Summary:

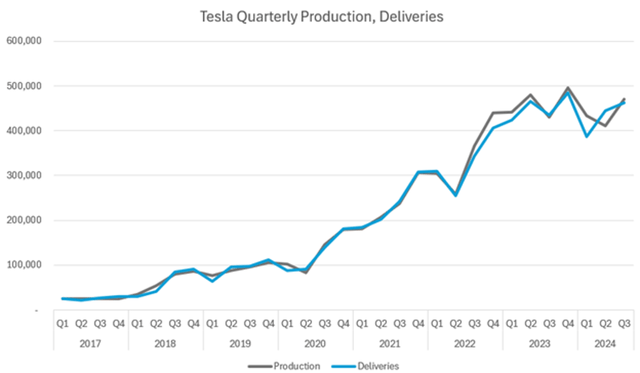

- Q3 saw Tesla report sequential growth for both production and deliveries after a weak Q1, where deliveries dropped below 400,000 for the first time since late 2022.

- CEO Elon Musk stated that the automaker is shooting for “20% to 30% vehicle growth next year,” or roughly at least 2.1 million vehicles assuming TSLA ends 2024 at around 1.75 million.

- From Q4 2023 to Q2 2024, ASPs were relatively unchanged while production costs rose 3.7%, denting both automotive margins and impacting profitability.

Дмитрий Ларичев

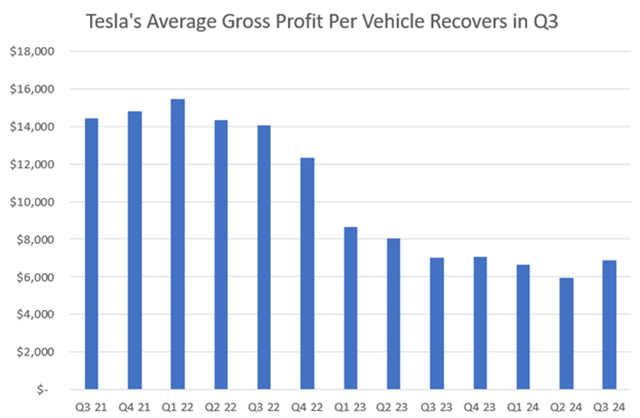

Tesla, Inc. (NASDAQ:TSLA) is arguably one of the most advanced AI companies in the world, yet its stock is dictated by margins. Over the past three years, Tesla’s average gross profit per vehicle has declined by 60%, falling from more than $14,400 in Q3 2021 to less than $6,000 in Q2 2024, highlighting the difficulty Tesla has faced in a high-interest rate environment.

Higher interest rates have forced Tesla to place more emphasis on affordability, either via price cuts or promotional financing rates, pushing average selling prices lower and thus impacting margins. Q3’s report indicated that margins may have bottomed, despite weakness in vehicle selling prices due to that focus on affordability.

Perhaps the long-term story is recurring software revenue from robotaxis and humanoid robotics. However, margins are driving the stock price for now.

Below, I look at the puts and takes of an AI front-runner who is battling economic headwinds.

Deliveries Recover, But Revenue Doesn’t

Q3 saw Tesla report sequential growth for both production and deliveries after a weak Q1, where deliveries dropped below 400,000 for the first time since late 2022. Tesla reported deliveries of 462,890 EVs in the third quarter, a 6.4% increase from last year and a 4.3% increase from the second quarter.

Tesla reported deliveries of 462,890 EVs in the third quarter, a 6.4% increase from last year and a 4.3% increase from the second quarter. (Tech Insider Network)

For the third quarter, Tesla reported automotive revenue of $18.83 billion, up just 1.3% YoY and 1.6% QoQ, and short of the consensus estimate for $19.50 billion. As a result, Tesla’s overall revenue fell short of estimates, with Tesla reporting $25.18 billion in revenue, nearly half a billion below the consensus for $25.67 billion.

A quick look at the growth rates shows that automotive revenue growth lagged delivery growth by just over 5 percentage points, at 1.3% versus 6.4%. This tells investors that automotive selling prices declined once again, and to a large degree – Q3’s ASP fell below $42,000, down ~(1.7%) from Q2 and falling (5.6%) from nearly $44,500 last year.

Notably, there is a risk the ASPs fall lower in Q4 as Tesla continues to cut some prices, with the Cybertruck seeing up to 20% cuts on different model variants in October. Musk mentioned that Tesla would be aiming for YoY growth, and with just Q4 left, that means Tesla would have to deliver more than 515,000 vehicles, a record high. This would also imply an acceleration to 11% QoQ growth, leaving the door open for more aggressive price cuts to spur demand, something management hinted at in the earnings call.

Tesla is aiming high for 2025, with CEO Elon Musk stating during the earnings call that the automaker is shooting for “20% to 30% vehicle growth next year,” or roughly at least 2.1 million vehicles assuming Tesla ends 2024 at around 1.75 million. CFO Vaibhav Taneja added that Tesla’s

“focus remains on growing unit volume, while avoiding a build-up of inventory. To support this strategy, we’re continuing to offer extremely compelling vehicle financing options in every market.”

The Fed has forced Tesla to focus on financing and affordability, which, in turn, has been a major driver of margin issues. I noted in July 2023 that the “comment on interest rates is the most important comment from the call as high interest rates mean Tesla must lower prices,” and that Tesla was “one of many tech stocks whose revenue growth and profitability is on borrowed time until the Fed instills a more dovish policy.”

Tesla’s Profitability Improved on Cost Optimizations

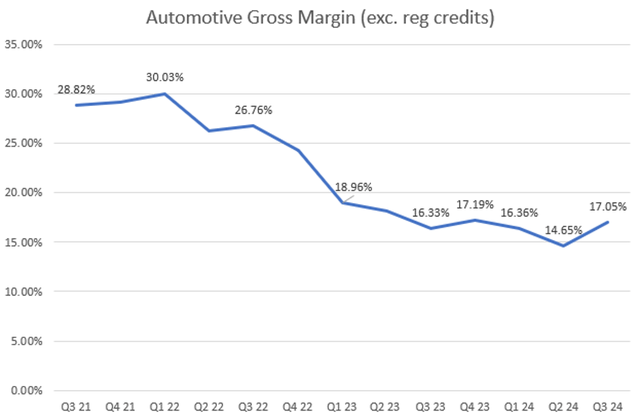

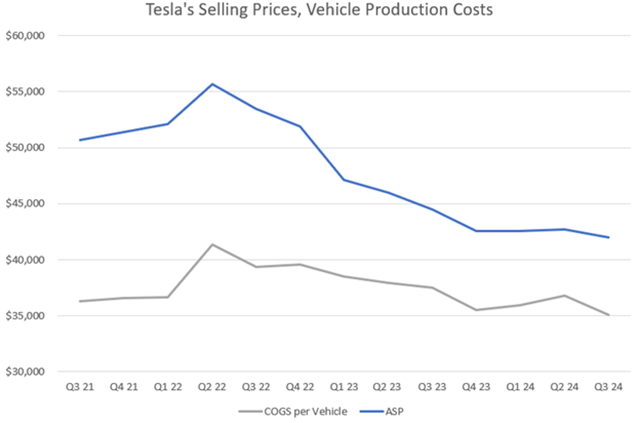

Despite ASPs declining again sequentially, profitability improved, and automotive margins recovered as Tesla captured some tailwinds from “lower raw material costs, freight and duties” and drove vehicle production costs to a record low.

Tesla headed into Q3’s report facing a tough test, as average selling prices were flat, and vehicle production costs were rising. From Q4 2023 to Q2 2024, ASPs were relatively unchanged while production costs rose 3.7%, denting both automotive margins and impacting profitability. This had been hindering Tesla’s ability to revitalize automotive gross margins – as a result of those two changes, automotive gross margins took quite a large hit, falling from 17.2% to 14.6% in that two-quarter span.

Q3 saw a sharp improvement in automotive gross margin, expanding ~240 bp QoQ and ~72 bp YoY, as Tesla drove production costs to a record low of ~$35,106. (Tech Insider Network)

Q3 saw a sharp improvement in automotive gross margin, expanding ~240 bp QoQ and ~72 bp YoY, as Tesla drove production costs to a record low of ~$35,106.

Q3 saw a sharp improvement in automotive gross margin, expanding ~240 bp QoQ and ~72 bp YoY, as Tesla drove production costs to a record low of ~$35,106, dropping ~(4.6%) from $36,802 just last quarter.

Because of the large improvements in production costs, average gross profit per vehicle bounced back, increasing ~16.3% QoQ to reach ~$6,886, up from $5,921 last quarter. Essentially, Tesla manufactured and sold 14,000 more vehicles this quarter for ~$220 million cheaper than last quarter.

Average gross profit per vehicle bounced back, increasing ~16.3% QoQ to reach ~$6,886, up from $5,921 last quarter. (Tech Insider Network)

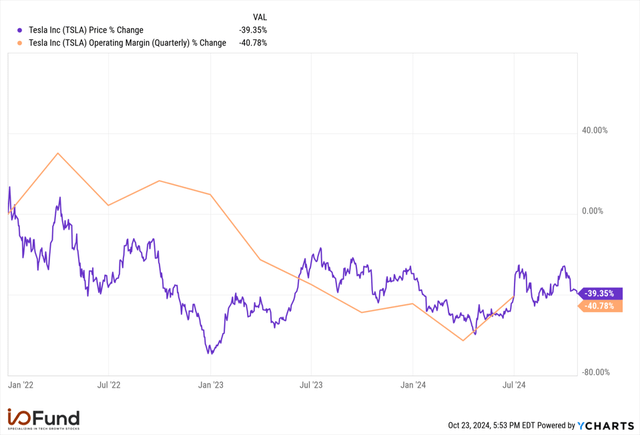

Operating margin also rebounded significantly, expanding to 10.8% in Q3, up from 6.3% in Q2 and 5.5% in Q1. This newfound operating margin growth adds more confidence in the margin recovery story, which has been paramount for investors as share price declines have correlated quite closely with operating margin contraction.

Tesla’s share price declines since late 2021 have correlated quite closely with operating margin contraction. (YCharts)

Energy Storage was a bright spot in Q3 as even with a sequential decline in deployments and (21%) sequential decline in revenue, gross margin expanded from 24.5% to 30.5%. This aided company-wide gross margin expansion, with Tesla reporting a 19.8% gross margin in Q3, up from 18.0% in Q2.

Q4 Margins Will Be “Challenging” to Sustain

Q3’s profitability is a welcome sign, yet CFO Taneja cautioned that “sustaining these margins in Q4, however, will be challenging given the current economic environment,” due to vehicle affordability issues.

Investors may need to get comfortable with thinner margins moving forward on the automotive side. When the stock was at all-time highs in 2021 and early 2022, Tesla was reporting more than $14,000 in gross profit per vehicle, or automotive gross margins in the high-20% range, topping 30% once. Now, average gross profit per vehicle has fallen more than (52%) to $6,886 in Q3, with automotive gross margins back to 17%, though it has remained below 20% since the start of 2023.

This decline in gross profit per vehicle stems from weaker average selling prices, which have fallen quite dramatically since the start of 2023, and continue to fall. The reason margins were able to expand in Q3 was from reducing production costs, not vehicle pricing.

Tesla’s average selling prices, which have fallen quite dramatically since the start of 2023, continue to fall. (Tech Insider Network)

As long as Tesla continues to cut prices, margin gains will be primarily realized on the cost side. The path to higher margins will arise when Tesla can push production costs towards $30,000 and lower, and once the pressure on ASPs has resolved.

Musk said in Q3’s call that Tesla is “still on track to deliver more affordable models starting in the first half of 2025,” which would require similar cost reductions to preserve margins. Musk also implied thin margins may be the norm for investors, as Tesla noted that affordable model production in the first half of 2025 “will result in achieving less cost reduction than previously expected.”

Robotaxis Still Not Here, Despite Numerous Timelines

While the robotaxi opportunity is promising for Tesla, it’s yet to provide tangible AI revenue. Tesla’s robotaxi reveal event earlier in the month was met with a lackluster response. It sent shares down more than (8%) the day after, as the production timeline for its “robotaxi” was pushed back once more, a familiar storyline for Tesla investors over the past few years.

At the unveiling of Tesla’s pedal and wheel-free purpose-built robotaxi, dubbed the Cybercab, CEO Elon Musk said that production may begin in 2026 or as late as 2027, saying that he “tend[s] to be optimistic about timeframes.” This is another years-long delay for Tesla’s most anticipated product, where in 2022, Musk had promised to reveal the robotaxi in 2023 and start production in 2024. This follows an initial promise from 2019 to have one million Tesla vehicles equipped with Level-5 autonomy in 2020. Years later, and Tesla has still not deployed the robotaxi, which places additional emphasis on the margins.

Musk reiterated Tesla’s goal to launch production of the Cybercab in 2026, adding that Tesla is “aiming for at least 2 million units a year of Cybercab.”

Following Q1’s earnings report in April 2024, I joined Bloomberg China to discuss the most pressing items for Tesla, saying that:

As AI approaches, that’s the piece that Tesla has to execute on. So what we’re seeing is a moment where it’s a little too early for AI software…. we’re not in that cycle right now, and that’s what Tesla really truly needs for its stock to resume where it was before as a Wall Street darling [in 2021]. And that AI software cycle, if I were to give you my best estimate, it would be more of a 2026 discussion.”

Conclusion

Despite a mixed Q3 earnings report featuring a revenue miss and an EPS beat, Tesla’s report exceeded expectations in the one area that mattered most – margins. Automotive gross margin rebounded due to production cost improvements, even as selling prices fell, boosting operating margins back to the double-digit range.

While the Tesla, Inc. AI story is one to watch, margins have been the behind-the-scenes driver for shares, and remain the data point to track until a credible, tangible revenue stream from robotaxis arises. Tech Insider Network Portfolio Manager Knox Ridley wrote in August 2023 as the Tech Insider Network cut our Tesla position for a 60% gain that the Tech Insider Network was “avoiding ‘Crocodile Jaw’ situations where the stock price is going up but fundamentals are decelerating.”

Recommended Reading:

- Palantir Stock Is Crushing Its Peers In AI Revenue

- Nvidia, Mag 7 Flash Warning Signs For Stocks

- Cybersecurity Stocks Seeing Early AI Gains

- 4 Things Investors Must Know About AI

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our cumulative returns are 131% and a lead over institutional technology portfolios by as much as 157% since inception.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services include an automated hedge, portfolio of 10+ positions, broad market analysis, deep-dives, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.