Summary:

- Tesla, Inc.’s vision includes Robotaxis, Optimus, Dojo & AI, with positive synergies, but Elon Musk’s political activism is becoming a significant risk factor.

- Q3 earnings show automotive margins under pressure, but energy and service sectors are strengthening.

- Tesla may continue sacrificing margins to outcompete rivals, aiming for long-term market share gains.

Angel Di Bilio/iStock Editorial via Getty Images

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) has delivered good quarterly figures overall, and I don’t share the negative assessment of the Robotaxi event. I think some expectations were simply too high; we should remember that this is still a rather slow industry. It is becoming increasingly clear that the long-standing claims are becoming reality: Tesla is finally more than just a car manufacturer. The services and energy sectors now significantly contribute to the bottom line and have high margins. And that’s even before the other future hopes of robots and self-driving taxis. For me, Tesla remains a long-term investment, even if CEO Elon Musk’s political stance is becoming increasingly risky.

What this article is about

In my last article about Tesla (“Tesla Stock Is A Great Buy Before The October Event”), I outlined the company’s vision for the future: Robotaxis, disrupting UBER, Optimus, Dojo & AI, how everything is connected, and the positive synergies. However, I wrote this article before the Tesla October event and the most recently published quarterly figures, so there are some updates to cover. In this article, I would also like to take a closer look at a significant risk factor, namely the extent to which Elon Musk’s political activism and related actions are increasingly becoming a risk for Tesla’s brand.

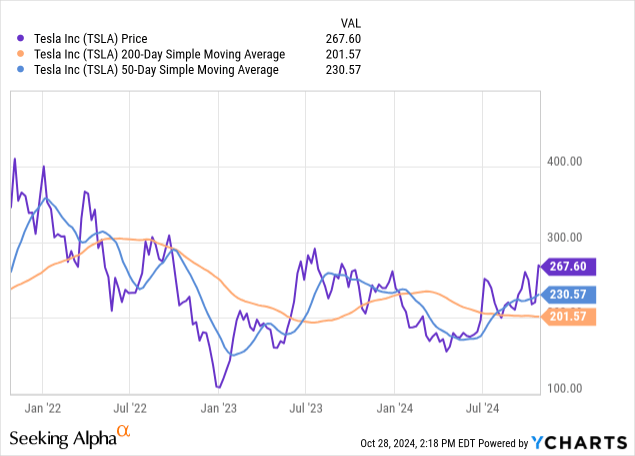

But first, let’s look at the aggregated results summarized in the chart. We can see here that the fifty-day moving average already reversed in June and that the 200-day moving average is about to turn positive. From a technical chart perspective, this is a positive picture.

Robotaxi recap

The future should look like the future. – Elon Musk.

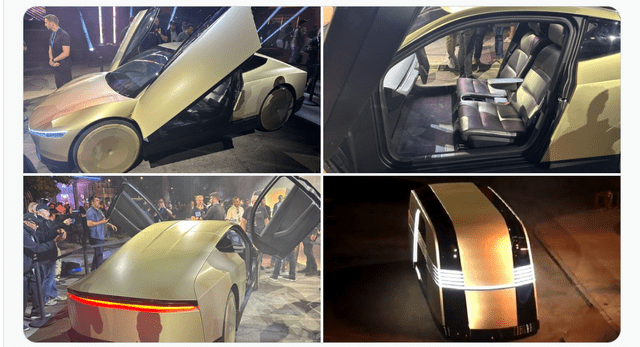

Following the event, the share price fell by almost 7%, and overall disappointment seemed to prevail. The event has already been discussed many times, and Seeking Alpha readers are well-informed, so I would rather not repeat it too much but rather give my perspectives:

1. “The event was a disappointment”

I disagree with this statement. The event was perceived as such mainly because of the lack of precise, measurable details. For example, there is a vague statement about the production of fully autonomous Cybercabs by 2026 or 2027. I think some people forget that we are still talking about cars; in this industry, things don’t move fast. We are already at the end of 2024; why should 2026 be a disappointment? That’s in 1.5 years, which in this industry is like tomorrow.

A self-driving Robotaxi is a revolutionary product, and that also applies to full self-driving in general. Legacy automakers have not produced anything remotely as revolutionary for decades. Yes, Elon Musk has repeatedly failed to meet his extremely ambitious timeline, but it is still impressive to see how much Tesla has achieved in its short history. Compared to the competition, Tesla is faster and more innovative. We should adopt a more realistic attitude to timescales, one that is the norm for this industry.

2. Not clear how the Robotaxi fleet will be monetized

This is a fair critique. It seems people can buy the cars for about $30k. Will they be able to rent them out? If so, how does this benefit Tesla besides the initial car purchase? Or will Tesla offer its service where people just pay per mile? If both happen simultaneously, then Tesla car owners would compete with Tesla’s service, and that would be weird.

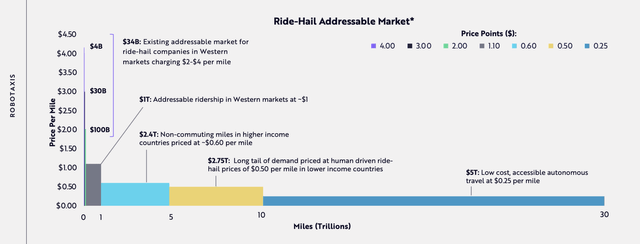

Overall, many questions remain, and that’s probably because the company doesn’t have the answers yet. But I don’t think this is a huge problem. That market opportunity is huge, especially when the cost per mile decreases (because it might reach a point where paying per mile becomes cheaper than owning a car). According to Ark Invest, the current costs are between $2 and $4 per mile, and in the autonomous driving scenario, this will most likely drop below $1 per mile.

The average US driver covers 42 miles per day. So if people gave up their cars and instead paid per mile, that would be $42 per day or more than $1000 per month-probably too expensive. But for $0.50 per mile, that would come down to only $21 per day, and that’s perhaps cheaper than owning a car. Let’s do an example calculation to get a grasp of the opportunity:

- Let’s say the average stays the same, and people pay about $7.000 per year (which is even less than $21 per day).

- If only 10 Million Americans would pay this amount, that already amounts to $70B in annual revenue.

- I can easily imagine worldwide 100 Million and more people paying this amount, which results in $700B annual revenue.

This quick calculation already shows the potential, so I don’t think Tesla has to outline its plans perfectly. Perhaps it is even better not to show the competition all their plans.

Q3 Earnings

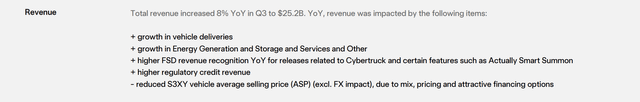

Revenue increased 8% YoY, and the company outlined what impacted these numbers:

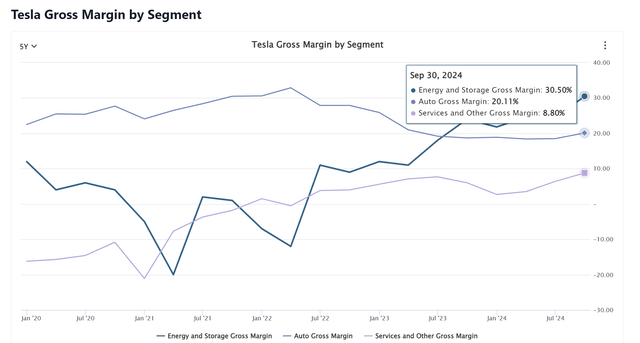

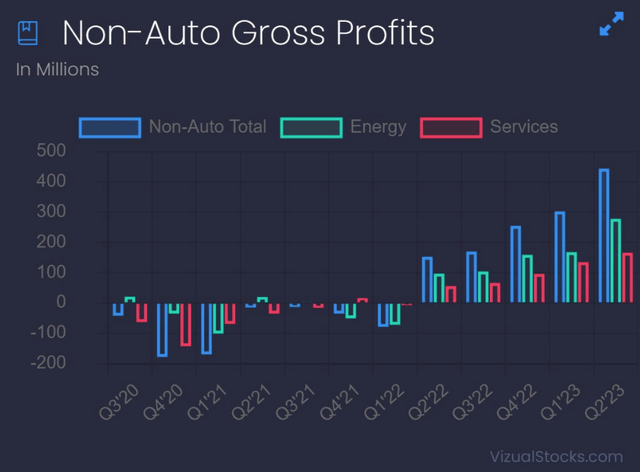

The margin development in the chart below shows that the automotive sector is still under pressure (we can’t speak of a turnaround yet). That said, the strength of the other sectors, particularly the energy and service sectors, is becoming increasingly apparent.

Given the massive competition in the EV sector and the strong Chinese companies, I assume that Tesla will continue to sacrifice margins to put pressure on the competition, especially the legacy carmakers. They have not been able to keep up in terms of price so far or, if they have tried to do so, then only by losing money per car sold. The earnings call also indicated continuing price pressure in the automobile sector (which could mean further price cuts).

Sustaining these margins in Q4, however, will be challenging given the current economic environment.

Q3 2024 Earnings Call.

I think it makes sense for Tesla to accept lower margins on car sales to drive some competitors out of the market in the long term. This would allow Tesla to gain greater market share, which can potentially be monetized in other ways, e.g., via charging infrastructure, fully autonomous driving, etc. I described this already in another article.

Tesla has already built up and optimized production capacities for EVs, which other manufacturers have to build up first. Therefore, Tesla can start lowering its prices earlier and thus make the electric car sales business a loss-making business for other manufacturers. If, simultaneously, the combustion business for these manufacturers is more and more shrinking, they are in a difficult position to remain competitive in the long run. In addition, manufacturers such as Volkswagen, Ford, and General Motors are already in enormous debt, while Tesla has no debt at all.

The Energy segment

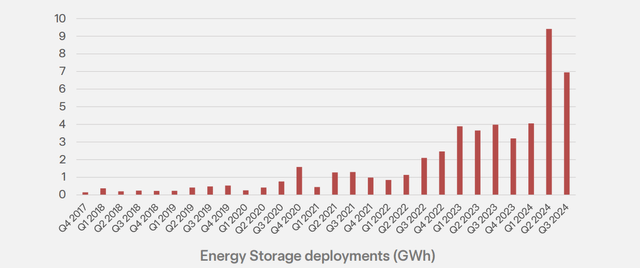

It appears that the market is increasingly realizing that Tesla is more than just a car company, even before the developments likely to come from Dojo, Robotaxis, and robots. Many people have argued this for years, but now the numbers are really starting to back it up. According to the Q3 presentation, “Powerwall achieved record deployments in Q3 for the second quarter in a row.” The Storage deployed in GWh was 75% higher YoY (from 4.0 to 6.9 GWh). As shown above, the Energy segment is becoming increasingly high-margin, significantly contributing to the overall result.

Around 17% of Total Net Income for $TSLA was non-auto (energy + services) Which means that $444M out of $2,614M reported for Net Income came from Megapack, FSD, Insurance, and Supercharging.

Alejandro Chavez (X).

The earnings call indicated that demand continues to rise, and the order backlog is increasing.

Energy margins in Q3 were a record at more than 30%. This is a function of mix of projects being deployed in the quarter. Note that there will be fluctuation in margins as we manage through deployments and our inventory. Our pipeline and backlog continue to grow quarter over quarter as we fill our 2025 production slots, and we’re doing our little best to keep up with the demand.

Q3 2024 Earnings Call.

The Energy deployment in GWh is seeing strong growth, and according to the latest quarterly report, the Shanghai Gigafactory will also be producing megapacks starting in Q1 2025. However, it is not stated for which market these will be made, whether for Asia or to export.

Valuation

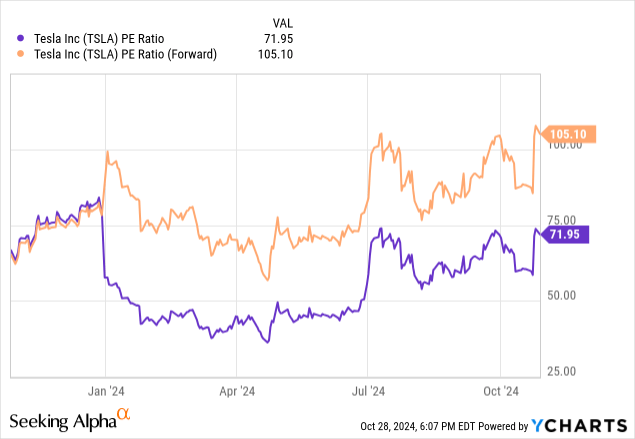

The company’s valuation is currently close to its yearly high and, of course, not cheaply valued. The opportunities and technical innovations are priced to some extent; whether enough or too much is impossible to estimate and, to some extent, subjective.

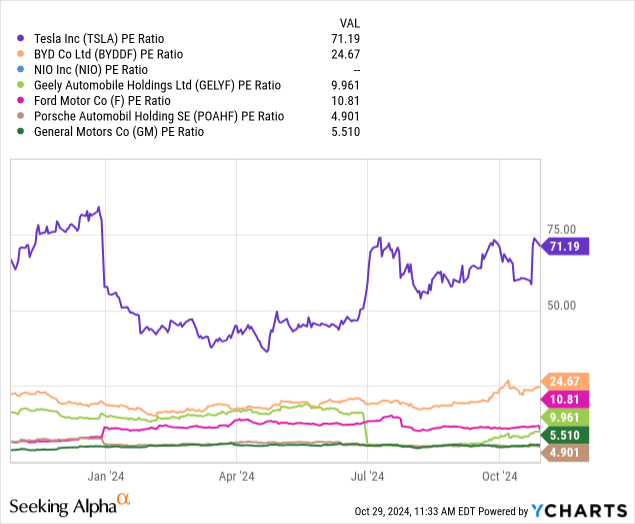

Tesla is also highly valued compared to other companies and the Chinese competition. But it’s difficult to draw comparisons because Tesla is doing and expanding in so many areas that the others are not.

Personally, I hope the stock will dip slightly, possibly if Q4 margins are a little weaker. This could lead to a short-term setback. From my perspective, anything below a P/E of 70 would be an excellent buying opportunity. It also remains to be seen what will happen to the share if the Democrats win the election, as this is one of Tesla’s risks-more on this in the next segment.

Risks

I already described some risks in detail in my last article, so I would rather not repeat them here: a general slowdown in the EV market and China. Primarily about China, I’ve written a detailed analysis of the EV market (which is, in my opinion, a must-read for EV investors because China is the most important market).

We have to see this in the context of the economic war. Chinese consumers are proud to have their Chinese car companies for the first time and want to support them. The country wants to become independent in all critical areas to realize its long-term goal of replacing the USA as the world’s number one power. I have already written two very detailed analyses about the general development in China, the last one in June with the title “Power Shift Part 2: Western Brands In China’s EV Market.”

My last article: Tesla Stock Is A Great Buy Before The October Event.

Elon’s political adventures are a risk

What are Lisa Su’s political views, CEO of Advanced Micro Devices, Inc. (AMD)? I have no idea, and that’s a good thing. Since the political views of the CEO should not play a role, a company should be well positioned regarding all parties and neither particularly favored nor disadvantaged, regardless of which party is in power. Elon Musk has recently taken a different path, firmly siding with the Republican candidate, Donald Trump.

This could bring advantages if Trump wins, but if not, it might lead to considerable disadvantages for Tesla. The angles of attack are manifold. For example, the company needs many permits from the authorities for the abovementioned robotaxis. What if Tesla gets penalized here in the future? If the company is disadvantaged compared to its competitor, Waymo from Alphabet Inc. (GOOG) (GOOGL).

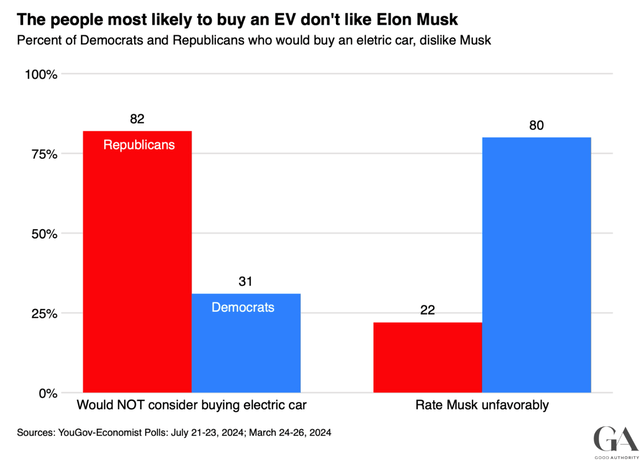

In addition, the traditional Republican electorate tends to be conservative, and this group is much less likely to buy an EV. Conversely, Democrat voters are much more likely to buy an EV. This whole dilemma is summarized here in a graph.

So Republicans like Elon Musk but don’t buy EVs, and Democrats buy EVs but don’t like Elon Musk. But Democrats like Google and Google have a competing system in the form of Waymo. Musk could have ensured that Tesla has a good relationship with everyone by adopting a quieter and neutral stance. Admittedly, this would probably have given the “Elon Brand” and thus his Tesla brand less publicity, but overall, it doesn’t seem to me to be a good idea to put himself on a war footing with the entire Democratic Party. If Trump wins the upcoming election, it will probably be fine, but if the Democratic Party wins, this could lead to considerable disadvantages.

In a recent interview with Tucker Carlson, Musk even speculated how long his prison sentence would be in this case. In addition, the constant negative portrayal of his person will likely continue almost indefinitely from now on, which will likely permanently deter people who follow and believe this media from Tesla.

Conclusion

But despite these risks, I still think Tesla is an excellent long-term investment because of its technological diversity and superiority. It is becoming clearer and clearer how the company’s different aspects are increasingly intertwined: The cars provide the revenue and data for Dojo (the supercomputer cluster). Dojo is needed to process the data and enable fully autonomous driving while enabling the robot technology. These robots, in turn, can build cars even faster and cheaper. This increases the size of the fleet even further and provides even more data…

Of course, Tesla is still not cheaply valued, but given its future potential, I think the valuation is understandable. For me, Tesla is not a trade but a long-term investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.