Summary:

- Google faces uncertainties in its core search business due to LLM tools and regulatory challenges, but remains a buy due to its current valuation.

- Despite potential disruptions from AI assistants, Google Search’s revenue is expected to maintain momentum in the short term.

- Alphabet’s diverse revenue streams, including YouTube and Waymo, provide additional growth opportunities and mitigate risks associated with its core business.

- Google’s stock is undervalued with a forward P/E of 20.6x, offering an attractive entry point for long-term investors.

vzphotos

I usually tend to be skeptical and when there is a relevant point in the thesis where there is great uncertainty, I prefer to wait for the earnings and see how management will deal with it, clarify the information and so on.

Google (NASDAQ:GOOGL, NASDAQ:GOOG), has some relevant uncertainties for the medium and long-term thesis. The most relevant, in my opinion, is whether LLM tools will really change the trending of search – its main business – or whether they will be something that will coexist with the possibility of a high CAGR in the coming years for both.

Not only that, the regulation of Google is also relevant, for example, when we think about the case with the DoJ.

In any case, it remains undeniable that Alphabet is an excellent company and that at current prices, it has a considerable chance of generating an attractive return for shareholders. This, together with options and a good track record of execution, makes me give Google stock a buy rating even before I see the earnings.

Addressing Growth Uncertainty in Google Search

In Q2 earnings, Google Search accounted for around 57% of Alphabet’s total revenue. But even though this segment showed a growth of almost 14%, it is still one of the points of doubt in the thesis. This dependence on Google Search puts a question mark on the perpetuation of good results, mainly due to LLMs.

There is some doubt as to whether tools like Google will still be the main search method. If it becomes as popular as it’s heading to be, with GPT Chat on iPhones and so on, it’s possible that instead of opening the browser to ask a question, make a reservation at a restaurant, find the nearest supermarket and so on, people will do it directly from their AI assistant. Additionally, there are trends with new tools such as TikTok gaining traction as a search engine.

It gets worse when Gemini is nowhere near as large a market share as ChatGPT and ends up losing out to Microsoft’s (MSFT) Copilot.

What I mean by this is that, both as an analyst and as a long-term investor, it’s important to have a good level of confidence that the company will continue to be able to grow its revenue at sustainable rates. Even though this is an important risk for the thesis, it seems to me that search tools are still far from being disruptive, and the most likely scenario is that the two business models will coexist, more importantly, that at least in the short and medium term this revenue should maintain an interesting momentum.

For the long term, the important thing will be for Google to find an alternative to keep this monetization at high levels. Whether it’s with its initiatives that incorporate AI into search, or with partnerships to advance Gemini’s market share and ultimately also monetize it to make up for any decline in the growth of its core business.

Exploring Alphabet’s Cash-Generating Optionalities

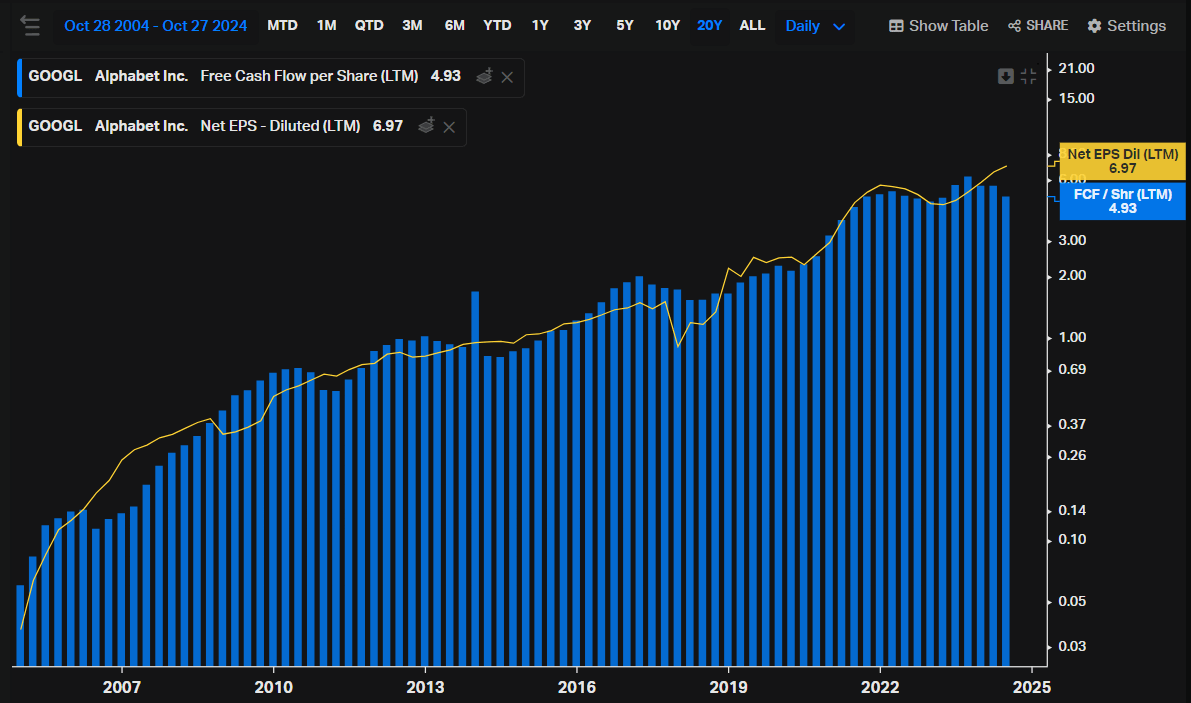

There are some factors that mitigate this risk. When you buy Alphabet stock, you’re buying an incredible company that generates a lot of cash. You can measure the quality of the company using various indicators, but among the most important are EPS and Free Cash Flow per share. Both have shown a remarkable evolution in recent decades, illustrating the excellent value creation for the shareholder and also showing us the high conversion rate.

Koyfin

Over the years, despite Google’s extensive cemetery, the company’s capital allocation is another highlight of the thesis. The fact that many projects have failed and been discontinued is a reflection of a company that tries a lot of new things all the time, and when they don’t yield the expected return, they are discontinued. The various projects initiated by Google provide an interesting perspective and show the intention to innovate.

The acquisition of YouTube in 2006 is one of the main examples of how an M&A can generate value. The deal was for $1.6 bn, and today YouTube generates revenue of more than $8.6 bn per quarter. This revenue line is also showing very interesting momentum, having grown 13% YoY in the last quarter. Given the initiatives to ban Adblock, the importance of YouTube as entertainment and streaming, and YouTube Music, I think this is a trend that could last for a few more quarters.

Even though the overwhelming majority will never become YouTube, other optionalities are quite interesting and could eventually improve the thesis. Waymo is one of them, a self-driving vehicle initiative similar to Tesla’s Cybercabs (TSLA), which recently received funding of $5.6 bn.

These ways of complementing revenue, whether by thinking about cross-selling, YouTube possibilities, Waymo, Android, Cloud, AI monetization, and the like, end up being part of the thesis and collaborating with better prospects for long-term revenue.

Google Stock Is Undervalued

Google stock’s forward price-to-earnings is 20.6x, equivalent to an earnings yield of just under 5%. I find this multiple attractive for a few reasons. The first is that a 5% yield for a company that is still expected to maintain close to double-digit EPS growth over the next few years is quite interesting, especially considering the quality of the company.

The second is that this multiple differs both from the company’s own history, whose mean over the last 10 years is 23.7x and median 22.9x, and from the Nasdaq (QQQ) average, which is above 27x. This suggests that if the risk narrative changes for Google, we could see an expansion/return of these multiples.

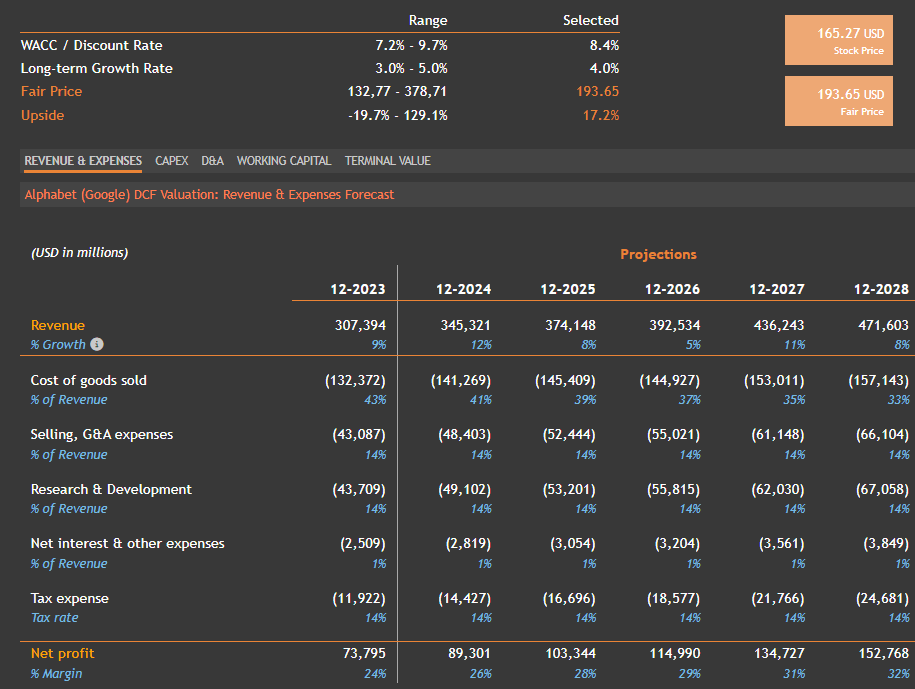

With reasonable assumptions on a DCF, it’s also possible to find an interesting upside for Google. Considering that the company will continue to grow at a rate close to the double-digit of the top line and expand its margin through efficiency gains and the like, discounting at a rate of 8.4% and considering a low long-term growth rate (for a technology company) of 4%, there is still an upside of 17%, considering the fair price of $193 for GOOGL stocks.

valueinvesting.io

For these reasons, I believe that although there are relevant risks to Google’s thesis, these should be monitored, but they do not justify the stock being traded at such a discount to its fair price and the multiple of the market average.

What Market Expects From Q3 and What to Look for.

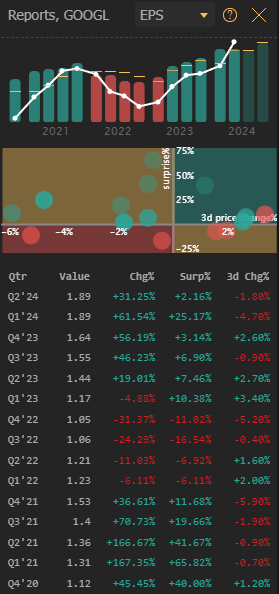

The market consensus estimates revenue of $86.4 bn for Q3, which represents YoY growth of just under 13%, an EPS of $1.85 against $1.55 for Q3 2023. I like these figures a lot, since even considering the drop in EPS compared to Q2, it’s still an interesting level and represents YoY growth of 19%.

In the last few quarters, it was possible to see that even with a positive surprise in EPS, there was still a downturn in the stock. This is because although EPS is one of the main indicators of value creation, it is not always the most important.

TrendSpider

In my opinion, factors such as the company’s medium and long-term plans related to the stability of Google Search, as well as its plans for AI monetization, matter even more than the beat or miss EPS itself. Not only that, but other news that could further clarify the thesis, such as regulation, prospects for YouTube, and the like, are of great value and could be covered in the earnings call.

The Bottom Line

Although it is more prudent to wait for the Q3 earnings to initiate a position or add more Google stocks, this also comes with a risk that with greater clarity and/or earnings beats, the valuation will become a little worse. Of course, the opposite is also true, but the current price is already attractive enough for a buy rating, especially if added to the other factors mentioned, such as optionalities, company quality, and the like, making it a solid option for the long-term investor.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOGL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.