Summary:

- Since many people already have a positive or negative attitude toward Tesla, it often seems difficult to take a neutral view of the company.

- And probably, as is often the case, the truth lies somewhere between the two extremes.

- That is why I believe Tesla is an exceptional company that is nevertheless currently overvalued.

Robert Way/iStock Editorial via Getty Images

The Tesla Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) is a company that divides opinion, a healthy middle ground is rarely found as it often seems that people either love or hate the company. Of course, some of this has to do with the fact that Elon Musk is a very polarizing personality, but sometimes you get the feeling that people are driven by whether they like him or not, and they are not neutral in their approach to Tesla.

Therefore, today, I will try to address some of the misconceptions about Tesla in a neutral way to find a middle ground. And here, as with any company, I’ve found things I like and things I don’t like, but at the end of the day, I think Tesla is an extraordinary company. But I still think the stock is a bit overvalued right now.

Misconception 1: Tesla’s Regulatory Credits Revenue

Tesla’s automotive regulatory credits revenue is a topic that often causes for divided opinions. On the one hand, there are the critics who say that Tesla would have much lower FCF without this type of revenue and that it should be deducted, and on the other hand, there are the supporters who say that it would be stupid not to take advantage of it.

And of course, these credits will probably run out at some point, but for now, they are an important part because they are high-margin revenues that can be used for growth. I think shareholders should be happy that management saw this opportunity and took advantage of it because it speaks to a forward-thinking, good management team. And second, even if you subtract the credits from net income, Tesla would still be earning close to tens of billions annually.

Net Income 22: $12.5b – Regulatory Credits: $1.7b = $10.8bNet Income 23: $14.9b – Regulatory Credits: $1.7b = $13.2bNet Income TTM: $12.7b – Regulatory Credits: $2.5b = $10.2b

However, it has to be said that the trend over the last 12 months has been for the credits to take a larger share of net income. But it should not matter how the money is earned, as it does not look like this type of income will disappear in the near future. So, in my opinion, it is a misconception to always put a special emphasis on these revenues.

Misconception 2: Free Cash Flow

I have sometimes seen FCF adjusted for the regulatory credits, which I do not think makes sense, but what I do think makes sense is to adjust FCF for SBC. Because FCF is a very popular metric today, it often results in more SBC than in the past because SBC is considered a non-cash item, so it is added back, making FCF appear higher. But since I think these are costs that matter, I think FCF should be adjusted.

FCF 22: $4.1b – SBC 22: $1.5b = $2.6bFCF 23: $2.2b – SBC 23: $1.8b = $0.4bFCF TTM: $676m – SBC TTM: $1.9b = ($1.2b)

From an SBC-adjusted perspective, it is clear that Tesla peaked in 2022 and has been in a steady downtrend ever since. This is all the more true given that SBC costs are rising while FCF is falling, compounding the effect. So I see the argument that Tesla has such strong FCF as the second misconception, because I think from an adjusted standpoint they are worse than they appear at first blush.

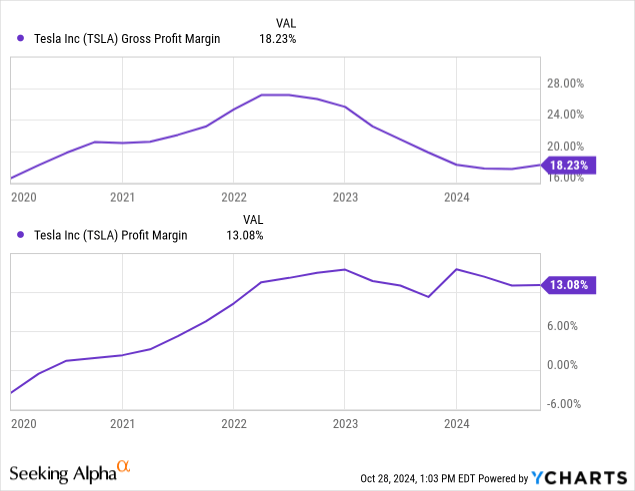

Misconception 3: The Margins

In terms of gross margins, we can see that they have also peaked around 2022, but the positive thing is that the profit margin, which, I think, is much more important, can hold up well at the 2022 level. That’s why I think the misconception that people often have that margins were so much higher in the past is not true because the profit margin is just below its peak. In my opinion, this rather shows that Tesla uses its capital more efficiently, since they still achieve high profit margins with a lower gross margin. If the gross profit margin were to increase again, this would most likely lead to new highs for the profit margin.

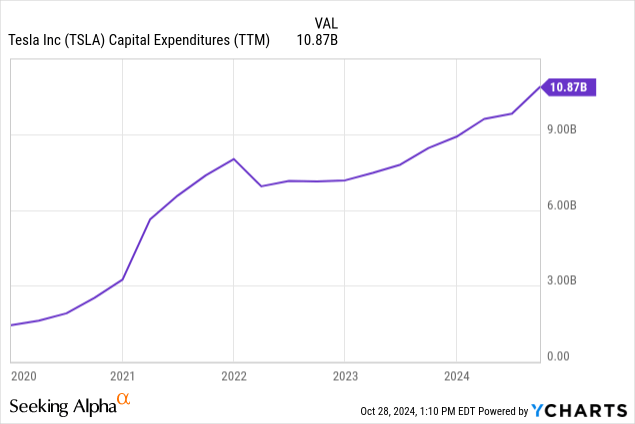

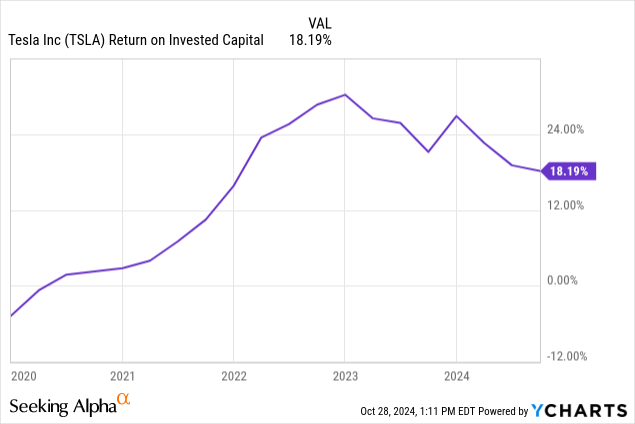

Misconception 4: Rising Capex And ROIC

A common criticism is rising capital expenditures, as shown in the chart above. But why is this a concern? For any long-term investor, increasing investment in the business is positive if the business is generating a positive return on capital. Normally, a shareholder should be happy that the company still sees plenty of growth opportunities, as this will benefit the company in the long run and secure future cash flows.

And Tesla is still generating well above-average ROICs that are well above the WACC of 7.7%, resulting in a ROIC-WACC spread of 18.19% – 7.7% = 10.49%. So these investments in growth and maintenance clearly create value for shareholders. So I do not see the criticism that Tesla’s capex is too high.

Misconception 5: Tesla Is an AI/Robotic/Energy Company

I still do not see the often repeated notion that Tesla is an AI, robotics, or energy company. That is the plan for the future, but today Tesla is still a car manufacturer. Automotive sales are $78 billion over the last 12 months and energy sales are only $8 billion, so it should be clear where we are today. I mean, no one would ever think of calling IKEA a restaurant chain, even though their hot dogs and snacks are very popular. When the sales in AI, robotics and energy are bigger, we can call the company that, but we are still far from that. Between the plans and the things that are achieved, there is still the execution part, which is sometimes difficult and unpredictable.

But I think Tesla is very good at marketing itself because they often manage to get large segments of the public to see Tesla as a leader in areas where objectively there are no clear winners, such as robotics. Because as long as the number of robots in homes and factories is so small, it is impossible to predict who will be the winners. And even legitimate criticism sometimes falls on deaf ears because it is often dismissed as unwarranted.

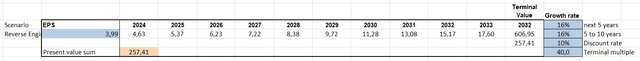

What Is The Market Currently Pricing In?

Currently, the market is pricing in Tesla to grow its earnings per share by 16% per year over the next 10 years. This is obviously a very high number that only the best companies will achieve. And unfortunately, there is no historical comparison because Tesla has not been profitable for a long time, so we only have the last 3 years when they achieved a CAGR of 52%. But of course, it is easier to achieve high-growth rates in the early years from a low base.

I do believe that Tesla will grow at an above-average rate, but whether they will reach 16% depends on many factors that are very difficult to quantify at this point.

Where Could Tesla’s EPS Be In Five Years?

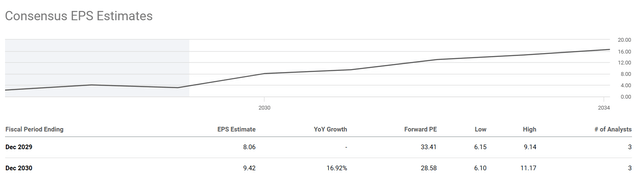

Seeking Alpha Earnings Estimates

The consensus for the EPS at the end of 2029 stands at $8.06, which at a multiple of 40x would result in a share price of $322. This would translate into EPS growth of about 15% per year, which would imply that the stock is slightly overvalued, as the market is currently pricing in 16%.

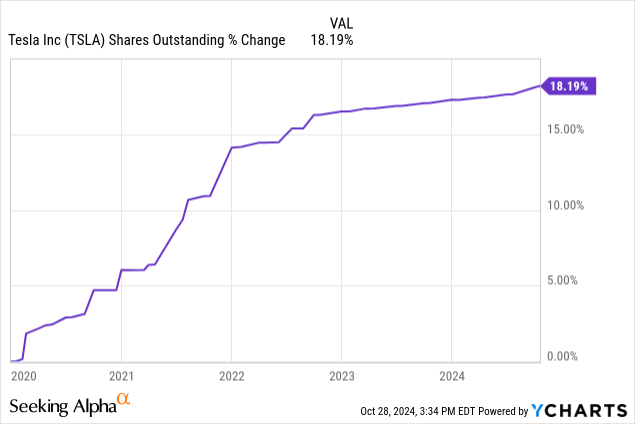

With shares outstanding up 18% over the last 5 years, I don’t think we’re going to see much of a reduction in shares outstanding that would have a positive impact on EPS. Therefore, the majority of EPS must come from either top-line growth or margin improvement.

Revenue is expected to grow at a low double-digit annual rate, but the margins will depend a lot on how profitable the new cars, taxis, and other ideas are. Of course, Tesla has the opportunity to beat expectations, but often the market is a good guide, and therefore I do not think the stock offers an attractive entry point at this time. Because based on what the market is pricing in, the upside is relatively small compared to the current price of the stock. $322 / $265 = ~1.22

TSLA’s Balance Sheet

On a positive note, Tesla’s cash position is strong, with over $33 billion in cash and ST investments, but only $12.7 billion in total debt. This means that the balance sheet is very secure and the downside in this area is protected. The current ratio of 1.8 also shows that the financial position is very strong, with assets exceeding liabilities by almost two times.

Tesla’s Risks

The biggest risk I see is that the expectations that many have for Tesla and its ideas will not be met because the competition in AI and robotics is extremely strong and well-funded. In addition, declining sales in China and the potential loss of market share in the electric vehicle segment represent additional risks. In 2023, Tesla’s China revenue was $21.7 billion, over the past 12 months, it is only $20.9 billion. This is already a slight decline in Chinese sales, mainly due to the weak first two quarters. However, the third quarter 2024 revenue of $5.6 billion exceeds the third quarter of 2023, which was only $5 billion.

Conclusion

All in all, Tesla is still a strong company that currently has an excellent position in the electric car market with a branding advantage, and they are also trying to expand into other areas. However, these other markets are still in the early stages, so it is to be hoped that the implementation will live up to expectations. Because of this large uncertainty, which can also be an opportunity, I think Tesla is overvalued right now because the market is still pricing in a lot of ambitious growth.

At the current price, I don’t see the upside as attractive, but I wouldn’t short Tesla either because the stock and the company are always good for surprises, and a lot of people have burned their fingers in the last few years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.