Summary:

- I reiterate a ‘Buy’ rating on PayPal with a fair value of $96 per share, driven by strong growth in payment transactions and profitability.

- Key partnerships with industry players and increased Buy Now, Pay Later usage are enhancing PayPal’s commerce platform and expanding its ecosystem.

- PayPal’s Fastlane rollout is gaining traction, with over 1,000 merchants adopting the service and large enterprise customers onboarding, promising future growth.

- Despite competitive pressures, PYPL’s branded checkout services are a primary growth driver, with projected 7% annual revenue growth and expanding operating margins.

AsiaVision

I initiated with a ‘Buy’ rating on PayPal (NASDAQ:PYPL) (NEOE:PYPL:CA) in March 2024, highlighting its growth in payment transactions and profitability. Since the initiation, the stock price has surged by more than 20%, outperforming the S&P 500 Index (SPX). While their Q3 result was below the market expectations, I remain confident in their business shift towards commerce platform. I reiterate a ‘Buy’ rating with a fair value of $96 per share.

Q3 Key Takeaways

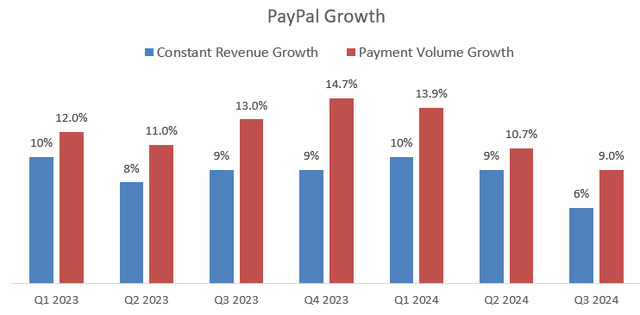

PayPal released its Q3 result on October 29th before the market opens, delivering 6% constant revenue growth and 9% payment volume growth, as depicted in the chart below.

PayPal Quarterly Result

My key takeaway from the quarter can be summarized as follows:

- Over the past two months, PayPal has announced several partnerships with industry players including Fiserv (FI), Adyen (OTCPK:ADYEY), Amazon (AMZN), Global Payments (GPN) and Shopify (SHOP). For instance, PayPal announced an expanded collaboration with Global Payments to simplify checkout services with Fastlane. With the partnership, Global Payments can offer their U.S. merchants enhanced PayPal and Venmo branded checkout solutions through Fastlane. I believe PayPal is trying to build an ecosystem for their commerce platform, offering both branded and unbranded checkout solutions.

- During the quarter, the company experienced a 15% to 20% increase in Buy Now, Pay Later usage. As discussed in my previous article, Buy Now, Pay Later service could enhance PayPal’s overall payment platform by providing alternative solutions for merchants and customers alike.

- PayPal has been rolling out their Fastlane, with more than 1,000 merchants already adopting the branded checkout service. During the earnings call, the management anticipates the rollout of Fastlane will continue through Q4 and into FY25. Notably, PayPal is now onboarding some large enterprise customers onto their Fastlane platform, which is quite encouraging.

Outlook and Valuation Update

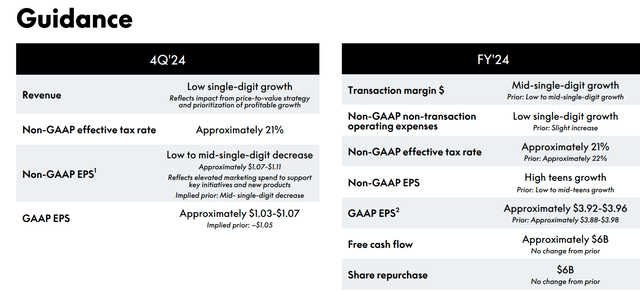

PayPal is guiding for high-teen growth for their non-GAAP EPS, with $6 billion in free cash flow for FY24, as detailed in the table below.

PayPal Investor Presentation

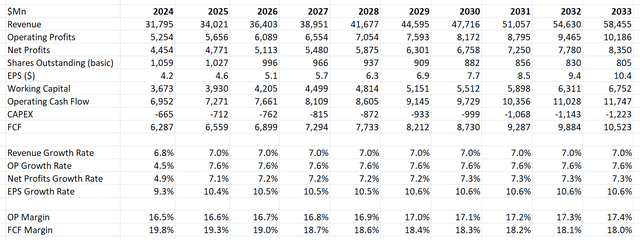

As PayPal has delivered its results for three quarters, I aligned my FY24 assumptions with their guidance. For growth from FY25 onwards, I am considering the following factors:

- As mentioned in my initiation report, McKinsey predicts the global payment market will grow at a CAGR of 7% from 2022 to 2027, driven by ongoing penetrations of digital payments.

- PayPal’s payment volume has been growing at mid-single-digit in recent years. With their branded checkout services, I anticipate PayPal will gradually expand its business into large-enterprise markets and accelerate their payment volume growth.

- In addition, PayPal has expanded its commerce payment ecosystem through key partnerships in payments and e-commerce, which could enable the company to increase the take rate and further monetize its customer base.

- Considering all these factors, I project PayPal will grow its revenue by 7% annually, with 6% payment volume growth and 1% growth from take rate.

- I continue to forecast PayPal will expand its operating margin by 10bps per year, driven by operating leverage.

- I have revised the WACC to 11.3% assuming: risk-free rate 3.8%; beta 1.55; cost of debt 5%; equity risk premium 7%; equity $21 billion; debt $9.6 billion; tax rate 21%.

With these assumptions, the DCF can be summarized as follows:

PayPal DCF

The fair value of PayPal’s stock price is calculated to be $96 per share after discounting all the free cash flow at 11.3%, as per my estimates.

Key Risk

As discussed in my previous article, the digital payment market is highly competitive, particularly in the unbranded payment market. During the earnings call, the management indicated that most checkouts are still guest checkout and PayPal is working to convert these merchants to branded checkout service. To accelerate its payment volume growth and expand margin, PayPal needs to continue investing in its Fastlane adoptions, particularly among large enterprise customers.

Conclusion

I believe the branded checkout services have become a primary growth driver for PayPal, and the company is successfully expanding its business into the large-enterprise market. I reiterate a ‘Buy’ rating with a fair value of $96 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.