Summary:

- PayPal’s Q3 report showed mixed results, with strong EPS growth but flat revenue and lackluster holiday quarter guidance, causing stock volatility.

- The company demonstrated improved fundamentals, including increased transactions per active account and strong cash flow, despite weak revenue growth.

- PayPal’s aggressive strategic partnerships position it for long-term growth, with promising developments in branded checkout and Venmo monetization.

- Despite current challenges, PayPal remains a compelling investment due to its robust free cash flow and significant share repurchases, offering an asymmetric risk/reward profile.

Justin Sullivan/Getty Images News

Prelude

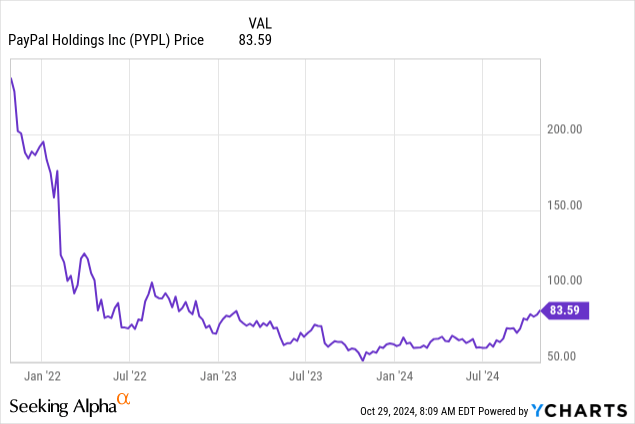

PayPal (NASDAQ:PYPL) delivered a mixed earnings report amidst very promising recent price performance in the stock. Since the COVID-era boom in Fintech stocks, PayPal and its peers have been stymied by inflation, interest rates, and a weak consumer. This has led to an awful three-year chart for the company, something that has generated a lot of interest from value investors who see the opportunity in the payments giant.

Today’s earnings report was preceded by three consecutive months of positive returns, with the stock currently up nearly 40% over that time period. I have covered PayPal several times in the past, all of which were ‘Buy’ or ‘Strong Buy’ rated articles that have outperformed the market. Most recently, I called the company a great value play and detailed the transformation the business is undergoing. While the market is displeased with the results of the Q3 report, these results strengthened my thesis and demonstrated consistent improvement in PayPal’s fundamentals.

The Q3 Report

PayPal reported Non-GAAP EPS of $1.20 (+22% YoY), beating by $0.13 but missed by $90m on revenue of $7.8b. Sales declined 1% QoQ but grew 5.4% YoY while several measures of the company’s fundamental quality continued to improve. Non-GAAP operating income increased 18% to $1.5b with a strong operating margin expansion of 194 bps to 18.8%.

Meanwhile, total payment volume increased 9% to $422.6b with a 6% increase in total transactions to 6.6b. Transactions per active account also grew 9% on a TTM basis to 61.4 while active accounts grew a meager 0.9% YoY to 432m. Excluding unbranded payments, transactions per active increase 5% to 34.5. Meanwhile, the company generated a healthy $1.6b in cash from operations and $1.45b in free cash flow (up 31% YoY). The company retained its full-year guidance for $6b in free cash flow, most of which is expected to go toward share repurchases. The company returned $1.8b to shareholders this quarter, buying back 28m shares at an average cost of $64.29. This brings the yearly total of stock buybacks to $5.4b at an average cost of $62.07 (87m shares), which represents 7% of the company’s shares outstanding.

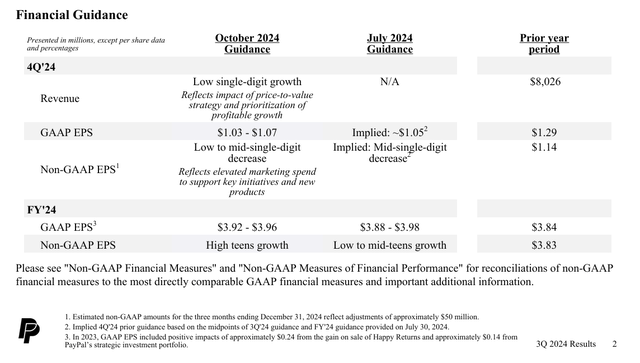

The weakest piece of this report was the guidance that management provided. The company guided for low single-digit revenue growth despite Q4 being the seasonally strong holiday shopping period. Meanwhile, Non-GAAP EPS is expected to increase in the high teens YoY mostly because of share buybacks, not bottom-line growth. This was a slight increase in guidance from the prior quarter. Additionally, the company expects to generate $6b in free cash flow in fiscal ’24 and use all $6b of that for share repurchases.

Shares were up significantly in overnight trading, reaching nearly $87 until dropping below $78 in pre-market action. The stock continued a whipsaw back and forth until the market open and the stock was sent hurdling down about 6%. The company will report fourth quarter earnings on February 4th, 2025 and is hosting its investor day on February 25th, 2025.

Business Quality

While the financial results themselves were mixed in this report, several measures of PayPal’s fundamental quality continue to improve. Transactions per active account is growing a healthy amount while active accounts has returned to growth after several quarters of declines. The company’s cash on hand decreased between December 31st, 2024 and September 30th, 2024 because loan origination volume increased. Operational expenses ticked up in the quarter due largely to increases in transaction expenses and sales and marketing expense. This should be of little to concern as transaction margin increased 80 bps QoQ to 46.6% and the company has been spending on a global marketing campaign to increase visibility. CEO Alex Chriss has been focused on “pricing to value”, especially with lower margin Braintree (unbranded) segment, which is beginning to show through in margins. At the current rate of stock buybacks, the company is on track to have fewer than 1b shares outstanding next quarter.

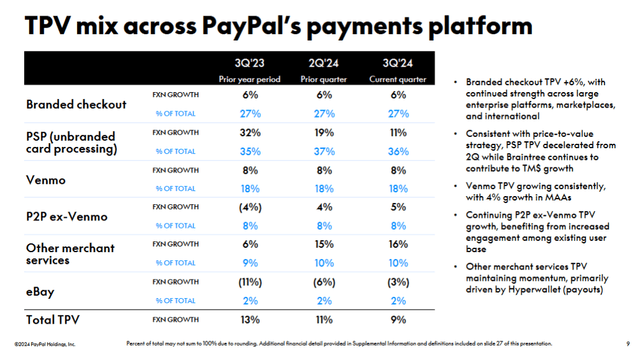

TPV mix showed a sharply decelerating PSP segment, illustrating the increase in Braintree margins. Fastlane, the company’s guest checkout product, is expected to contribute to strong growth in branded checkout over the next year. Weak branded growth plus an increase in transaction share of large merchants contributed to another sequential decline in take rates, with total take rate declining 3 bps to 1.86% and transaction take rate declining 5 bps to 1.67%. However, it’s still a promising sign that transaction margin expanded for the first time in a while.

Despite a relatively weak quarter with no sales growth and lackluster guidance headed into a seasonally strong Q4, 2025 looks as promising as ever for PayPal. The company has announced several partnerships in the past two months with companies like Pfizer (PFE), Amazon (AMZN), Global Payments (GPN), and Spotify (SPOT).

The company has been hard at work embedding itself on both sides of the payment processing network. For large enterprises, Fastlane checkout offers promising upticks in conversion rates while PayPal’s cashback debit and credit cards incentivize more spending. For small to medium-sized businesses, PayPal Complete Payments (planned for further global expansion in 2025) offers access to both sides of PayPal’s network, unlocking access to PayPal’s massive user base. For consumers, the company is focused on ease of use with guest checkout enhancements, biometric authentication, and a redesign of the mobile checkout experience in 2024. Further, the company is deepening user relationships with the launch of PayPal Everywhere, which has generated over 1,000,000 first time debit card users for the company. Alex Chriss also noted that PayPal card users are more likely to use branded checkout when shopping online and expects NFC enablement to contribute to further growth in transactions per active.

Meanwhile, Venmo remains a huge untapped asset for the company. The debit card penetration rate remains low at only 5% of the user base but grew 30% in the quarter. Venmo debit card users generate four times more revenue on average. Meanwhile, the “Pay with Venmo” online payment product has an 8% penetration rate with Venmo active accounts, which was up 20% in the quarter. The average revenue of these users is three times higher than the average Venmo user. For merchants, combining both Pay with Venmo and PayPal Checkout accelerates time-to-market for online products.

Finally, the company is planning to scale its ads platform in 2025, which is perhaps the most exciting development for long-term investors. Allowing merchants to tap into the massive scale of PayPal’s platform and the social nature of Venmo will greatly accelerate profitable growth for the company.

Investor Takeaway

Overall, this report was good but not great. The continued decline in take rates mixed with flat revenue and lackluster holiday quarter guidance has pressured the stock today. Regardless, PayPal is a free cash flow generating machine that is gobbling up significant portions of the company through stock buybacks. Investing in PayPal represents a very asymmetric risk/reward at its current valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.