Summary:

- Snowflake’s Data Cloud market could reach a $342 billion TAM by 2028, expanding growth opportunities for its AI-powered platform.

- Product revenue growth averaged 52% CAGR from 2022-2024, reaching $2.67 billion in fiscal 2024 with sustained double-digit expansion.

- High-value clients, including 510 generating over $1 million, increased 28% YoY, enhancing Snowflake’s stable, recurring revenue base.

- RPO grew to $5.23 billion in Q2 fiscal 2025, indicating strong client commitments and future revenue stability.

- Stock-based compensation challenges profitability, with EPS dilution from increased share issuance, impacting shareholder value and earnings growth.

Jia Na/iStock via Getty Images

Investment Thesis

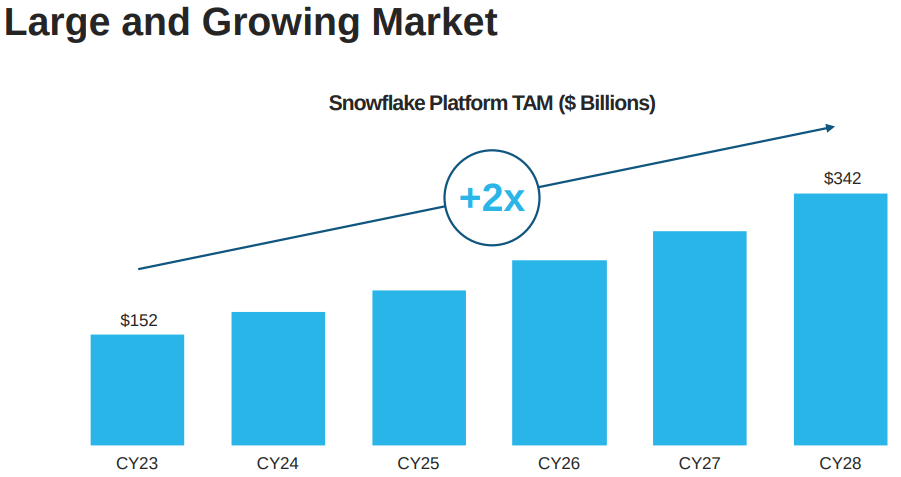

Snowflake Inc. (NYSE:SNOW) stands at the forefront of the rapidly expanding Data Cloud market, poised to capitalize on an expected $342 billion total addressable market (TAM) by 2028. Snowflake has been posting solid top-line growth powered by its AI-powered Data Cloud platform, high-value client additions, and maintenance of recurring revenues.

The growth trajectory is then complemented by solid retention rates and rising performance obligations, supportive of a long-term revenue outlook. Even with profitability challenges related to the impact of stock-based compensation, Snowflake’s unique positioning, innovative product offerings, and market demand underpin its potential for enduring value creation and market leadership in the cloud data sector.

Snowflake’s Billion-Dollar Data Cloud Expansion

Snowflake’s top-line growth is based on the expanding Data Cloud market, marking solid valuation prospects. Its consolidated addressable market (TAM) may grow to $342 billion in 2028 (from $152 billion in 2023). This boost in TAM aligns with market demand for Snowflake’s platform (AI Data Cloud). The company can (fundamentally) capture more of this expanding market through unique offerings.

To begin with, Snowflake’s product revenue shows considerable growth and is a core indicator of its business stability. The company’s product revenue was $1.14 billion in fiscal 2022 and $1.94 billion in fiscal 23. Then, it reached $2.67 billion in fiscal 24 and maintained a 52% CAGR (2022-2024). The revenue growth decreased from 106% annually in fiscal 2022 to 70% in fiscal 2023 and 38% in fiscal 24. However, Snowflake is still projecting to deliver considerable double-digit growth. Product revenue guidance for fiscal 2025 stands at $3.36 billion, marking a 26% YoY growth, a pace that reflects stable, long-term expansion.

Snowflake Investor Presentation Q2

Moreover, quarterly product revenue has grown consistently, adding to Snowflake’s growth aspect. Quarterly revenue increased each quarter, hitting $640 million in Q2 fiscal 24 and then $829 million in fiscal 25, representing a 30% YoY growth. This pattern points to Snowflake’s capacity to increase revenue through new clients and existing client growth. Recurring revenue trends show a solid client retention strategy and a boost in cloud-based data services.

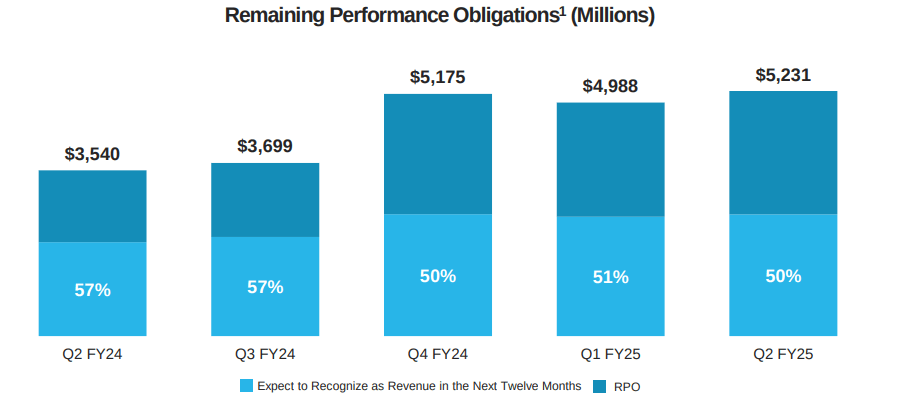

Furthermore, Snowflake’s consolidated Remaining Performance Obligations (RPO) highlight high client commitments. RPO rose from $3.54 billion in Q2 fiscal 24 to $5.23 billion in Q2 fiscal 25. Though RPO growth decelerated slightly from 57% in fiscal 24 to around 50% by Q2 fiscal 25, this metric still points to stable, long-term revenue expectations. In short, the company’s high RPO supports Snowflake’s long-term revenue outlook, pointing to stable growth with established enterprise clients. The rise in high-value clients further strengthens Snowflake’s outlook.

Finally, the number of clients surpassing $1 million in product revenue rose to 510 in Q2 fiscal 25 from 399 in Q2 fiscal 24, marking a 28% YoY growth. These clients often lead to considerable, recurring revenue, helping Snowflake maintain and grow its top line. The expanding, high-revenue client base reflects Snowflake’s capability to secure substantial client investments, leading to considerable revenue stability.

Snowflake Investor Presentation Q2

Snowflake’s Path to Profitable Growth in 2025

Looking forward, Snowflake’s guidance for fiscal 25 reflects a focus on revenue growth alongside profitability. Beyond Product revenue growth, profitability metrics show improvement, with non-GAAP product gross margins climbing from 74% in fiscal 22 to 78% in fiscal 24. The projected gross margin of 75% for fiscal 25 points to Snowflake’s capability to balance costs and grow bottom-line sustainability.

Non-GAAP operating margin improved sharply from -3% in fiscal 22 to 8% in fiscal 24, showing that Snowflake has boosted operational sharpness. Its non-GAAP adjusted free cash flow margin also increased from 12% in fiscal 22 to 29% in fiscal 24, with fiscal 25 guidance projecting 26%. This stable, strong cash flow generation gives Snowflake flexibility in self-funding growth.

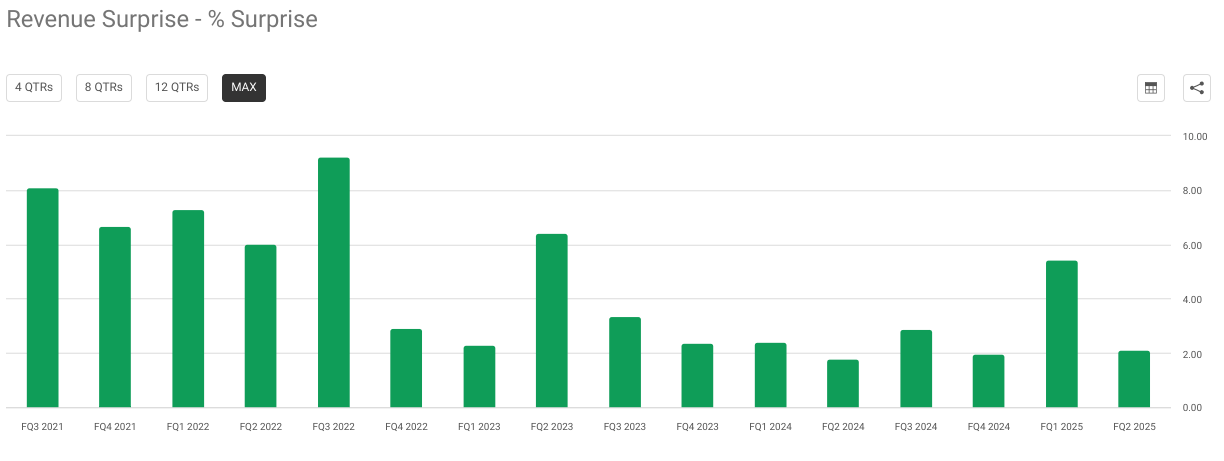

Interestingly, earnings surprise data supports Snowflake’s financial consistency. Over the past two years, Snowflake has exceeded EPS expectations seven times and constantly beat revenue expectations. Its stable record of matching estimates indicates its capability to improve project performance sharply. For Q3 2025, consensus EPS projections stand at $0.15 (-39.22% YoY). For Q4 2025, EPS projections are $0.12 (-66.05% YoY). Although earnings estimates project YoY declines, Snowflake’s constant revenue growth suggests room for performance stability in upcoming quarters. Consensus estimates also reflect stockholder optimism.

Over three months, 31 upward revenue estimate revisions against three downward revisions indicate street confidence. Snowflake’s growth metrics, including a growing TAM, strong revenue growth, and a growing high-value client base, underscore the company’s solid market value expansion prospects.

seekingalpha.com

Stock-Based Compensation: A Profitability Hurdle for Snowflake’s Growth

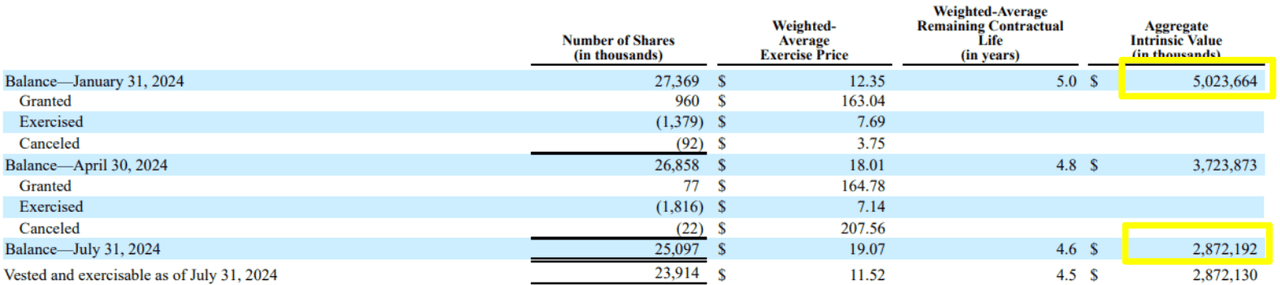

Snowflake’s focus on stock-based compensation trends relative to profitability projections reveals specific concerns. High stock-based compensation remains a barrier to profitability. The company issues stock options and restricted stock units (RSUs) for employee compensation. For instance, outstanding options under the 2020 and 2012 Equity Incentive Plans stood at 25,097 thousand as of July 2024. Although slightly lower than the 27,369 thousand in January 2024, this only marks a minimal reduction. Meanwhile, RSUs increased considerably, with 22,309 thousand outstanding by July 2024 compared to 20,168 thousand in January 2024. Such trends reflect a considerable dependence on stock options and RSUs for talent retention.

Moreover, the dilution risk is rising, impacting stockholder value and Snowflake’s profitability trajectory. Stock compensation results in the issuance of new shares, leading to a consolidated increase in common stock. Between January and July 2024, consolidated shares reserved for issuance rose to 134,374 thousand, an increase from 121,461 thousand. The continuous issuance risks diluting EPS further, weakening the stock’s market performance if profitability remains muted.

Further, stock option pricing and intrinsic value changes present additional concerns. The weighted average exercise price rose 54% over six months to $19.07 by July 31, 2024, compared to $12.35 on January 31, 2024. While this shift boosts the cost burden of exercising options, it also marks higher stock price expectations for new grants.

The intrinsic value decline-from $5,023,664 thousand to $2,872,192 thousand by July 31, 2024-points to potential employee dissatisfaction if options lose value relative to the stock’s market price. Declining intrinsic value could impact the street’s perception of valuation, particularly if intrinsic values remain lower than expected. In short, EPS dilution, related to Snowflake’s stock compensation structure, further erodes value for stockholders who seek stable EPS growth.

The company’s growth potential is limited if revenue fails to grow with compensation expenses. Snowflake’s stock-based compensation trajectory makes it difficult to match expectations for profitable expansion. Overall, this factor may continue adversely impacting SNOW’s market value, which can be observed in the stock’s performance relative to normalized income.

Takeaway

In summary, Snowflake’s expanding Data Cloud market presence and strong client growth underline its potential as a leader in data-driven cloud solutions. While top-line growth and an expanding TAM are clear positives, profitability constraints from stock-based compensation and dilution risks temper the bullish outlook. Investors should weigh Snowflake’s impressive market positioning against the challenges of achieving sustainable profitability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.