Summary:

- JPMorgan beat estimates easily with its Q4 report.

- The company is well-positioned to benefit from a rising rates environment.

- Profits are pretty strong and the valuation is far from high.

subman

Article Thesis

JPMorgan Chase & Co. (NYSE:JPM) announced Q4 results that were a lot better than expected. Profitability is strong thanks to rising interest rates, which was enough to offset headwinds from lower investment banking activity. Overall, the results show that the bank is doing well in the current environment. Since JPMorgan is trading at a pretty inexpensive valuation, JPM shares look attractive.

What Happened?

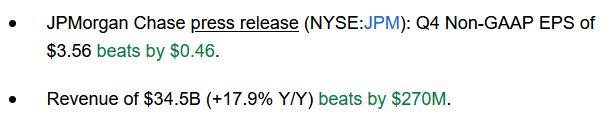

JPMorgan Chase reported its fourth-quarter earnings results on Friday morning. The following snapshot shows its head and bottom line performance:

Seeking Alpha

A double beat is always great, of course. In this case, revenue was up by almost 18%, which was marginally ahead of what the analyst community had predicted. Looking at JPMorgan’s bottom line, the earnings beat was much more pronounced — JPM beat estimates by a hefty 15%. This was JPMorgan’s largest earnings beat since Q3 2021, when the bank beat estimates by an even wider $0.55.

Initially, shares climbed immediately following the earnings release, but they are currently trading down by around 3% (at the time of writing).

JPMorgan Benefits From Rising Interest Rates

An 18% revenue increase is quite a feat for a diversified bank that is as large as JPMorgan. Of course, business performance wasn’t even across all of its units, as some did better than others.

Not surprisingly, lower deal activity resulted in lower investment banking fees, although JPMorgan remained the world’s largest investment bank, thanks to a global wallet share of 8% for the quarter. Rising interest rates have made companies more reluctant to pursue inorganic growth, and harsh and volatile equity markets have made non-publicly-traded companies reconsider whether an IPO makes sense. This is why JPMorgan’s revenues in the equity side of the Corporate & Investment Banking division were down slightly compared to the previous year’s quarter. In the Commercial Banking division, the hit to JPM’s investment banking business was more pronounced, as the company generated just $700 million in revenue, which was down a little more than 50% compared to one year earlier.

In the Asset and Wealth Management business unit, revenues were surprisingly up slightly from one year ago, rising by 3% to $4.6 billion. This was possible despite the fact that equity markets and also bond prices pulled back over that time frame, which hurt JPM’s assets under management. Assets under management (“AuM”) declined by 11% to a still hefty $2.8 trillion, but JPM was able to demand a higher average deposit margin, which is why its revenue and profit still grew marginally.

Of course, the biggest positive contributor to JPMorgan Chase’s strong top-line performance was its Consumer & Community Banking division. Revenues rose by a highly attractive 29% for that unit, driven by a 56% increase in the revenues of the subunit Banking & Wealth Management. JPMorgan explains that a higher deposit margin was the deciding factor for that. When interest rates rise, that generally impacts both the rates that a bank can demand when lending money, as well as the rates banks have to pay when they borrow money. But the impact is not even across these two. In a rising rates environment, banks increase the rates they demand when they lend money at a faster rate compared to the rates they offer when they borrow money, which is why their net interest margin expands.

Expanding net interest margins have a huge effect on net interest income, which is a primary source of revenue for most banks, including JPMorgan Chase. During the fourth quarter, overall net interest income across all units rose by a hefty 48% year-over-year thanks to the massive increase in interest rates we have seen over the last year, as the Fed was forced to tighten considerably in order to reign in record-high inflation rates.

Growth in JPM’s loan book benefitted net interest income as well, although to a lesser degree compared to the net interest margin expansion the bank experienced during the period. Firmwide, loans rose by 6% compared to one year earlier, which is still a very solid performance, with most of that loan growth being driven by the Commercial Banking unit, where loans rose by an attractive 14% year-over-year.

Overall, business momentum was encouraging. While headwinds for the investment banking business were expected, portions of that still did well, such as the Fixed Income Markets business, which generated revenue growth of 7%. And JPMorgan clearly benefits a lot from the massive increase in interest rates we have experienced over the last year, as this boosted its net interest margin and net interest income dramatically, which is why JPM was able to report the highest revenues it had ever recorded for the period.

Profitability Remains Strong And Shares Are Inexpensive

On the revenue side, JPMorgan has thus been doing well. Looking at the expense side, we unsurprisingly see that credit costs increased. During the pandemic, thanks to massive fiscal and monetary stimulus, credit default rates were pretty low. An increase in credit costs thus had to be expected, no matter what. On top of that, it looks like the U.S. and some other markets will be experiencing an economic slowdown, which is why JPMorgan has increased its provisioning — other banks will do the same. Overall, JPMorgan has built its reserves up by $1.4 billion during the fourth quarter on a net basis, which, combined with $900 million in net charge-offs, resulted in a credit cost of $2.3 billion. That was up from the lows seen during the pandemic, but is far from dramatic or worrisome, I believe.

One year ago, there was a reserve release, which is why credit costs were negative during that period. The reversal to a more normal level of credit costs hurt profitability, but the strong net interest income performance more than offset this headwind. This is why JPMorgan was able to grow its net profit year-over-year, despite higher credit costs and the headwinds experienced by the investment banking business. Overall, net income was up 6% year-over-year, with earnings per share rising by 7% thanks to a marginally lower share count.

7% earnings per share growth is very solid in absolute terms, but not outstanding. Of course, whether that makes for an attractive investment or not depends on a stock’s valuation to a large degree. If a company like Amazon (AMZN), trading at a high valuation, were to report earnings growth of 7%, that would be far from compelling. But JPM is trading at a pretty low valuation today. When we annualize the Q4 profit, we get to a $14.24 estimate. Relative to the current share price, that makes for an earnings multiple of just 9.8, which equates to an earnings yield of slightly more than 10%.

Analyst estimates for 2023 are a little more conservative, as the Wall Street community currently expects that JPMorgan Chase & Co. will earn $12.80 per share this year. If that holds true, the earnings multiple is still rather low, at 10.9. Since analysts have a history of underestimating JPM’s profitability — once again visible in the most recent report — I do believe that there is a good chance that actual results will come in ahead of what analysts are predicting today. It looks like the analyst community had been underestimating the positive impact of higher rates on JPM’s profitability. Since this tailwind should persist through 2023, I would not be surprised to see JPM beat estimates this year again, as it has routinely done in the past.

Takeaway

But even when we assume that current estimates won’t be beaten, JPMorgan Chase & Co. stock seems attractively priced. JPM currently offers a dividend yield of 2.9% and trades at less than 11x (potentially understated) forward profits, making it look like a good value in this environment. The fact that JPMorgan Chase & Co. benefits from rising interest rates, unlike many other companies, is another positive fact for investors to consider.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!