Summary:

- Taiwan Semiconductor is positioned very well to benefit from the continuing adaption of AI.

- Even when considering a growth rate of 25% p.a. in TSM’s biggest segment, the company still seems expensive.

- I think that TSMC has currently run too hot due to AI “euphoria” and currently rate the company a Sell.

BING-JHEN HONG

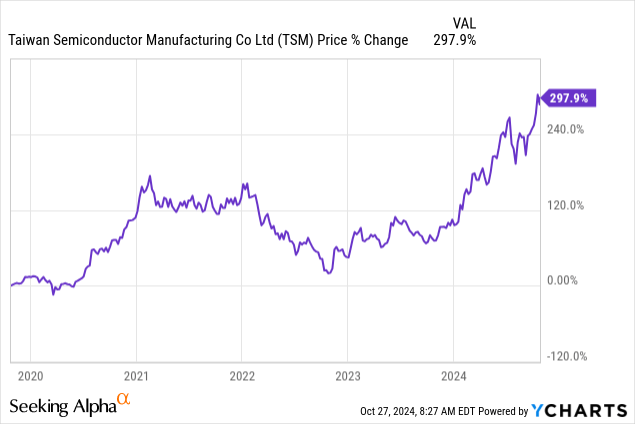

Taiwan Semiconductor’s (NYSE:TSM; OTC:TSMWF) stock has performed phenomenally due to the current AI hype in the market, as the company is positioned to highly benefit from the continuing adaption of AI.

In this article, we will look at the different business segments that TSM is currently supplying, to assume a suitable growth rate for each customer segment and eventually evaluate the company using a Discounted Cash Flow Analysis and the three scenarios Bear-, Base- and Bull-Case.

Growth Prospects

Every business area that TSMC serves has different semiconductor requirements:

-

High-Performance Computing (HPC): For the production of cutting-edge chips that power data centers, supercomputers, AI applications, and gaming platforms, TSMC’s HPC sector is essential. High computing power, energy efficiency, and sophisticated node technologies (such as 5nm and 3nm) are necessary for these processors. Several cloud service providers, AMD (AMD), and NVIDIA (NVDA) are among the major clients. More here.

-

Smartphone: One of TSMC’s biggest markets is smartphones, where it manufactures chipsets for mobile devices made by firms like Apple and Qualcomm. Because of TSMC’s experience with cutting-edge nodes like 5nm, smartphone processors can operate at fast speeds while using little power, which is essential for mobile devices.

-

Internet of Things (IOT): For Internet of Things applications where low-power consumption is essential, TSMC produces energy-efficient processors. This market comprises wearables, sensors, and smart home appliances that must be durable and connected. IoT chips frequently have nodes like 22nm, 28nm, and specialist processes.

-

Automotive: The automotive division of TSMC is primarily focused on semiconductors for in-car entertainment systems, electric vehicle (EV) power management, and advanced driver-assistance systems (ADAS). Chips for automotive applications need to be strong, durable, and highly reliable. With specialized technologies like 16nm and 28nm, TSMC satisfies these expectations. It is also growing to suit the car industry’s increased safety and automation needs.

-

Digital Consumer Electronics (DCE): For digital consumer goods where cost and performance balance are crucial, such as TVs, game consoles, and smart appliances, TSMC supplies chips. For high-volume consumer markets, this category frequently employs established technological nodes like 28nm to 65nm, striking a balance between price and capabilities.

By focusing on these areas, TSMC can meet the various demands of the semiconductor industry while also making R&D investments to expand its capabilities for high-demand applications.

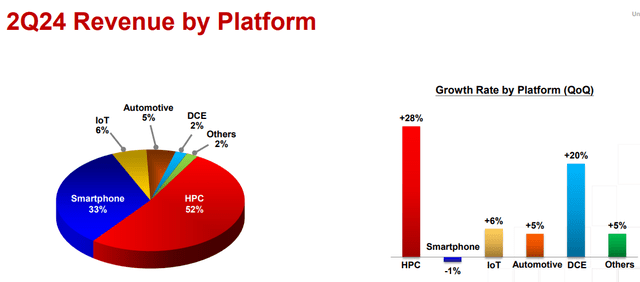

Their revenue was distributed in their latest earnings like follows:

TSMC revenue by platform (investor.tsmc.com)

We will now assume growth rates for each of the segments.

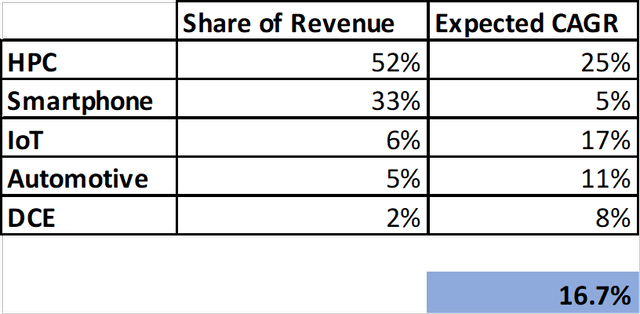

High-Performance Computing (HPC)

Like mentioned above, this segment supplies chips for data centers, supercomputers and AI applications. The data center is expected to growth between 9.6% and 11.4% p.a. in the next several years. The AI market, on the other hand, is expected by experts to grow at rates between 20.4% and 36% p.a., with this in mind and assuming that most of this segment will grow like the AI market, a aggressive growth rate of 25% p.a. seems reasonable to assume.

Smartphone

The smartphone market is expected to achieve growth rates of 3.5% to 7.3% p.a. until 2029. The average of these assumptions is a CAGR of 5.4% p.a.

Internet of Things

For the IoT segment, experts are assuming a growth rates between 11.4% and 24.3% p.a., meaning the average of 17% p.a. seems suitable for our following analysis.

Automotive

The automotive semiconductor market has projected growth rates between 8.1% and 11.1% p.a. With this in mind, a growth rate of 9.6% seems like a good assumption for this segment.

Digital Consumer Electronics (DCE)

For the DCE segment, experts assume growth rates between 2.9% and 13.2% p.a., giving us an average of 8% p.a.

With weighing the different business segments according to the revenue share of the latest quarter, we get an anticipated revenue CAGR of 16.7% p.a. for the whole business of TSMC.

TSMC’s Growth Prospects (own assumptions)

With this we can now anticipate different growth rates for the Bear-, Base- and Bull-Case scenario.

Bear: 13.4% p.a. / -20%

Base: 16.7% p.a.

Bull: 22% p.a. / +30%

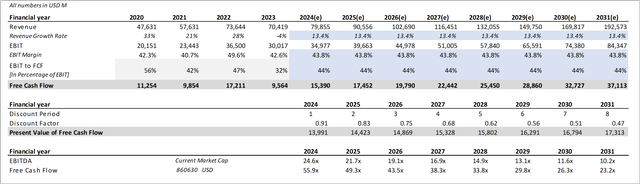

Discounted Cash Flow Analysis

- EBIT Margin: Here I took the metrics of the last four years and averaged them out, to get a EBIT margin of 43.8%.

- Free Cash Flow: I once again took the EBIT to FCF metrics of the last few years to then average them out and use a EBIT to FCF conversion rate of 44% in the analysis.

- WACC: Here I used 9%, which is right around TSM’s current WACC.

- Perpetuity Growth Rate: For the perpetuity growth rate, I used a conservative 3.5%.

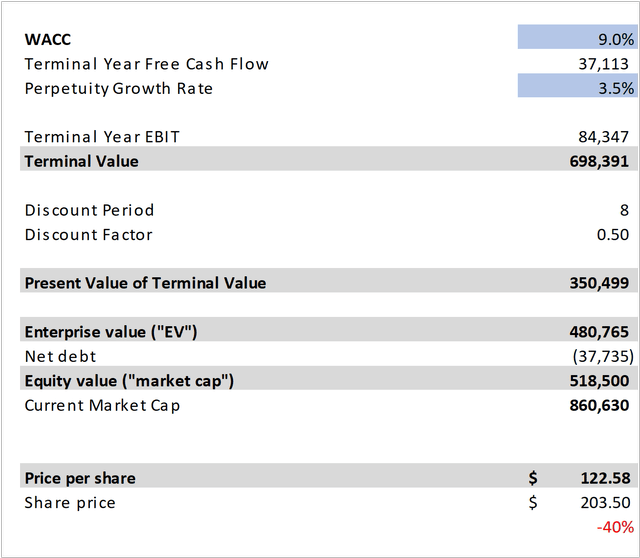

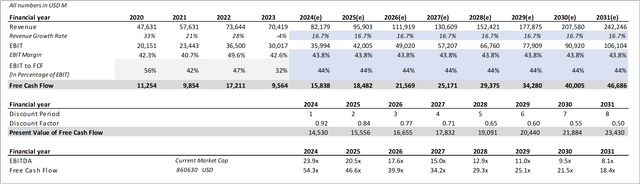

Bear-Case

TSM Discounted Cash Flow Analysis Bear-Case I (own assumptions)

TSM Discounted Cash Flow Analysis Bear-Case II (own assumptions)

Within our Bear-Case we get a fair value share price of $122, indicating that the company might be overvalued by 40%. This however, factors in growth rates lower than the markets that are supplied by TSM.

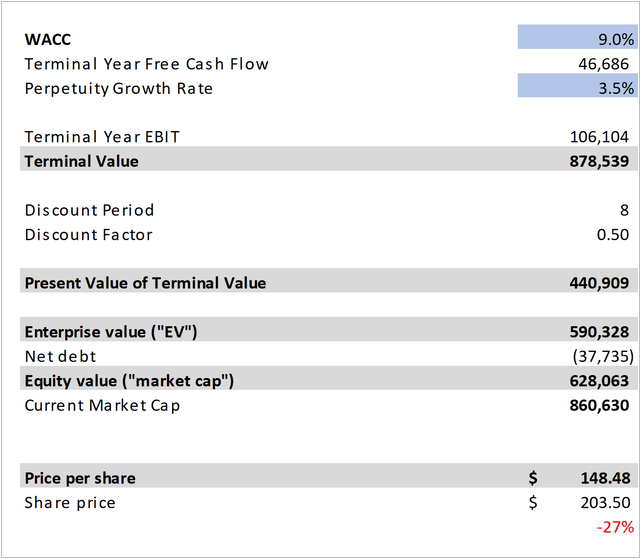

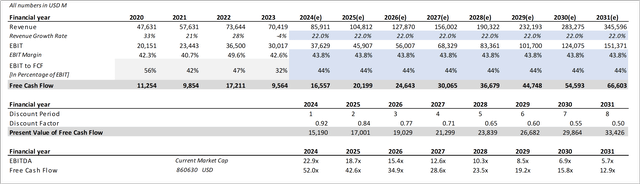

Base-Case

TSM Discounted Cash Flow Analysis Base-Case I (own assumptions)

TSM Discounted Cash Flow Analysis Base-Case II (own assumptions)

For the Base-Case, we get a fair value share price estimate of $148, indicating that the company could be overvalued by 27%. For reference the 5y revenue CAGR of TSM is at 20.5% and the 10y CAGR is right around 14.5%. Meaning that our assumptions are also right in the middle of historical growth rates.

Bull-Case

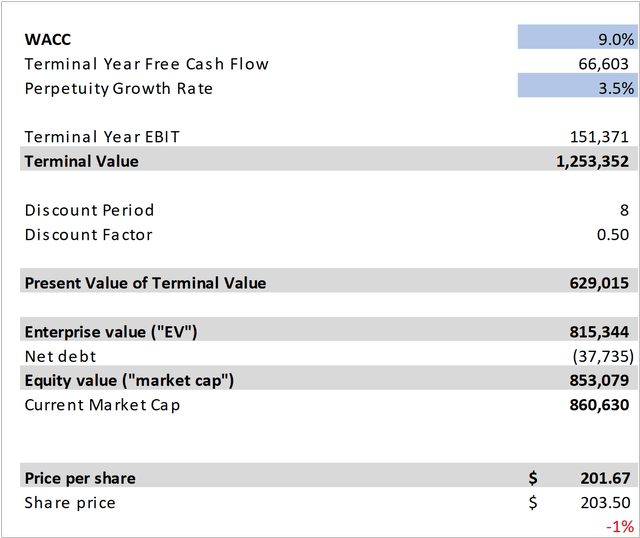

TSM Discounted Cash Flow Analysis Bull-Case I (own assumptions)

TSM Discounted Cash Flow Analysis Bull-Case II (own assumptions)

For our Bull-Case, we get a fair value estimate of $201, which translates into a potential overvaluation of 1%. This is, however, calculated with growth rates 30% higher than the underlying market rates of TSM’s customers.

Conclusion

Within our analysis, we get the following mis-valuation:

Bear: $122 / 40% overvaluation

Base: $148 / 27% overvaluation

Bull: $201 / 1% overvaluation

Despite being the industry leader, TSM’s FCF conversion rate is pretty low, mostly as a result of its significant capital expenditures (CAPEX) and continuous technological advancements. In order to create the newest process nodes (such as 3nm, 2nm, and beyond), TSM must continuously invest billions on state-of-the-art manufacturing capabilities and research. Although this investment puts short-term pressure on the current free cash flow conversion, it puts TSM in a position to maintain its advantage and increase its market share as demand for cutting-edge semiconductors rises across important sectors. The current FCF conversion, however, in my opinion, currently doesn’t match with the dominant market position of TSM, resulting in lower valuations in our DCF analysis.

Given that investors see TSM as a vital supplier to the data processing and artificial intelligence sectors, the market’s confidence over AI-driven development has greatly increased the company’s stock price. This development, paired with the CAPEX intensive research and development in the semiconductor industry, lead to an overvaluation of TSM, when looking at the generated Free Cash Flow. The valuation appears to be very concerning when considering that even anticipated growth rates 30% higher than the expected rates of TSM’s target markets for the next eight years still mean no undervaluation.

As a result, even though TSM has a very bright future and ideal market position, I think that TSMC has currently run too hot due to AI “euphoria”, which is why I currently rate the company a Sell. I am nevertheless waiting for a better opportunity to re-enter this very high-quality stock.

What’s Your Perspective? Let’s Discuss!

Thank you for reading my analysis! I’d love to hear your ideas and points of view – whether you agree, disagree, or have your own take on the stock. Let’s start a discussion in the comments! I welcome any helpful arguments and ideas that can help us better comprehend this topic. Thanks!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.