Wolterk

Boeing’s (NYSE:BA) stock fell 2.6% in premarket trading Tuesday after the aviation giant said it will raise about $21 billion through public offerings of common stock and depositary shares, more than the $19 billion initially targeted. The share sale comes as Boeing (BA) grapples with several crises including a labor strike.

The deal was expanded to 112.5 million shares of common stock, up from 90 million announced Monday, and $5 billion of depositary shares that each represent one-twentieth of a share in newly issued convertible preferred stock.

The stock offering priced at $143 a share to raise $15.81 billion and the depositary stock offering raised $4.9 billion.

Boeing (BA) will use the proceeds for general corporate purposes. Analysts expect the company to roll over debt that’s coming due in 2025 while also funding operations until it can resume plane deliveries when the strike ends. The company has more than $57 billion of outstanding debt.

The company’s share sale comes as Boeing (BA) works to overcome major issues. More than 32,000 machinists went on strike on September 13, demanding higher pay and expanded benefits. Management has said layoffs may be necessary to preserve cash. The company may sell its storied space business to raise money, The Wall Street Journal reported last week.

A key priority with Boeing’s (BA) financing plans is maintaining an investment-grade rating. A downgrade to junk status would raise the company’s borrowing costs and limit the number of investors that buy corporate bonds.

Boeing (BA) last week reported a $6 billion loss for the third quarter and said it had burned through $2 billion of cash. The company surprised investors with an announcement that it expected to be burn cash through the next three quarters.

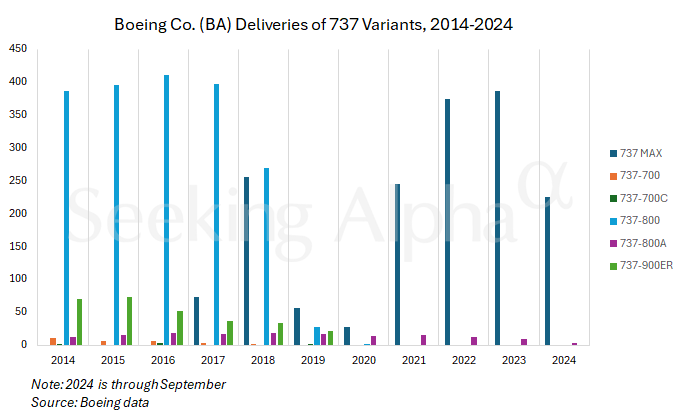

Aside from the labor dispute, Boeing (BA) is grappling with the aftermath of a midflight incident in January, when a 737 Max’s door panel blew out from an Alaska Airlines flight carrying 177 passengers and crew. The Federal Aviation Administration capped Boeing’s (BA) production of the best-selling plane until it is satisfied that the company has implemented quality and safety controls on its assembly lines.

“It will take time to return Boeing (BA) to its former legacy, but with the right focus and culture, we can be an iconic company and aerospace leader once again,” new Chief Executive Kelly Ortberg said in prepared remarks as Boeing (BA) announced third-quarter results.

Boeing (BA) on Tuesday expanded the over-allotment offering to underwriters to 16.9 million additional shares of common stock, up from 13.5 million initially. Underwriters can buy an additional $750 million of depositary shares to cover over-allotments, which may raise another $3.2 billion if exercised.