Summary:

- Electric vehicles are likely at or entering the early acceleration phase of the S-curve, which means that EV adoption can accelerate from here.

- Price parity with ICE vehicles is expected to be reached by 2027, and robotaxis will provide low-cost-per-mile transportation and generate revenue for owners. This will accelerate the transition to EVs.

- Tesla may face regulatory issues regarding its robotaxi ambitions. However, Google’s Waymo is paving the regulatory path for Tesla, which can make things a bit easier.

- The current valuation prices in lots of success for Tesla. I’d rather wait until the stock is hated again to start buying it.

Xiaolu Chu

Tesla, Inc. (NASDAQ:TSLA) stock soared recently after its Q3 earnings report, as the company easily beat EPS estimates (non-GAAP EPS of $0.72 beat by $0.12). As someone who is watching from the sidelines, I’ll provide my unbiased opinion about Tesla’s future. I think the company can have its “iPhone moment” with electric vehicles (“EVs”) and robotaxis, where people will swiftly abandon gas-powered cars and head to EVs.

Since Tesla can operate its EV business profitably, it’s the company that is best-positioned to take advantage of this eventual shift. Plus, Tesla has plenty of other promising businesses and ambitions.

At the same time, however, a lot of this is factored into the current share price, making the opportunity less compelling. Plus, Tesla will have to navigate regulatory hurdles to get its robotaxis on the road. Therefore, I rate TSLA stock as a Hold.

The Consumer Switch To EVs Will Be Swift, And Tesla Will Have Its iPhone Moment

Currently, internal combustion engine, or ICE, cars are generally cheaper than EVs. That’s one of the main reasons why 78% of new car sales in the US are still ICE cars. The trend, of course, is toward EVs, as 97% of US auto sales were ICE vehicles in 2016. But I believe this trend will start to accelerate within a few years.

The second that EV prices reach parity with ICE cars, the shift could be drastic. Gartner predicts that by 2027, the average next-generation BEV will be cheaper to produce than a comparable ICE vehicle. If so, EVs will likely be priced lower or at about the same price as an ICE vehicle. In that scenario, I think most people would choose to buy EVs due to lower maintenance expenses and no fuel costs. This is especially true since there will be more charging stations around by then.

Take Norway, for example, which has achieved price parity on EVs due to government support. As a result, over 80% of new car sales in the country are electric, and there are more EVs on their roads than ICE cars. The same can happen in the US, and Tesla should benefit the most because of its relative efficiency and scale.

As CEO Elon Musk said in the most recent earnings call,

“I think if you look at EV companies worldwide, to the best of my knowledge, no EV company is even profitable. And I’m not — to the best of my knowledge, there was no EV division of any company, of any existing auto company that is profitable.”

Case in point, Ford (F) just reported its Q3 results, and its model e (EV division) segment reported EBIT of -$1.2 billion for the quarter and is expected to see a full-year EBIT of -$5 billion.

Another point worth mentioning is that as demand for ICE cars falls and legacy automakers eventually scale back their ICE vehicle manufacturing, they will achieve negative economies of scale. This could increase the per-unit costs of ICE vehicles, further accelerating the shift to EVs.

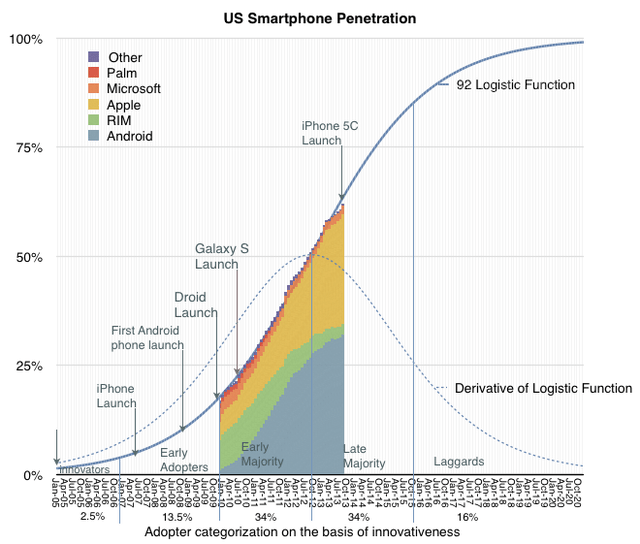

EV Adoption Should Follow An S-Curve, We’re In The Early Stages

An S-curve is what it sounds like. It’s a line that follows somewhat of an “S” shape. It shows how new technology gets adopted. At first, it’s a slow process, but then, it accelerates and is followed by a maturity phase. You can see the example below on US smartphone penetration. EV penetration should see the same sort of acceleration, in my opinion.

S-Curve Of Smartphones (asymco.com)

Full Autonomy And Robotaxis Will Further Speed Up EV Adoption

Although Tesla hasn’t rolled out robotaxis, ride-hailing, or driverless autonomy just yet, it should be able to in the future.

In the Q3 earnings call, Elon Musk predicted,

“We’ll definitely have [ride-hailing] available at Texas, and probably have it available in California subject to regulatory approval. And then — and maybe some other states actually, next year as well, but at least California and Texas.”

Now, I’m not 100% sure that Tesla can achieve this next year, as Musk tends to overpromise and underdeliver, and there are regulatory hurdles. However, over the coming years, this can be a reality.

This will speed up EV adoption further. Assume ICE/EV price parity in 2027 or so, as well as a car that can generate income for you as a robotaxi while you’re not using it. Who, then, would buy a regular ICE car? The EV would provide more value.

Regarding Cybercabs, they won’t have a steering wheel or pedals, meaning they’ll be cheaper to produce and cheaper to maintain. With such low costs, the cost per mile can come down enough to the point where people may not even want to buy and maintain their own cars anymore if they don’t see the value in that.

Instead, people can get around by paying a robotaxi a low fare, and these robotaxis can rule the streets. Again, this points to a scenario where EV adoption should accelerate.

Regulatory Risks Are A Hurdle For Robotaxis, But Tesla Has A Unique Advantage

I recently wrote an article titled, “Tesla Stock: Too Many Unknowns After Robotaxi Event.” In the article, I discussed potential regulatory hurdles Tesla can face, and I still believe the regulatory path won’t be that easy. However, I realize that I missed something. But first, here’s what I wrote in the past article, and then I’ll explain what I missed:

Tesla’s autonomous ambitions don’t include Lidar (light detection and ranging) technology, and this can cause regulatory hurdles, as the technology may not be perceived as safe relative to Waymo’s technology.

Tesla uses camera-based systems, computer vision, and AI for its autonomous tech. The problem is that cameras may struggle in low-light, fog, rain, or other conditions of that nature, so Tesla will have to find a way around that with advanced software. If it can, then it will be a big advantage because cameras are significantly cheaper to implement than Lidar technology. But that’s an “if.”

For what it’s worth, Matthew Wansley, a professor at New York’s Cardozo School of Law, said, “Tesla software is at least years behind where Waymo is. That’s the hard part. No flashy vehicle design is going to change that.”

My mind hasn’t changed too much about that, as I still view Google’s (GOOG) Waymo vehicles as safer. What I didn’t realize, though, is that Tesla has a unique advantage being behind Waymo in terms of not operating a fleet of AVs (autonomous vehicles) at the moment.

Essentially, Waymo is paving the regulatory path for Tesla. Waymo is showing that AVs can be trusted, which could make it relatively easier for Tesla to obtain approvals compared to if Waymo didn’t exist, saving the company time and resources. So, it’ll still be difficult to obtain approval, but maybe it won’t be as bad as I thought.

Once (if) Tesla’s robotaxis get approved, Tesla can flood the market with them, and it will have a cost advantage over Waymo’s vehicles. I’m not saying that Waymo will go bankrupt or that it won’t have its own use case, but Tesla will almost certainly have the cost advantage.

Tesla’s Other Ambitions Impress Me

I am impressed by Tesla’s other businesses and ambitions. I won’t talk too much about them since I want the focus of this article to be EVs, but, for example, the Energy Generation and Storage segment grew its revenue by a blistering 52% year-over-year.

Additionally, as per the Q3 investor presentation, the segment “achieved a record gross margin of 30.5% in Q3, a sequential increase of 596 bps, despite lower Megapack volumes.” Tesla’s Energy business constituted about 9.44% of Q3 revenues and 8.7% of TTM revenues, so it’s bigger than I’m guessing many people realize.

Additionally, the Optimus robot has the potential to be a game-changer. In my recent Tesla article, I wrote the following:

Elon Musk also unveiled Tesla’s humanoid robot, Optimus. He claimed that it could perform human tasks—from walking dogs to babysitting children—and said that it will cost between $20-30,000.

Notably, he said, “I think this will be the biggest product ever, of any kind.” That’s a bold statement, but it can be true. Imagine not having to pay factory employees or bartenders and servers and just replacing them with robots. Or using a robot as your personal housekeeper. That can be a huge market.

I then went on to say that while the Optimus robots can be huge, it’s tough to predict how far into the future it will be until Tesla starts making money off them. Therefore, it’s an unknown for now. Nonetheless, it’s something to add to the pot of Tesla’s growth potential.

Has The Valuation Priced In All Of Tesla’s Potential?

It’s hard for me to say whether Tesla’s potential is fully priced in or not because, quite frankly, it’s very difficult to predict just how big the future opportunities will be. However, what I do know is this: General Motors (GM) trades at a non-GAAP P/E ratio of 5.3x. Meanwhile, TSLA has a non-GAAP P/E ratio of 109.38x based on $2.40 in TTM EPS and a share price of $262.51.

If Tesla was valued at 5.3x non-GAAP earnings, with $8.338 billion in TTM non-GAAP net income, its market cap would be about $44.191 billion. However, the market cap is $842.673 billion. Therefore, it’s worth about $798.48 billion more than it would be if it were a legacy automaker. I know this isn’t a perfect example, but it’s to give an idea of how much is priced in (hundreds of billions worth).

It’s not as if Tesla is some sort of unknown opportunity. Based on the valuation, the market clearly knows it’s not just a car company. Thus, while I think Tesla as a business can have its iPhone moment, I’m not sure that the stock will have its Apple (AAPL) moment in terms of share price appreciation after that happens. A good amount of that has been priced in already. Don’t get me wrong. The stock can still rise, just maybe not meteorically.

I’d prefer to invest in Tesla when it’s more hated. This happens every so often. Just in April, it was at nearly half its current price.

The Takeaway

Tesla looks set to have its iPhone moment in the upcoming years, as EVs are likely approaching or in the early acceleration phase of the S-curve. The cost of EVs is expected to come down and reach parity with ICE vehicles by 2027 (in the US), which would make owning an ICE vehicle much less appealing. Additionally, ICE vehicles could become pricier to produce if legacy automakers eventually scale down ICE operations.

Next, robotaxis should be able to operate at very low costs per mile, driving down the costs of transportation. This can make people want to abandon their ICE cars and either use robotaxis for transportation or buy their own Teslas to put onto the ride-hailing network. Combined with a quickly growing Energy business and interesting initiatives like the Optimus robot, the future looks bright for Tesla.

Still, there are regulatory risks to consider, as the company may not be able to roll out Cybercabs as quickly as it wants to, although it’s good that Waymo is paving the regulatory path for Tesla. Plus, the valuation already prices in a lot of the upside. As a result, I rate TSLA stock as a Hold and will wait for the stock to become hated again before considering a Buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.