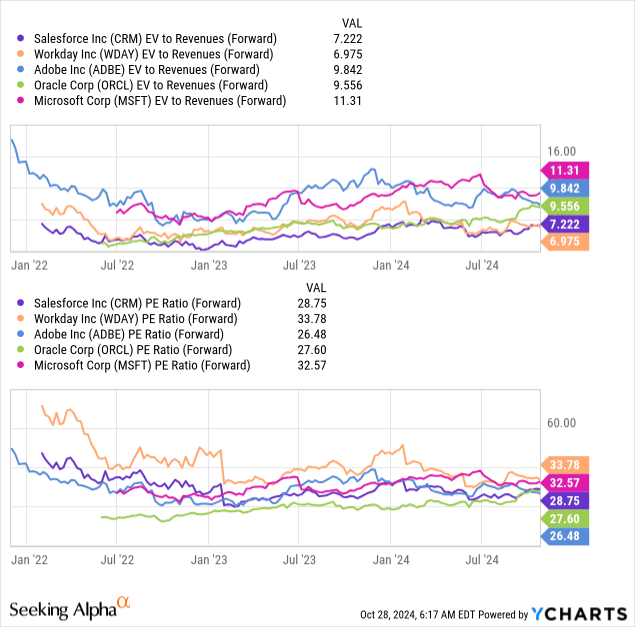

Meanwhile, for the upcoming fiscal year FY26 (the year for Salesforce ending in January 2026), Wall Street analysts are expecting the company to generate $11.11 in pro forma EPS (+10% y/y) on $41.25 billion of revenue (+9% y/y). This puts Salesforce’s valuation multiples at:

- 6.5x EV/FY26 revenue.

- 26x P/E.

- 2.6x PEG, which I no longer find quite as attractive given both the company’s expansion in share price and deceleration in EPS growth.

I don’t find these to be bargain multiples. Of course, we do have to keep in mind that Salesforce’s richer valuations are a reflection of an expensive market today. Salesforce sits on the lower end of revenue multiples, and in the middle of the pack on P/E multiples, against its large-cap enterprise software peers:

Still, with Salesforce having already risen sharply since May, and the threat of deceleration still on the horizon, it’s a great time to lock in gains here and invest elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.