Summary:

- AT&T’s strong financial performance, driven by growth in mobility and fiber businesses, supports its ability to pay a 5% dividend yield and reduce debt.

- The company is focused on expanding its 5G and fiber portfolios, expecting $2B+ cost savings by mid-2026 and achieving a net debt-to-adjusted EBITDA of 2.5x by 1H 2025.

- Despite competition from T-Mobile, AT&T’s investments in fiber and 5G, along with its manageable debt load, position it for continued shareholder returns.

- The company’s FCF yield is expected to be ~11%, enabling it to comfortably pay dividends, invest in growth, and potentially initiate share buybacks.

jetcityimage

AT&T (NYSE:T) is one of the largest telecommunication companies in the world, with an almost 5% dividend yield, and a market cap of more than $160 billion. The company not only has a strong mobility business, but it also has a growing fiber business and increased FCF. As we discussed in the company’s most recent earnings, its growth remains impressive.

That will enable the company to continue improving its financial position as almost 50% YoY returns, with future returns, reward patient investors.

AT&T Business Priorities

The company is continuing to focus on growth while managing its balance sheet effectively.

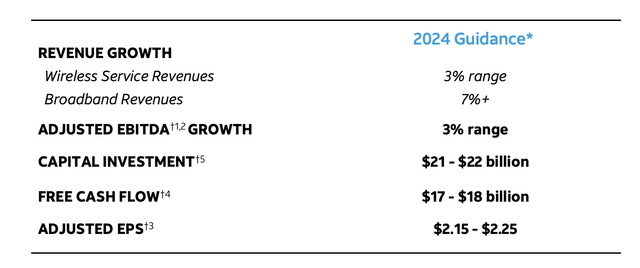

To start, the company is focused on growing both its 5G and fiber portfolios. The company sees numerous expansion opportunities here and, given its hefty 5G spectrum investments, should be able to back up capital expenditures here. The company is expecting to achieve $2B+ cost savings by mid-2026, and the company has recently spun off less profitable divisions.

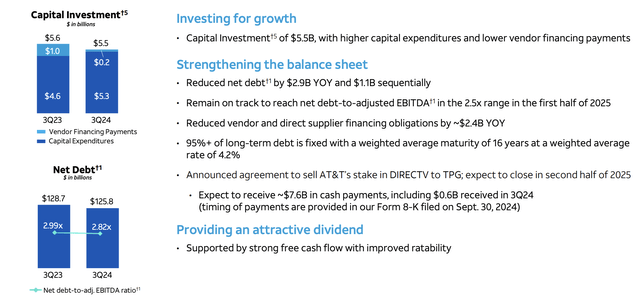

The company is balancing its very hefty capital investments, especially in regard to fiber. The company expects to achieve its net debt-to-adjusted EBITDA of 2.5x in 1H 2025 and continue providing its 5% dividend and FCF.

AT&T Performance

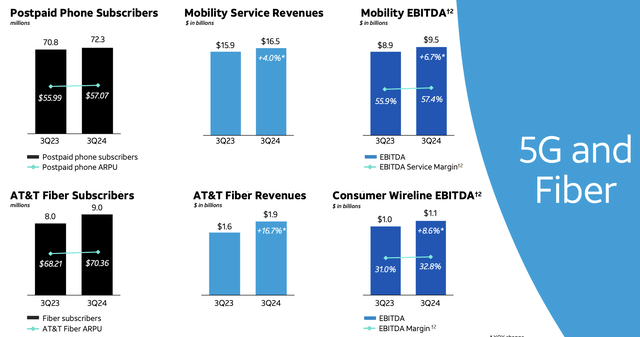

The company saw strong growth across its operating segments.

Specifically, the company saw a 2% growth in prepaid phone ARPU and roughly 1.5 million subscribers added YoY. At the same time, the company managed almost 17% fiber revenue growth as well through 1 million additional subscribers, showing the benefits of the company’s lofty investments here. Overall, strong performance here helped the company’s financials.

The company’s weakest segment remains Business Wireline, but that also remains a minor segment for the company.

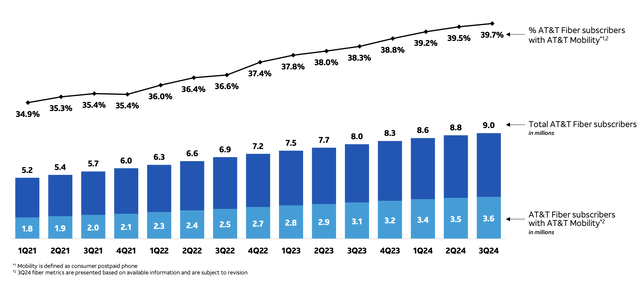

AT&T Fiber Growth

Looking at the company’s core fiber business, not only has the company seen substantial growth, but it has also seen increased synergies.

The company gained 1 million new fiber subscribers YoY with 0.5 million new mobility subscribers also with fiber. That’s a 50% YoY ratio, which pushed the company’s total % of AT&T fiber subscribers with AT&T mobility to almost 40%. That’s almost a 2% improvement in that ratio YoY. That improvement will enable the company to maximize revenue from customers and therefore returns.

The company is investing billions in fiber, which will help future returns.

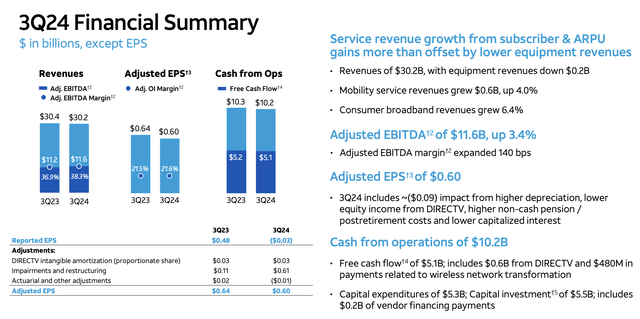

AT&T Financial Performance

The company is continuing to generate strong financial results.

The company saw a slight decline in revenue caused by weakness in its Business Wireline segment, though it’s one of the company’s least important. The company managed to improve EBITDA margins by >1%, improving adjusted EBITDA from $11.2 billion to $11.6 billion. The company’s EPS declined some, but it still trades at a single-digit P/E.

That shows the company’s financial strength but also the impact of the company’s debt load. The company’s $125 billion in net debt costs it ~$5.3 billion in annual interest expenditures. However, it’s a comfortably manageable debt load financially. The company has continued to invest heavily in its business with $5.1 billion in FCF, annualized at more than $20 billion.

That $0.6 billion in DirecTV shows how the declining business is still a cash cow, generating >$2 billion FCF next year.

Among the company’s investments are massive capital expenditures of more than $20 billion annualized. Fiber expansions are expensive, while it’s tough to know the exact costs, the company has been adding 3-4 million locations a year. The company was recently awarded $30 million to expand fiber to 7500 California locations, implying several thousand $ / location.

That means billions in annual capex for the company’s capital expenditures alone. The company managed to reduce net debt by $2.9 billion YoY as it works towards its 2.5x target. The company’s long-term debt is 95+% fixed at a 4.2% rate, with a 16-year duration. That makes the debt comfortably manageable, despite market fears of the $ value.

The company could earn a higher return by putting cash in a savings bank versus paying back debt. The company is exiting its remaining DirecTV stake for $7.6 billion, a close to an expensive acquisition, which will cost it $2 billion in annual future FCF, a near-term impact. It will help clean up the company’s portfolio and prior mistakes.

The company’s cash flow and continued FCF will enable long-term shareholder returns.

At the end of the day, the company’s capital investments are comfortably affordable and drive strong returns. The company is seeing growth, especially in adjusted EBITDA, and its adjusted EPS comes in right at the threshold of a single-digit P/E. The company expects its FCF yield to come in at ~11%.

The company can pay its 5% dividend yield comfortably, continue to invest in its business, and drive overall shareholder returns through debt reductions. We’d like to see the company initiate and ramp up share buybacks.

Thesis Risk

The largest risk to our thesis is that AT&T is now facing a much stronger competitor in T-Mobile US (TMUS) versus T-Mobile and Spring being individually weaker. T-Mobile already has an incredibly strong 5G portfolio, which the company has had to spend to catch up on. That could hurt the company’s ability to drive future returns as competition heats up.

Conclusion

AT&T has had strong financial performance over the past year as the company has remained committed to its core business. The company has seen growth in its mobility business along with its fiber business, where the company is investing manually. That’s translating to the company’s bottom line financials at the end of the day.

The company does face risks from competition from strong competitors such as T-Mobile. However, it can comfortably afford to continue paying its 5% dividend yield and drive overall shareholder returns. With its debt at target in 1H 2025, it can drive additional shareholder returns. Overall, that makes AT&T a valuable investment right now, despite its run-up.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.