Summary:

- Devon Energy’s acquisition of Grayson Mill is expected to be accretive to existing shares.

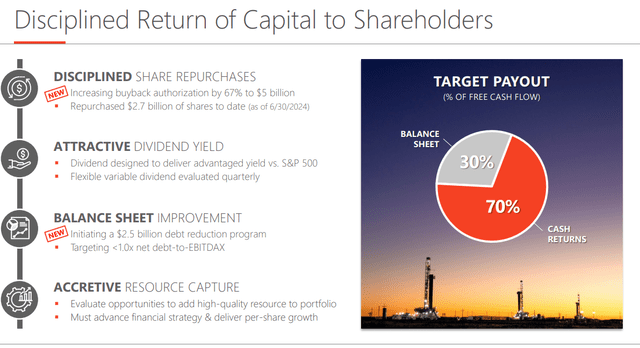

- Devon Energy’s balance sheet is improving, with a goal of reducing net debt to less than 1x EBITDAX.

- Devon Energy’s free cash flow is expected to increase substantially with a rise in oil prices while maintaining capital efficiency.

halbergman

Devon Energy (NYSE:DVN) is an oil and gas company with a market cap of $26.01 billion.

It’s been a while since I last wrote about Devon Energy and I believe it’s time to revisit it and provide an update. The oil price environment hasn’t provided Devon or the oil industry any favors in the recent past, which could be perfect time to evaluate oil and gas companies like Devon Energy.

I last wrote about Devon Energy on February 3, 2024 and the price was $41.07 per share. Shortly after that, the price ran up to $54 per share in conjunction with rising oil prices but since then, oil prices have been on a slow and steady decline causing the share price to return to the $40 range.

Devon Energy has a quarterly earnings report quickly approaching on November 5, 2024 where it will share updates from its recent and exciting acquisition of Grayson Mill in the Williston Basin.

Overview

Devon Energy is one of the largest oil and gas producers in the contiguous 48 states. In Q2 the company managed to increase production by 3 percent, creating a record volume for the company. Devon Energy is famous for their acquisition of Mitchell Energy in 2002 where it became one of, if not THE pioneer in horizontal drilling and fracking in gas shale. However, Devon became overly aggressive and the company was stifled by debt and low natural gas prices for the decade between 2009 to 2021. Thankfully for investors, the company has not only become more disciplined with its capital but also with its production profile with much more of its production focused on oil rather than natural gas. I go into some depth highlighting Devon’s transition into a more oil-focused company and thus a more profitable company in this article here.

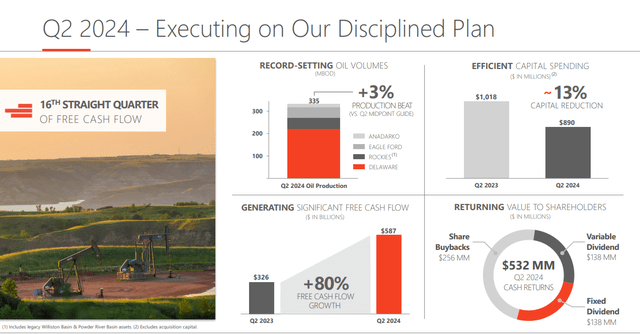

To share some of the companies highlights in Q2 2024, the company reduced capital spending by 13 percent while still managing to increase production quarter over quarter. As a result of more efficient capital spending and higher production, the company managed to increase their free cash flow quarter-over-quarter by 80 percent according to their Q2 investor presentation.

Q2 Devon Energy Highlights (Q2 Investor Presentation)

Balance Sheet

Devon Energy has become much more disciplined with their capital structure in recent years and is continuing to improve their balance sheet each quarter. This quarter, they implemented a new program with the end goal of getting their net debt to levels that are less than 1x their EBITDAX. EBITDAX is an industry term which takes the traditional EBITDA metric and adds exploration expenses back to earnings in addition to interest, taxes, depreciation, and amortization expenses.

Currently, the company has net debt of 11.3 billion and an EBITDAX of around 7.5 billion in the trailing twelve months.

| (millions) | 2020 | 2021 | 2022 | 2023 | 2024 Q2 |

|

Assets |

9,912 | 21,025 | 23,721 | 24,490 | 25,162 |

| Debt | 6,893 | 11,626 | 12,425 | 12,273 | 12,433 |

| Debt-to-Assets | .695 | .553 | .524 | .501 | .494 |

Source: Seeking Alpha

To help the company reach its debt-level goals, they plan to implement a 2.5 billion debt reduction program which all else remaining equal, will reduce their debt-to-asset ratio to .4 relative to its current .494 debt-to-asset ratio. This balance sheet ratio will be closer to the likes of industry leaders such as EOG Resources (EOG) who as of my last article has debt-to-asset ratio of .36.

Devon Energy Returns Capital (Devon Energy Q2 Presentation)

Shares Outstanding

Devon Energy recently increased its share buyback program by 67% up to $5 billion. Although they are buying back more shares, they also recently increased shares due to its acquisition of Grayson Mill being accomplished partially by new shares. That said, the Grayson Mill acquisition is supposed to be accretive to existing shares thanks to the acquisition being made at an attractive valuation of 4x EBITDAX and a FCF yield of 15x. You will see below in the cash flow section that this is greater than the company’s current FCF yield of 13x.

| 2021 | 2022 | 2023 | Q2 2024 |

Grayson mill Acquisition |

|

| Shares (Millions) | 664.2 | 654.0 | 634.6 | 626.2 | 37 |

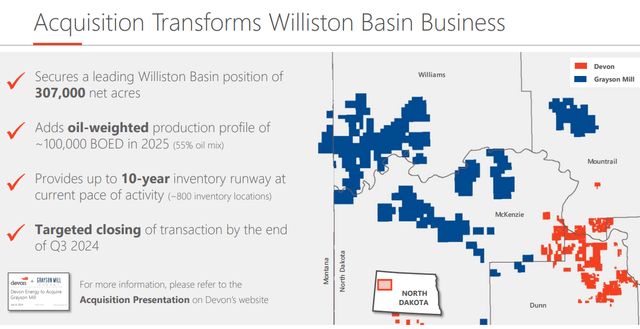

The Grayson Mill acquisition will bring the total shares to around 663 million shares outstanding. This equates to a 5.9 percent increase in shares while increasing production by 100 MBoe/day of which is 55 percent oil. This is a 14.6 percent increase in MBoe/day. The acquisition also included 3.25 billion in cash consideration.

Inventory

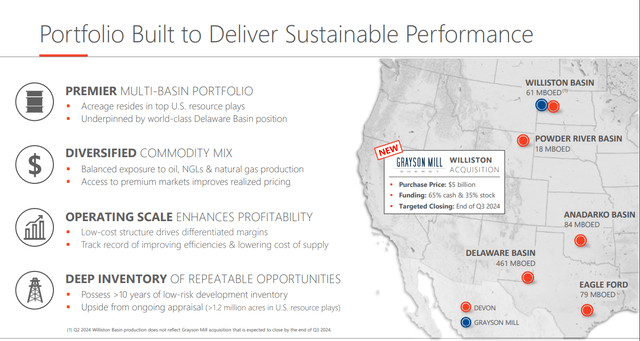

Devon Energy has a deep inventory of drilling locations and with the recent acquisition, they have 10 years of drilling inventory in the Williston Basin as well as company-wide.

Devon Energy Portfolio (Devon Energy Q2 Presentation)

Grayson Mill Acquisition

The company announced the completion of its acquisition of Grayson Mill a month ago on September 27th. You can see from the map below how this acquisition is very meaningful to Devon’s position in the Williston Basin.

Grayson Mill was a company under the umbrella of Encap Investments and was started in October 2016. The company grew aggressively through a combination of strategic acquisitions and organic drilling results.

Grayson Mills Acquisition (Devon Energy Q2 Presentation)

Cash Flow

Despite a challenging price environment, Devon Energy has continued to increase their free cash flow based on the TTM of 2024.

| 2021 | 2022 | 2023 | TTM 2024 | |

| Operating Cash Flow | 4,899 | 8,530 | 6,544 | 6,735 |

| Capital Expenditure | (2,007) | (5,125) | (3,947) | (3,757) |

| Free Cash Flow | 2,892 | 3,405 | 2,870 | 2,978 |

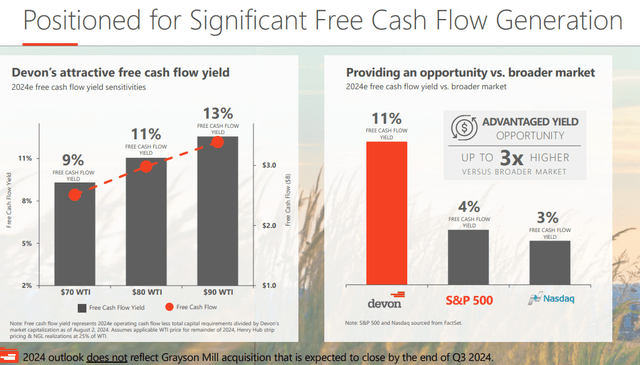

The below graphic demonstrates the cash flow potential for Devon Energy if oil prices strengthen. Today, we are experiencing a $70 oil environment and FCF is approaching $3 billion. In a $90 price environment, FCF will increase by more than half a billion dollars with all else being equal.

Next to that, Devon shows how its FCF Yield compares to the broader market. A companies Free Cash Flow Yield is a measurement of its FCF relative to its market capitalization. This demonstrates the value proposition for Devon Energy and I suspect the relative value proposition of the oil and gas industry as a whole.

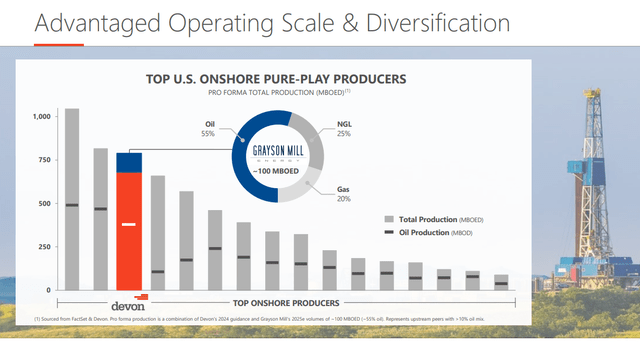

Devon Energy Free Cash Flow (Devon Energy Q2 Presentation)

Devon shows its advantages of scale and diversification in the slide below as one of the top onshore pure-play companies. This is certainly an advantage against volatile operating environments of smaller companies but it also depends on how you view it. Smaller companies can grow faster but are also more affected by local, more acute risks. Depending on your risk tolerance, a larger E&P company like Devon Energy can provide much broader geographical diversification. A company like Devon can lean on its scale to drive greater efficiencies than a smaller company as well. Once again, these advantages can also be disadvantages if you value the higher risk and potentially greater returns of a smaller, more geographically focused company.

Devon Energy Operating Scale (Devon Energy Q2 Presentation)

Production

Devon Energy continues to increase production despite the challenging prices. With the acquisition of Grayson Mill, the company will be adding around 100 Mboe/d as of the company’s next report.

| Q1 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q2 2024 |

| Oil (Mbod) | 294 | 316 | 320 | 323 | 321 | 327 |

| NGL (Mbod) | 154 | 148 | 149 | 164 | 166 | 174 |

| Natural Gas (Mmcf) | 1,000 | 1,034 | 1,030 | 1,054 | 1,070 | 1,108 |

| Combined (Mboed) | 614 | 636 | 641 | 662 | 665 | 686 |

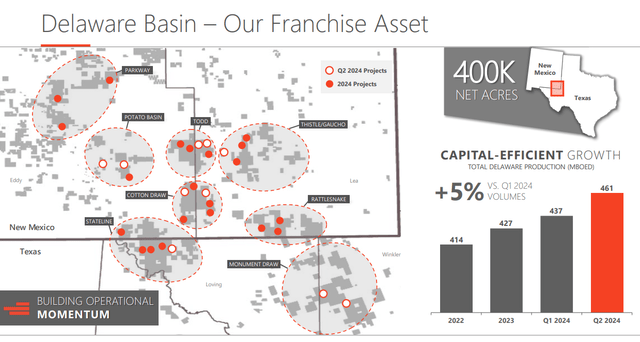

The Delaware Basin continues to be Devon Energy’s flagship asset as it is driving the highest returns across the industry. As the company allocates greater amounts of capital to this play, and as experience continues to drive efficiency, the production momentum continues to grow.

Devon Delaware Basin (Devon Energy Q2 Presentation)

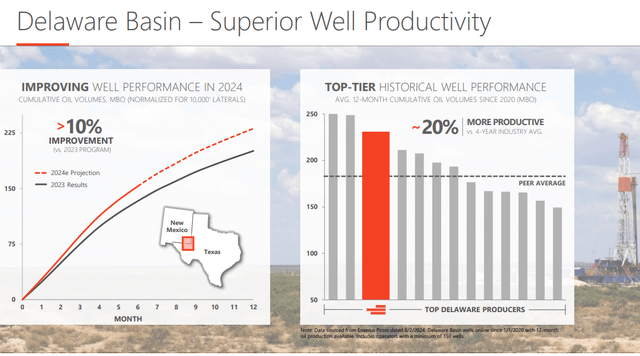

During 2024, Devon has continued to improve their average well productivity from the Delaware Basin. This highlights the scale and efficiency we talked about earlier.

Delaware Basin Well Productivity (Devon Energy Q2 Presentation)

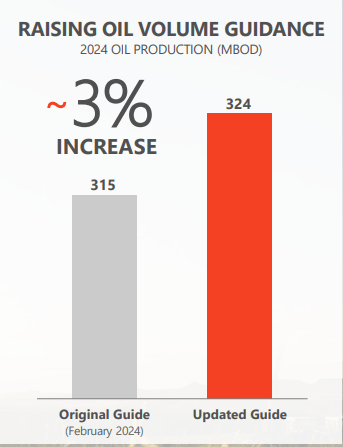

Thanks to these greater efficiencies, Devon Energy is raising its 2024 oil production guidance from 315 MBOD to 324 MBOD.

Devon Energy Volume Guidance (Devon Energy Q2 Presentation)

Risks

Oil Prices

Devon’s biggest risk, similar to the rest of the industry is oil prices. I think it’s possible and probable that we continue to see a weaker oil price through Q4 and the first two quarters of 2024. I don’t know when oil prices will reverse course, but I expect we will see oil find a bottom sometime in the next six to nine months. With the presidential election in the front of everyone’s mind, there is a nervous sense of waiting to see what happens. I would expect the general business environment to improve in 2025 after the election gets sorted out resulting in a gradual rise in oil prices.

Natural Gas Prices

In recent years, oil and gas companies have primarily focused on oil causing the natural gas price environment to be overlooked. For companies like Devon Energy that operate in the Permian Basin, most gas gets sold into a market known as Waha. While natural gas prices are usual quoted in terms of Henry Hub not all natural gas prices are the same. Waha prices have seen a challenging environment in 2024 with Waha prices dropping as low as negative seven dollars at one point thanks to pipeline maintenance.

Aegis Hedging, who tracks the pulse on various gas markets, said this in their most recent report on the Waha market.

[Permian gas] production is only expected to increase from here. In times of pipe maintenance, planned or unplanned, spot market Waha prices have the potential to realize negative.

When Permian gas prices realize negative, companies like Devon are faced with a dilemma. They can flare, shut in production, or produce at negative prices. The State of New Mexico is becoming more punitive against flaring despite there not being clearly defined regulations on the books. Without flaring as an option, shutting in production including the oil production or selling gas at negative prices becomes the primary alternatives.

This will remain a risk for Permian producers until pipeline capacity can meet the continuous supply growth.

Regulation

Another critical risk for a company who operates largely in the Delaware Basin is the regulatory environment. I personally know that the environment in New Mexico is getting more difficult each year. For companies who come up against challenges where they need to flare natural gas, the writing is on the wall that this is going to become very regulated in the near future. It is already becoming difficult for large companies like Devon Energy. It is also likely that other states will continue to grow their regulations around flaring as well.

Geopolitics

Geopolitics has played an important role in short-term price movements in energy markets in the past. Given that there are many different conflicts playing out in the world, I don’t see this going away any time soon. And personally, I would never invest in something that depended on there being greater conflict and chaos in the world. Although, I don’t believe geopolitics plays as big of a role as some might think, this will continue to be a factor. Conversely, if the world’s economic potential was unleashed in the absence of war, it is my opinion that oil prices would likely rise much further than they would be due to geopolitical unrest in certain regions of the world. So although some may view this as a risk, I don’t think it should affect decision-making.

Conclusion

Devon Energy continues to be a buy in my opinion. If you’ve held Devon Energy since my last article, you may be discouraged by the company’s flat share price performance. However, despite slightly lower oil prices over that time frame, the company has grown production, reduced balance sheet leverage, increased free cash flow, implemented a larger share buy-back program, increased its fixed and variable dividend and increased drilling inventory.

Oil prices may have already found a bottom, but if not, I would look for them to bottom in the first half of 2025 once the presidential election and all the ensuing unknowns are sorted out. If this is the way it plays out, then accumulating long-term positions in American oil producers with strong positions in key American oil plays, could be a wise decision in retrospect.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.