Summary:

- Intel has been one of the worst performers this year, as the stock corrected after every earnings result.

- Over the past year, I have mentioned that Intel’s main headwind is the wrong strategy within the foundry business where it competes with highly efficient TSM.

- The upcoming earnings result is a make-or-break moment for the company, and the management needs to provide greater clarity about the future roadmap.

- The turnaround would not materialize until 2026 which can continue to put pressure on the stock for the next few quarters.

- Due to enormous challenges facing the company, the stock does not look like a value buy despite the massive correction in YTD.

JHVEPhoto/iStock Editorial via Getty Images

Intel Corporation’s (NASDAQ:INTC) previous earnings result caused one of the biggest corrections in the stock in its history. The stock has declined by 55% YTD compared to a 21% jump in S&P 500 index. The upcoming earnings are on the October 31st. Over the last year, I have maintained a Sell rating on the stock which has proven correct as the company continues to face enormous challenges within its business model. The foundry business continues to require massive resources and has taken up a big part of management focus. However, the results for this segment are expected to reach break-even in 2027 in the best-case scenario. The company is facing cost overruns in almost every single foundry project. In the previous article, it was mentioned that the turnaround would take longer than expected causing a pushback from Wall Street.

Intel has already announced suspending the planned factories in Germany, Poland, and Malaysia. There are talks of outside investment for the foundry segment, but any future roadmap is increasingly looking uncertain. Over the last few years, different Intel CEOs have proposed a different strategic model. We could see another big change in Intel in the next few quarters which makes it more difficult to estimate future earnings. For the fiscal year ending 2026, Intel is expected to deliver EPS of $1.79 which gives the stock a forward PE ratio of 13. However, there have been numerous EPS downward revisions for the stock in the last few quarters, and we could continue to see these more down revisions if the margins do not improve. On the other hand, Advanced Micro Devices, Inc. (AMD) and Taiwan Semiconductor Manufacturing Company Limited (TSM) are trading at a forward PE ratio of close to 20 for fiscal year 2026 and with much better clarity on the future roadmap.

Don’t catch a falling knife

Intel’s sharp decline in 2024 might attract some value hunters, but it is better not to catch a falling knife. There are lots of challenges that the company has to overcome, and the management has not laid out a clear roadmap of how they will get out of this situation. Intel stock has corrected massively after each of the past three earnings results this year. The company has failed to meet even the bare minimum expectation and its forward EPS projection keeps on getting downward revisions.

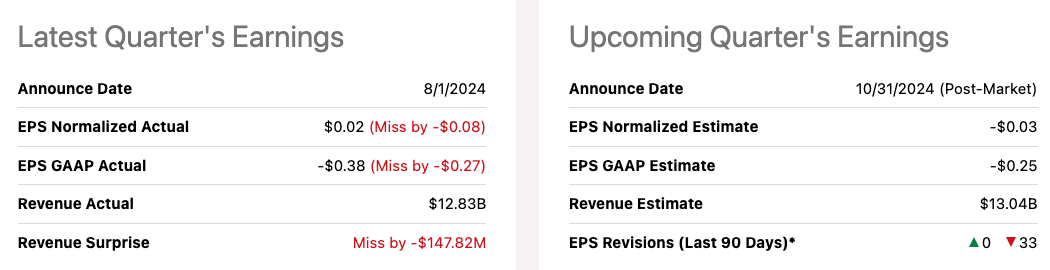

Seeking Alpha

Figure: Intel’s performance in the last earnings report. Source: Seeking Alpha

It is interesting to see that the stock has received 33 down revisions for its EPS in the last 90 days without any up revisions. The company is estimated to deliver negative $0.03 EPS in the upcoming earnings, but if it fails to meet this number we could very well see another major correction.

There is a lot of skepticism over the management’s initiatives, and we could see some activist investor scrutiny. The company is now looking to make a separate entity for its foundry business and allow outside funding. This seems like a positive step, but it does not solve the core economics issue of the foundry business. The labor and operational cost for Intel’s foundry business in the U.S. and other Western economies is significantly higher than that of TSM in Taiwan. Even after taking into account the billions of dollars in subsidiaries, Intel would struggle to make a strong business case for this segment. Even TSM has faced hurdles in diversifying operations in Western countries.

Strategic error and a massive lost opportunity

In the past few years, different CEOs have laid out different visions for Intel. I believe this has led to a lack of focus and a loss of precious resources and time. However, the recent effort to build a foundry segment could be a fatal error for the company. It has already lost a golden opportunity in AI chips as NVIDIA Corporation (NVDA) and AMD delivered rapid growth in this segment. Intel is now playing catch up with Nvidia and is pricing the AI chip Gaudi 3 very aggressively. Despite achieving good progress in the process node roadmap, Intel continues to face headwinds in terms of margin.

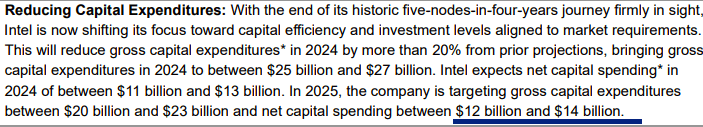

Company Filings

Figure: Intel’s CapEx in the foundry business. Source: Company Filings

The company has forecasted that it will have a net capital spending of between $12 billion and $14 billion in 2025. Some projects have been cancelled which should reduce this burn rate.

We could see a better sentiment towards the stock if the management follows through with its cost-cutting plan and makes a significant reduction in the CapEx plan for the near term. At the same time, Intel would need to show good sales and margins for its Gaudi 3 chips which are competing directly against Nvidia’s H100 flagship chips.

The stock is not cheap

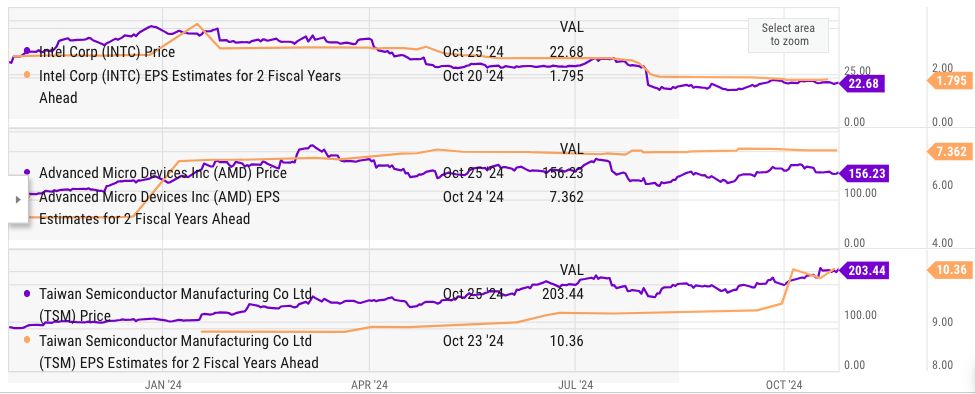

After the massive correction in YTD, Intel stock might look like a good value buy. However, looking at the forward EPS projections, the stock does not appear to be very cheap. The EPS estimate for the fiscal year ending Dec 2026 is $1.8 which gives the stock a forward PE ratio of 13 for 2026. On the other hand, AMD and TSM are trading at a forward PE ratio of close to 20 for the fiscal year ending 2026.

Ycharts

Figure: Comparison of forward PE ratio of Intel, AMD, and TSM. Source: YCharts

Both AMD and TSM have seen a number of EPS upward revisions in the last few quarters. On the other hand, Intel continues to see downward EPS revisions. If Intel stumbles on its margins, we could see a sharp down revision in its EPS in the next few quarters which would increase the forward PE ratio of the company.

The upcoming earnings result is a make-or-break moment for the company in my opinion, as they will need to reassure Wall Street about the long-term strategy of the company. In the last three months, the company has already announced cutting CapEx plans, taking massive cost-cutting steps, and the possibility of creating a separate entity for its foundry business. None of these announcements has improved the sentiment towards the stock.

It should be noted that even big tech companies like Alphabet Inc. (GOOG) (GOOGL) and Microsoft Corporation (MSFT) have faced a correction after previous earnings as Wall Street focuses more on the return on investment for the AI initiatives of the company. It is clear that unless Intel can deliver better results, we might not see a change in the bearish sentiment. Investors should avoid Intel stock unless there is greater clarity on the roadmap and some improvement in the key earnings and revenue metrics.

Investor Takeaway

Intel has been one of the worst-performing tech stocks in 2024. There is no clear path of how the company will overcome the challenges. Despite the correction, Intel stock is not significantly cheaper than other peers like AMD and TSM when we look at the EPS estimates for the fiscal year ending Dec 2026. There is also a high possibility that we might see further down revisions in EPS for Intel which can make the valuation multiple expensive.

The company has announced postponing some foundry investments in Germany, Poland, and other countries. However, the short-term CapEx requirement is still going to be quite high. Intel is now lagging behind Nvidia and AMD in the AI race, and it is unclear how much market share and margins Intel would be able to achieve in the AI business as competitors continue to launch new chips. We could see another correction in Intel stock if the company fails to meet the rock-bottom expectation in the upcoming earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.