Summary:

- AT&T investors have gained more confidence lately, helping the stock to outperform the S&P 500.

- AT&T’s wireless and fixed broadband convergence leadership has spurred its valuation re-rating, lifting its outperformance.

- As T’s valuation bifurcation relative to its sector median narrowed, its buying momentum could face an unanticipated pullback.

- Investors must remain cautious as T undergoes a consolidation, as investors are likely assessing its growth prospects.

- I argue why AT&T investors should remain patient and avoid being latecomers to its party.

jetcityimage

AT&T: Investors Likely Bullish On Its Convergence Strategy

AT&T Inc. (NYSE:T) investors have continued to ride the stock’s incredible recovery since T bottomed in July 2023. As a result, T has managed to hold on to its gains as investors are likely more assured of its market share positioning, notwithstanding prevailing consumer spending challenges in the economy. T has also outperformed the S&P 500 (SPX) (SPY) since my previous update, validating its “A-” momentum grade. As a result, it seems like the market has not been unduly concerned with its lackluster near-term growth prospects, even as it aims to gain market share through the 5G and fiber convergence opportunities.

In my previous AT&T article, I discussed why investors must remain cautious, notwithstanding its remarkable outperformance. Although T’s valuations appear reasonable, investors must consider whether the anticipated iPhone upgrade cycle could renew Wall Street’s optimism about its growth prospects.

AT&T: Focus Could Shift To Apple’s iPhone Upgrade Cycle

In AT&T’s Q3 earnings release, management urged caution over a significant Apple Inc.’s Intelligence-driven (AAPL) upgrade cycle, given the uncertainties. Recent reports corroborate management’s circumspection and suggest the market could remain in a wait-and-see posture. Moreover, the CQ4 has typically been a seasonally strong quarter for AAPL, potentially heightening the execution risks. Wall Street’s optimism on AAPL as it remains close to its all-time highs suggests investors have likely reflected a robust Q4 guidance when Apple reports its upcoming earnings release this week.

Despite that, a less intense promotional campaign may not necessarily be unfavorable for AT&T, potentially underpinning its FY2024 guidance. Wall Street’s earnings estimates on AT&T have mostly been upgraded, bolstering my thesis. Consequently, I assess that the company is well-positioned in the increasingly favorable convergence opportunity, as its 5G and fiber adoption nearly reached the 40% mark in Q3. Hence, it’s expected to help mitigate the performance decline in its legacy business wireless segment, which saw its adjusted EBITDA fall 20% in Q3. Hence, the focus on transitioning its business segment to wireless strategies is expected to become increasingly crucial, in line with its convergence blueprint.

AT&T has maintained a robust 403K postpaid net adds in Q3, bolstering the momentum in its consumer business. I assess that its convergence strategy should help underpin a less worrisome churn rate, which aligns with the company’s observation. Hence, the company seems well-primed to leverage strategic growth opportunities to drive its coverage outside its existing footprint, broadening market access.

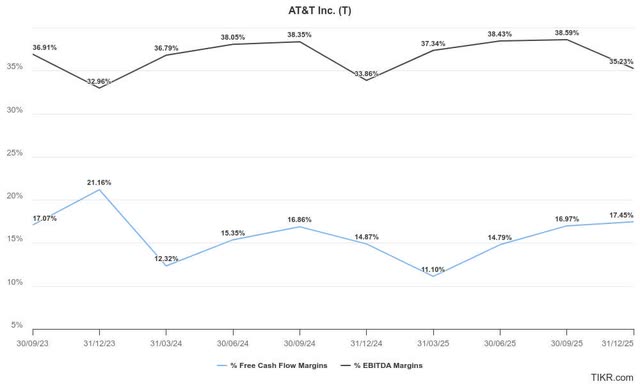

AT&T’s Profitability Remains Robust

Coupled with the recent divestment of its DirecTV stake, it has clarified the company’s focus, allowing it to improve its debt-leverage ratio. Accordingly, AT&T emphasized that it’s on track to achieve an adjusted EBITDA leverage ratio of 2.5x in the first half of FY2025 compared to the 2.8x it reported in Q3. Moreover, the company reported a solid $5.1B in free cash flow in Q3, solidifying the market’s confidence in AT&T’s ability to achieve its FCF outlook of between $17B and $18B for FY2024.

AT&T estimates (TIKR)

Therefore, the market is likely more confident of its earnings clarity through 2025 as the Fed possibly lowers its interest rates further. A more robust iPhone-driven upgrade cycle within a rational promotional environment could provide pleasant upside surprises to the company’s estimates. In addition, T’s attractive forward dividend yield of 5.1% is well covered by its robust FCF profitability.

Unless AT&T’s broadband competitors intensify the competitive landscape as they seek to enhance their bundling offerings, I don’t expect a valuation de-rating on the stock. Based on T’s forward adjusted EBITDA multiple of 7.1x, it’s still 10% below its sector median of 7.8x, although the valuation bifurcation has narrowed markedly.

Is T Stock A Buy, Sell, Or Hold?

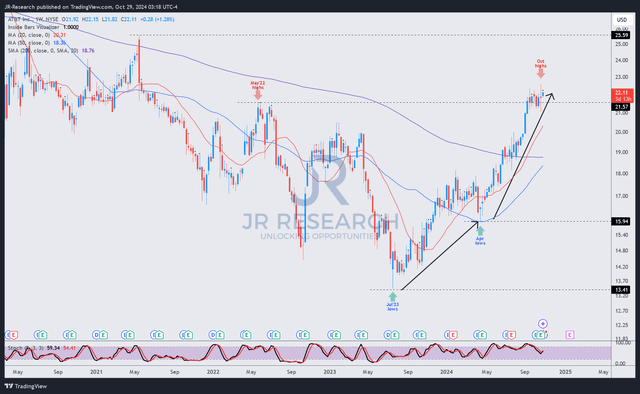

T price chart (weekly, medium-term) (TradingView)

T’s price action indicates little signs of a bearish reversal over the past eight weeks, corroborating its recent momentum surge. As a result, the re-test against T’s May 2022 highs seems credible, underpinned by the upgrade of its buying momentum over the past six months (from “B” to “A-“).

While a near-term pullback is expected, I have not assessed the need for investors to turn bearish on AT&T stock. The resilient US economy and still robust labor market conditions have helped to bolster a constructive consumer spending outlook through 2025. Hence, I assess that the recent mean-reversion of T’s valuation is justified.

However, the lack of a more attractive discount against its sector peers could work against a further valuation re-rating as investors reassess its growth prospects through 2025. Over the past eight weeks, the consolidation underpins my observation that the market could remain in a wait-and-see posture as investors gauge the strength of Apple’s iPhone upgrade momentum for CQ4.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!