Summary:

- Weak discretionary spending, with consumers focusing on essentials and promotional offers, could limit Target’s revenue growth for fiscal year 2024.

- Target’s valuation ratios are near 5-year lows, with a strong 3% dividend yield and favorable P/FCF ratio.

- Improvements include a 75% increase in free cash flow and higher gross and operating margins, despite the aggressive promotional strategy in the last quarter.

- In my view, the cluster insider selling activity by executives, including the CEO, signals possible low confidence in the current share price.

- I maintain a Hold rating for now, waiting to see either more insider confidence or a boost in discretionary spending in the next quarters, before reconsidering my rating.

Sundry Photography

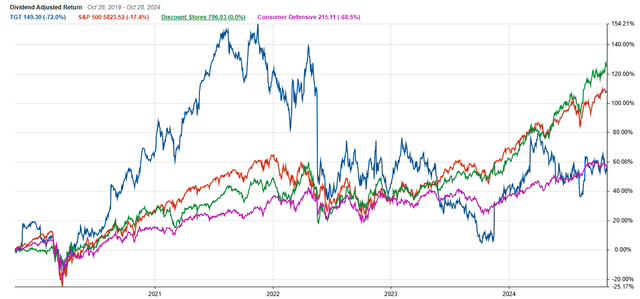

Target Corporation (NYSE:TGT) has been underperforming the discount stores industry since mid-2023. As a matter of fact, over the past five years, Target’s returns have trailed the S&P 500 by 54% and the broader discount stores sector by 72%.

Considering that the company is only 3 weeks away from releasing Q3 earnings results, I considered reviewing the contributing factors that are pressuring the share price, including consumer spending trends and management’s cautious outlook on revenue growth despite recent financial improvements.

Additionally, I will review the insider activity over the last 12 months.

However, I will advance here that one of the main drivers behind my Hold rating was the cluster insider selling activity by key executives, among them, the CEO of the company.

I will provide below the full details of my Hold rating, along with key factors to watch for in the upcoming earnings release.

Price Action

Over the last 5 years, Target’s returns have fallen 54% behind the S&P 500 and 72% behind the discount stores industry.

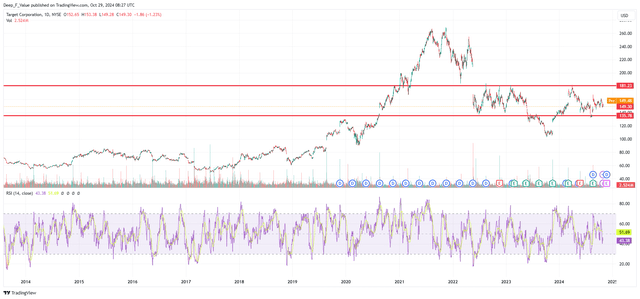

Looking at the daily chart below, the share price has been essentially trading sideways since mid-2022, between $180 and $135 (except for a period in Q2 and Q3 2023).

Let’s understand now the factors that are pressuring the company.

Discretionary Spending Pressure

Management anticipated their growth expectations to be in the lower half of its projected comparable sales range of 0% to 2%.

There are a few factors that led to this cautious outlook, but I believe the main one is the current economic environment where consumer spending remains cautious, particularly in discretionary categories.

As a matter of fact, in Q2 2024, consumer traffic increased by 3% YoY, however, the average transaction amount declined by 0.9%

Brian Cornell, Target’s CEO, stated during the last earnings call transcript:

… we’re seeing that our guests are indeed being ‘choiceful‘ with their spending. They are making planned, specific purchases focused on value, often opting for essential items and searching for the best deals…

… this behavior is also impacting overall sales in higher-ticket, discretionary categories, such as electronics and home goods, where consumers are holding back on large, unplanned purchases.

However, I am not overly concerned about the decline in the average transaction amount, as total revenue improved in the last quarter by 2.7% YoY.

Improved Margins Despite Promotions

The company’s operating margin rate increased to 6.4%, up from 4.8% in Q2 2023. Additionally, the gross margin rate rose to 28.9% from 27.0% in the previous year.

Among the drivers for this improvement were cost improvements in merchandising (which helped offset higher promotional markdowns), and lower book-to-physical inventory adjustments compared to the prior year.

Furthermore, this improvement happened despite Target rolling out discounts on 5,000 frequently purchased items.

It seems the main driver for the 3% increase in consumer traffic was the availability of these discounts.

On one hand, the discounts increased sales in some discretional purchases, like apparel, which grew by 3% in the last quarter. However, management noted that this improvement in apparel was driven by value-focused items.

Similarly, the discretionary category of home goods experienced softer performance when compared to the previous year and required promotional pricing to attract sales.

Double-Digit Growth In Operating And Net Income

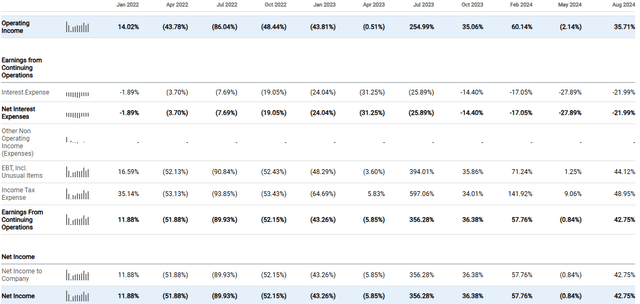

In Q2 2024, operating income was up by 36%, and net income was up by 42% showing a significant improvement despite a modest increase in revenue growth.

Among the drivers for this improvement in earnings, was a decline in net interest expense of 22% YoY. In July 2024, Target repaid $1 billion of 3.5% unsecured fixed-rate debt, reducing overall interest obligations.

Speaking of debt, on October 15, the company released an 8K detailing a new 364-day credit agreement, with a credit limit of $1 billion, expandable by up to $500 million.

Therefore, I expect net interest expenses to increase in the next quarters.

Decent Improvements In Free Cash Flows

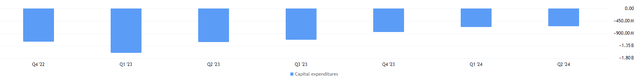

In the last quarter, free cash flow was up by 75%. Additionally, in Q1, FCF was $427 million, a big improvement from the -$340 million in Q1 2023.

As mentioned above, the improvement in net income was one of the contributing factors to this increase.

However, looking closer at CapEx, it seems that the reduction in capital expenditures was the main driver for this improvement.

Target’s capital spending has dropped from $2.8 billion in the first half of 2023 to $1.3 billion in H1 this year. This decrease mainly comes from management’s decision to cut back on planned investments in several areas, which is a decision I highly support.

It seems that store remodeling projects had elevated capital spending in the prior year. With most of these projects completed in 2024, there are fewer remodeling projects in the pipeline.

As I mentioned before, I highly support the strategic shift to cheaper upgrades and maintenance across its existing stores.

Additionally, in 2023, Target increased capital spending on digital fulfilment centers to support its e-commerce growth. Now that these facilities are fully operational, the company can operate these investments with less ongoing CapEx expenses.

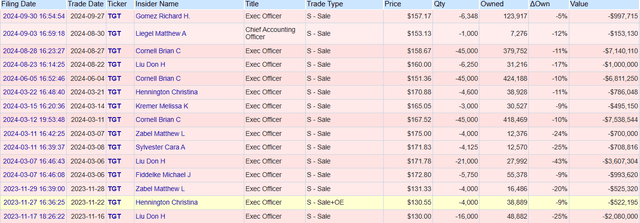

Decent Buybacks, But Insider Selling Activity Is Concerning

On one side, I’m glad to see the $155 million spent on share buybacks in the last quarter, especially since the company hasn’t repurchased any shares since 2022.

However, I am discouraged by the cluster insider selling activity in the past year.

As shown below, several executives, including the CEO, significantly reduced their ownership in the company by double-digit percentages in the last year.

The books say that insider selling activity is irrelevant in most cases. In my own experience, I found this to not be the case, especially when the share price has been flat for an extended period of time and a group of three or more executives each sold shares worth over $200k.

Valuation

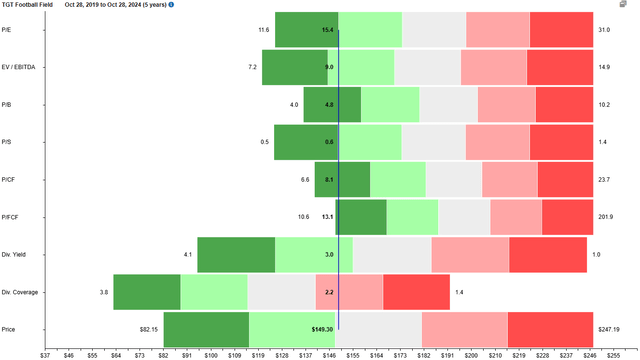

From a valuation perspective, most of the valuation ratios are trading close to the 5-year minimum.

When compared to some of its peers (notice that not all are direct competitors), Target’s share price looks attractive.

If we use P/FCF as the comparison metric, the company is the second cheapest in the group.

In my view, from a valuation perspective, the company looks quite attractive. Additionally, it pays a good dividend, with a TTM yield of 3%, and a decent coverage ratio of 2.2. However, I maintain a Hold rating for the reasons explained below.

Conclusion

To wrap up, I maintain a Hold rating for this company.

On the positive side, there are significant operational improvements, including an increase in both gross and operating margins. This improvement was possible despite the aggressive promotional strategy of the company in the last quarter. Additionally, I am encouraged by the 75% increase in free cash flow in the last quarter, mainly driven by fewer remodeling expenses and the completion of digital fulfillment centers.

At the current valuation, the stock appears undervalued compared to its peers, with a compelling P/FCF ratio and a solid 3% dividend yield. Additionally, there has been a decent amount of share buybacks in the last quarter

However, I maintain a Hold rating mainly due to the following factors.

Consumer spending on discretionary items remains weak, with management expecting full-year growth to be at the low end of their guidance.

Despite a 3% increase in traffic, the average transaction amount declined, which is a strong indication that consumers are still focused on essentials over discretionary items.

However, my main concern is the cluster insider selling activity in the past year. Several executives, among them the CEO, reduced their ownership by 10%. This is a significant amount, which makes me concerned about their confidence in the current share price. Especially, when considering their low growth expectation for FY 2024.

Therefore, I maintain a Hold rating until I see some insider buying activity, or an improvement in discretionary consumer spending, particularly in the electronics and home goods categories.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.