Summary:

- Boeing announced a significant capital raise to address its precarious financial condition, including issuing common stock, preferred stock, and depositary shares, totaling up to $25 billion.

- Despite the capital raise providing temporary relief, Boeing’s fundamental issues, such as declining revenue, labor strikes, and fixed-price contract losses, continue to deteriorate its financial health.

- The capital raise will dilute existing shareholders’ ownership by 18.7% to 21.6%, but it’s necessary to avoid a potential downgrade to junk status.

- Boeing remains a “hold” due to the cash inflow. But without resolving labor and cost issues, a downgrade is likely within 12 months.

sanfel

Oct. 28 and Oct. 29 ended up being very big days for shareholders of airplane manufacturer Boeing (NYSE:BA). On Oct. 28, the management team at the business announced that they were officially raising billions of dollars of additional funding. More details came out on Oct. 29 that give us a better idea of the overall picture. The fact of the matter is that things have not been going particularly well for the enterprise. As of Oct. 28, shares of the company were down 13.4% over the last year. But this is nothing compared to where the stock is trading from its highs. At that time, shares were down 42.6% compared to their 52-week-high.

Those who follow my work closely know some of the troubles facing the company. Back in July 2023, I downgraded the company from a

“buy” from all the way back in July 2020 to a “hold.” In that article, I said that recovery for the company is imminent. But that did not make it an attractive opportunity. And in December of last year, I cautioned that shares were rising faster than the fundamental condition of the company warranted. I still kept it as a “hold” at that time. And even in early July, when the company announced what I considered to be a “questionable” decision to acquire Spirit AeroSystems (SPR) in a multi-billion dollar transaction, I maintained my stance.

This latest move for the company has been treated in a positive light. Shares rose 1.5% on Oct. 29, recovering some of the losses that incurred after the raise was initially announced. The good news is that this capital raise will give the company some breathing room. It may also give the firm the ability to reduce debt if used appropriately. On the other hand, this should be viewed as a Band-Aid. The fact of the matter is that the firm’s fundamental condition continues to show signs of deterioration. Because of the new capital raise, and in spite of the dilution that it will subject investors to, I’m not prepared to downgrade the stock. However, if we don’t start seeing some major progress soon, such a move may be inevitable.

A big raise

Rumors have been circulating for some time that Boeing might eventually raise a sizable chunk of capital. This comes at a time when the fundamental condition of the company can most aptly be described as precarious. However, nothing was confirmed until Oct. 15 when the company filed a registration statement with the SEC wherein it stated that it could raise up to $25 billion from outside investors. Often, these registration statements are very open-ended. This is to give the company in question maximum flexibility. And that was the case here. In the document, the company specifically said that some or all of this capital could be in the form of senior debt securities, subordinated debt securities, common stock, preferred stock, depositary shares, stock purchase contracts, and even stock purchase units.

Ultimately, management decided to go with a hybrid approach utilizing common stock, preferred stock, and depositary shares. The simple side of this transaction involves the issuance of 112.5 million shares of common stock (upsized from 90 million) at a price of $143 per share. This happens to represent a discount of 7.7% compared to the $155.01 that shares closed at the day prior to the announcement being made. After factoring in certain fees and expenses, net proceeds from this issuance will be $15.81 billion. However, in the event the demand for these shares is high, underwriters have the ability to sell another 16.875 million units at the same price. This would bring in another $2.37 billion for the company. And considering that the stock is currently at $154.44 as I type this, it’s likely that investors will snap up these shares.

The slightly more complicated side of the transaction involves preferred stock and depositary shares. In essence, Boeing is issuing $5 billion of depositary shares. Each share will represent 1/20th of an interest in a share of newly issued Series A Mandatory Convertible Preferred Stock that will carry a distribution rate of 6% per annum. This works out to $50 per depositary share. Net proceeds from this will be $4.91 billion. However, the company is also granting underwriters the option to sell another $750 million worth, which would bring net proceeds up to roughly $5.65 billion if my math is right.

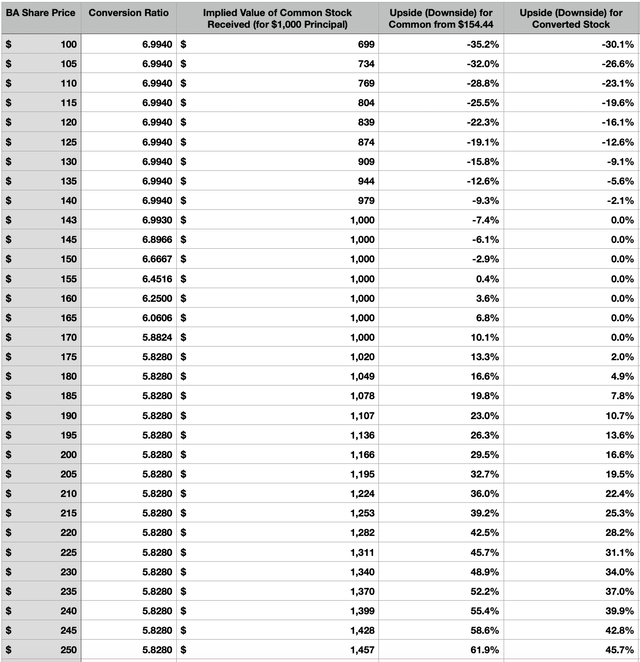

At any point between now and Oct. 15, 2027, holders of the depositary shares have the right to convert those into common shares of the company. The only stipulation is that they must do this in increments of 20 shares to match a single preferred share. Distributions can be paid out in common stock, though management has not indicated that they will do anything other than cash. And on Oct. 15, 2027, all shares will be mandatorily converted into common stock. In the event of an early conversion initiated by investors, this would be done subject to an exchange ratio of 5.8280 common shares for each preferred share, or 0.2914 common shares for each depositary share. However, at the conversion date, the actual exchange ratio will be determined based on the 20-day volume weighted average price of Boeing’s common stock, with a maximum exchange ratio of 6.9940 shares of common for each preferred unit, or 0.3497 shares of common for each depositary share.

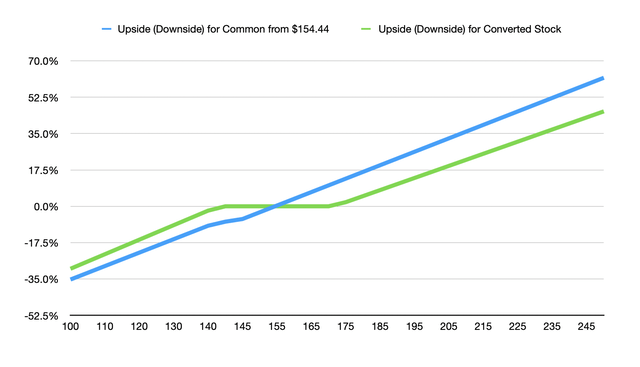

Author

In the table above, you can see what this conversion would mean for shareholders of these new units. And in the chart below, you can see upside or downside that investors in these shares will experience based on where shares of Boeing might be at the time of conversion. As an example, if shares of Boeing were to drop to $100 apiece, downside for common shareholders would be 35.2%. But for owners of these new units, it would be 30.1%. If shares of Boeing trade at $250 apiece, upside for common shareholders would be 61.9%. But for shareholders of these new units, we would be looking at upside of 45.7%. In addition to offering a little bit of protection on the downside, there’s also a wide range of prices where shareholders of these new units would see their return be stable. However, none of these figures factor in the 6% distribution that the preferred units will ultimately be paying out as time goes on. At the moment, Boeing is not paying out any dividend. So this gives investors an opportunity to have a stake in the business while also generating yield.

Author

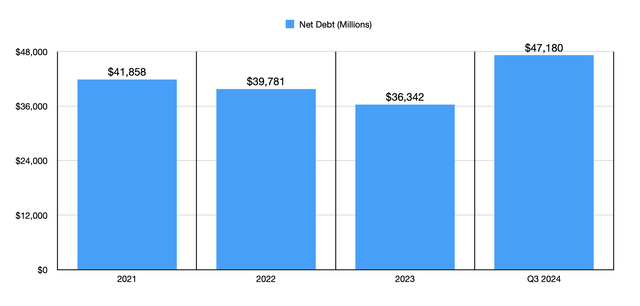

For those who have looked at the historical debt that Boeing has had, it may seem odd that the company would do such a large capital raise. While net debt did fall from $41.86 billion in 2021 to $36.34 billion in 2023, there was an increase to $47.18 billion as of the end of the third quarter of this year. But the problem has less to do with debt and more to do with the bottom line of the business. Even though revenue has grown nicely in recent years, cash flows have struggled. In 2021, the company saw adjusted operating cash flow, which strips out changes in working capital, come in at $3.57 billion. In 2022, this figure was negative to the tune of $627 million. And in 2023, it was positive only by $1.87 billion.

Author – SEC EDGAR Data

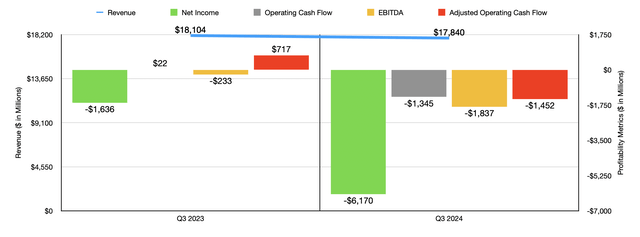

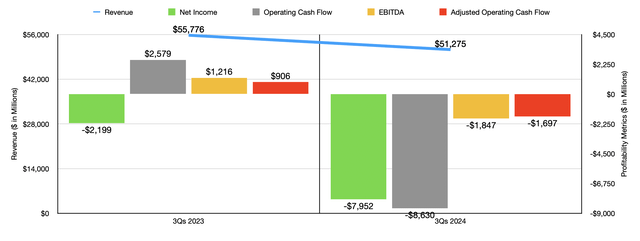

The real troubles for the company, however, began in the current fiscal year. Revenue is no longer climbing. In fact, for the third quarter of this year, it was $17.84 billion compared to the $18.10 billion reported for the third quarter of 2023. And for the first nine months of this year, it was $51.28 billion, compared to $55.78 billion last year. This drop in sales is primarily the result of weakness when it comes to its Commercial Airplanes business. Management has blamed this on a variety of factors that have all led to a reduction in airplane deliveries. Global supply chain issues remain a problem according to management. Ramping up deliveries also takes time. However, it is also undeniable that there are labor issues at the business as well.

Author – SEC EDGAR Data

On Sept. 13 of this year, a fresh strike of workers began at the business. This came after 95% of the firm’s unionized workers voted to reject a previous contract offer that had been backed by not only the airline producer, but also by union leaders. This on its own is proving to be a costly endeavor. According to estimates, the firm is losing around $1 billion each month that this strike goes on. And, at the moment, there’s no telling when this might end.

If the business was profitable and generating meaningful cash flows, I would say that yielding to unions would probably be best for all parties involved. Right now, the situation is made incredibly complex by the fact that profitability remains a big issue with the business. For the latest quarter of this year, the firm generated a net loss of $6.17 billion. That compares to a $1.64 billion loss reported the same time last year. Year over year, operating cash flow has declined from $22 million to negative $1.35 billion. And if we adjust for changes in working capital, the decline was from $717 million to negative $1.45 billion. Finally, EBITDA for the business went from negative $233 million to negative $1.84 billion.

Author – SEC EDGAR Data

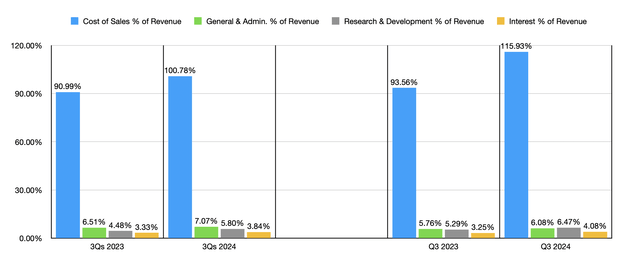

In the chart above, you can see results for the first nine months of the 2024 fiscal year compared to the same time of 2023. Clearly, the third quarter on its own was not a blip on the radar. In the chart below, you can see the percent of revenue that’s eaten up by each of the four major cost items for the business. Some of this, like interest expense, can be easily dealt with thanks to this capital raise. The company has a weighted average interest rate on its debt right now of 5.05%. However, some of the most recent fixed debt issued carries rates as high as 7.008%.

Author – SEC EDGAR Data

To make matters worse, the company was warned by rating agencies that it could see it downgraded to junk status if it sees its cash balance fall below $10 billion. With the enterprise ending the latest quarter with cash and cash equivalents of only $10.47 billion, and the firm having $4.47 billion worth of debt coming due in the 12-month window ending with the third quarter of this year, that’s the last thing that it wants to have on its books. This would make refinancing even more costly. So, in a sense, this big capital raise was a necessary evil. My big complaint, however, is the dilution that shareholders will deal with. Based on my estimates, depending on the overallotment for common shares and depositary shares, shareholders will see their ownership diluted by between 18.7% and 21.6%.

Author – SEC EDGAR Data

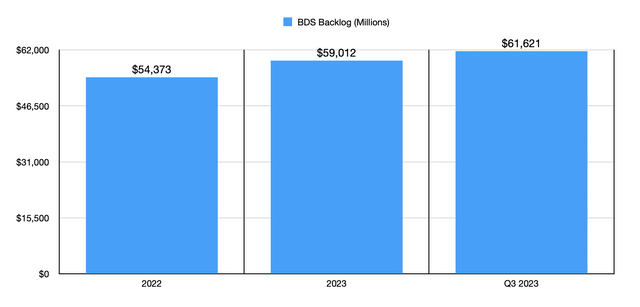

In looking through the firm’s financial results, one area that I found that’s definitely a pain point for the company would be the fixed price contracts that it has under its Defense, Space & Security (or BDS) segment. From 2022 through the present day, the total backlog for this segment grew from $54.37 billion to $61.62 billion. Not all of this backlog is fixed price, But a good portion of it is.

Author – SEC EDGAR Data

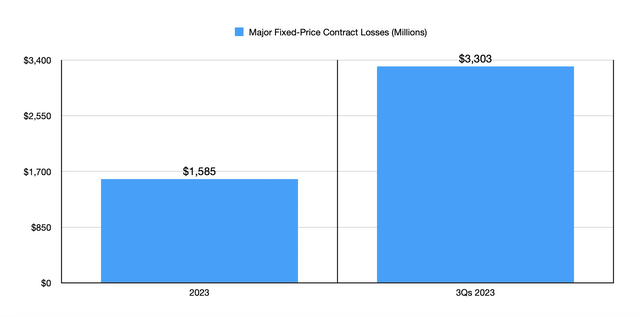

For five major contracts that it has with the US government, the company reported losses of $1.59 billion during 2023. We don’t have any data for 2022. But in all likelihood, it was less that year, if at all. However, for the first nine months of this year, losses totaled $3.30 billion. $1.45 billion of this was incurred in the third quarter on its own. I remember, years ago, researching some troubled construction companies. Fixed price contracts proved to be the issue for those as well. When you already have an inefficient operating structure, union issues, global supply chain problems, and inflationary pressures, fixed price contracts can be disastrous. And that does seem to be the pain point that the company should be addressing.

Takeaway

Ultimately, I do not think that Boeing deserves to be downgraded just yet. This latest move, while painful from a dilution perspective, at least gives the company a lifeline of sorts. But considering the troubles that Boeing currently has, I would say that this is more of a Band-Aid than anything. If management does not solve its labor issue, and if it does not address major cost problems throughout the organization, the end result could be disastrous for shareholders. For now, because of the inflow of cash, I’m keeping the enterprise as a “hold” candidate. But if things don’t change in the next 12 months, a downgrade would be very likely.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!