Summary:

- I recommended Ford stock before Q3 earnings due to strong EV sales in September and GM’s positive results, but shares dropped 6% post-earnings.

- Ford beat top line and EPS estimates, showing that Ford actually did pretty well in the third-quarter.

- Ford reduced its adjusted EBIT guidance for FY 2024 to $10B, down from $10-12B amid pricing pressures in the EV market.

- Ford’s valuation remains attractive at a 6.0X forward P/E ratio, showing an earnings yield of 17%.

Vera Tikhonova

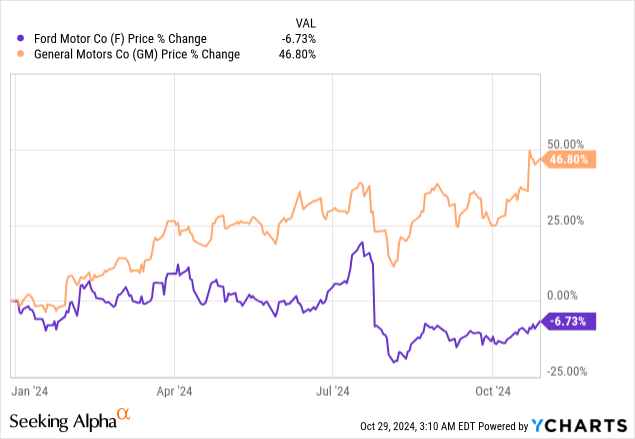

I made an aggressive stock recommendation for Ford (NYSE:F) (NEOE:F:CA) just ahead of the third-quarter earnings release because the automaker reported strong electric vehicle sales for the third-quarter, which I figured raised the odds of a strong earnings report. Further, General Motors (GM) crushed expectations for the third-quarter amid continual EV momentum last week. Ford reported an earnings and top line beat on overall strength in sales, both ICE and electric vehicles, but the automaker trimmed its adjusted EBIT guidance as well, which was unexpected. Investors reacted negatively to Ford’s Q3’24 report, which resulted in a 6% share price drop in extended trading. I believe Ford is set for strong earnings growth going forward and since Ford did not change its free cash flow guidance, I believe investors should consider buying the drop here.

Previous rating

I rated shares of Ford a strong buying a week ago — Strong Buy Ahead Of Q3 — in light of General Motors’ strong Q3’24 earnings report as well as the fact that Ford saw decent momentum for its F-150 Lightning and e-Transit sales in the third-quarter. Ford did not disappoint and easily beat consensus estimates, but the automaker also lowered its guidance for adjusted EBIT. All metrics considered, Ford’s Q3’24 delivered a solid earnings report card, and I believe the automaker remains widely undervalued at a forward P/E ratio of 6.0X.

Ford beats estimates, continual EV losses, trims guidance

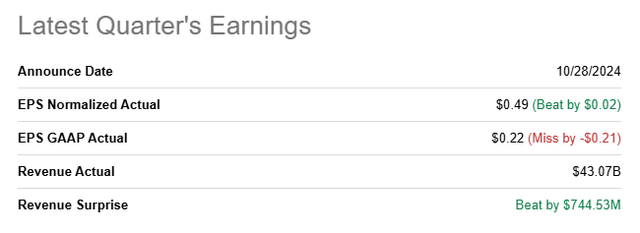

Ford’s Q3’24 earnings beat consensus expectations for both the top and bottom line: the automaker had adjusted earnings of $0.49 per-share in the third-quarter, which surpassed the average prediction by $0.02 per-share. Revenues were reported at $43.07B, which topped the consensus estimate by $744.5M. General Motors last week reported earnings which were also very strong on growing electric vehicles and higher demand for ICE vehicles, allowing the company to also beat top and bottom line estimates.

Seeking Alpha

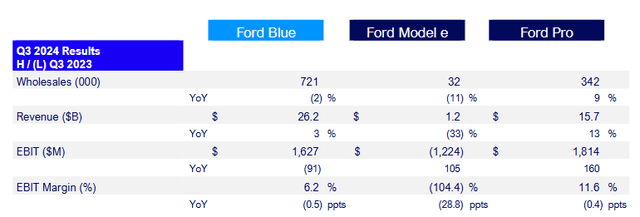

Ford submitted solid earnings, although in some respects they could have been better. The automaker saw strong momentum in Ford Pro, which is where wholesale volumes rose 9% and its revenues were up 13% compared to the year-earlier period. Ford Blue, which is Ford’s ICE division, generated 3% top line year-over-year growth. This growth was overshadowed by falling revenues in the electric vehicle business — they were down 33% Y/Y — but as I indicated in my last work on Ford, the F-150 Lightning is seeing solid momentum regardless.

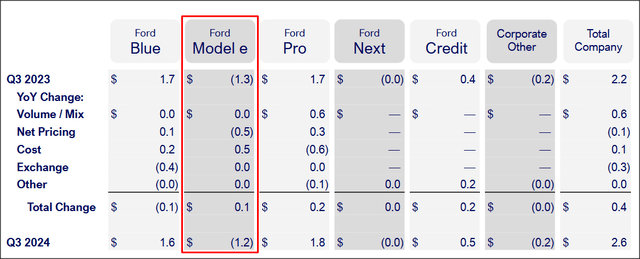

Ford

Ford’s electric vehicle segment made a loss of $1.2B (+$0.1B Q/Q) in the third-quarter which met expectations. The company guided for $5.0-5.5B in total EV segment losses this year due to continual pricing pressures in the industry. However, with electric vehicle sales momentum being robust — the company’s EV sales overall surged 12.2% in the September quarter — Ford still has a very good chance of reducing its EV losses in the years ahead.

Ford

Ford unfortunately revised its FY 2024 guidance for adjusted EBIT lower, which explains why shares declined 6% after Ford’s Q3 earnings report. The company lowered its outlook due to lower industry pricing in the EV market. The automaker now calls for ~$10B in adjusted EBIT (previously: $10-12B), but its free cash flow outlook remained unchanged at $7.5B to $8.5B… which Ford raised in the second-quarter by $1.0B at both the bottom and the top-end of its previous guidance. General Motors raised its expectations for free cash flow as its electric vehicle sales are soaring, which may make GM the better bet for investors when taking into account their relative valuations.

Ford’s valuation

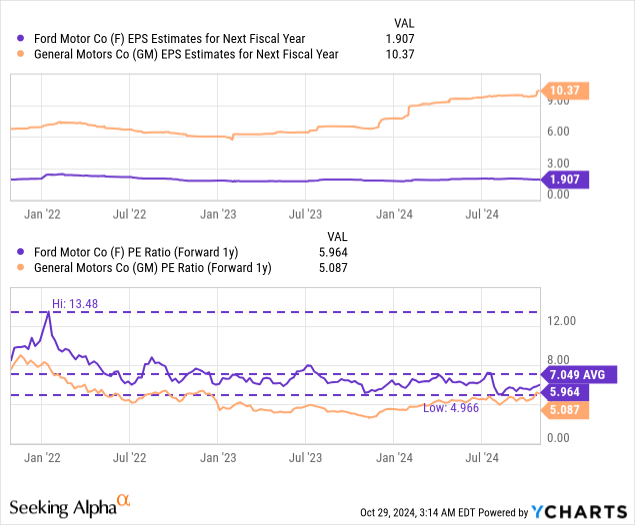

Ford is a steal based off of its earnings valuation, and I have said so many times before. The automaker is trading for a 6.0X forward earnings, while General Motors is trading for a 5.1X FY 2025 P/E ratio. These P/E ratios imply massive earnings yields of 17% and 20% for Ford and General Motors.

In my last work on Ford, I stated that I saw a fair value of 7-8X for Ford given that the automaker is seeing strong momentum in electric vehicle sales, which translated to a fair value range of 13.50 and $15.40 per-share. Following the submission of Ford’s Q3’24 earnings sheet, I believe this remains a very reasonable valuation range considering that Ford’s revenues are still growing, and the company did not touch its free cash flow outlook for FY 2024. General Motors — facing an inflection point itself — may be the better choice for investors going forward, given its higher earnings yield and increases in FY 2024 guidance.

Risks with Ford

The biggest risk for Ford, as I see it, would be a potential slowdown in EV sales, especially with regard to the company’s flagship F-150 Lightning pickup truck. This is not so much because EVs represent such a large share of total sales — in fact, they represent just about 3% of Ford’s total wholesale volume — but because the EV division is loss-making and weakening electric vehicle adoption means that the EV business will remain a drag on the company’s earnings for longer than expected.

Final thoughts

Ford did better than expected, a suspicion I already had ahead of the company’s third-quarter earnings sheet due to September EV sales, which were very good. Ford beat earnings and top line expectations, but unfortunately lowered its full-year EBIT guidance (as opposed to General Motors), which weighed heavily on the automaker’s shares in extended trading. However, Ford did not touch its free cash flow guidance, which the company raised by $1.0B at both the top and bottom end of its previous guidance range.

I like Ford’s valuation more than anything, with investors being able to snatch up a solid 17% earnings yield. Ford also retains a lot of surprise potential, in my opinion, as the company rolls out new products in its EV business next year, which could accelerate the company’s electric vehicle growth. While the changed EBIT guidance was a bit of a disappointment, I don’t believe it fundamentally changes the investment case for Ford.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F, GM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.