Summary:

- Meta’s Q3 earnings are very likely to beat market consensus again due to recent developments on the AI front.

- In particular, the advancements in the development of self-taught evaluator AI models have overarching implications.

- They could further reduce human involvement, enhance productivity, and boost margins.

- These catalysts can sustain its ongoing double-compounding mechanism through aggressive share buybacks and strong growth capex investments.

Derick Hudson/iStock Editorial via Getty Images

META stock develops an AI that can review other AI work

My last coverage on Meta Platforms (NASDAQ:META) focused on the development surrounding its Reality Labs. As suggested by its title, “Meta Platforms: Reality Labs Cost Cuts Could Support Breakout (Technical Analysis),” that article analyzed how the cost cuts at its RL can improve its profitability. More specifically, I argued that:

Meta Platforms’ recent plan to cancel its premium headset and restructuring Reality Labs are improving sentiment and profitability prospects. This could catalyze a stock price breakout in the near term. In the longer term, Reality Labs cost cuts should help to expand its profit margins noticeably in the near future (my model points to about 200 basis points expansion).

Since then, another key catalyst has developed to further enhance its margin expansion and growth potential. Meta has recently unveiled a series of new AI models that can evaluate other AIs’ work (more details are quoted below). I consider this as an immediate catalyst to boost Meta’s margins and a game changer in the longer term. I do not use the phrase “game changer” too often, and this is the second time I’ve used it in all my articles (the other time I used to describe the combination of Nvidia’s (NVDA) Blackwell chips and direct liquid cooling). Later in this article, I will elaborate more on my thoughts on this development.

Reuters New York, Oct 18 – Facebook owner Meta said on Friday it was releasing a batch of new AI models from its research division, including a “Self-Taught Evaluator” that may offer a path toward less human involvement in the AI development process… The ability to use AI to evaluate AI reliably offers a glimpse at a possible pathway toward building autonomous AI agents that can learn from their own mistakes, two of the Meta researchers behind the project told Reuters.

Another catalyst is Meta’s upcoming Q3 earnings report. The ER is scheduled next week, on Oct. 30, after market close. Given this background, this article also serves as a preview of its Q3 ER. In the ER, I would certainly look for any additional comments from the management regarding the above AI models. Moreover, I would also pay attention to its margins and its capital allocations.

By my model, I expect the company to report robust cash flow supported by wider margins so it can continue growth capex investments and also its aggressive buyback programs at the same time – a mechanism that I call double compounding. Finally, I also consider its current P/E (of around 27x) to be very reasonable, both in absolute terms and relative terms. As such, I rate the stock as a Buy under conditions, and will now move onto elaborate on my thoughts on its Q3 ER in more detail.

Meta stock: Q3 preview and margin expansion potential

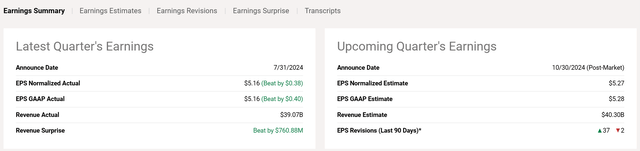

As background, Meta reported strong earnings for its FY Q2 (which was announced on July 31, 2024). The earnings beat analyst expectations for both earnings per share and revenue, as seen in the chart below. To wit, on a normalized basis, Meta’s EPS was $5.16, which surpassed the consensus estimate of $4.78 by $0.38. The company’s revenue reached $39.07 billion, surpassing the consensus by $760.88 million. Looking ahead to the upcoming quarter, analysts expect Meta to maintain its positive momentum. The consensus estimate for EPS is $5.27 and the revenue estimate is $40.308 billion. Notably, in the past quarter, there have been 37 upward revisions to EPS estimates, indicating strong analyst sentiment toward the company’s future performance. I share analysts’ optimism given the continued success of its core platforms, the expansion of its advertising business, and also the cost-cutting efforts, as described in my earlier article.

Seeking Alpha

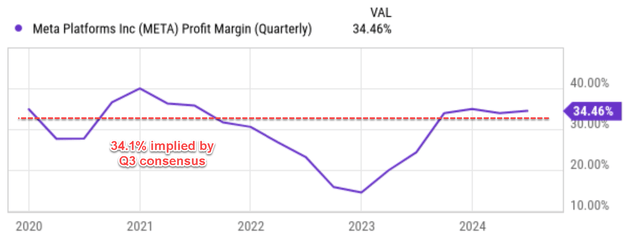

Despite the above upbeat expectation, my view is that the consensus estimates are still underestimating its earnings power. To better contextualize this discussion, the chart below shows Meta’s profit margin in recent years. As seen, its margin has experienced some fluctuations in recent quarters and currently hovers around the 34.46% mark. The consensus estimate mentioned above implies that the third quarter profit margin would shrink a bit to 34.1% (under the assumption that its outstanding share count remain unchanged during the past quarter). I consider a margin compression to be very unlikely given the cost-cutting efforts in the past quarter, and thus anticipate good odds for the company to report earnings that beat consensus projections (again).

Seeking Alpha

Meta stock’s double compounding

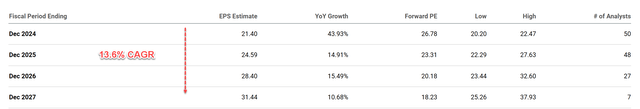

Looking further out, I’m optimistic about the company’s future EPS growth, as reflected in the following consensus estimates. To wit, for FY 2024, analysts predict that Meta’s EPS will reach $21.40, representing a remarkable 43.93% year-over-year growth. This strong growth is expected to continue in the following years, with a projected compound annual growth rate of 13.6% in the next four years.

Seeking Alpha

More importantly, I expect the quality of the earnings to expand too in terms of wider margin due to the cost-cuts efforts mentioned above and the potential of its AI initiatives. For example, the AI evaluator mentioned in the first section has the potential to reduce (or even eliminate) human input in its future AI model training/evaluation, which opens tremendous opportunities for productivity boost and cost savings.

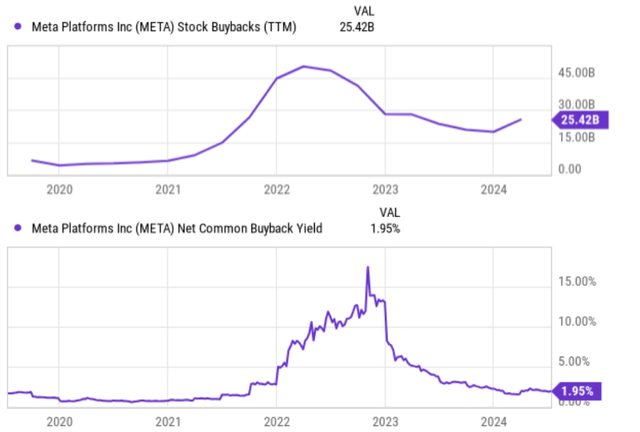

The combination of EPS growth and margin expansion should continue to support what I call the double-compounding mechanism – the combination of EPS growth and aggressive share buybacks. Meta has been a large buyer of its own shares in recent years as you can see from the figures shown below. The pace especially accelerated around 2022. As an example, it spent on average $40 billion in 2022 on share repurchases each quarter. Such repurchase translated into a net common buyback yield of around ~15% given its market cap and stock prices then. Looking ahead, I certainly expect META to keep allocating considerable amounts of capital on this front. As a support for this expectation, Meta recently announced another repurchase program of $50 billion. Given its current market cap of $1.45 trillion as of this writing, this additional program alone represents a 3.4% net common buyback yield already.

Seeking Alpha

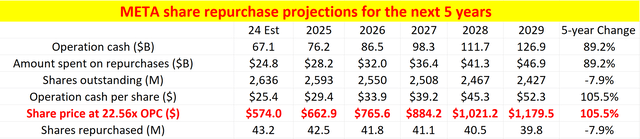

As an illustration of the potency of the double-compounding mechanism, my model below projects the shares repurchased and share prices for the next five years. I’ve applied this model to analyze other stocks, and readers can find detailed description of the model in those articles. Here I will just recap the key assumptions and directly present the end results below:

- I assumed Meta’s operating cash flow (OCF) to grow at a CAGR of 13.6% following the consensus estimates for the next 4 years.

- I assumed Meta to keep spending the same percentage of OCF on share repurchases in the next five years. The percentage I used was 37%, obtained from the amount it spent on repurchases in recent years and its buyback plans announced.

- Finally, I also had to make an assumption about the price at which the future buybacks are made. I assumed the buybacks to be made at 22.56x of its OCF, which is the current multiple.

Using these assumptions, its profit is projected to increase by 89.2% in five years and its share counts to decrease by 7.9%. On a per-share basis, the OCF would increase by 105.5% thanks to the combination of profit growth and a decrease in outstanding share count. Note that 105.5% is noticeably higher than the addition of these effects (89.2% plus 7.9% is about 97% only) simply because of the multiplicative nature (rather than additive nature) of compounding.

Author

META stock: Other risks and final thoughts

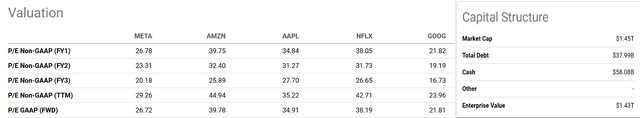

As an additional upside risk, the stock is attractively valued both in absolute terms and relative terms. A FWD P/E of around 27x is very reasonable in absolute terms in my view for such a sector leader with double-digit growth potential. In relative terms, Meta’s P/E ratio of 27 is among the lowest compared to similar peers (e.g., either the FAANG group as shown below or the Mag 7). For example, Amazon (AMZN) trades at 39.75 P/E, Netflix (NFLX) at 38.05, and Apple (AAPL) at 34.84. Also note that Meta has a sizable net cash position on its balance sheet, too. As shown in the next chart too, its total debt is about $38B, but cash is more than $58B. Thus, when adjusted for its cash position, its effective P/E is even lower.

Seeking Alpha

In terms of downside risks, META faces the same macroeconomic risks as other tech firms. A significant economic downturn could lead to reduced advertising spending, which is a major revenue driver for tech companies like META. This could impact their top-line growth and profitability. However, there are some risks that are more specific to Meta given its reliance/dominance on social platforms and ad income. The rise of new social media platforms, such as TikTok, could divert user attention and advertising dollars away from Meta’s platforms, impacting its user growth and revenue. Meta also faces significant data privacy risks and regulatory scrutiny. These risks could lead to higher costs (e.g., in terms of compliance, content moderation, potential fines, etc.).

To close, the thesis of this article is largely twofold. First, I want to comment on the near- and longer-term impact of a recent catalyst, Meta’s development of new AI models that can review other AI models’ work. Second, I want to provide a preview of its upcoming Q3 ER. My conclusion is that its Q3 ER is very likely to beat market consensus again due to these developments. In particular, I think the market underestimates its margin potential. Looking past Q3, I expect the combination of profit growth and margin expansion to keep supporting the double-compounding mechanism and deliver outsized shareholder returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.