Summary:

- Alphabet Inc. aka Google reported exceptional Q3 earnings, beating expectations with $88.27 billion in revenue and $2.12 GAAP EPS, and driving an after-market stock rally.

- Google’s dominance in digital advertising and growth in search, video, and cloud segments indicate that its growth story is far from over.

- Despite regulatory challenges, Google’s business model remains strong, and the stock is undervalued, making it a solid BUY.

400tmax

Alphabet Inc. aka Google (NASDAQ:GOOG, NASDAQ:GOOGL) has once again reported exceptional earnings results and managed to beat expectations in Q3, which prompted the after-market rally of its stock. To this day, the company remains the dominant force in the digital advertising industry and will likely continue to leverage its advantages to create additional shareholder value for years to come.

While the rising regulatory challenges will certainly try to undermine its business model along with its growth story, they are unlikely to materialize in the short to near term. As such, Google remains a solid investment, which remains undervalued at the current price. That is one of the main reasons why I hold its shares in my portfolio and believe that its stock is still a BUY.

Google Continues To Silence The Naysayers

Back in August, I noted that the depreciation of Google’s shares after the Q2 results was unjustified, since the company reported solid earnings results and has plenty of growth catalysts to retain its business momentum. Since that time, Google’s shares have appreciated by ~9%, and I believe they have additional room for growth.

This is because Google released another exceptional earnings report for Q3, which once again exceeded expectations. In Q3, the company’s revenues were up 14.9% Y/Y to $88.27 billion, above the expectations by $2.05 billion. At the same time, the GAAP EPS of $2.12 was above the expectations by $0.27.

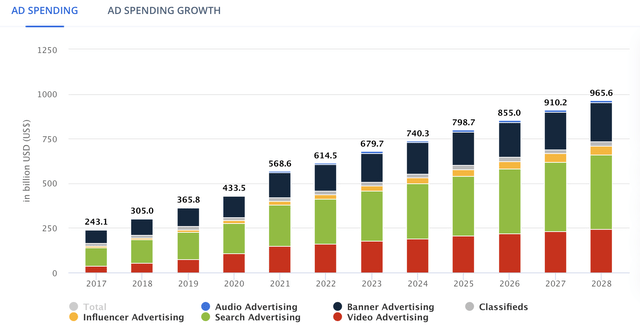

While those results are certainly impressive, there are plenty of reasons to believe that in the following quarters, Google will continue to perform exceptionally well too. The holiday spending is expected to reach a record this year, which should be a positive development for Google, considering that advertising spending will also be on the rise. At the same time, Google in the past has been benefiting from election cycles as it has access to millions of potential voters through its platforms. With 2024 election spending expected to reach a record this year, it’s safe to assume that Google will also benefit from this, since its platforms are used for political advertisement as well.

What’s more important, is that the search segment of the digital advertising industry is expected to continue to receive the most advertising dollars in comparison to other segments. While there were attempts by Google’s competitors to dethrone the company from its dominant position in the search business, those efforts have been unsuccessful so far. As of now, Google continues to own 90% of the global search market. At the same time, in Q3, its search revenues increased to $49.39 billion, up ~12.2% Y/Y, which shows that its search business remains robust.

The video segment is also expected to grow significantly in the upcoming years, which is another positive development for Google. In Q3, YouTube generated $8.92 billion in revenues, up ~12.19% Y/Y. If TikTok fails to sell its American operations to a U.S.-based entity or convince the U.S. Justice System to avert its ban in the United States, then in 2025 YouTube will compete only with Meta Platforms (META) Reels in the short-form video segment. Considering that TikTok is expected to generate $7.74 billion in revenues in the United States this year, its fall will certainly help YouTube attract some portion of the growing short-form video market next year and beyond.

The cloud business also has no signs of slowing down. In Q3, Google’s cloud business generated $11.35 billion in revenues, up ~35% Y/Y. Such an impressive performance at large was achieved thanks to the increased demand for its generative AI solutions. Ever since the start of the generative AI revolution in late 2022 with the launch of ChatGPT, Google has been investing in the expansion of its AI infrastructure and scaling its AI offerings, which now yield impressive returns. Going forward, it’s likely that the cloud business will continue to grow at an impressive rate, given that the cloud business and the generative AI industry both are expected to grow at a double-digit rate for years to come.

Such a great performance in Q3 shows that Google’s growth story is not over yet. Back in August, when my latest article on the company was published, my DCF model showed that Google’s fair value is $209.32 per share. Given the successful performance in Q3, I decided to update my model and upgrade some assumptions.

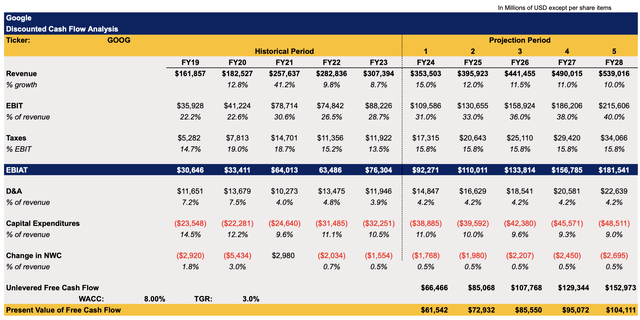

The previous model assumed that Google’s revenues would increase by 13% this year. Considering that in Q1, Q2, and Q3 revenues were up 15.4%, 13.6%, and 14.9%, respectively, while Q4 also expects to be promising given the expected higher spend on ads due to holidays and elections, it makes sense to revise the growth assumptions. The updated model below assumes a 15% revenue growth rate this year, which, I believe, is more than reasonable considering all the growth opportunities that Google has going for it. All the other assumptions for other metrics remained the same as before.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author )

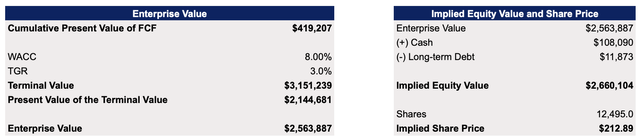

The updated model shows that Google’s fair value is $212.89 per share.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author )

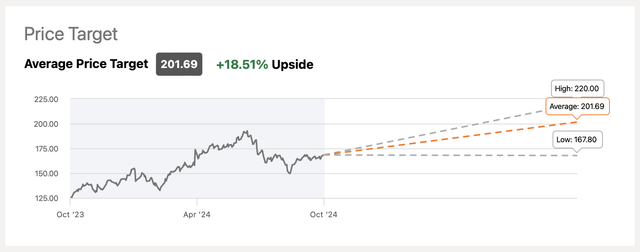

The increase in valuation came primarily due to the expected improvement of the revenue growth rate this year. While the fair value in my model is slightly higher in comparison to the consensus price target, it’s still below the most optimistic price targets. However, even the consensus on the street is that Google is undervalued, and its shares have additional room for growth.

Google’s Consensus Price Target (Seeking Alpha)

Major Risks to Consider

While the upside remains significant, Google also faces different macro and regulatory challenges that continue to mount with each passing quarter. Earlier this month, news came out that the U.S. government is considering a breakup of Google. The filing by the Department of Justice came months after the federal judge said that the company had violated the US antitrust law. At the same time, the European Union has also been investigating Google’s search dominance on the old continent.

While this is certainly a major development, in one of my previous articles on Google, I noted that any drastic decision by the government that can undermine the company’s business model is more than likely to be appealed. The appeal process will take years before a final verdict is made. While it doesn’t guarantee that Google’s business model won’t be disrupted in the end, at the very least it gives the company enough time to find a solution on how to minimize risks. It also gives time for investors to benefit from the growth of the company’s business for a while.

Considering this, I don’t consider the ongoing regulatory challenges as a major risk to Google and its share price in the short to near term, but it could certainly become an issue by the end of the current decade.

The Bottom Line

After releasing another successful earnings report, it’s safe to say that Google’s growth story remains intact for now. Despite the rising macro and regulatory challenges, the company is poised to continue to generate solid returns in the upcoming quarters thanks to its ability to leverage its advantages primarily in the cloud and the digital advertising industry. Google’s stock also remains undervalued, and it’s one of the reasons why I believe that it makes sense to give it a rating of BUY at this stage.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.