Summary:

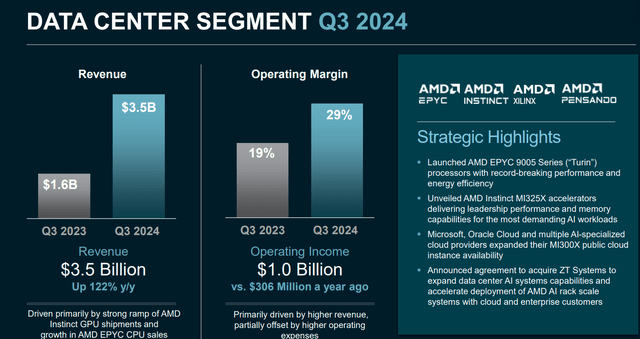

- AMD delivered record revenue in its data center business in Q3, increasing by 122% year-over-year and 25% sequentially.

- The strong data center growth was primarily driven by the robust ramp of Instinct GPU shipments and EPYC CPU sales.

- AMD’s MI325X and MI355X aim to outperform Nvidia’s H200, with MI325X offering 1.8x more memory capacity and 1.3x more bandwidth.

- I reiterate a ‘Buy’ rating on AMD, driven by their robust roadmap for MI325X, MI355X, and MI400 accelerators with CDNA architecture.

JHVEPhoto

I reiterated a ‘Buy’ rating on Advanced Micro Devices (NASDAQ:AMD) (NEOE:AMD:CA) as of October 2024, discussing their roadmap for MI325X, MI350, MI400 with CDNA new architecture. In Q3, AMD’s data center revenue grew by 122% year-over-year, driven by strong ramp of Instinct GPU and EPYC CPU shipments. I think AMD’s data center business will continue to grow by 45% in FY25. I like their recent acquisition of ZT Systems and reiterate a ‘Buy’ rating with a fair value of $205 per share.

AMD Instinct MI325X And MI355X Accelerators

On October 10th, 2024, AMD unveiled their Instinct MI325X, a new AI chip designed to compete with Nvidia’s H200 chips. AMD Instinct MI325X accelerators could deliver industry-leading memory capacity and bandwidth with 256GB of HBM3E supporting 6.0TB/s offering 1.8X more capacity and 1.3x more bandwidth than the H200, according to its release.

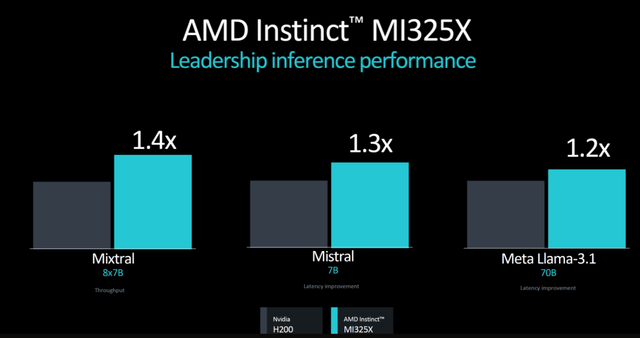

The Instinct MI325X accelerators are on track for production shipments in Q4 2024, with several providers like Dell (DELL), Hewlett Packard Enterprise (HPE) as well as Super Micro Computer (SMCI) launching related server rack products in Q1 2025. As shown in the chart below, AMD claims their Instinct MI325X could be 40% faster than NVIDIA H200 in Mixtral, 30% faster in Mistral, and 20% faster in Meta Llama 3.1 LLMs.

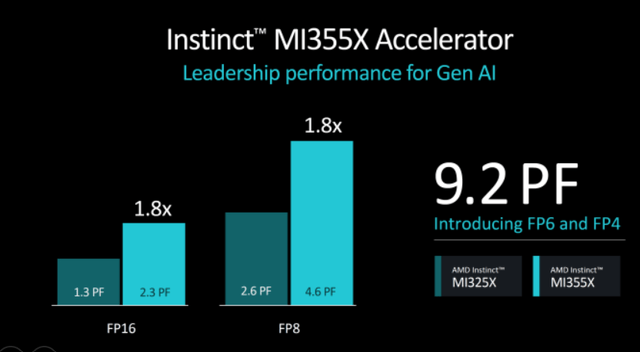

In addition, AMD plans to launch their MI355X in the second half of 2025, featuring their first 3nm chiplets from TSMC (TSM) and CDNA 4 generation. As discussed in my previous article, AMD relies on their CDNA architecture to deliver superior computing power and differentiate itself from competitors. As shown in the comparison below, MI355X could deliver 80% faster than MI325X in both FP16 and FP8 compute, with a 50% increase in both memory capacities and bandwidth.

As discussed in my previous article, AMD has a robust product roadmap positioned to capture the growing demands for data center accelerators. With their upcoming product lines, AMD has the potential to provide cost-effective options for hyperscalers and enterprise customers looking to deploy their AI training and inference workloads.

Recent Result and Outlook

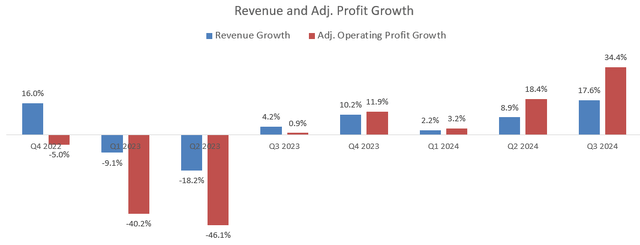

AMD released its Q3 result on October 29th after the close of the market, delivering 17.6% revenue growth and 34.4% adjusted operating profit growth, as shown in the chart below.

AMD delivered record revenue in its data center business, increasing by 122% year-over-year and 25% sequentially. The strong data center growth was primarily driven by the robust ramp of Instinct GPU shipments and EPYC CPU sales, as shown in the slide below.

On August 19th, AMD announced to acquire ZT Systems, a leading provider of high performance rack scale systems, for $4.9 billion.

ZT Systems has more than 15 years of experience in AI computing and storage infrastructure markets. With AMD’s Instinct AI accelerator, EPYC CPU, and networking product, ZT Systems can fully leverage their rack scale systems to offer AI training and inference solutions to enterprise customers. ZT Systems has around 1,600 system designer and engineers dedicated to design high-performance servers powered by GPUs. In other words, AMD acquired a mini version of Super Micro Computer, or Dell’s data center server business unit. I favor the deal as it enables AMD to strengthen its GPU and CPU businesses through these high performance rack scale systems, providing holistic solutions to hyperscalers.

AMD is guiding for $7.5 billion revenue, plus or minus $300 million for Q4, representing around 22% year-over-year growth at the mid-point.

As discussed in my previous article, I estimate their Data Center business will soon represent around 60% of total revenue. Emergen predicts data center accelerator market will grow at a CAGR of 25% from 2024 to 2033, driven by rapid growth in AI market. As AMD has a robust product roadmap for advanced data center accelerators, I anticipate the company will outpace the overall market growth, delivering 45% annual growth from FY25 to FY28. For the Client business segment, AMD’s growth should be in line with the overall consumer electronics growth. I anticipate the segment will grow by 5% annually.

AMD has gained growth momentum in its Gaming segment through their Radeon 6000 and 7000 series GPUs. Considering gaming console business cycle as well as Radeon portfolio growth, I model the segment will grow by 7% annually. Lastly, I forecast Embedded business will grow by 5%, aligned with their historical average.

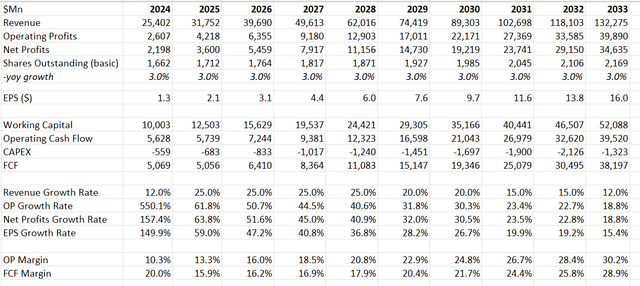

As such, I calculate AMD will deliver 25% revenue growth from FY25 to FY28. As AI workloads mature, I anticipate their revenue growth will decelerate gradually to 12% by FY33.

I continue to forecast 170bps-300bps operating margin expansion, driven by their continuous gross margin improvement, higher revenue mix towards data center segment, as well as reduced amortization of acquisition-related intangibles.

I keep the WACC to be 12% assuming: risk-free rate 3.6%; beta 1.81; equity risk premium 5%; cost of debt 5%; equity $55.8 billion; debt $4.8 billion; tax rate 13%. With these assumptions, the DCF can be summarized as follows:

Discounting all the future free cash flow, the fair value is calculated to be $205 per share, as per my estimates.

Key Risks

As reported by Bloomberg on October 15th, the Biden administration has privately discussed capping sales of advanced AI chips from Nvidia and AMD to certain Persian Gulf countries, including Saudi Arabia and the United Arab Emirates. Due to the incoming President election, export policies for advanced AI chips in 2025 remain uncertain. If the US government limits exports to Saudi Arabia and the United Arab Emirates, it could hurt AMD’s revenue growth in the near-term.

Conclusion

I think AMD’s production of Instinct MI325X and MI355X could become a major catalyst for its stock price in 2025. With these new accelerators, AMD’s products could serve as cost-efficient alternatives to Nvidia’s GPUs. I reiterate a ‘Buy’ rating with a fair value of $205 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.