Summary:

- Palantir’s Q3 2024 revenue is expected to fall between $697 million and $701 million, indicating roughly 26% year-over-year growth.

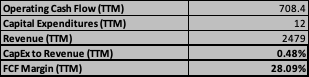

- Free cash flow margins remain solid, and capital expenditures are low due to Palantir’s software-focused business model.

- Palantir’s continued expansion in the commercial sector, especially in healthcare and finance, is crucial for sustaining revenue growth.

- The strongest case against Palantir is its high valuation, which requires sustained 30%+ revenue growth to justify.

- I recommend holding Palantir stock until it demonstrates consistent growth in both revenue and free cash flow to justify its premium valuation.

Anastasiia Shavshyna/E+ via Getty Images

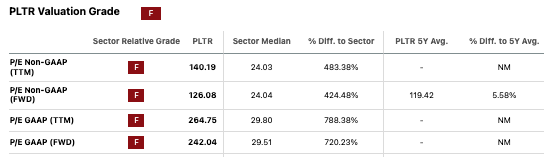

Judging by its underlying metrics, Palantir Technology (NYSE:PLTR) is vastly “overvalued.”

Seeking Alpha

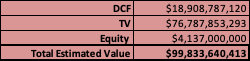

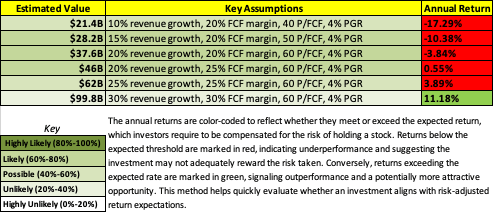

However, this does not say much or provide any insight. Rather, I am more interested in determining what implicit assumptions about Palantir’s future growth and profitability the market currently has. In order to find out, I’ve conducted a discounted cash flow [DCF] analysis on Palantir. This involves (1) projecting free cash flows for 8 years with expected growth rates, (2) estimating the value of all future cash flows beyond year 8 using the terminal growth rate, and (3) discounting both the projected cash flows and the terminal value back to the present value using the discount rate (CAPM). Let’s walk through it.

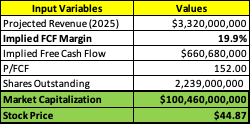

First, let’s look at analyst expectations for Palantir in 2025.

Author

The free cash flow and FCF margin are implied by Palantir’s market capitalization and P/FCF. Judging by historical performance (in the trailing twelve months, Palantir’s FCF margin was 28.09%), these results are probably the bare minimum of what Palantir will achieve next year.

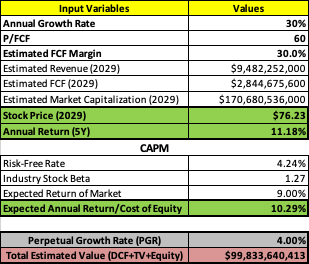

Next, I have to determine what growth rate and FCF margin give us a total estimated value that is similar to Palantir’s current valuation. This reveals the implicit assumptions the market is making about Palantir’s future. From there, readers can determine whether or not they think these expectations are reasonable.

Author

Author

This actually wasn’t difficult to ascertain, because this is what Palantir is nearing (30% revenue growth and FCF margins). From this perspective, Palantir’s valuation does not appear ludicrous. Instead, the mystery surrounds whether or not the company has the goods to deliver such results over an extended period of time. By doing so, Palantir would join very rare company — the likes of Nvidia (NVDA), Tesla (TSLA), Google (GOOGL), Amazon (AMZN), and Meta (META). These companies did not achieve sustained 30%+ revenue growth by mistake; they benefited from significant network effects, scalable business models, international expansion, and entry into new high-growth markets.

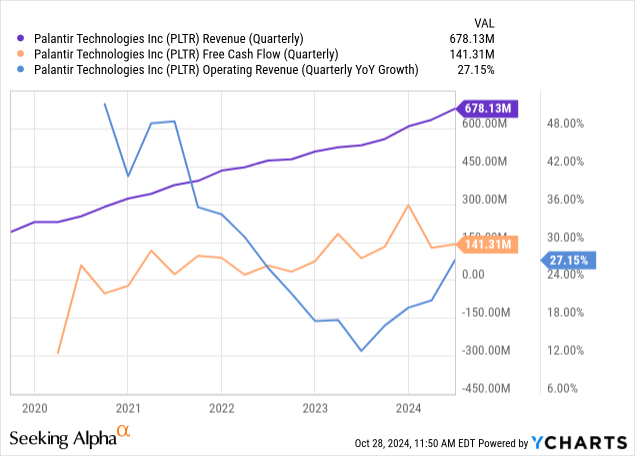

In Q2, Palantir’s $678.13 million in revenue beat by $25.71 million and represented 27.15% YoY growth. The beat was due, in large part, to Palantir’s massive US commercial growth. Recall that Palantir provides data analytics and software platforms to help organizations integrate, analyze, and visualize vast amounts of data. Its government platform, Gotham, is focused on defense and intelligence. As we have seen in the past with applications such as the internet, GPS, drones, and microwaves, technology that was initially used by the government can later be found to be useful in the market. The same appears to be occurring with Palantir’s Foundry, which is intended for commercial enterprises and includes big-name clients like BP, Ferrari, and Merck, spanning many industries (energy, automotive, and pharmaceuticals, respectively). Indeed, Palantir’s US commercial revenue increased 55% year on year. Furthermore, the government continues to find applications for Gotham, with revenues increasing 23% YoY. Cash from operations totaled $144.2 million. Capital expenditures remain low at $2.9 million. This is good for a GAAP FCF margin of 20.8% (Palantir’s “adjusted” FCF margin was 22%). Recall that FCF margin = (operating cash flow – CapEx / revenue) x 100. Palantir’s low CapEx is partially attributed to the nature of their software-centric business and dependency on third-party cloud infrastructures like AWS and Azure.

Palantir is expected to announce Q3 earnings on 11/4 (post-market). The current revenue estimate is $704 million with an EPS of $0.04. This would represent YoY revenue growth of 26.2%. Recall that Palantir guided Q3 revenue between $697 million and $701 million.

Financial Health

As of June 30, Palantir reported $512.659 million in cash and cash equivalents. Marketable securities totaled $3.485 billion. Total current assets were $4.773 billion, while total current liabilities were just $806.919 million. This implies a current ratio well over 2.0, which indicates that the company can readily cover any short-term obligations. The company is without significant long-term debt.

They are profitable and enjoy superior margins.

Author

Here’s a look at some key trends during the past few years:

PLTR Stock: High Expectations, Narrow Path to Outperformance

Now valued over $100 billion, PLTR is priced for significant performance. For PLTR to be a worthwhile investment, it has to outperform its expected annual return (derived from CAPM) of 10.29%. Let’s look at how differences in growth, margins, and valuation metrics impact potential returns.

Author

As you can see, the path to annual returns greater than expected annual returns is likely narrow at this time. Moreover, although close, Palantir has not yet demonstrated an ability to sustain 30% YoY revenue growth and 30% FCF margins. I believe these figures are major inflection points (look at how the EV jumps from $62B to $99.8B). It’s also important to note that stock returns are also dependent on how the market perceives the stock (P/FCF), which is inherently unpredictable and can drastically change at a moment’s notice. It also depends on external factors such as the economy and sector trends, but one can assume PLTR will continue to trade at a premium so long as its revenue growth outpaces the sector median of 6.19%.

Looking ahead to Q3 earnings, Palantir will need to continue to show rapid growth in the commercial segment. Growth in this segment is critical for diversifying its revenue base beyond government contracts and establishing a stronger presence in high-margin industries such as healthcare, energy, and finance, where they presumably have greater pricing power. This expansion is critical for justifying its premium multiples, particularly as competition in the AI and big data analytics space heats up. Competitors in the enterprise AI and analytics space include Snowflake (SNOW) and Databricks, alongside giants like Amazon, IBM, Google, and Microsoft. Notably, companies like Google and Microsoft have the benefit of being more “vertically integrated” than Palantir due to their ownership of cloud infrastructure. This grants them a distinct competitive edge in cost control, scalability, and end-to-end service integration across products. Palantir does have the benefits of network effects (where the system’s effectiveness grows with time and scale), reputation (from dealing with sensitive, high-stakes data problems), and AI expertise to become the next “super company,” and the stock rally could, feasibly, still be in its early stages. However, until the company demonstrates the ability to deliver the growth and margins required to sustain such a lofty valuation, I believe it is best to proceed with caution (“hold”) until, ironically, we have more data available.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.