Summary:

- Alphabet Inc. aka Google reported Q3 2024 earnings that surpassed estimates with $88.3B in revenue (+15% y/y) and $2.12 EPS (+37% y/y), driven by strong Search, YouTube, and Cloud performance.

- Operating margin rose to 32%, enhancing Alphabet’s profitability. However, in light of recent stock gains, GOOGL is now rated “Neutral/Hold” at $177 per share.

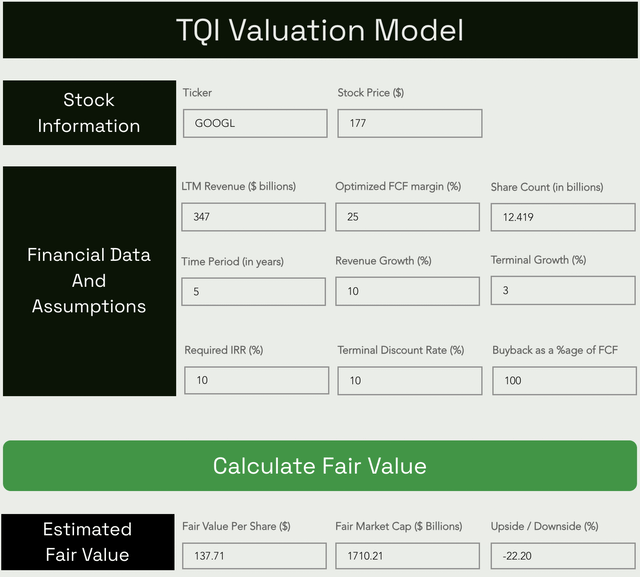

- My five-year model assumes a 10% CAGR revenue growth and a 25% FCF margin, with a 10% discount rate, valuing Alphabet at $137.71 per share.

- Alphabet’s expected CAGR return of ~9.93% over five years falls below my 10% investment hurdle, making it a “Hold” rather than a “Buy” at current levels.

Paper Boat Creative

Analyzing Alphabet’s Q3 2024 Earnings Report

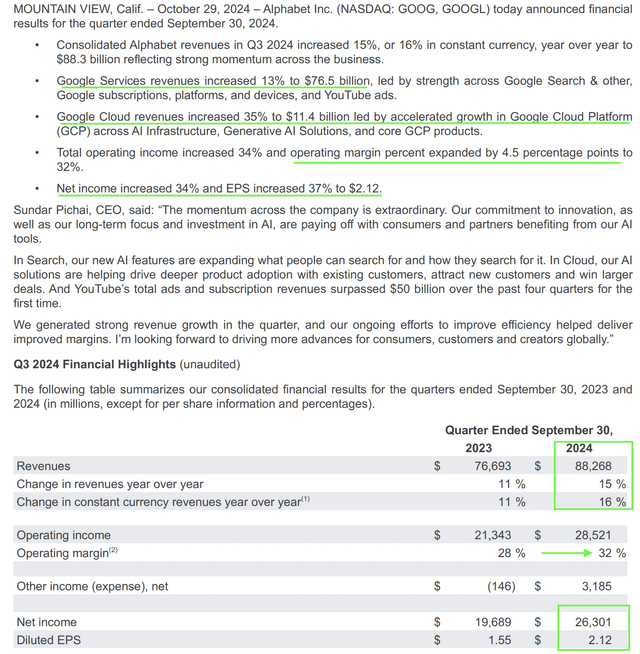

In Q3 2024, Alphabet, Inc. aka Google (NASDAQ:GOOGL, NASDAQ:GOOG) eased past consensus analyst estimates on both top and bottom-lines, with revenues coming in at $88.3B (+15% y/y, vs. est. $86.2B) and normalized EPS coming in at $2.12 (+37% y/y, vs. est. $1.85).

While noises around AI-powered disruption of Google’s Search dominance have been growing louder in recent weeks and months, it was business as usual in Q3 at Google, with Search revenues rising +12.2% y/y to $49.4B. In addition to continued resilience in Search, YouTube Ad revenue of $8.92B (+12.2% y/y) came in slightly above estimates — pointing to improved monetization. Last, but not the least, Google Cloud revenue growth accelerated to +35% y/y driven by strong demand for AI infrastructure.

For several quarters, I have been highlighting Alphabet’s operating margin story, and these positive trends have extended into Q3 2024 with Alphabet’s operating margin rising to 32% this quarter, up ~450 bps y/y.

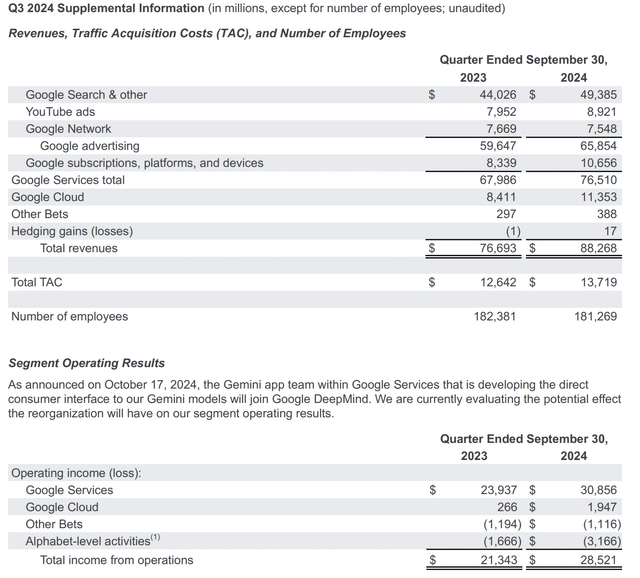

Driven by strong top-line growth and healthy margin expansion, Alphabet delivered diluted EPS of $2.12 per share, which was +37% higher than last year. Now, just last week, I highlighted GOOGL stock as a relative bargain based on its recent business performance and very reasonable trading multiple of ~20x P/E.

Source: Google Q3 2024 Preview: Relative Bargain, Consider Buying.

In light of its Q3 2024 report, I believe that particular pre-ER “Buy” call in the low $160s was the right one. However, is GOOGL still worth buying?

Alphabet’s Fair Value And Expected Return

The assumptions for this five-year model are quite straightforward, but I’ll walk you through the tricky ones quickly.

- Alphabet’s Q3 FCF margin came in at ~20% [based on FCF of $17.6B]; however, in this model, we will use an optimized FCF margin of 25%, which refers to steady or mature state margins. Currently, Alphabet is re-investing aggressively in AI infrastructure to drive future growth in its business, but when the company reaches terminal growth, I believe Alphabet will generate an FCF margin of 25%-30% [based on the robust margin profile of its Search, YouTube, and Cloud businesses]. To remain conservative with the model, I have opted for a 25% FCF margin assumption.

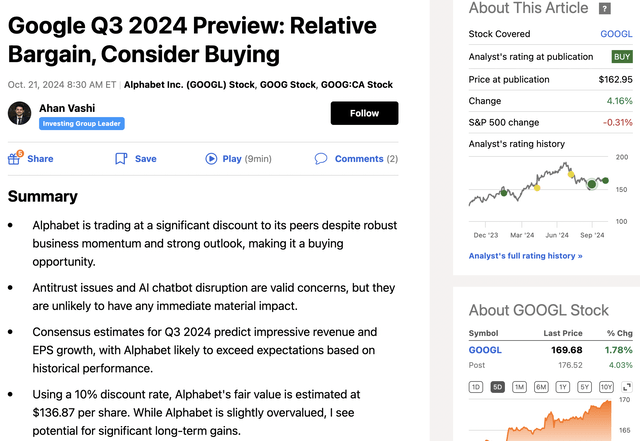

- According to Seeking Alpha, Alphabet’s consensus revenue estimate for 2029 currently stands at ~$570B. This estimate implies a five-year CAGR revenue growth rate of ~10%.

- For my model, I have assumed a 10% CAGR revenue growth rate for the next five years, given my belief that AI could unlock massive new revenue opportunities for Alphabet.

- Generally, I utilize a 15% discount rate in my discounted cash flow, or DCF, models. However, I think Alphabet’s business resilience and robust cash flow generation warrant a lower discount rate. For this exercise, I assumed a required IRR (discount rate) of 10%, which is what I have used only for Microsoft and Apple in the past.

Here’s my updated valuation model for Alphabet:

TQI Valuation Model (Free to use at TQIG.org)

As you can see above, TQI’s fair value estimate for Alphabet has moved up from $136.87 per share (or $1.70T in market cap) to $137.71 per share (or $1.71T in market cap) post Q3 earnings.

With GOOGL stock now trading at ~$177 per share (up from ~$163 at previous assessment), it has moved deeper into the overvalued territory; however, if we add back Alphabet’s huge cash hoard of $100B+ (~$8 per share), the valuation premium is less than 20%.

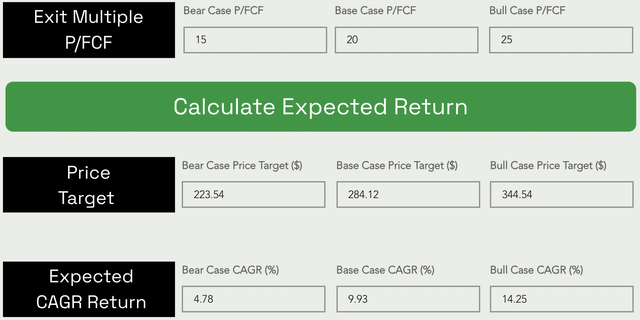

Assuming a base case P/FCF (exit) multiple of ~20x, Alphabet’s stock could rise from $177 to $284 at a CAGR rate of ~9.93% over the next five years.

TQI Valuation Model (Free to use at TQIG.org)

Unfortunately, Alphabet’s expected CAGR return has slipped under our investment hurdle rate of 10% on the back of its latest leg up [from low $160s to high $170s] — rendering the stock a “Hold” under our valuation methodology. Henceforth, I am not a buyer of Alphabet at current levels.

Key Takeaway: I rate Alphabet “Neutral/Hold” at $177 per share

At my investing group, we continue to own Alphabet under our Buyback-Dividend strategy; however, a few weeks ago, we swapped Alphabet with Baidu, Inc. (BIDU) within our GARP strategy due to its far superior long-term risk/reward. Learn more about my investment thesis for the “Google of China” here:

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.